How to Buy Starlink Stock Before Its IPO

In 2019, the first Starlink satellite fleet was launched into orbit. Today, it has a $1.4 billion revenue stream (and growing) and is expected to become profitable this year.

Starlink builds and launches satellites that deliver high-speed, broadband internet to users around the world. With its low-orbit network, users can stream seamlessly from even the most remote locations.

As of September 2023, more than 2 million people are using Starlink, a figure that is now increasing by 150,000 per month.

The man behind it all — Elon Musk.

While Starlink IPO rumors have been circulating, there is no clear indication it will happen soon. Still, there are ways for investors to buy Starlink stock in 2024, well before its IPO.

Can you buy Starlink stock?

Starlink is still a subsidiary of SpaceX, and while it's expected to spin off and go public in the future, it has not scheduled any plans to IPO. There is no Starlink stock symbol and you can't buy it in your brokerage account.

Starlink is expected to become profitable this year and has access to plenty of funding (more on that below). At this point, there's no need for it to turn to the public markets.

Right now, it's impossible for retail investors to buy Starlink stock before its IPO, but there may be a way for accredited investors to invest alongside the private equity firms who are getting in before everyone else.

If you're a retail investor, don't worry, there are a few indirect ways you can gain access to Starlink's upside.

How to buy Starlink stock in 2024

If you're an accredited investor (individuals with an annual income of more than $200,000 or $300,000 for married couples, or a net worth exceeding $1,000,000 excluding your primary residence), check out the first section below.

If you're a retail investor, skip down to the 2nd section.

1. How to buy Starlink stock as an accredited investor

Starlink is a subsidiary of SpaceX, so you will need to invest in SpaceX to get exposure to Starlink.

You can invest in SpaceX directly through Hiive, which is a marketplace for private, pre-IPO companies.

As of the time of this writing, there are 4 unique listings for SpaceX on Hiive:

Hiive allows you to buy shares directly from sellers, which may include company employees, founders, venture capital funds, hedge funds or angel investors.

Investors can place bids and negotiate with sellers or accept their asking prices. Additionally, there are no fees for investors .

Check out the listings available on Hiive, including asking prices and shares available:

2. How to invest in Starlink as a retail investor

While there's no way to invest directly in Starlink or SpaceX right now, here are a few ideas for gaining indirect exposure.

1. Invest in Starlink's investors

Two public companies have participated in SpaceX's previous funding rounds and own stakes in SpaceX and Starlink: Alphabet (Google) and Bank of America.

Alphabet (GOOGL) first invested in SpaceX in January 2015. This was a $900 million investment at a valuation of $12 billion. It invested a second time in December 2021, at a valuation of $100 billion.

Together, these investments are worth $10.5 billion, or about 7% of SpaceX and Starlink.

While this is a sizable stake, Alphabet is a $1.75 trillion company, so its $10.5 billion stake in SpaceX represents about 0.6% of its total business.

If you don't like the other 99.4% of Google's business, I wouldn't recommend buying its shares to gain exposure to Starlink.

Bank of America (BAC) invested $250 million at a valuation of ~$30 billion in November 2018. At today's valuation, this investment is likely worth around $1.15 billion.

Again, this stake in SpaceX and Starlink represents just 0.5% of Bank of America's total market capitalization, so I wouldn't recommend buying its shares solely for its investment in Starlink.

If you like Google and/or Bank of America and want to invest in their stock anyway, simultaneously getting exposure to Starlink is a nice bonus.

2. Invest in Starlink's partners and competitors

SpaceX, like all Musk-run companies, develops the vast majority of its parts internally.

There are, however, a handful of companies that SpaceX does business with and who may directly benefit from any future success the company has:

That said, I'm not sure which of these companies (if any) are supplying parts for Starlink, specifically.

The most direct Starlink partnership came in 2021 when Shift4 Payments (FOUR) announced a 5-year partnership with Starlink to process its customer payments.

Shift4 currently processes over $111.6 billion in payments each year.

If we assume the average customer pays Starlink $100 per month, its 2 million customers are currently generating $200 million per month in revenue, or $2.4 billion per year. This accounts for about 2% of Shift4's total payment volume.

And while Starlink is the world's first and largest satellite-based broadband provider, it does have several competitors. Here are a few of the biggest:

-

HughesNet: HughesNet is a satellite internet provider owned by EchoStar (SATS). Because of the rise in popularity of Starlink, its subscriber base has shrunk to under 1.3 million and its stock price has fallen by more than 60% since its all-time high in 2018, though it still generates roughly $2 billion in annual revenue.

-

Viasat: Viasat (VSAT) has the second largest broadband satellite internet service in the U.S., with a subscriber base of 590,000 customers. Its stock price has also taken a beating since Starlink became operational.

-

OneWeb: OneWeb, a private company, is Starlink's biggest competitor in the low-Earth orbit industry, though Starlink's latency is markedly better.

-

Kuiper Systems: Kuiper Systems is a project by Amazon (AMZN), which plans to eventually launch a total of 3,236 satellites into Earth's low orbit. The project was first announced in 2019 and will likely be Starlink's biggest competition in the coming years.

-

Telesat: Telesat (TSAT) provides satellite internet services to corporate, telecom, and government customers and generates around $745 million per year. It also will likely have a hard time competing with Starlink.

3. Invest in a fund that owns Starlink/SpaceX

While it doesn't own any Starlink or SpaceX yet, Cathie Wood's Ark Space Exploration ETF (ARKX) would likely be the first ETF to invest in it if shares become available. You may want to keep an eye out for news of any such investment.

Andreessen Horowitz (a16z) is a venture capital firm that has been a primary investor in SpaceX in multiple funding rounds. When a16z invested in X (formerly Twitter) (TWTR), it sold some of its shares to Cathie Wood's Ark Venture Fund.

Does SpaceX own Starlink?

Yes, SpaceX currently owns and operates Starlink, but Starlink is expected to become its own company in the near future.

Even after that happens, Starlink will likely contract with SpaceX to use its rockets for launches (as do many of Starlink's current competitors).

In June 2023, Musk commented that Starlink's valuation “will be at least half of SpaceX's private net worth.” SpaceX's current valuation is about $150 billion, so this indicates Starlink is worth around $75 billion on its own.

When Musk decides to list its shares, I would expect Starlink's IPO to command a valuation north of $100 billion.

Worth noting, Musk owns 42% of SpaceX and controls almost 79% of its voting power.

How to buy the Starlink IPO

In September 2020, Elon Musk tweeted, “We will probably IPO Starlink but only several years in the future when revenue growth is smooth & predictable.”

Three years later, the company is just about there.

That said, Starlink's revenue and profitability (plus the lineup of private equity investors waiting for it to accept further funding) will allow Musk to delay the IPO until more favorable market conditions.

Today's stock market has not been friendly to IPOs, so there's no reason to rush it.

Plus, Musk made an offhand comment indicating the Starlink IPO may not happen until 2025 at the earliest.

When it does go public, you'll need a brokerage account to buy shares.

If you don't have a brokerage account, we recommend Public. On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

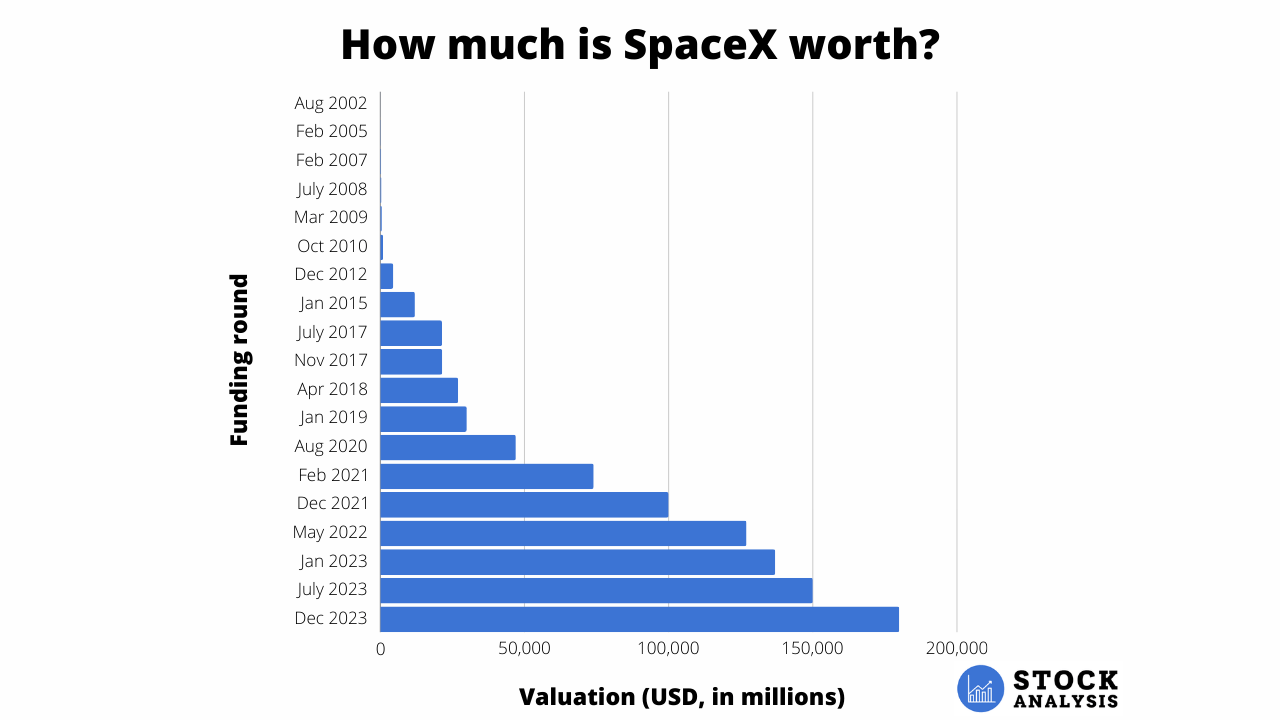

SpaceX valuation chart

Starlink is currently a subsidiary of SpaceX and is the primary driver of SpaceX's valuation.

Here's how SpaceX's valuation has changed over time:

Starlink is expected to be spun off from SpaceX and have its own IPO in the next few years. Recent comments by Elon Musk and several analysts indicate Starlink is probably worth at least $75-90 billion on its own.

.png)