Shell plc (AMS:SHELL)

Netherlands · Delayed Price · Currency is EUR

Netherlands · Delayed Price · Currency is EUR | Market Cap | 204.67B +6.3% |

| Revenue (ttm) | 227.31B -6.1% |

| Net Income | 15.19B +10.8% |

| EPS | 2.56 +18.6% |

| Shares Out | n/a |

| PE Ratio | 13.47 |

| Forward PE | 13.66 |

| Dividend | 1.24 (3.43%) |

| Ex-Dividend Date | Feb 19, 2026 |

| Volume | 9,098,392 |

| Average Volume | 5,817,011 |

| Open | 35.76 |

| Previous Close | 35.76 |

| Day's Range | 35.66 - 36.42 |

| 52-Week Range | 26.53 - 37.39 |

| Beta | -0.07 |

| RSI | 72.68 |

| Earnings Date | Mar 12, 2026 |

About Shell

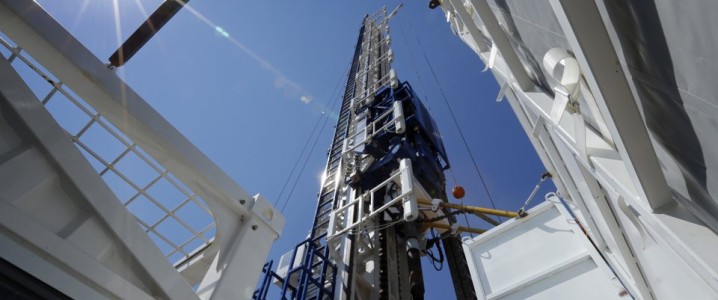

Shell plc operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas. It operates through Integrated Gas; Upstream; Marketing; Chemicals and Products; and Renewables and Energy Solutions segments. The company explores for and extracts natural gas to produce liquefied natural gas or convert into gas-to-liquids products; explores for and extracts crude oil and natural gas liquids; and operates upstream and midstream infrastructure to deliver gas to market. It is also involved in marketing ... [Read more]

Financial Performance

In 2025, Shell's revenue was $266.89 billion, a decrease of -6.13% compared to the previous year's $284.31 billion. Earnings were $17.84 billion, an increase of 10.84%.

Financial numbers in USD Financial StatementsNews

Transaction in Own Shares

Transaction in Own Shares 06 March 2026 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 06 March 2026 it purchased the following number of Shares for cancellation. Aggre...

Data Center Liquid Cooling Fluids Market worth $2.01 billion in 2032, at a CAGR of 32.7%, says MarketsandMarkets™

Delray Beach, FL, March 06, 2026 (GLOBE NEWSWIRE) -- The Data Center Liquid Cooling Fluids Market is projected to grow from USD 0.28 billion in 2025 to USD 2.01 billion in 2032, at a CAGR of 32.7% dur...

BP Chair Manifold trims board, former Shell CFO to exit

BP Chairman Albert Manifold on Friday announced plans for a slimmer board as part of the British oil major's reset strategy, with former Shell chief financial officer Simon Henry among those departi...

Final Trade: BSY, SHEL, VRTX, IGV

CNBC’s “Fast Money” team share their final trades of the day.

Shell (SHEL) Expands Ventures with New Venezuelan Agreements

Shell (SHEL) Expands Ventures with New Venezuelan Agreements

Transaction in Own Shares

Transaction in Own Shares 05 March 2026 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 05 March 2026 it purchased the following number of Shares for cancellation. Ag...

Venezuelan gov't, Shell sign oil deals, state television says

Venezuela's acting President Delcy Rodriguez has signed oil deals with international major Shell , state television said on Thursday, without providing any details.

Shell Signs Oil and Gas Exploration Deal in Kazakhstan

Shell and Kazakhstan have signed an agreement for oil and gas exploration in the Zhanaturmys block in western Kazakhstan, the Kazakh Energy Ministry said on Thursday. The agreement – signed by Kazakhs...

Shell (SHEL) Signs Long-Term Exploration Contract in Kazakhstan

Shell (SHEL) Signs Long-Term Exploration Contract in Kazakhstan

Shell signs contract with Kazakhstan to explore Zhanaturmys oil and gas block

Shell's Kazakhstan subsidiary and the Central Asian country's Ministry of Energy have signed a contract for geological exploration of the Zhanaturmys field in the Aktobe region, the ministry said o...

Transaction in Own Shares

Transaction in Own Shares 04 March 2026 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 04 March 2026 it purchased the following number of Shares for cancellation. Ag...

Shell (SHEL) and Cosan (CSAN) Fail to Reach Agreement on Raizen Rescue Plan

Shell (SHEL) and Cosan (CSAN) Fail to Reach Agreement on Raizen Rescue Plan

Director/PDMR Shareholding

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS DISCHARGING MANAGERIAL RESPONSIBILITIES IN ACCORDANCE WITH THE REQUIREMENTS OF THE EU AND UK MARKET ABUSE REGIMES March 4, 2026 ...

Shell (SHEL) to Invest $666M in Ethanol Producer Raizen

Shell (SHEL) to Invest $666M in Ethanol Producer Raizen

Transaction in Own Shares

Transaction in Own Shares 03 March 2026 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 03 March 2026 it purchased the following number of Shares for cancellation. Ag...

Venture Global (VG) Gains as Court Upholds Arbitration Win Against Shell

Venture Global (VG) Gains as Court Upholds Arbitration Win Against Shell

Shell sees 'enormous opportunity' for Brazil oil amid Middle East conflict

The U.S.-Israeli conflict with Iran presents Brazil with an "enormous opportunity" to attract investments to develop its oil assets, Shell's CEO in the country told reporters on Tuesday.

Shell committed to backstop Raizen with $668 million investment, Brazil CEO says

London listed oil company Shell is committed to investing 3.5 billion reais ($667.84 million) in troubled sugar and ethanol maker Raizen , the energy company's Brazil CEO said on Tuesday.

Venture Global shares jump as court rejects Shell's challenge to LNG ruling

Venture Global shares jumped more than 8% on Tuesday, hitting their highest level since October 10, after a New York court rejected Shell's bid to overturn an arbitration award in the U.S. LNG devel...

NY court refuses to overturn arbitration ruling that favored Venture Global over Shell

A New York state judge on Monday rejected British oil major Shell's request to throw out an arbitration award that favored Venture Global in a dispute over the American company's alleged improper sal...

IFLN: A New Fallen Angels ETF In An Old Shell

Invesco Bloomberg Enhanced Fallen Angels ETF is a newly restructured fund focusing on fallen angels, with historical data prior to 2/23/2026 irrelevant. IFLN offers lower aggregate credit risk than br...

Transaction in Own Shares

Transaction in Own Shares 02 March 2026 • • • • • • • • • • • • • • • • Shell plc (the ‘Company') announces that on 02 March 2026 it purchased the following number of Shares for cancellation. Aggre...

Energy Stocks Surge As 'Operation Epic Fury' Ignites Middle East Oil Risk Premium

Oil giants and related ETFs rocketed in pre-market action Monday, fueled by Brent crude’s sharp climb on U.S.-Iran hostilities. The weekend killing of Iran’s Supreme Leader Ayatollah Ali Khamenei in j...

JPMorgan Says Buy European Oil Majors as Gulf Supply Risks Rise

JPMorgan Chase & Co. analysts are telling investors to buy European oil and gas stocks like Shell Plc or TotalEnergies SE, arguing that US military strikes on Iran could keep energy prices elevated.

Exclusive: Nigeria splits OPL 245 oilfield into four blocks under deal with Eni, Shell, source says

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell , a source told Reuters, potentially settling the future of the field at the centre of one of the oil i...