BRF S.A. (BVMF:BRFS3)

Brazil · Delayed Price · Currency is BRL

Brazil · Delayed Price · Currency is BRL | Market Cap | 28.58B |

| Revenue (ttm) | 63.95B +13.1% |

| Net Income | 3.59B +93.1% |

| EPS | 2.20 +96.2% |

| Shares Out | 1.59B |

| PE Ratio | 8.15 |

| Forward PE | 8.48 |

| Dividend | 0.58 (3.24%) |

| Ex-Dividend Date | Sep 19, 2025 |

| Volume | 20,737,500 |

| Average Volume | 20,103,055 |

| Open | 18.75 |

| Previous Close | 18.97 |

| Day's Range | 17.95 - 18.77 |

| 52-Week Range | 17.31 - 29.00 |

| Beta | 0.71 |

| RSI | 34.74 |

| Earnings Date | Nov 13, 2025 |

About BRF S.A.

BRF S.A. raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products. The company offers frozen whole and cut chicken, frozen pork, and turkey, and halal products for Islamic markets; processed foods, such as marinated, frozen, seasoned whole, and cut chicken, roosters, sausages, ham products, bologna, frankfurters, salamis, bacons, cold meats, and other smoked products; hamburgers, steaks, breaded meat products, kibbeh, and meatballs; a... [Read more]

Financial Performance

Financial StatementsNews

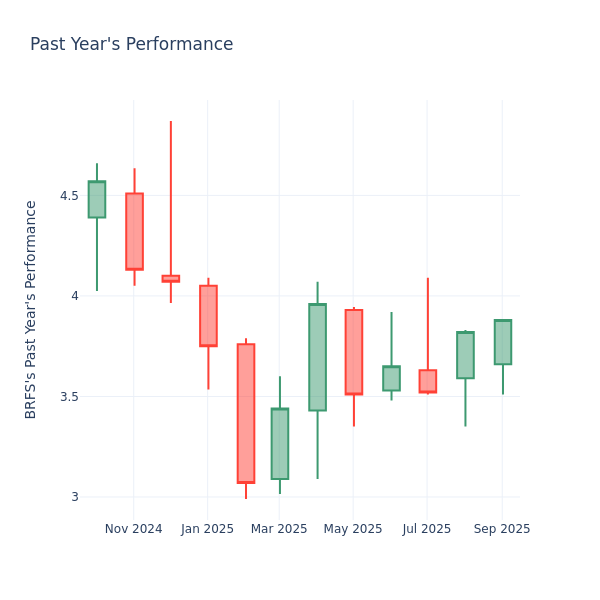

BRFS Crosses Above Average Analyst Target

In recent trading, shares of BRF S.A. (Symbol: BRFS) have crossed above the average analyst 12-month target price of $4.15, changing hands for $4.16/share. When a stock reaches the target an analyst h...

P/E Ratio Insights for BRF

Looking into the current session, BRF Inc. (NYSE: BRFS) shares are trading at $3.82, after a 2.14% increase. Moreover, over the past month, the stock went up by 13.45% , but in the past year, decreas...

BRF S.A.: The Potential Merger With Marfrig Makes It Interesting

BRF S.A. 2025 Q2 - Results - Earnings Call Presentation

BRF S.A. (BRFS) Q2 2025 Earnings Call Transcript

BRF S.A. reports Q2 results

BRF S.A. Q2 2025 Earnings Preview

Earnings Outlook For BRF

BRF (NYSE: BRFS) will release its quarterly earnings report on Thursday, 2025-08-14. Here's a brief overview for investors ahead of the announcement. Analysts anticipate BRF to report an earnings per...

BRF Q1: This Merger Changes The Whole Thesis (Downgrade)

BRF Q1: This Merger Changes The Whole Thesis (Downgrade)

BRF S.A. 2025 Q1 - Results - Earnings Call Presentation

The following slide deck was published by BRF S.A. in conjunction with their 2025 Q1 earnings call.

BRF S.A. (BRFS) Q1 2025 Earnings Call Transcript

BRF S.A. (NYSE:BRFS) Q1 2025 Earnings Conference Call May 16, 2025 9:00 AM ETCompany ParticipantsMiguel Gularte - CEOFabio Mariano - CFOConference Call...

BRF S.A. reports Q1 results

BRF: Undervalued Yet Overperforming Brazilian Poultry Market Giant

Brazil Foods' low valuation multiples and strong EBITDA growth present significant upside potential, despite recent share price recovery. The company has successfully reduced leverage, improved margin...

BRF filed its Annual Report on Form 20-F

SÃO PAULO, April 30, 2025 /PRNewswire/ -- BRF S.A. ("BRF" or "Company") (B3: BRFS3; NYSE: BRFS) announces to its shareholders and the market in general that it filed on this date, its Annual Report on...

Global Poultry Prices May Be Peaking, But BRF Should Be Getting More Credit

BRF SA shares have plunged due to concerns about peaking poultry prices and a weaker Brazilian real, but the sell-off seems excessive. Despite disappointing Q4 margins, BRF showed strong revenue growt...

Q4 2024 BRF SA Earnings Call Transcript

Q4 2024 BRF SA Earnings Call Transcript

BRF S.A. reports Q4 results

BRF S.A. (BRFS) Q4 2024 Earnings Call Transcript

BRF S.A. (NYSE:BRFS) Q4 2024 Earnings Conference Call February 27, 2025 8:00 AM ETCompany ParticipantsMiguel Gularte - CEOFabio Mariano - CFOConference Call...

BRF S.A. 2024 Q4 - Results - Earnings Call Presentation

BRF S.A. goes ex dividend tomorrow

BRF SA (BRFS) Q3 2024 Earnings Call Highlights: Record EBITDA and Market Expansion Amid Challenges

BRF SA (BRFS) Q3 2024 Earnings Call Highlights: Record EBITDA and Market Expansion Amid Challenges

Q3 2024 BRF SA Earnings Call Transcript

Q3 2024 BRF SA Earnings Call Transcript

BRF S.A. (BRFS) Q3 2024 Earnings Call Transcript

BRF S.A. 2024 Q3 - Results - Earnings Call Presentation

The following slide deck was published by BRF S.A. in conjunction with their 2024 Q3 earnings call.

Chicken Giant BRF Sees Trump’s Trade War Boosting Brazil Sales

BRF SA, one of the world’s largest chicken suppliers, expects Brazil to benefit from a potential trade war between the US and China when Donald Trump takes over next year.