Anglo American plc (ETR:NGLB)

Germany

· Delayed Price · Currency is EUR

Germany

· Delayed Price · Currency is EUR | Market Cap | 31.76B |

| Revenue (ttm) | 26.36B |

| Net Income (ttm) | -2.96B |

| Shares Out | n/a |

| EPS (ttm) | -2.45 |

| PE Ratio | n/a |

| Forward PE | 22.41 |

| Dividend | 0.57 (2.17%) |

| Ex-Dividend Date | Mar 13, 2025 |

| Volume | 380 |

| Average Volume | 10,996 |

| Open | 25.65 |

| Previous Close | 26.15 |

| Day's Range | 25.65 - 26.00 |

| 52-Week Range | 19.70 - 31.21 |

| Beta | 0.98 |

| RSI | 54.61 |

| Earnings Date | Jul 31, 2025 |

About Anglo American

Anglo American plc operates as a mining company in the United Kingdom and internationally. It explores for copper concentrate and cathodes; iron ore; platinum group metals and nickel; rough and polished diamonds; steelmaking coal; and manganese ore. Anglo American plc was founded in 1917 and is headquartered in London, the United Kingdom. [Read more]

News

Anglo American: Becoming A More Focused Copper-Iron Ore Producer

Steel, not energy, is key to coal's future growth. Here's why.

Thermal coal may retire for good in the U.S., but metallurgical coal could see “healthy” growth, says analyst.

ASX: South32 tap Anglo American executive as new CEO

ASX:S32 South32 taps Anglo American executive as new CEO

Peabody halts $5b capital raise to buy Anglo American’s Qld coal mines

Peabody is threatening to walk away from the deal over a key fire-damaged mine.

US coal producer Peabody threatens to terminate deal with Anglo American

Peabody formally notifies UK-listed miner of ‘material adverse change’ affecting $3.3bn acquisition of coal assets

Peabody Says Mine Fire Threatens $3.8 Billion Anglo Deal

Peabody Energy Corp. is considering walking away from a $3.78 billion deal to acquire Anglo American Plc’s steelmaking coal assets after a fire at an Anglo mine in Australia.

Anglo American: 2025 Guidance Unchanged, Buy Confirmed

Anglo American maintains steady cost and production targets while shifting toward higher-growth segments and divesting coal. See why AAAUKF stock is a buy.

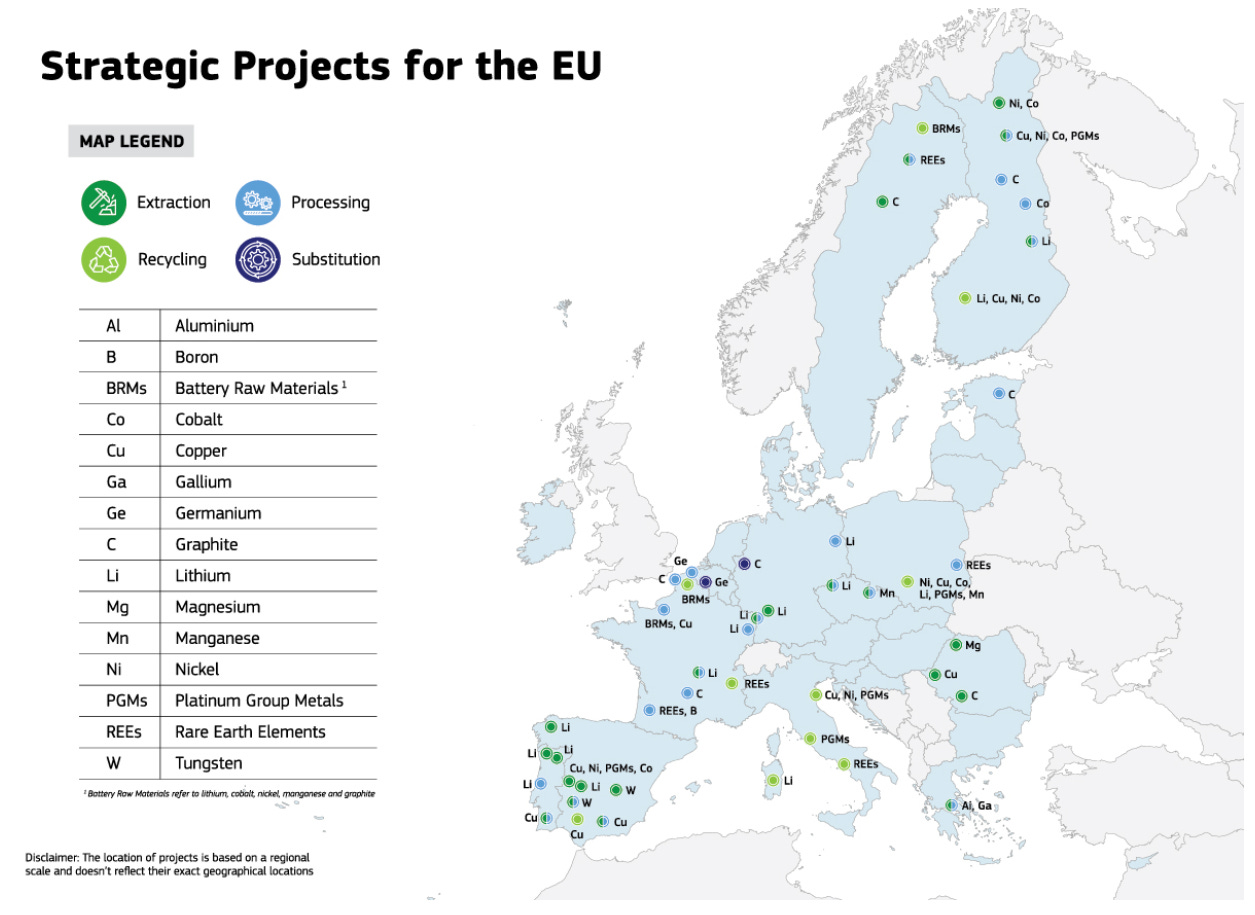

EU Fast-Tracks Mining To Cut China Reliance, Builds €216M Rare Earth Recycling Plant

The European Union (EU) wants to secure its critical minerals supply chain by reducing its import reliance. The bloc also wants to strengthen its production and recycling initiatives as it vies with t...

Miners Urge Chile To Cut Bureaucracy Before Country Loses Copper Leadership

Multinational miners BHP (NYSE: BHP) and Anglo American (OTCQX: AAUKF) urge the Chilean government to reduce bureaucratic obstacles, preparing to invest billions into expanding the country's copper ...

Peabody reviewing options for $3.78B Anglo American coal deal after mine fire

Peabody Reviews $3.78 Billion Anglo American Coal Deal After Mine Fire

Peabody Energy said it is reviewing an up to $3.78 billion deal to buy Anglo American's steelmaking coal operations following a fire at an Australian mine.

Peabody Reviews $3.8 Billion Coal Deal After Anglo Mine Fire

Peabody Energy Corp. is reviewing a deal worth up to $3.78 billion to buy Anglo American Plc’s steel-making coal business after a fire at an Australian mine.

Peabody Energy reviews options for $3.78 billion deal for Anglo American's assets

Peabody Energy said on Tuesday it was reviewing all options related to its $3.78 billion acquisition agreement with Anglo American for some of its Australian steelmaking coal assets after an ignition ...

Nickel Miners News For The Month Of March 2025

Nickel spot prices were higher the last month. Critical Raw Materials Act: EU funds 47 raw materials projects, includes 12 nickel projects. Nickel market news - Indonesia's nickel boom is forcing its ...

Anglo American starts talks with banks on possible De Beers IPO - Bloomberg

Anglo American planning more job cuts in Johannesburg, London - Bloomberg

Anglo American begins consultation to cut jobs amid business overhaul

Anglo American has begun a consultation process in the United Kingdom and South Africa to cut jobs, amid a broader restructuring aimed at refocusing its operations on copper and iron ore mining, a spo...

Anglo American's Mogalakwena PGM mine completes IRMA audit

South African complex achieves IRMA 50 when audited against the world's only equally governed mining standard South African complex achieves IRMA 50 when audited against the world's only equally gover...

Cleantech, mineral security demand drive China miners’ overseas buying spree: MMG chair

Last month, MMG said it would buy British miner Anglo American’s nickel business in Brazil.

Anglo American Sells Nickel Business for $500 Million

Via Metal Miner Mining multinational Anglo American recently agreed to sell its nickel business to a subsidiary of MMG Resources, which has its main offices in Beijing and Melbourne, for up to $500 mi...

ICYMI - Chile's nationwide power outage - has impacted copper operations

A major power outage plunged Santiago and much of Chile into darkness, disrupting daily life and transportation. Key copper mines, including Escondida, Codelco operations, Antofagasta, and Anglo Ameri...

Anglo American: Disposal Ongoing With More Value To Come

Anglo American targets $1.8B cost savings and copper growth to 1M tons by 2027

Anglo American plc (AAUKF) Q4 2024 Earnings Call Transcript

Anglo and Codelco Sign Pact to Boost Copper Output in Chile

Anglo American Plc signed a pact with Chile’s state copper company Codelco to jointly develop their adjacent mines near Santiago in a bid to boost production without major investments.