Super Group Limited (JSE:SPG)

South Africa · Delayed Price · Currency is ZAR · Price in ZAc

South Africa · Delayed Price · Currency is ZAR · Price in ZAc | Market Cap | 5.63B -39.5% |

| Revenue (ttm) | 44.51B -1.4% |

| Net Income | 4.03B +9,179.0% |

| EPS | 11.91 +9,121.1% |

| Shares Out | 338.78M |

| PE Ratio | 7.01 |

| Forward PE | 5.59 |

| Dividend | 16.90 (1.03%) |

| Ex-Dividend Date | Jun 18, 2025 |

| Volume | 486,807 |

| Average Volume | 440,549 |

| Open | 1,660.00 |

| Previous Close | 1,661.00 |

| Day's Range | 1,649.00 - 1,680.00 |

| 52-Week Range | 1,202.00 - 3,103.00 |

| Beta | -0.35 |

| RSI | 37.11 |

| Earnings Date | Feb 24, 2026 |

About Super Group

Super Group Limited engages in the supply chain management, mobility, dealership, and fleet management activities in South Africa, sub-Saharan Africa, Europe, and the United Kingdom. It operates through seven segments: Supply Chain Africa, Supply Chain Europe, Fleet Africa, SG Fleet, Dealerships SA, Dealerships UK, and Services. The company provides supply chain services comprising primary and secondary distribution, multi-temperature-controlled product distribution, integrated distribution to the national convenience market, bonded cross-borde... [Read more]

Financial Performance

In fiscal year 2025, Super Group's revenue was 44.51 billion, a decrease of -1.42% compared to the previous year's 45.15 billion. Earnings were 4.03 billion, an increase of 9178.98%.

Financial StatementsNews

Super Group (SGHC) Faces Potential Share Price Decline, Says Report

Super Group (SGHC) Faces Potential Share Price Decline, Says Report

Strategy To YieldBoost Super Group To 15.4% Using Options

Shareholders of Super Group Ltd (Symbol: SGHC) looking to boost their income beyond the stock's 1.9% annualized dividend yield can sell the July covered call at the $10.75 strike and collect the premi...

Super Group Enters Oversold Territory (SGHC)

Legendary investor Warren Buffett advises to be fearful when others are greedy, and be greedy when others are fearful. One way we can try to measure the level of fear in a given stock is through a tec...

Super Group (SGHC) Ltd (SGHC) Shares Up 3.64% on Jan 22

Super Group (SGHC) Ltd (SGHC) Shares Up 3.64% on Jan 22

Brokers Suggest Investing in Super Group (SGHC) (SGHC): Read This Before Placing a Bet

According to the average brokerage recommendation (ABR), one should invest in Super Group (SGHC) (SGHC). It is debatable whether this highly sought-after metric is effective because Wall Street analys...

Super Group expects FY revenue between $2.17B and $2.27B

Super Group (SGHC) Announces Special Dividend Amid Strong Financial Outlook

Super Group (SGHC) Announces Special Dividend Amid Strong Financial Outlook

Super Group declares $0.25 dividend

HARBOR CAPITAL ADVISORS, INC. Buys 429 Shares of Super Group (SGHC) Ltd (SGHC)

HARBOR CAPITAL ADVISORS, INC. Buys 429 Shares of Super Group (SGHC) Ltd (SGHC)

Super Group Breaks Below 200-Day Moving Average - Notable for SGHC

In trading on Wednesday, shares of Super Group Ltd (Symbol: SGHC) crossed below their 200 day moving average of $10.65, changing hands as low as $10.38 per share. Super Group Ltd shares are currently ...

Super Group (SGHC) Positioned for Earnings Surge Through 2026

Super Group (SGHC) Positioned for Earnings Surge Through 2026

Super Group is the best performing casino stock year-to-date

Super Group (SGHC) Limited (SGHC) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Super Group (SGHC) (SGHC) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Super Group (SGHC) Responds to UK Gambling Duty Hikes

Super Group (SGHC) Responds to UK Gambling Duty Hikes

Super Group says UK gambling tax hikes to cut 2026 EBITDA by about 6%

Wall Street Bulls Look Optimistic About Super Group (SGHC) (SGHC): Should You Buy?

According to the average brokerage recommendation (ABR), one should invest in Super Group (SGHC) (SGHC). It is debatable whether this highly sought-after metric is effective because Wall Street analys...

Wall Street Analysts See a 48.76% Upside in Super Group (SGHC) (SGHC): Can the Stock Really Move This High?

The mean of analysts' price targets for Super Group (SGHC) (SGHC) points to a 48.8% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement amo...

Super Group lifts 2025 revenue guidance to $2.27B with Super Coin launch and record customer growth

Super Group (SGHC) Limited (SGHC) Q3 2025 Earnings Call Transcript

Super Group (SGHC) Ltd (SGHC) Q3 2025 Earnings Call Highlights: Record Growth and Strategic ...

Super Group (SGHC) Ltd (SGHC) Q3 2025 Earnings Call Highlights: Record Growth and Strategic Innovations Amidst Regulatory Challenges

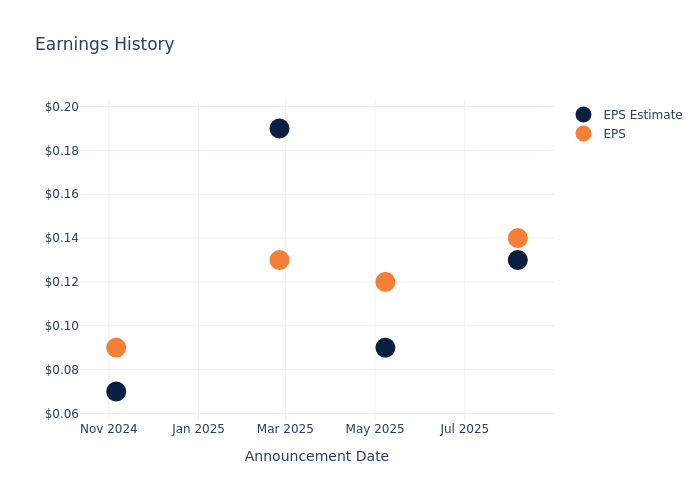

Super Group (SGHC) Limited (SGHC) Surpasses Q3 Earnings and Revenue Estimates

Super Group (SGHC) (SGHC) delivered earnings and revenue surprises of +35.71% and +5.29%, respectively, for the quarter ended September 2025. Do the numbers hold clues to what lies ahead for the stock...

Super Group GAAP EPS of $0.18 beats by $0.03, revenue of $556.9M beats by $46.51M

Oversold Conditions For Super Group (SGHC)

Legendary investor Warren Buffett advises to be fearful when others are greedy, and be greedy when others are fearful. One way we can try to measure the level of fear in a given stock is through a tec...

Super Group (SGHC) Ltd (SGHC) Q3 2025 Earnings Report Preview: What To Expect

Super Group (SGHC) Ltd (SGHC) Q3 2025 Earnings Report Preview: What To Expect

What's Next: Super Group (SGHC)'s Earnings Preview

Super Group (SGHC) (NYSE: SGHC) is gearing up to announce its quarterly earnings on Monday, 2025-11-03. Here's a quick overview of what investors should know before the release. Analysts are estimati...