China Evergrande Group (EGRNF)

| Market Cap | n/a |

| Revenue (ttm) | 37.09B +45.2% |

| Net Income | -10.01B |

| EPS | -0.82 |

| Shares Out | n/a |

| PE Ratio | n/a |

| Forward PE | n/a |

| Dividend | n/a |

| Ex-Dividend Date | n/a |

| Volume | 101,286 |

| Average Volume | 26,228 |

| Open | 0.0001 |

| Previous Close | 0.0001 |

| Day's Range | 0.0001 - 0.0001 |

| 52-Week Range | n/a |

| Beta | 0.51 |

| RSI | 46.95 |

| Earnings Date | Aug 29, 2025 |

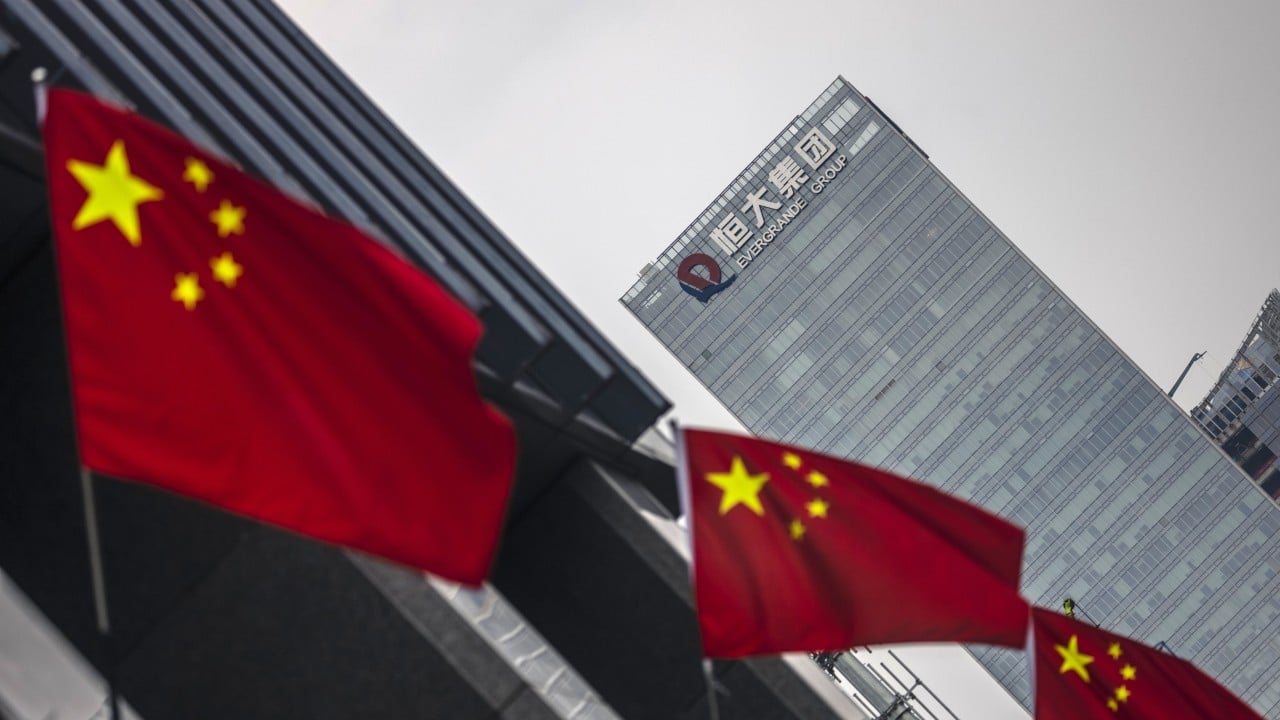

About China Evergrande Group

China Evergrande Group, an investment holding company, primarily engages in the property development business in the People’s Republic of China. It operates through Property Development, Property Investment, Property Management Services, and Other Businesses segments. The company offers property development, investment, and management services; and engages in new energy vehicle, cultural tourism, and health industry business. It also provides sale and manufacturing of smart mobility; and development and sale of health and living projects, as we... [Read more]

Financial Performance

In 2022, China Evergrande Group's revenue was 230.07 billion, a decrease of -7.98% compared to the previous year's 250.01 billion. Losses were -105.91 billion, -77.75% less than in 2021.

Financial numbers in CNY Financial StatementsNews

Evergrande Property Services: Hot Potato Or Hot Property?

Liquidators of the failed developer are seeking buyers for its property management arm, Evergrande Property, with several companies reportedly showing interest Key Takeaways: Guangdong Provincial Tour...

China may think it's time to 'rip the band-aid off' its struggling property market: Macrolens

Brian McCarthy from Macrolens says China Vanke, once viewed as a state-backed stabiliser in China’s property crisis, now appears set to follow Evergrande and Country Garden into default. With Beijing ...

China's property crisis: Is recovery possible in 2026?

It's been over four years since Evergrande's collapse sent shockwaves through China's property market – and the hits keep coming. Debt, liquidity, and flagging confidence continue to loom over the sec...

Evergrande liquidators win more power over key assets

The decision is “necessary for ensuring the effectiveness” of the injunction from the Hong Kong court, said the judge

Evergrande’s Iconic Canadian Hotel to Be Sold After Default

China Evergrande Group’s iconic log-cabin hotel in Canada has been placed in receivership after the defaulted real estate developer failed to make payments on its debt.

Evergrande liquidators set month-end deadline for bids on property services unit

Liquidators for the delisted China Evergrande Group have asked “selected bidders” to submit their offers by the end of the month for a property management unit they have been seeking to sell, accordin...

China’s micro-drama craze turns idle real estate projects into lavish film sets

In Xingyang, Henan province, a long-stalled project by Evergrande – the world’s most indebted real estate developer – lays bare two sharply contrasting realities. On social media, frustrated buyers wh...

Shenyang Sweetens Buyout Offer To Privatize Shengjing Bank - Should Investors Sell?

A local government entity is trying to privatize the lender, which is reeling from the aftermath of troubles surrounding its former owner, China Evergrande Group Key Takeaways: A government entity fro...

Hong Kong court names Evergrande’s liquidators as receivers of founder’s assets

A Hong Kong judge on Tuesday appointed China Evergrande Group’s liquidators as receivers of the assets of company founder Hui Ka Yan, following his failure to comply with a previous order requiring hi...

Evergrande eyes sale of stake in US$1.3 billion property services unit

Liquidators for the delisted mainland property group China Evergrande Group have received non-binding offers for a property management unit they have been seeking to offload, according to a Hong Kong ...

China Evergrande liquidators looking to sell stake in property services unit

Liquidators of China Evergrande Group have received approaches from parties looking to take over the developer's stake in its property services unit.

ForEvergrande? No

All property bubbles burst eventually. India should learn from China’s mistakes The fall of Evergrande, whose shares were delisted in Hong Kong on Monday, is a cautionary tale for India’s real estate ...

Evergrande: China’s indebted property behemoth delisted from Hong Kong stock market

When traders kicked off another week of action at the Hong Kong Stock Exchange, data on the shares of one previously high-soaring firm was nowhere to be seen. China Evergrande Group — once the country...

Evergrande’s Big Fall: A Lesson for India

Sometimes when people build too much without thinking, things go wrong. That’s what happened in China with a company called Evergrande. It borrowed a huge amount of money (about $300 billion!) and qui...

Delisting of once-loved Evergrande closes tumultuous chapter for investors

HONG KONG — China Evergrande Group was kicked off the Hong Kong stock exchange on Monday in one of the largest delistings by market value and volume in recent years and marking an end to what’s been a...

Evergrande's $50 billion rise and fall leaves scars on China's property sector

China Evergrande Group was delisted from the Hong Kong Stock Exchange on Monday. The risk of more developer defaults has subsided, but consolidation around state-backed developers appears inevitable.

Evergrande: China’s property giant delisted from Hong Kong stock exchange

Once the country’s biggest real estate firm, Evergrande was worth more than $50bn at its peak and helped propel China’s rapid economic growth Evergrande, formerly one of China’s biggest property devel...

From boom to bust: Evergrande delists from Hong Kong Stock Exchange

China Evergrande delists from Hong Kong today – and China's real estate woes continue to mount.

All the large Chinese property developers are going to become 'zombies': Strategist

Brian McCarthy, managing principal of Macrolens, says that he expects Evergrande bondholders and shareholders to be "largely wiped out", and that the rally in Chinese property stocks could be a sign o...

From boom to bust: Evergrande delists from Hong Kong Stock Exchange

China Evergrande delists from Hong Kong today and China's real estate woes continue to mount.

Evergrande: Why should I care about the crisis-hit Chinese property giant?

The stricken companies shares have been removed from the Hong Kong stock market.

Chinese property giant Evergrande to be delisted after spectacular fall

The embattled property giant's shares will be taken off the Hong Kong stock market on Monday.

China Evergrande Founder In Eye of Liquidation Storm

China Evergrande's founder Hui Ka Yan has become the target of the developer's liquidators for not disclosing his assets. The high-profile case is now entering a critical phase, with a hearing schedul...

4 years after Evergrande crash, Chinese families still stuck in ‘broken houses’

Rebecca Wei’s new home still looks like a construction site. The road running up to the high-rise housing complex in the central Chinese city of Luoyang is unfinished, dissolving into gravel before re...

Liquidators hire UBS and Citic to sell Evergrande’s property services unit

Liquidators of China Evergrande Group, the developer whose default in 2021 set off a broader years-long property debt crisis, has hired bankers to sell a property management unit after previous attemp...