Vonovia SE (VONOY)

| Market Cap | 25.96B +6.4% |

| Revenue (ttm) | 8.81B +20.8% |

| Net Income | 3.28B |

| EPS | 3.96 |

| Shares Out | n/a |

| PE Ratio | 7.91 |

| Forward PE | 13.96 |

| Dividend | 0.66 (4.48%) |

| Ex-Dividend Date | May 30, 2025 |

| Volume | 66,895 |

| Average Volume | 145,980 |

| Open | 15.28 |

| Previous Close | 14.85 |

| Day's Range | 15.24 - 15.36 |

| 52-Week Range | 12.91 - 17.80 |

| Beta | 1.35 |

| RSI | 58.39 |

| Earnings Date | Mar 19, 2026 |

About Vonovia SE

Vonovia SE operates as an integrated residential real estate company in Europe. It operates through four segments: Rental, Value-Add, Recurring Sales, and Development. The company offers property management services; property-related services; and value-added services, including maintenance and modernization of residential properties, craftsmen and residential environment organization, condominium administration, cable TV, metering, energy supply, and insurances services. It also involved in the sale of individual condominiums and single-family... [Read more]

Financial Performance

In 2024, Vonovia SE's revenue was 7.03 billion, an increase of 16.71% compared to the previous year's 6.02 billion. Losses were -896.00 million, -85.74% less than in 2023.

Financial numbers in EUR Financial StatementsNews

Vonovia: Quite Attractive For Income And Value Investors At 5.2% Yield And 0.55x NTA Multiple

Vonovia: Further NAV Growth Expected In 2026 (Rating Upgrade)

Discover why Vonovia is rated a Strong Buy for 2025-2026, with forecasts on EPRA NTA growth and tax cuts boosting sales.

Vonovia SE (VNNVF) Q3 2025 Earnings Call Highlights: Strong EBITDA Growth Amid Market Challenges

Vonovia SE (VNNVF) Q3 2025 Earnings Call Highlights: Strong EBITDA Growth Amid Market Challenges

Vonovia SE (VONOY) Q3 2025 Earnings Call Transcript

Vonovia SE (OTCPK:VONOY) Q3 2025 Earnings Call November 5, 2025 8:00 AM ESTCompany ParticipantsRene Hoffmann - Head of Investor RelationsRolf Buch -...

Q3 2025 Vonovia SE Earnings Call Transcript

Q3 2025 Vonovia SE Earnings Call Transcript

Vonovia SE GAAP EPS of Є2.73, revenue of Є1.27B; reaffirms FY25 and initiates FY26 outlook

ANALYSE-FLASH: JPMorgan setzt Vonovia auf 'Positive Catalyst Watch' • news

NEW YORK (dpa-AFX Broker) - Die US-Bank JPMorgan hat die Einstufung für Vonovia mit einem Kursziel von 35,50 Euro auf "Overweight" belassen. Analyst Neil Green drückte den Papieren des Immobilienkonz…

Vonovia: An Off-The-Radar Income Play

Vonovia: Recent Underperformance Presents A Buying Opportunity

Vonovia operates an apartment portfolio focused on Germany, Sweden, and Austria, with current rents substantially below market levels. H1 2025 financial results remain solid, prompting the company to ...

Vonovia SE 2025 Q2 - Results - Earnings Call Presentation

Vonovia SE (VONOY) Q2 2025 Earnings Call Transcript

Vonovia SE GAAP EPS of Є0.37, revenue of Є1.27B; reaffirms FY outlook

Vonovia: Analyst And Investor Day Confirms Bullish Outlook

Vonovia operates an apartment portfolio focused on Germany, Sweden, and Austria. Click here to read why VONOY stock is a Buy.

Vonovia SE 2025 Q1 - Results - Earnings Call Presentation

Vonovia: Loan-To-Value Declines To 45%

Vonovia SE (VONOY) Q1 2025 Earnings Call Transcript

Vonovia SE reports Q1 results

Vonovia SE (VONOY) Q4 2024 Earnings Call Transcript

Vonovia SE 2024 Q4 - Results - Earnings Call Presentation

Vonovia SE reports FY results

German Spending Plan Adds to Housing Uncertainty, Vonovia Says

Germany’s landmark spending package will have mixed effects on the country’s battered housing market, according to Vonovia SE, Europe’s largest landlord.

Vonovia Narrows Net Loss

The real-estate company posted a net loss for 2024 of $1.05 billion compared with $7.40 billion the prior year, and raised its dividend as adjusted earnings hit the upper end of guidance.

Vonovia: The Bull And Bear Case For The Next 10 Years

Vonovia SE: Resilience Amid Challenges With Promising Growth Prospects For 2025

Vonovia's stock is poised for growth in 2025 due to strong fundamentals, including high rental demand, efficient cash flow, and strategic asset sales. Despite a modest 6% return in 2024, Vonovia outpe...

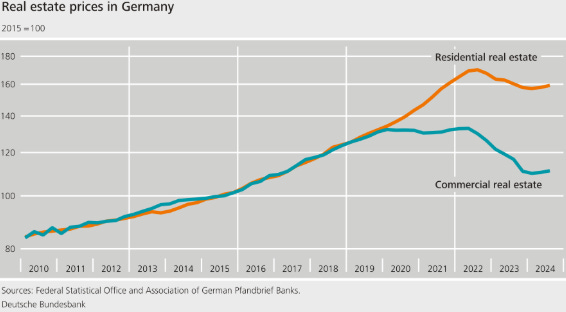

German Commercial Property Market Is 'Source Of Elevated Risk'

The Germany commercial property market " remains a source of elevated risk ," one that financial regulators are monitoring closely after a rapid succession of interest rate increases hit property valu...