Valeura Energy Inc. (TSX:VLE)

Canada · Delayed Price · Currency is CAD

Canada · Delayed Price · Currency is CAD | Market Cap | 1.14B +46.8% |

| Revenue (ttm) | 930.30M -1.0% |

| Net Income | 347.27M +395.7% |

| EPS | 3.17 +393.6% |

| Shares Out | 105.61M |

| PE Ratio | 3.40 |

| Forward PE | 33.01 |

| Dividend | n/a |

| Ex-Dividend Date | n/a |

| Volume | 201,733 |

| Average Volume | 325,589 |

| Open | 10.81 |

| Previous Close | 10.76 |

| Day's Range | 10.81 - 11.38 |

| 52-Week Range | 6.06 - 11.36 |

| Beta | -1.46 |

| RSI | 71.77 |

| Earnings Date | Mar 18, 2026 |

About Valeura Energy

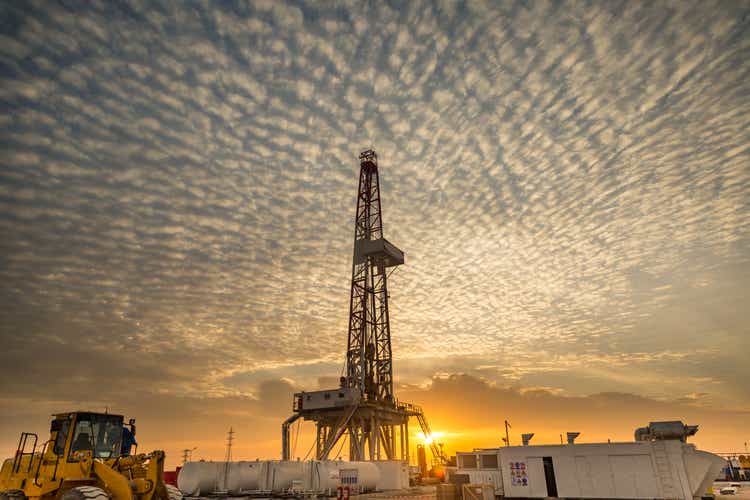

Valeura Energy Inc., together with its subsidiaries, engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey. The company was founded in 2010 and is headquartered in Singapore. [Read more]

Financial Performance

In 2024, Valeura Energy's revenue was $683.02 million, an increase of 35.80% compared to the previous year's $502.96 million. Earnings were $240.80 million, a decrease of -1.73%.

Financial numbers in USD Financial StatementsNews

Valeura Energy Inc (VLERF) Q3 2025 Earnings Call Highlights: Strong Production Growth and ...

Valeura Energy Inc (VLERF) Q3 2025 Earnings Call Highlights: Strong Production Growth and Strategic Developments

Q3 2025 Valeura Energy Inc Earnings Call Transcript

Q3 2025 Valeura Energy Inc Earnings Call Transcript

Valeura Energy Inc. (VLE:CA) Q3 2025 Earnings Call Transcript

Valeura Energy Inc. 2025 Q3 - Results - Earnings Call Presentation

Valeura Energy reports Q3 results

Valeura Energy Inc (VLERF) Q2 2025 Earnings Call Highlights: Strategic Expansion and Strong ...

Valeura Energy Inc (VLERF) Q2 2025 Earnings Call Highlights: Strategic Expansion and Strong Financial Position Amid Market Challenges

Valeura Energy: With Payback As Short As 24 Months, Each 'No Surprises' Quarter Is A Gift

Valeura Energy (VLERF) Reports Strong Oil Sales in Q2 2025

Valeura Energy (VLERF) Reports Strong Oil Sales in Q2 2025

Valeura Energy reports Q2 oil sales of 1.90 million bbls

Valeura Energy: A Deep-Value, Shallow-Water Asymmetric Bet On Brent

Valeura Energy reports Q1 results

Valeura Energy: Margin Of Safety, But Falling Prices Are A Concern

Valeura Energy reports FY results

Valeura Energy: More Cash Than Its Market Capitalization

Valeura Energy, a Canadian oil company, has a $400 million market capitalization, no debt, and $156 million in cash. Check out my analysis of VLERF stock.

Valeura Energy reports Q3 results

Valeura Energy reports Q3 production, reaffirms FY2024 outlook

Valeura Energy reports Q2 results

Valeura Energy reports Q4 production, issues 2024 outlook

Valeura Energy (VLERF) projects increased oil production and provides guidance for 2024 capex and opex, indicating positive growth potential.

Valeura Energy reports Q3 results

Valeura Energy (VLERF) reports $149.4M Q3 revenue and $116.52M cash holdings, reflecting strong financial performance and liquidity position.

TTA takes 10.14% share in Valeura

Growing oil and gas demand in Asia has prompted SET-listed Thoresen Thai Agencies (TTA), an investment holding firm, to acquire a 10.14% share in Valeura Energy Inc, the second-largest oil producer in...

Top Oil and Gas Stocks for Q4 2023

Saturn Oil & Gas, Teekay, and Valeura Energy are top for value, growth, and momentum, respectively