Kyocera Corporation (KYOCY)

| Market Cap | 15.21B |

| Revenue (ttm) | 13.45B |

| Net Income (ttm) | 160.92M |

| Shares Out | n/a |

| EPS (ttm) | 0.11 |

| PE Ratio | 94.55 |

| Forward PE | n/a |

| Dividend | 0.34 (3.09%) |

| Ex-Dividend Date | Mar 28, 2025 |

| Volume | 13,073 |

| Average Volume | 70,958 |

| Open | 10.80 |

| Previous Close | 10.99 |

| Day's Range | 10.73 - 10.87 |

| 52-Week Range | 9.21 - 13.18 |

| Beta | 0.17 |

| RSI | 27.35 |

| Earnings Date | Jul 30, 2025 |

About Kyocera

Kyocera Corporation develops, produces, and distributes products based on fine ceramic technologies in Japan, China, rest of Asia, Europe, the United States, and internationally. It operates through Core Components Business, Electronic Components Business, and Solutions Business segments. The Core Components Business segment offers components, such as fine ceramic components for semiconductor processing equipment, automotive camera modules, and ceramic packages, as well as organic packages and boards to protect electronic components and ICs to ... [Read more]

Financial Performance

In 2024, Kyocera's revenue was 2.01 trillion, an increase of 0.51% compared to the previous year's 2.00 trillion. Earnings were 24.10 billion, a decrease of -76.16%.

Financial numbers in JPY Financial StatementsNews

Oscillator Market Forecasts Report 2025-2030, Profiles of Major Players - Murata Manufacturing, Seiko Epson, Kyocera, Rakon, Tai-Saw Technology, and Morion

The global oscillator market is set to grow at a 3.31% CAGR, reaching $6.483 billion by 2030. Key drivers include rising demand in consumer electronics and advanced semiconductor manufacturing in Asia...

Oasis Intends to Vote Against Kyocera's Top Management at the Upcoming AGM

HONG KONG--(BUSINESS WIRE)--Oasis Management Company Ltd. (“Oasis”) is manager to funds that beneficially own shares in Kyocera Corporation (6971 JP) (“Kyocera” or the “Company”). Oasis has adopted th...

Kyocera Launches New Air-cooled UV LED Light Source “G7A Series”

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto, "Kyocera")(TOKYO:6971) has developed a new air-cooled, UV LED light source that ranks among the smallest in its class*1 w...

Oasis Announces a Second Campaign -- A Decade After the First -- to Create A Better Kyocera

HONG KONG--(BUSINESS WIRE)--Oasis Management Company Ltd. (“Oasis”) is manager to funds that beneficially own shares in Kyocera Corporation (6971 JP) (“Kyocera” or the “Company”). Oasis has adopted th...

Kyocera GAAP EPS of Yen 17.11, revenue of Yen 2.01B

Kyocera reports FY results: GAAP EPS of ¥17.11 & revenue of ¥2.01B.

Kyocera Licenses Quadric's Chimera GPNPU AI Processor IP

BURLINGAME, Calif.--(BUSINESS WIRE)-- #AI--Quadric® today announced that Kyocera Document Solutions Inc. (hereinafter: Kyocera) has licensed the Chimera™ general purpose neural processor (GPNPU) intel...

Kyocera Integrates HAPTIVITY® Technology into Sigma BF Mirrorless Camera

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto; “Kyocera”) announced today that HAPTIVITY®, its proprietary tactile technology that replicates realistic touch sensations...

Kyocera Document Solutions – New Initiative at Milan Design Week 2025: Collaboration with Elle Decor Italia to Merge Art with the "FOREARTH" Inkjet Textile Printer

OSAKA, Japan--(BUSINESS WIRE)--Kyocera Document Solutions Inc. (President: Takashi Nagai) is pleased to announce that a collaborative work featuring our environmentally friendly inkjet textile printer...

Kioxia, AIO Core and Kyocera Announce Development of PCIe 5.0-Compatible Broadband Optical SSD for Next-Generation Green Data Centers

TOKYO--(BUSINESS WIRE)--Kioxia, AIO Core and Kyocera announced the development of a PCIe 5.0-compatible broadband optical SSD for next-generation green data centers.

Kyocera - ANREALAGE and FOREARTH Collaborate for the third time at Paris Fashion Week 2025 AW

OSAKA, Japan--(BUSINESS WIRE)--Kyocera Document Solutions Inc. (President: Hironori Ando) is pleased to announce that a collaborative work designed and produced by Mr. Kunihiko Morinaga of the Japanes...

The Rise of Enterprise Content Management Market: A $78.4 billion Industry Dominated by Tech Giants - Xerox (US) and OpenText (Canada)| MarketsandMarkets™

Delray Beach, FL, March 06, 2025 (GLOBE NEWSWIRE) -- The global Enterprise Content Management Market will grow from USD 47.6 billion in 2024 to USD 78.4 billion by 2029 at a compounded annual growth r...

Kyocera Document Solutions - Florania and FOREARTH Collaborate on Pioneering Sustainable Fashion Ideas at Milan Fashion Week 2025 AW

OSAKA, Japan--(BUSINESS WIRE)--Kyocera Document Solutions Inc. (President: Hironori Ando) is pleased to announce that the designer and founder of Italian fashion brand Florania, Ms. Flora Rabitti, pre...

KYOCERA to Showcase Ceramic Lab Analytic Technologies for Multilayer Direct Bonding, Ceramic Additive Manufacturing, and Sapphire Apertures at Pittcon 2025

VANCOUVER, Wash.--(BUSINESS WIRE)-- #3Dprinting--KYOCERA Showcases Ceramic Lab Analytic Tech for Multilayer Direct Bonding, Ceramic Additive Manufacturing, & Sapphire Apertures at Pittcon Booth 428.

Kyocera, Ataya, and Ecrio Collaborate on End-to-End Private 5G Network Solution for Critical Communications

SAN DIEGO--(BUSINESS WIRE)-- #5G--Kyocera DuraForce PRO 3 smartphone uses Ecrio server software platform on Ataya Private 5G Network to support Edge AI deployments in new solution.

Kyocera to Establish "O-RU Alliance" to Advance 5G Open RAN Deployment in Collaboration With Six Telecom Partners

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (Kyoto, Japan; President: Hideo Tanimoto; "Kyocera") (TOKYO:6971) today announced that it will establish the "O-RU Alliance" on March 3, 2025, in col...

Kyocera Develops AI-powered 5G Virtualized Base Station for the Telecommunication Infrastructure Market

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto) (TOKYO:6971) today announced that it has officially begun the full-scale development of an AI-powered 5G virtualized base...

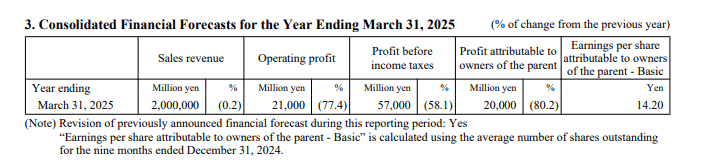

Kyocera GAAP EPS of ¥13.01, revenue of ¥1492.06B; updates FY outlook

Kyocera press release (KYOCY):GAAP EPS of ¥13.01 for the nine months ended December 31, 2024. Revenue of ¥1492.06B (-0.0% Y/Y).

Kyocera Q3 Earnings Assessment

The Q3 earnings report for Kyocera (OTC: KYOCY) was released on Monday, February 3, 2025 at 02:00 AM. Here's what investors need to know about the latest announcement. Earnings Kyocera missed estimat...

KYOCERA AVX EXHIBITS AT CES 2025

KYOCERA AVX and Kyocera Corporation are showcasing an extensive selection of highly engineered component and device technologies designed to enable state-of-the-art innovations in the automotive, tran...

Revolutionizing Detection: Kyocera Unveils the World's First Camera-LIDAR Fusion Sensor with Perfect Optical Alignment

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto; “Kyocera”) today announced the development of its unique Camera-LIDAR Fusion Sensor, the world's first1 LIDAR that aligns...

Kyocera Showcases Aerial Display, AI-Based Depth Sensor, Camera-LIDAR Fusion Sensor, and More at CES 2025

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto, "Kyocera") today announced the technologies Kyocera Group companies will exhibit at CES 2025, the world's largest and mos...

Kyocera's AI-Based High-Res Depth Sensor for Close Imaging New Records

KYOTO, Japan--(BUSINESS WIRE)--Kyocera Corporation (President: Hideo Tanimoto; hereinafter: Kyocera) today announced a high-resolution AI-based depth sensor for measuring tiny objects that have been d...

Kyocera, a 24M Technology License Partner, Doubles Production of SemiSolid™ Lithium-Ion Batteries Using 24M Technology

Success of Kyocera’s Enerezza residential energy storage system based on 24M technology is a testament to the company’s innovation and quality CAMBRIDGE, Mass. — 24M today announced that its technolog...

Kyocera, a 24M Technology License Partner, Doubles Production of SemiSolid™ Lithium-Ion Batteries Using 24M Technology

CAMBRIDGE, Mass.--(BUSINESS WIRE)--24M today announced that its technology license and joint development partner, Kyocera Corporation, aims to double its production capacity for 24M SemiSolid™ lithium...

$89.65+ Bn Building Integrated Photovoltaics (BIPV) Market Forecasts, 2024-2029, Profiles of Trinasolar, Dow, Onyx Solar, AGC, Solarday, Mitrex, Polysolar, Kyocera, MetSolar, and SunTegra Solar

Dublin, Nov. 15, 2024 (GLOBE NEWSWIRE) -- The "Building Integrated Photovoltaics Market - Forecasts from 2024 to 2029" report has been added to ResearchAndMarkets.com's offering. The building-integrat...