The 6 Best Stock-Picking Services

The stock market has been one of the most reliable ways to create wealth over the long run.

However, if you invest in the wrong stocks at the wrong times, it can also be one of the fastest ways to destroy wealth.

But choosing the right investments is hard. It's also time-consuming. You have to dig through financial statements, read earnings reports, and stay on top of the latest news. It's a lot of work.

That's where stock-picking services come in. These services employ teams of experts who do all of the research and analysis for you. All you have to do is follow their recommendations.

But while all of these services promise the same thing — great performance — they're not all created equally. And without firsthand experience of each of them, it can be difficult to determine which one is right for you.

That's why I put together this list.

As someone who's tried dozens of these services over the years, here's my list of the 6 best stock-picking services in 2026.

Summary of the best stock-picking services

In my opinion, the most important criteria when evaluating stock-picking services are 1) returns, 2) consistency, and 3) price.

With those factors in mind, here's a quick look at my list:

- Best overall: Motley Fool Stock Advisor

- Best quant-driven service: Alpha Picks

- Best for disruptive technology: Motley Fool Rule Breakers

- Best for traders: Mindful Trader

- Best for long-term swing trades: Ticker Nerd

- Best for a high-caliber team of analysts: Moby

Keep reading for detailed breakdowns of each service.

All performance figures are as of Aug 25, 2025.

1. Best overall: Motley Fool Stock Advisor

- Our rating:

- Best for: Long-term investors

- Cost: $199/year ($99 for new members through this link)

Ultimately, the best stock-picking service is the one that reliably generates the highest returns.

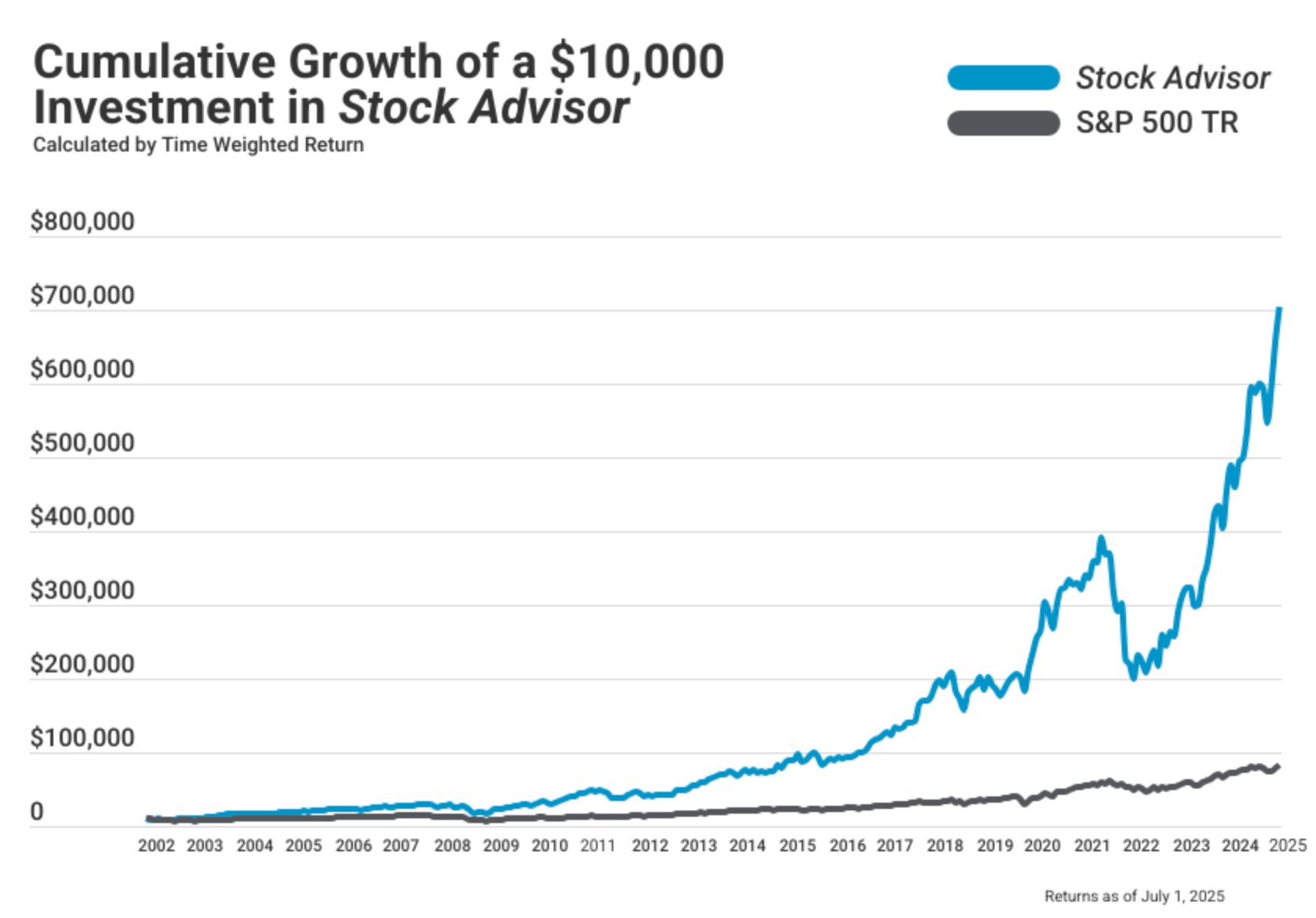

Since its launch in 2002, Stock Advisor has consistently delivered outperforming stock recommendations to its subscribers.

Over the last 20+ years, these stock picks have outperformed the S&P 500 by almost 5.7x (1,057% vs 185%) according to The Motley Fool site:

Source: Motley Fool

While past performance doesn't guarantee future returns, there is no other service that can boast this type of long-term track record.

Brothers Tom and David Gardner launched The Motley Fool with the goal of bringing high-quality investment advice to individual investors. They focus on established, growing companies that they plan to hold for 5+ years.

While the results have been outstanding, I don't think Stock Advisor's rule of investing in “25+ companies recommended by The Motley Fool over time” provides sufficient diversification, and may cause its members to take on an unnecessary level of risk.

Personally, I think around 50% of your stock portfolio should be in index funds (like VOO, Vanguard's S&P500 ETF, etc.).

The extra diversification may lower your returns (if the Motley Fool picks continue to outperform), but it may also substantially reduce your risk.

Other than that, I don't have anything negative to say about the service.

What you'll get

The Stock Advisor team sends two new stock picks each month with a detailed analysis of each investment.

Additionally, new members will enjoy using GamePlan, a tool to help you build your portfolio from scratch based on your preferred investing style.

You'll also receive access to additional educational resources, community features, and all previous recommendations and their performance.

You can get the first year of Stock Advisor for $99 (save 50%) with the link below:

2. Best quant-driven service: Alpha Picks

- Our rating:

- Best for: Quantitative-based stock picks

- Cost: $499/year (right now, $449 for new members through this link)

Alpha Picks is a momentum-based stock-picking service that was launched by Seeking Alpha in July 2022. It's off to an excellent start.

I've been a paying subscriber to Seeking Alpha Premium for the last five years — it's one of my favorite places to find high-quality investment research from a broad range of contributors.

After finding out about Alpha Picks, which combines the research on the platform with its Quantitative Ratings system, I knew I had to sign up.

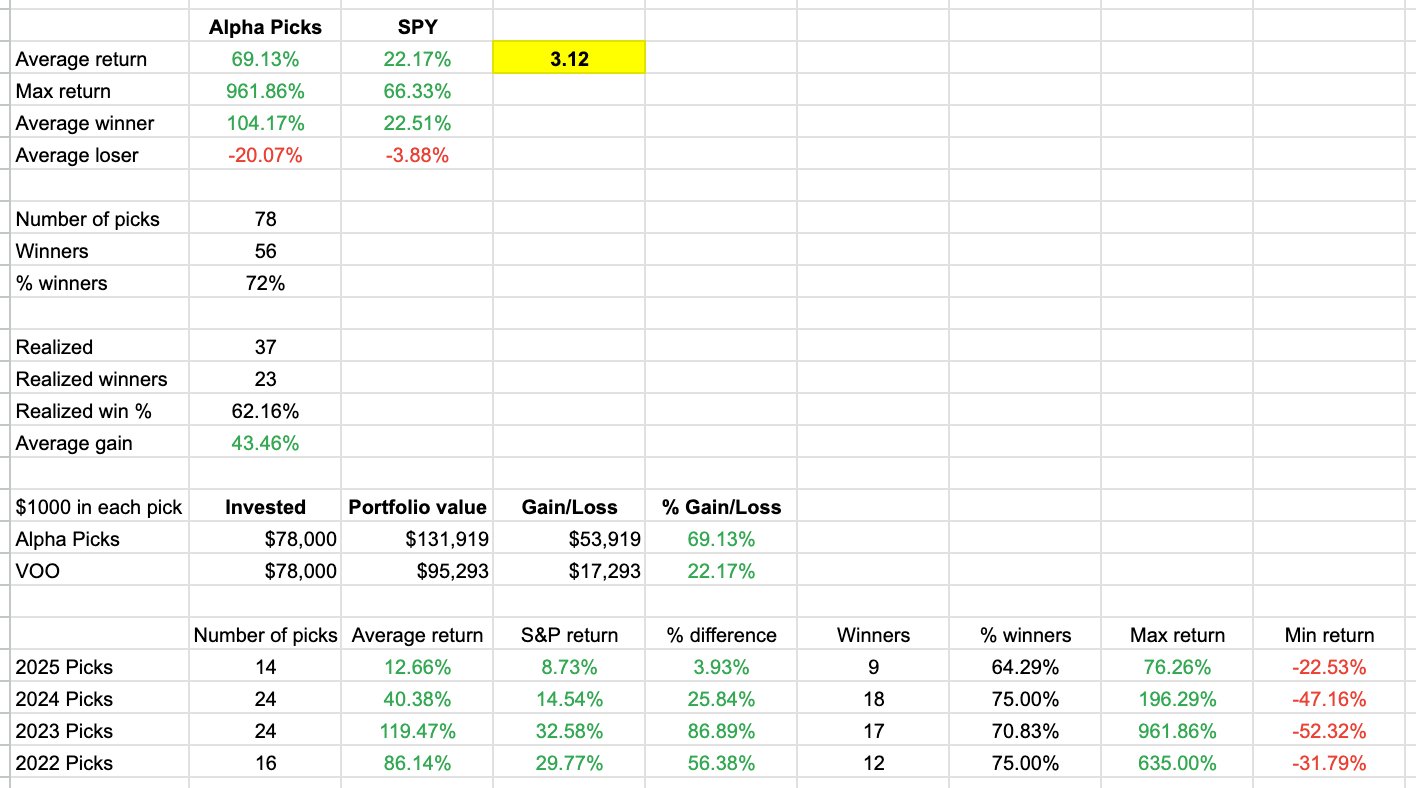

I've tracked each one of its stock picks for the last 3+ years. Here are the results:

Source: Alpha Picks Review

Alpha Picks has returned 3.12x over the S&P. While the service is still pretty new, the returns are as good as I could have possibly expected.

At the heart of the Alpha Picks service is its quantitative analysis, which is primarily driven by its Quant Ratings model. This model ranks stocks based on five factors: value, growth, profitability, EPS revisions, and momentum.

After filtering stocks through its Quant model, the Alpha Picks' investment team always makes the final buy/sell/hold decisions. The average holding period is 1–2 years, which is quite a bit shorter than Stock Advisor's.

What you'll get

Alpha Picks will send you two new stock recommendations per month, along with an analysis of why each stock is being selected.

You'll also get complete access to every previous recommendation, along with an up-to-the-minute display of every stock's (and the entire portfolio's) performance.

3. Best for disruptive tech: Motley Fool Rule Breakers

- Our rating:

- Best for: Long-term investors who want to invest in disruptive technology

- Cost: $499/year ($299 for new members through our link)

Rule Breakers is now only available through Motley Fool's Epic service, which includes subscriptions to Rule Breakers, Stock Advisor, and a few other products. You can read our Motley Fool Epic review for more information.

In addition to its flagship newsletter (Stock Advisor), The Motley Fool also launched Rule Breakers back in the early 2000s.

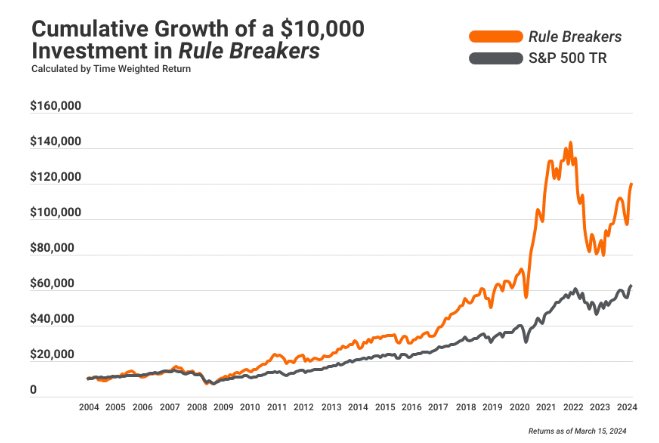

While it doesn't have near the popularity of Stock Advisor, the returns are similarly impressive according to the website (+345.01% vs +149.71% for the S&P):

Source: Motley Fool

While the Stock Advisor team can select any stock it deems to be high-quality, to qualify for the Rule Breakers portfolio, a stock must have the potential to disrupt and reshape an entire industry.

As you can imagine, many of these stocks come with high valuation multiples and are high-risk, high-reward investments. Because of this, the Rule Breakers portfolio tends to be more volatile than the Stock Advisor portfolio.

This leads me to my primary complaint about Rule Breakers, which is similar to my complaint about Stock Advisor: the service suggests holding a fairly concentrated portfolio of highly volatile stocks.

While this may lead to outperformance, it can also be extremely difficult to stomach.

For example, the above chart may look great, but you would have had to withstand a ~50% drawdown — without selling — in 2021.

When investing in the types of companies that Rule Breakers does, these types of drawdowns are almost inevitable. If you don't have a large appetite for risk and can't handle the pain of losses this large, Rule Breakers isn't for you.

However, if you do want to add Rule Breakers disruptive stocks to your portfolio, blending those stocks with an allocation to broad-market index funds may help to reduce the drawdowns and volatility.

What you'll get

As mentioned above, Rule Breakers is only available through Motley Fool's Epic service. The service provides 5 new stock picks per month — 2 from Stock Advisor, 1 from Rule Breakers, 1 from Hidden Gems, and 1 from Dividend Investor.

Altogether, you end up with a diverse set of stock picks each month.

You'll also receive bonus features like GamePlan+, additional strategies, educational resources, and a members-only podcast which covers investing strategies and personal finance topics.

4. Best for traders: Mindful Trader

- Our rating:

- Best for: Short-term “swing” trades

- Cost: $47/month

Mindful Trader is a swing trading alert service run by Eric Ferguson.

Eric, a Stanford graduate, spent four years developing his own trading system by running hundreds of thousands of simulations.

By doing so, he was able to identify a select few trading strategies that had consistently produced strong performance throughout multiple market cycles.

He's been a professional trader ever since.

All of Eric's trades are based on his system — there's no room for subjectivity, "gut feelings," or any other type of emotion. If his system sends him a buy order, he buys it.

Here's a sample of his trade alerts:

Source: Mindful Trader

While he doesn't expect to win every trade, he trusts the math and statistics behind his system and knows that, given enough time, his strategy makes money.

I like Eric's service because he's taking every trade himself with his own money, is incredibly transparent, and genuinely wants his subscribers to learn how to be successful traders.

What you'll get

Eric often sends between 1-3 trade alerts per day, both stocks and options, with average holding periods of 2-4 days.

This is a service for active traders, not long-term investors (like the rest of the entries on this list).

5. Best for long-term swing trades: Ticker Nerd

- Our rating:

- Best for: Long-term “swing” trades

- Cost: $199/year ($99 for new members through this link)

Ticker Nerd is another relatively new stock-picking advisory service. It was launched in February 2021.

The team uses software to filter stocks based on analyst ratings, social media sentiment, and institutional trading data.

After narrowing the list using these filters, the team performs a combination of fundamental and technical analysis and provides readers with only their favorite investment ideas.

Their approach resembles a long-term swing trading style, in which most picks are held for 3–24 months.

Another small difference is that Ticker Nerd produces one report each month with two stock picks, as opposed to most other services on this list, which produce two reports with one stock pick per issue.

The website doesn't have much in the form of performance data, however, so you'll have to start the free trial to see the team's recent picks and how they've performed.

What you'll get

You'll receive one report per month with two stock recommendations and accompanying analysis. You'll also get access to Wall Street analyst ratings for every stock covered and a database with all prior picks.

6. Best for a high-caliber team of analysts: Moby

- Our rating:

- Best for: Many, medium- to long-term investments

- Cost: $199/year ($99 for new members through this link)

Moby is a mobile-friendly investment research platform for stock and crypto investors.

Unlike the other services on this list (which only provide 2 new stocks per month), Moby makes 3 new recommendations per week.

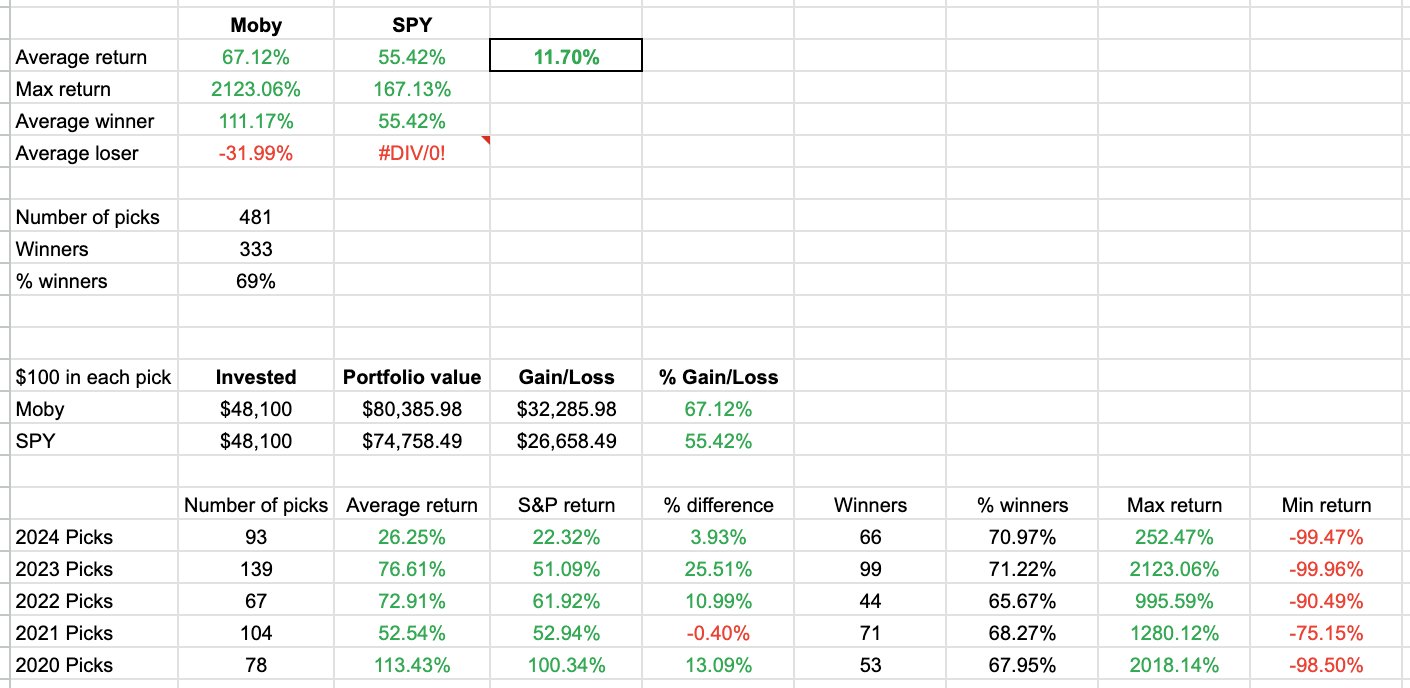

Like I'm doing with Alpha Picks, I've tracked Moby's picks since its inception:

Source: Moby Review

Those picks have averaged outperformance of 11.70% over the S&P.

In addition to the volume of picks it provides, what sets Moby apart is its team. The team is made up of expert analysts from institutions like Goldman Sachs and Morgan Stanley.

Every piece of content on Moby — all of its investment ideas, daily market updates, market summaries, and research reports — is written by this team.*

*To keep its content jargon-free and easily accessible to everyone, these ex-Wall Street analysts were paired with journalists who remove the complexity and distill the information into actionable insights.

In addition to the fundamental analysis performed by the team, Moby deploys machine learning and quantitative algorithms to find new investment ideas.

What you'll get

You'll receive 3 new stock picks per week, each with a jargon-free report on why it's being recommended.

You'll also get access to Moby's Model Portfolios and a suite of other features (Political Trades, Stock Screener, online community, and more).

What does a stock-picking service do?

Stock-picking services provide their members with stock recommendations.

Each service has a team of analysts who spend all of their time researching companies and scouring the market for the best available investment opportunities.

While every service has its own set of criteria for what makes a good investment, they're all aiming to 1) provide you with high-quality stock picks that 2) require minimal effort by you to implement.

Most of these services operate as subscription newsletters. They will send you 1–2 new stock picks per month via email. You'll also get regular portfolio updates, sell alerts, and bonus features.

What should you look for when choosing a stock advisor service?

As mentioned in the introduction, there are a handful of factors you should pay special attention to when evaluating these services.

1. Track record and returns

Each service's performance is by far the most important factor to consider when choosing between subscriptions. If they don't provide this information or if they have a history of mediocre results, the service probably isn't that good.

If you're wondering who has the best stock-picking record, Stock Advisor, Rule Breakers, and Alpha Picks are all performing very well.

That said, keep in mind that just because something has performed well in the past does not mean that it will continue to do so in the future.

2. Consistency, reliability, and credibility

One year of outperformance is one thing, but consistently delivering outperformance year after year is what really matters — and is also exceptionally difficult.

The longer a service has been around and the more consistently it has beaten the market, the better.

It's this factor that makes The Motley Fool (both its Stock Advisor and Rule Breakers services) really stand out. Both services have fairly reliably outperformed the market over a span of more than two decades.

3. Cost and affordability

If you're wondering whether stock-picking services are worth it, simply compare the performance of a service to the S&P 500, multiply the outperformance by the amount of money you're investing, and compare that to how much the service costs.

For example, if a service averages 40% per year and the S&P averages 10% per year, you would need to be investing at least $500 to make a $150 annual subscription worth it.

Here's the math:

$500 * 10% = $50

$500 * 40% = $200 - $150 = $50

This is for illustrative purposes only. Past performance does not guarantee future results.

The cheaper the service and the higher the returns it provides, the better.

4. Investing strategy

Finally, you'll want to use a subscription service that aligns with your risk tolerance and financial goals.

If you want to be a buy-and-hold, long-term investor and have very few transactions, Mindful Trader probably isn't the right service for you. Similarly, if you can't stomach volatility, you should probably pass on Rule Breakers.

While many different investing strategies do work, you want to find one that fits well with your personality and makes it easy for you to manage.

How we chose the best stock-picking services

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good the product or service is — i.e., how its returns have been and how long it has been generating those returns.

- Cost: Overall price and value for money.

- Usability: What the interface looks like, whether the emails are easy to read and access, design elements and features, and general accessibility.

- Credibility: Quality of information, as well as company and brand reputation.

- Audience: Who the product is for, the uses and applications, whether it actually works, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Stock-picking services can help you save time, provide market education, and help you learn how to build your portfolio. But, while earning high returns might be your goal, choosing the wrong service can have the exact opposite effect.

That's why you should choose one that comes highly recommended, aligns with your investing goals, and is produced by a high-quality company.

If you're having a hard time deciding between a few of the services I mentioned above, don't be afraid to sign up for several and compare them side-by-side.

Most of them offer 30-day money-back guarantees, so you can try them for a month before making a decision.

It may be worth testing. For many people, a subscription to a good stock-picking service can be one of the highest ROI investments you can make.

.png)