How to Invest in Blue Chip Art in 2026

Art has been a status symbol and a preferred investment vehicle of the ultra-wealthy for hundreds of years.

Recently, however, investing in art has become accessible to all investors.

As an asset class, high-end art has been known to offer diversification outside of public markets, a hedge against inflation, and the potential for outsized returns.

Nevertheless, like stocks, not all art investments are created equal. Some pieces, known as “blue chip art,” have been more stable than others.

Here's everything you need to know about blue chip art and how to invest in it.

What is blue chip art?

The term “blue-chip” art comes from the stock market.

The most reputable, well-established, and profitable public companies are known as “blue-chip” companies, or simply “blue chips,” and their stocks are “blue-chip” stocks.

Who coined the term "blue chip?"

An employee at Dow Jones, Oliver Gingold, is credited with coining the term.

In 1923, he noticed several stocks trading at more than $200 per share and made a comment about them being “blue-chip stocks,” in reference to the most valuable poker chips.

Given the track record of blue-chip stocks, this term has become synonymous with quality, stability, and profitability.

In a similar manner, blue chip art refers to well-established works that are considered to be among the safest and most stable art investments.

These pieces earn this reputation because they were created by well-known artists who have track records of producing high-quality, time-tested, and in-demand works of art.

If an artist's previous works have steadily increased in value over time, it's more likely this will continue in the future (both for their previous works and new creations).

Because of this, blue-chip artwork often sells for the highest prices at auction and, indeed, becomes more valuable over time.

Who are blue-chip artists?

Even if you're unfamiliar with the world of art, chances are you've heard the names of some of the most popular artists.

Pablo Picasso, Jean-Michel Basquiat, Keith Haring, Andy Warhol, and other globally recognized artists — these are the names of blue-chip artists.

These artists, who may be actively creating art or retired, alive or dead, have solid and established reputations. Each of them has cemented their name in the history of art.

In addition to the names above, others generally considered to be blue-chip artists include:

- Claude Monet

- Damien Hirst

- Rembrandt

- Qi Baishi

- Gerhard Richter

- Fu Baoshi

- Amedeo Modigliani

The list of blue-chip artists is dominated by modern artists (such as Jeff Koons, Takashi Murakami, and Damien Hirst), followed by post-war artists (such as Andy Warhol, Jasper Johns, Cindy Sherman), 19th-century artists (such as Claude Monet), and a handful of old masters (such as Van Gogh and Rembrandt).

Each of these artists has one thing in common: their work is in increasingly high demand. If a piece by one of these artists is at an auction, you can be sure it will be the centerpiece of the show.

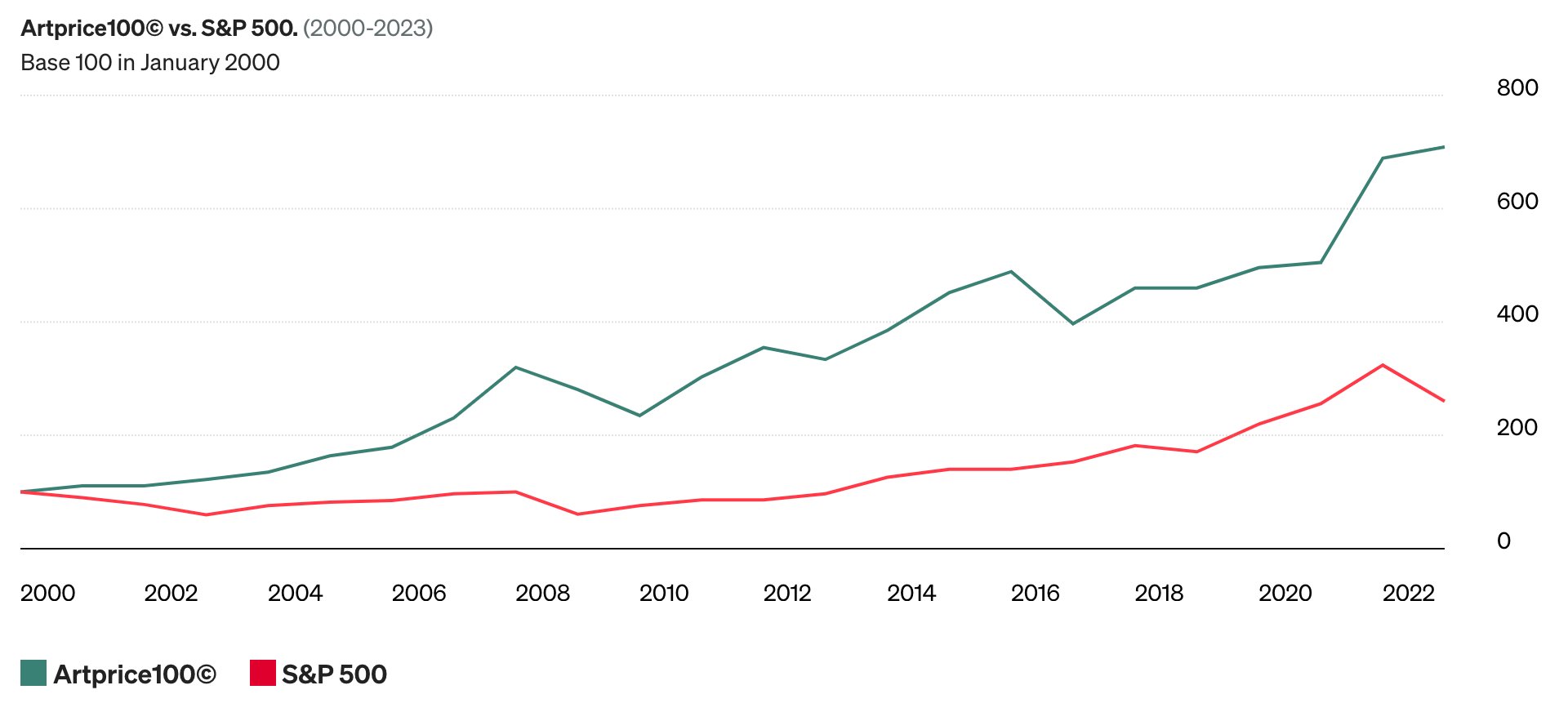

Blue chip art vs the S&P 500

If you landed on this article, you're likely aware of the art market's strong returns relative to the S&P 500 over the last 20+ years:

Source: Masterworks

What is the Artprice100?

The Artprice100 index is comprised of the art market's 100 most successful artists based on their auction revenue over the previous five years (in this case, January 2018 through December 2023).

To qualify, each artist must have auctioned at least ten works (excluding prints and multiples) annually for them to be included in the calculations.

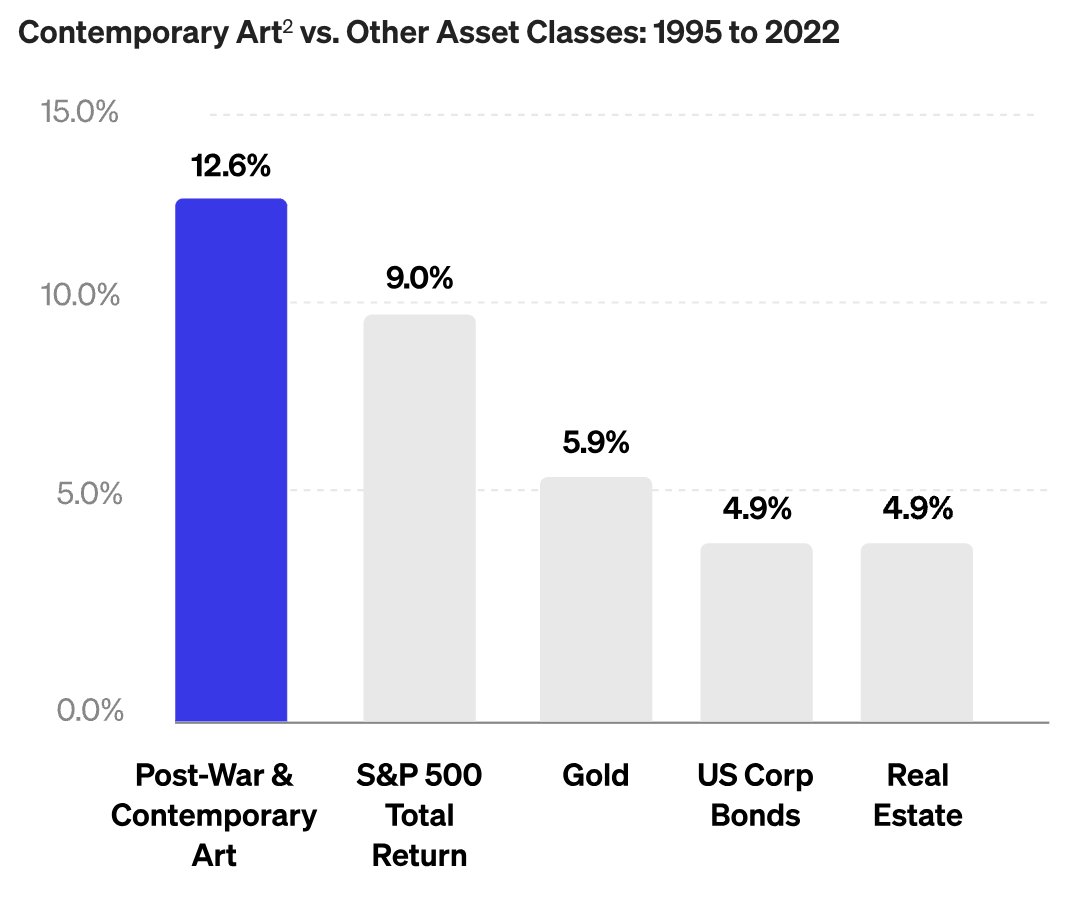

Masterworks is an art investing platform that focuses on post-war and contemporary art. These artists make up the bulk of the Artprice100 and, as a class, have had strong appreciation since the mid-90s:

Source: Masterworks

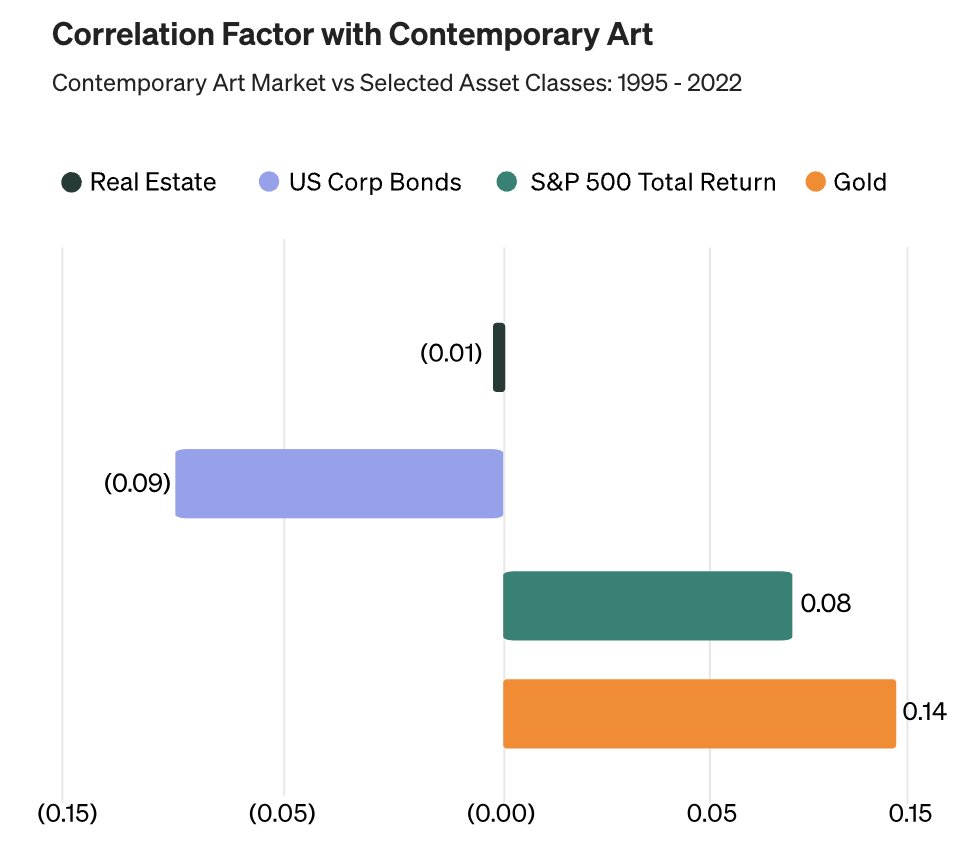

In addition to outperforming these assets over the time period selected, art prices have demonstrated a low correlation with these other investments over the same period:

Source: Masterworks

A low correlation between a portfolio's investments means that when one asset class experiences volatility or decline, the others have historically been largely unaffected (or may have even performed well), thereby reducing the portfolio's overall risk.

Art's historically strong returns and diversification benefits have made it an increasingly popular investment in the last few years, especially as new investment platforms have emerged to increase accessibility to the asset class.

Check out our Masterworks Review for more information on investing on the platform.

How to invest in blue chip art

The most in-demand paintings regularly sell with 7-, 8-, and even 9-figure price tags. As an example, Andy Warhol's "Shot Sage Blue Marilyn" sold for $195 million in 2022.

These price tags make blue-chip art prohibitively expensive for all but the ultra-wealthy unless you invest through fractional ownership.

Fractional ownership is where you purchase shares of a painting alongside other investors and become a co-owner in the piece, similar to how investors buy shares of publicly traded companies.

Because of these offerings, the art market (especially the blue-chip art market) has become increasingly accessible to more investors.

Before diving into art investing, though, you should align your expectations.

While historical returns have been strong, this trend isn't guaranteed to continue in the future. Art is also more illiquid than other types of investments, which carries additional risks.

Additionally, unlike stocks (which are income-producing assets), art investing is subject to speculation, and investment returns are almost wholly tied to investor sentiment and popularity.

Platforms for investing in fine art

Masterworks and Willow Wealth are two platforms where you can invest in fine art.

Masterworks

Masterworks is one of the most popular fractional ownership platforms for investing in high-end art.

There are over 970,000 members who have invested a combined $1.1 billion on the platform.

How investing on Masterworks works:

- A team of experts searches for and purchases art by artists with the most momentum.

- After purchasing the work, the company securitizes it with the SEC, which allows users to invest in individual shares in as small as $20 increments.

- The painting is stored in an air-, temperature-, and humidity-controlled environment.

To realize returns, shareholders can sell their shares to other users on Masterworks or wait until the Masterworks team sells the painting and distributes the proceeds.

Willow Wealth

Another platform for investing in art — along with 10 other alternative asset classes — is Willow Wealth (formerly Yieldstreet).

Unlike on Masterworks, where you can choose between and buy shares of individual pieces, Willow Wealth only offers shares of an art fund.

The paintings in the fund are curated and stored similarly to Masterworks, but the investment vehicle itself is different.

Masterworks vs Willow Wealth

If you're trying to decide between Masterworks and Willow Wealth, here's a simple guide:

- If you only want to invest in art, choose Masterworks. Masterworks specializes in art, and this focus shines through in the quantity and quality of its offerings.

- If you're an accredited investor and want to invest in art along with other alternative assets, choose Willow Wealth. Willow Wealth makes it easy to build a diversified portfolio of alternative investments.

Should you invest in blue chip art?

The art market can be quite volatile. Artists can explode in popularity overnight — and the prices of their paintings alongside them — but can fall out of favor just as fast.

And while blue-chip art is one of the most resilient segments of the market, it's certainly not immune to risk.

Here's a short summary of the pros and cons:

| Pros | Cons |

| Performance. Strong, relatively stable performance over the past 25+ years. | Volatility. While more stable than other art investments, blue chip art can still have large price swings. |

| Diversification. Unique diversification into an alternative asset class. | Illiquid. Depending on what art you own, it can be very difficult to find a buyer. |

| Accessibility. For non-ultra-wealthy investors, fractional art investing is the most accessible and liquid form of art investment. | Expensive. While much cheaper than buying these artworks outright, many platforms still have high minimum investments for buying shares. |

If you're willing to accept these risks, are interested in the asset class, and will conduct thorough research before making an investment, you may enjoy allocating some portion of your portfolio to art.

Blue-chip vs red-chip art

Unlike blue-chip artists, who have a well-established reputation and proven track record, emerging artists gaining rapid commercial interest are known as red-chip artists.

Red-chip artists skip the traditional route (i.e., art galleries, dealers, and museums), promoting their work on the internet instead. Some red-chip artists specialize in creating digital art known as NFTs (non-fungible tokens).

Compared to blue-chip art, red-chip art can offer significantly higher returns in the short- and medium-term but carries far more investment risk.

Beeple, one of the most well-known red-chip artists, sold an NFT for $69 million in 2021. Just 5 months earlier, the artist had never sold a piece of art for more than $100.

In addition to Beeple, other red-chip artists include Ayako Rokkaku, Matthew Wong, Amy Sherald, Issy Wood, and Jerkface. Each of these artists has a significant online following, a hallmark of a red-chip artist.

Here's a simple table to summarize the differences:

| Blue chip art | Red chip art |

| World-renowned artists with long, established track records | Emerging artists with rapidly increasing commercial interest |

| Pieces are typically sold through traditional channels like auction houses and galleries | Promoted via the internet and social media rather than traditional routes |

| In general, pieces appreciate slowly over time | Less predictable price trends and more speculative in nature |

Final thoughts

Blue-chip art earns that status from the reputation of its creators.

Thanks to their popularity, quality, and staying power, their artworks tend to steadily increase in value over time.

This makes blue-chip art a relatively stable segment of the art market.

However, like all investments, it's not without risks. The art market can be illiquid and fickle, and can be driven by large swings in popularity.

Be sure to perform your due diligence before making any investment decision, especially when considering alternative investments.

.png)