How to Build a Diversified Investment Portfolio (Plus 5 Examples)

While it may sound complicated, diversification is a relatively simple concept and is similarly easy to execute.

At its core, diversification means spreading your money across multiple investments. This way, if one investment drops in value, the others can offset the loss and stabilize your portfolio.

For example, if you only owned Apple stock and it dropped 10%, your portfolio would fall 10%. But if you also owned equal amounts of Microsoft and a bond fund and those stayed flat, your portfolio would only dip ~3%.

How exactly does diversification smooth out the bumps? It boils down to two simple ideas.

How it works

There are two concepts you need to know about diversification:

- Idiosyncratic risk: This is the risk that is unique to each asset. For instance, any individual company can go bankrupt or fall by 70%+ and never recover. You can reduce this risk by owning multiple investments within an asset class, like buying equal amounts of Apple, Microsoft, and Chevron.

- Asset correlation: Similar assets tend to move together. This is especially true for stocks in the same sector. For example, Apple and Microsoft (both tech) or Chevron and Exxon (both oil) are often influenced by the same economic trends. To reduce correlation risk, it's important to diversify not just within asset classes, but across them — owning a mix of stocks, bonds, and cash.

It's easy to overcomplicate diversification, but once you understand these two concepts, you're most of the way there. And thanks to ETFs and other low-cost funds, you can build a well-diversified portfolio with just 3-5 investments.

That might sound overly simple, but it's exactly how several billionaire investors recommend investing (more on those portfolios below).

Before we get to those examples, let's quickly cover risk tolerance and asset allocation.

Disclaimer: This is not investment advice. This article reflects my opinions based on my knowledge and experience. There are many nuances that I cannot cover in this article. Before investing, always do your own research and due diligence.

Risk tolerance and asset allocation

A well-diversified portfolio balances risk and reward by investing across different types of assets, primarily stocks, bonds, and cash. This mix is known as your asset allocation, and it's one of the most important decisions you'll make as an investor.

Stocks offer higher return potential but come with greater volatility. Bonds are steadier and less risky but produce lower returns. Cash provides liquidity and safety, though it doesn't grow much over time.

By adjusting how much you allocate to each asset, you can shape your portfolio's risk/reward profile:

- More stocks = more growth potential and more volatility

- More bonds and cash = less volatility and lower expected returns

Your allocation should reflect your risk tolerance and time horizon.

Younger investors can allocate more of their portfolios to stocks because their portfolios have more time recover from market drops. As investors approach retirement, many shift toward safer assets.

Popular assets

As mentioned above, stocks, bonds, and cash make up the bulk of most investors' portfolios.

Here's more information on each.

Remember: You can diversify within asset classes and across asset classes. For example, if your portfolio only consisted of U.S. companies, you could diversify by investing in international stocks (within) and/or by investing in bonds (across).

You can buy stocks, ETFs, bonds, and more with a Public brokerage account.

1. Stocks

When you buy a stock, you're buying partial ownership in a company.

Stocks are the main drivers of long-term growth and investment returns in portfolios. However, they're also the most volatile, especially in the short term.

To reduce this risk, you can diversify your stock holdings in several ways:

- By geography (U.S., international)

- By sector (tech, energy, consumer staples)

- By size (large-cap, mid-cap, small-cap)

- By style (growth vs. value)

Rather than buying dozens of individual stocks, you can achieve broad diversification through ETFs. An ETF is a single investment that holds a basket of securities.

Two popular stock ETFs are:

- VOO tracks the S&P 500 and holds 500 of the largest U.S. companies.

- VT holds shares in almost every major publicly-traded company in the world.

2. Bonds

When you buy a bond, you're lending money in exchange for regular interest payments. While stocks are the main drivers of growth in a portfolio, bonds are used to reduce risk and provide steady cash flows.

You can diversify your bond holdings by investing across different issuers (like governments and corporations) and maturity lengths (short-, intermediate-, and long-term).

Like with stocks, you can buy individual bonds, but many investors use bond ETFs for simplicity and diversification.

Two popular bond ETFs are:

3. Cash

Cash is money you have set aside in a checking, savings, or brokerage account that isn't invested.

This isn't an investment per se, but you should have cash on hand to cover your monthly expenses and any unexpected emergencies.

Most financial advisors recommend having 6–12 months of living expenses in cash on hand for an “emergency fund.”

Many investors also keep a certain amount of cash on hand in case any investment opportunities present themselves. This cash allows them to act quickly and without needing to sell another investment to free up funds.

This cash can be deposited into a high-interest savings account.

4. Alternative investments (optional)

Some investors also include alternative investments like real estate, commodities, cryptocurrencies, private credit, art, and more. These can enhance diversification, but they often come with higher risk and complexity.

Most investors (myself included) focus primarily on stocks, bonds, and cash.

Five investment portfolio examples

Below are five of the most commonly used and frequently recommended investment portfolios.

All of these example investment portfolios are relatively simple to implement with a few ETFs, which I recommend in parentheses.

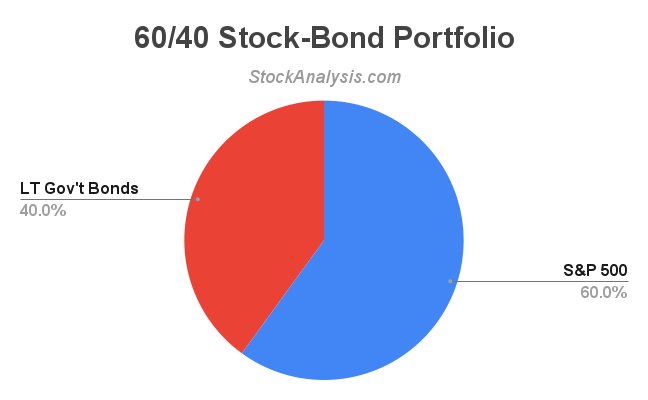

1. 60/40 Stock-Bond Portfolio

The 60/40 portfolio is one of the most popular asset mixes used by a broad range of investors, regardless of age.

As its name suggests, 60% of the portfolio is invested in stocks, and the remaining 40% goes to bonds. Most frequently, when deployed by a U.S. investor, the portfolio is split between the S&P 500 (like VOO) and 10-year U.S. Treasury bonds (like IEF).

This blended stock/bond portfolio is known for having moderate risk and generating moderate returns.

Potential drawbacks

This approach may be too conservative for younger investors and too risky for older investors.

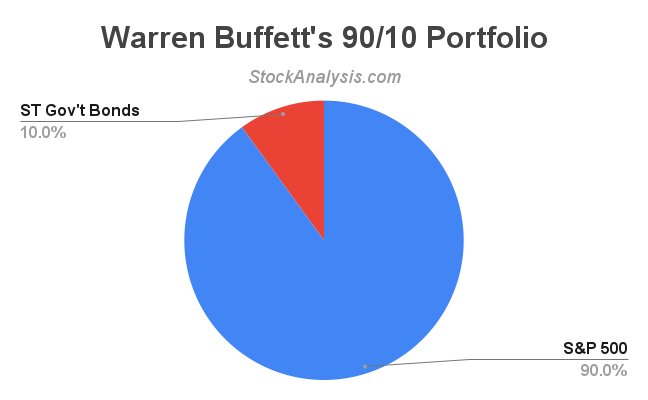

2. Warren Buffett's 90/10 Portfolio

Warren Buffett famously laid out a simple investing plan in his 2013 shareholder letter, which is the one he instructed for his wife's trust:

- 90% in a low-cost S&P 500 index fund (such as Vanguard's VOO)

- 10% in short-term U.S. government bonds (like SGOV)

It's a low-fee, broadly diversified portfolio that requires virtually no maintenance. And Buffett didn't just recommend it for simplicity — he believes this mix will outperform most actively managed strategies over time.

Buffett notes, “I believe the trust's long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions, or individuals — who employ high-fee managers.”

Potential drawbacks

This portfolio is very stock-heavy and may not be appropriate for older or risk-averse investors.

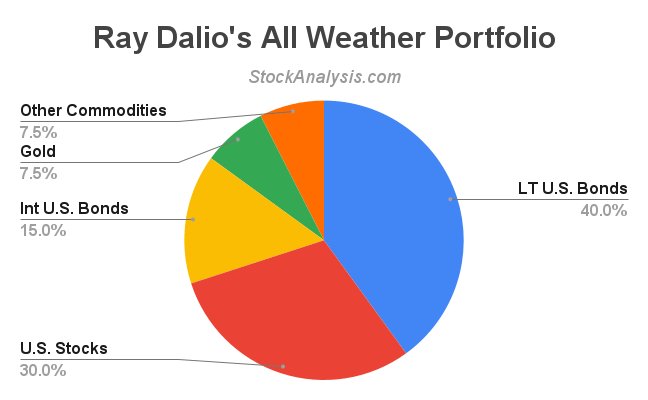

3. Ray Dalio's All Weather Portfolio

Ray Dalio founded Bridgewater Associates, one of the largest hedge funds in the world.

Dalio created the All Weather Portfolio to perform well in any economic environment. The portfolio is made up of long-term and intermediate U.S. bonds, U.S. stocks, gold, and other commodities.

To achieve this mix, consider the following ETFs:

The portfolio has largely achieved its goals of reducing volatility and performing pretty well regardless of the economic environment.

Potential drawbacks

Lower volatility comes with lower returns — the All-Weather Portfolio has not kept up with stock-only portfolios. Younger investors who can stomach volatility will likely have better results in a less conservative portfolio.

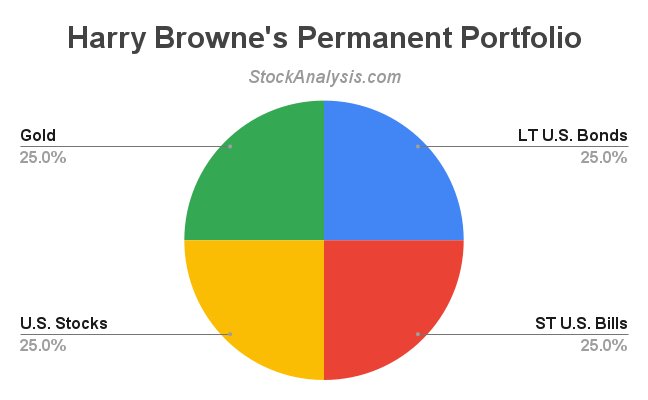

4. Harry Browne's Permanent Portfolio

Harry Browne was an author and investment advisor who developed the Permanent Portfolio.

The Permanent Portfolio has the same investment objective as the All Weather Portfolio — to perform well under any set of market conditions — but utilizes one less fund.

The portfolio is made up of equal parts long-term U.S. Treasury bonds (like TLT), short-term U.S. Treasury bills (like SGOV), U.S. stocks (like VTI), and gold (like GLD).

Like Dalio's, Browne's portfolio is known for moderate returns and low-moderate risk.

Potential drawbacks

The relatively small portion of the portfolio allocated to stocks reduces the volatility of the portfolio but also limits its upside.

5. The Barbell Strategy

The Barbell Strategy is how we at StockAnalysis.com invest our money.

We like to invest in individual stocks, which gives us the opportunity to outperform the market, but we also believe Warren Buffett is right about investing passively in index funds.

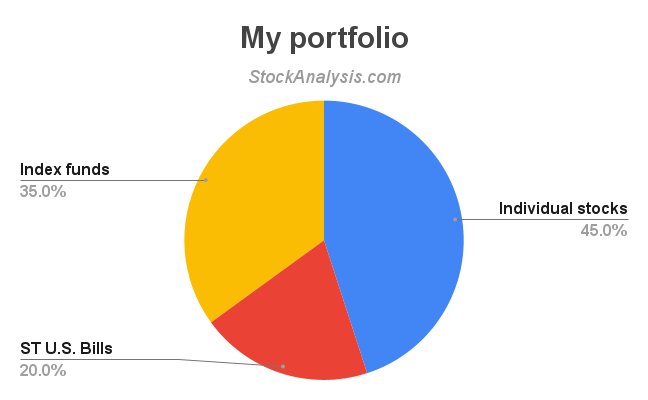

So, we combined the two into the barbell strategy. My portfolio looks like this:

The bulk of my money is in index funds (primarily VOO and VT) and short-term U.S. Treasury bills (SGOV). The rest is in individual stocks.

Microsoft (MSFT), Markel (MKL), Alphabet/Google (GOOGL), and Shopify (SHOP) are my largest individual positions.

Potential drawbacks

Although it can generate higher returns, owning individual stocks can result in a more volatile portfolio than passive investing.

The takeaway

Diversification is a fundamental aspect of managing risk and building long-term wealth. And, as you just saw, it's fairly easy to achieve.

Three expert investors — Warren Buffett, Ray Dalio, and Harry Browne — have recommended portfolios that only require owning 2–5 ETFs each. It doesn't get much simpler than that.

If you want to take things a step further, you can add additional asset classes to your portfolio (like alternatives) or be more granular within the asset classes you're already invested in.