The 7 Best Websites for ETF Research and Analysis

ETFs are one of the most popular investment options, and for good reason.

An ETF (exchange-traded fund) is a type of investment that holds a basket of assets, such as stocks, bonds, or commodities, and trades on a stock exchange like an individual stock.

ETFs offer instant diversification, are inexpensive, and provide easy access to nearly any market or theme you can imagine.

But with more than 26,000 ETFs available globally, including 4,400+ in the U.S. alone, figuring out which ones are best for your portfolio can be overwhelming.

That's why I put together this list.

Below are seven of the best websites for researching and analyzing ETFs. Whether you're looking for quick facts, fund comparisons, overlap analysis, or detailed analyst commentary, these sites have everything you need.

Summary of the best ETF research websites

| Website | Rating | Best for | Pricing (for ETF research) |

| VettaFI (ETF Database) | Comprehensive U.S. ETF research | Primarily free | |

| Stock Analysis | Global coverage, fast lookups, holdings breakdowns, dividend history, and more | Primarily free | |

| etf.com | Detailed U.S. ETF data, free tools, and industry news | Primarily free | |

| Morningstar | Fund analysis and analyst commentary | Primarily paid | |

| ETF Research Center | Fund overlap analysis and diversification checks | Mixed | |

| Yahoo Finance | ETF screener | Free | |

| justETF | European ETFs | Primarily free |

1. VettaFi (ETF Database)

- Rating:

- Best for: Comprehensive U.S. ETF research

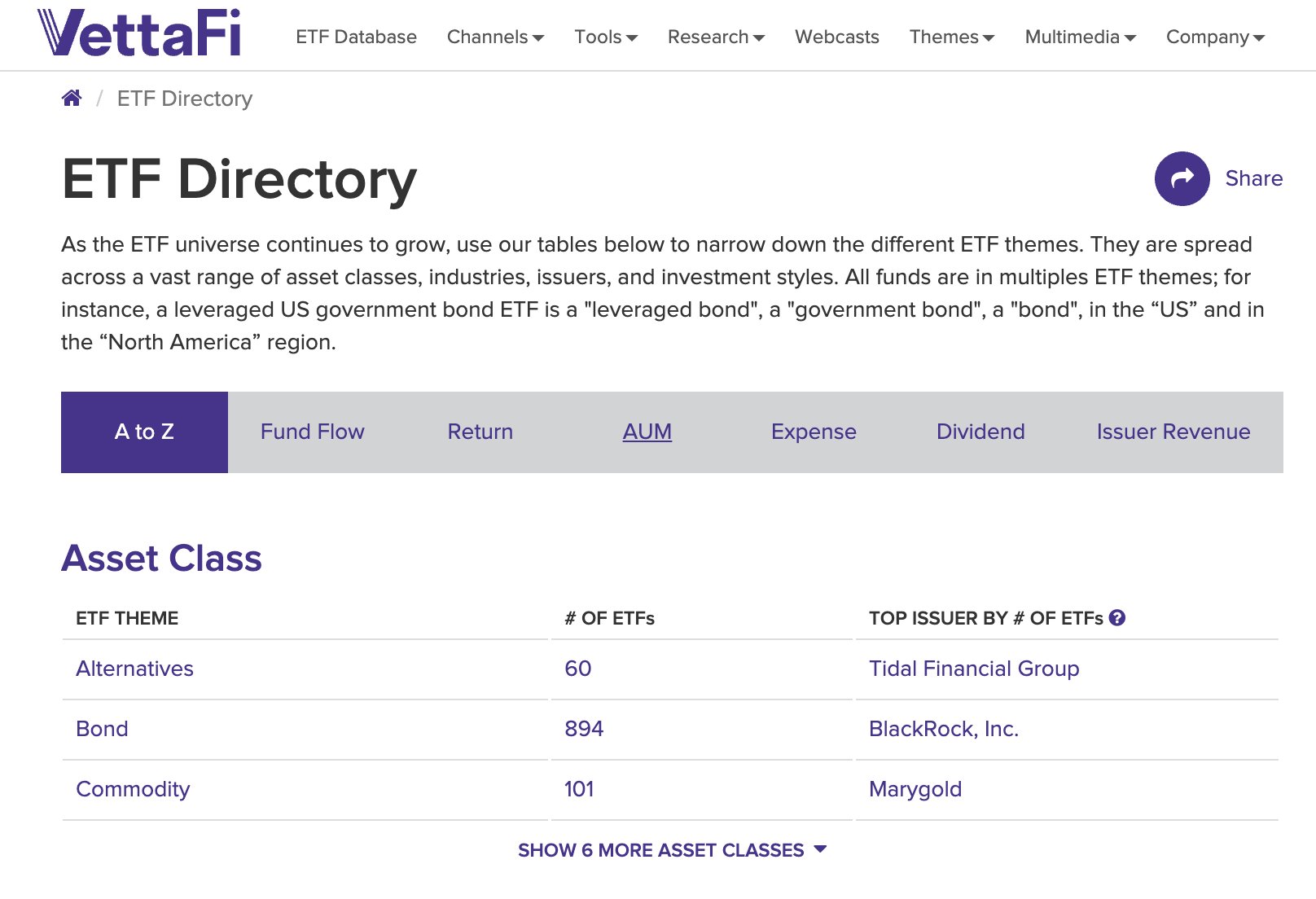

VettaFi (formerly known as ETF Database, ETFdb, or just etfdb.com) is one of the most comprehensive U.S.-focused ETF research hubs online.

It has data on thousands of U.S.-listed ETFs and makes it easy to filter, compare, and analyze funds across themes, regions, sectors, performance, and more.

As you would expect, the site has detailed information on each of the ETFs in its database. Each fund page includes the fund's profile, holdings, performance, fund flows, expense ratio and fees, current dividend, and more.*

*While a good portion of its data is accessible for free, some of the more granular information is hidden behind a paywall. For example, non-members can only see a fund's top 15 holdings.

VettaFi also has features for discovering new ETFs to invest in. In addition to its ETF Directory (pictured above), its ETF screener allows you to search by issuer, expense ratio, sector, performance, and more.

It also provides thematic ETF lists, like artificial intelligence, renewable energy, or dividend-focused funds. These lists are a great way to quickly find ETFs built around specific themes you may be interested in investing in.

All of these features combine to make VettaFi the most comprehensive site for discovering, researching, and analyzing U.S.-listed ETFs.

2. Stock Analysis

- Rating:

- Best for: Comprehensive U.S and global ETF coverage, fast lookups & comparisons, holdings breakdowns, dividend history, and more

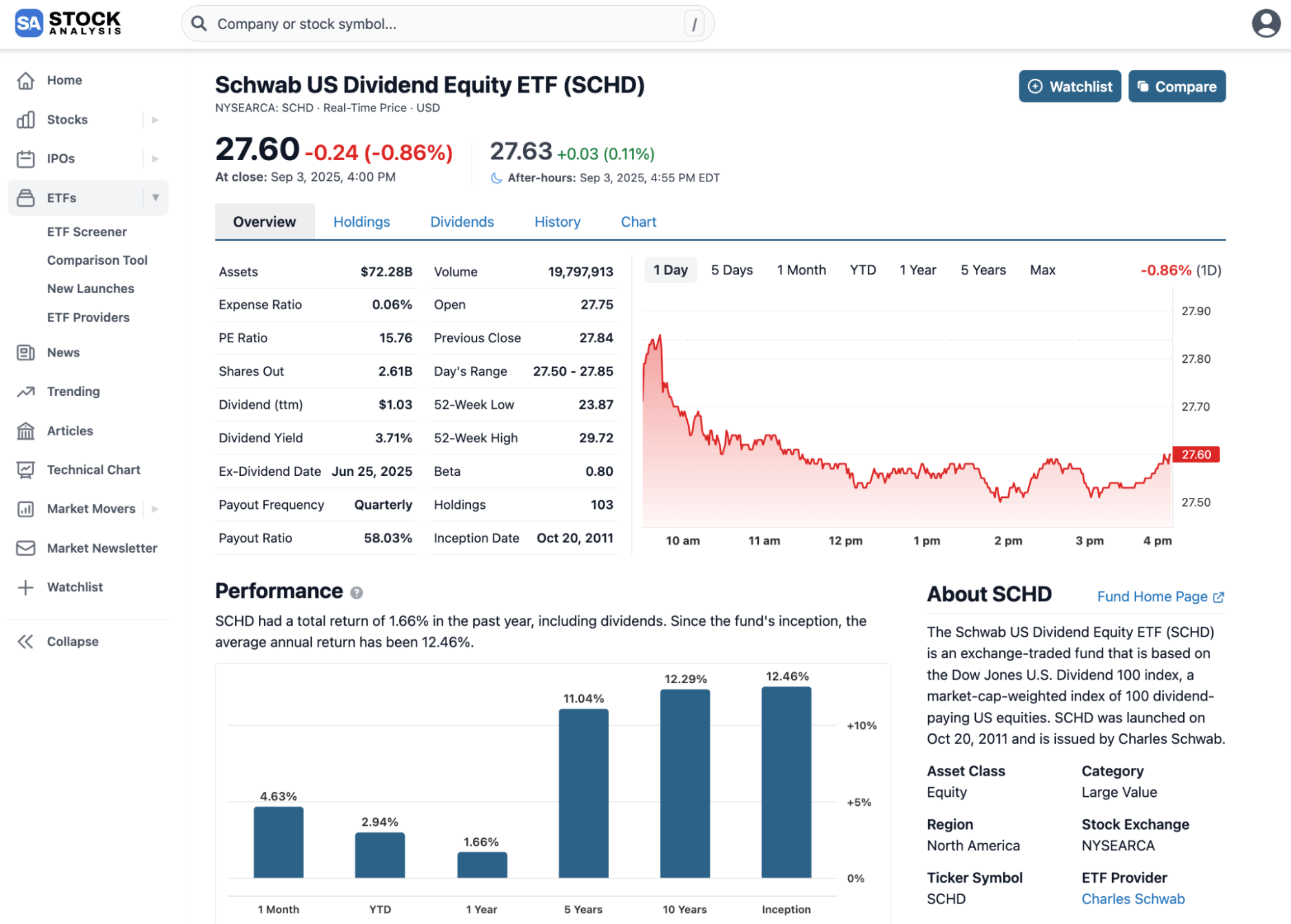

Stock Analysis is designed for investors who want fast and reliable data without any unnecessary clutter.

While it's best known for individual stock research, the site also has data on 16,000+ ETFs globally (including all 4,400+ U.S. ETFs), plus an ETF screener, an ETF comparison tool, ETF lists, and more.

You can start by looking up an ETF to see a stock chart and fund-relevant information (assets, expense ratio, dividend yield and payout frequency, holdings, performance, etc):

From there, you can drill down into the fund's holdings,* dividends, and stock price history.

*Free users can see the top 25 holdings for every fund. Plus, you can click straight through to analyze the underlying stocks without leaving the site.

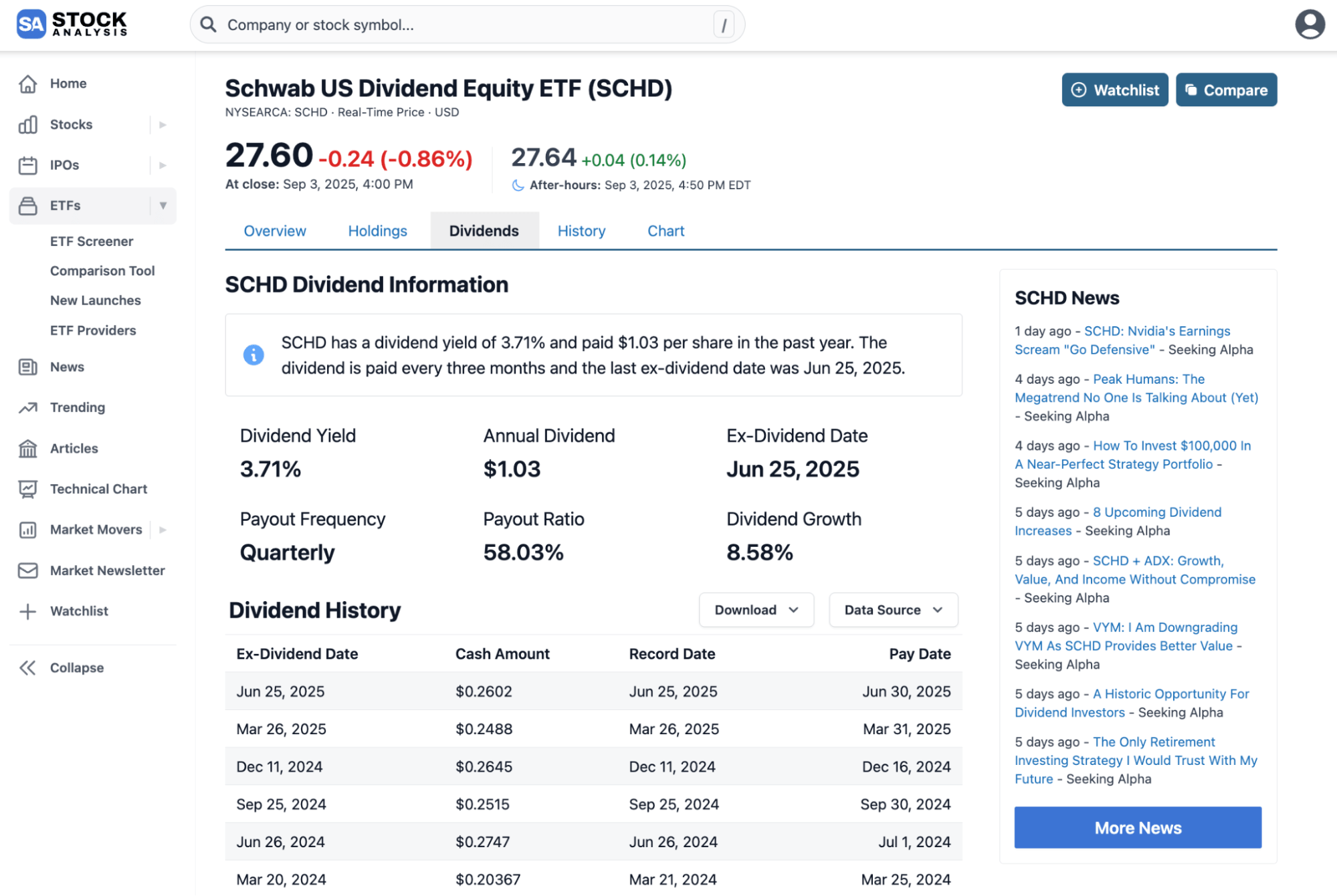

In addition to providing information on the current dividend, you can also see an ETF's dividend history (related dates and dividends paid):

If you're looking for new ETFs, the ETF screener allows you to easily sort through the 16,000+ ETFs listed based on 96 filters, such as issuer, class, performance, or technical indicators.

Once you find one you're interested in, you can easily add it to your existing watchlist.

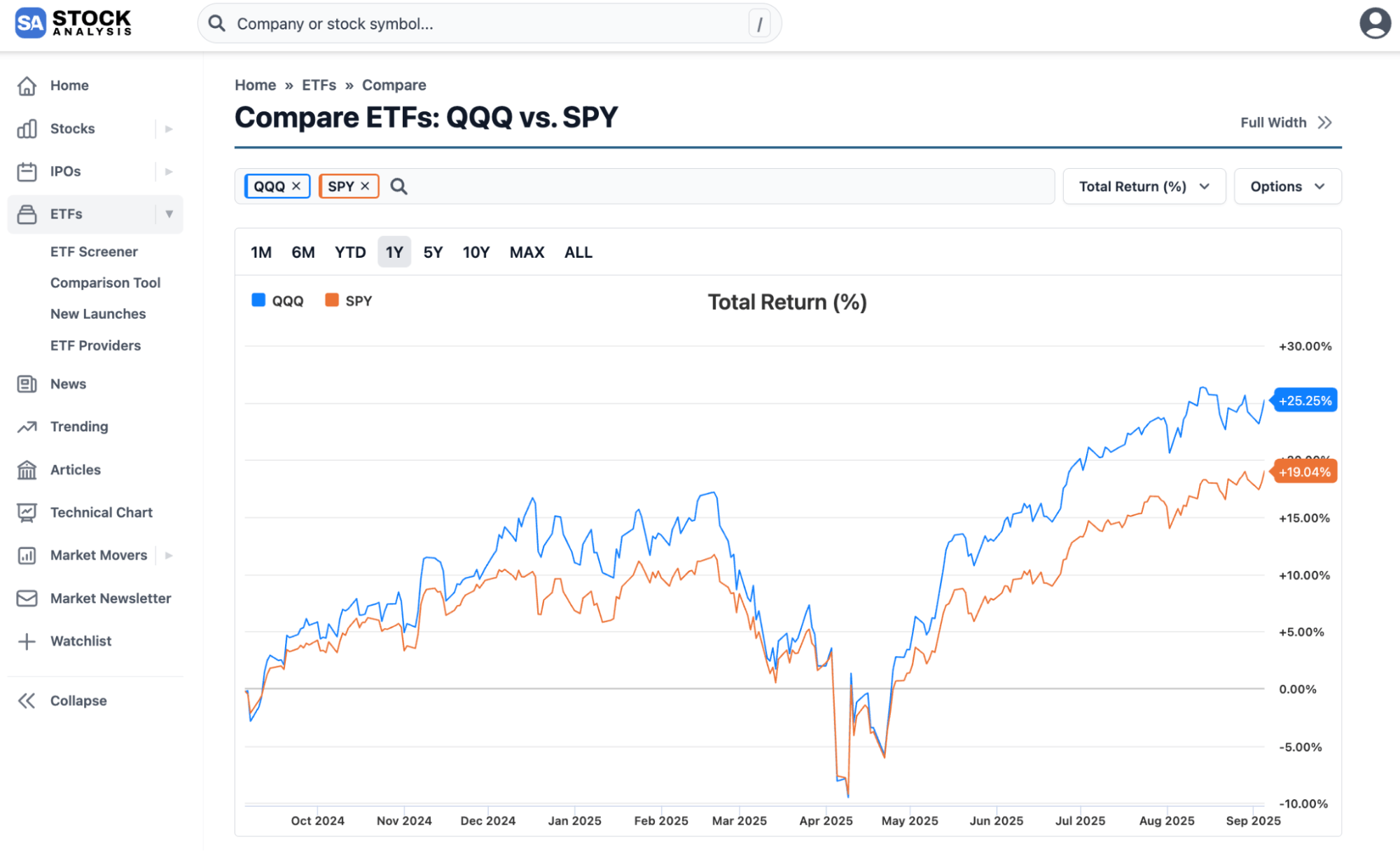

You can also compare the performance of two or more ETFs on a chart with the ETF comparison tool.

The tool also shows you each fund's top 25 holdings in a side-by-side view.

For investors who want to quickly research ETFs and dive deeper into the individual stocks inside them, Stock Analysis is the best one-stop solution.

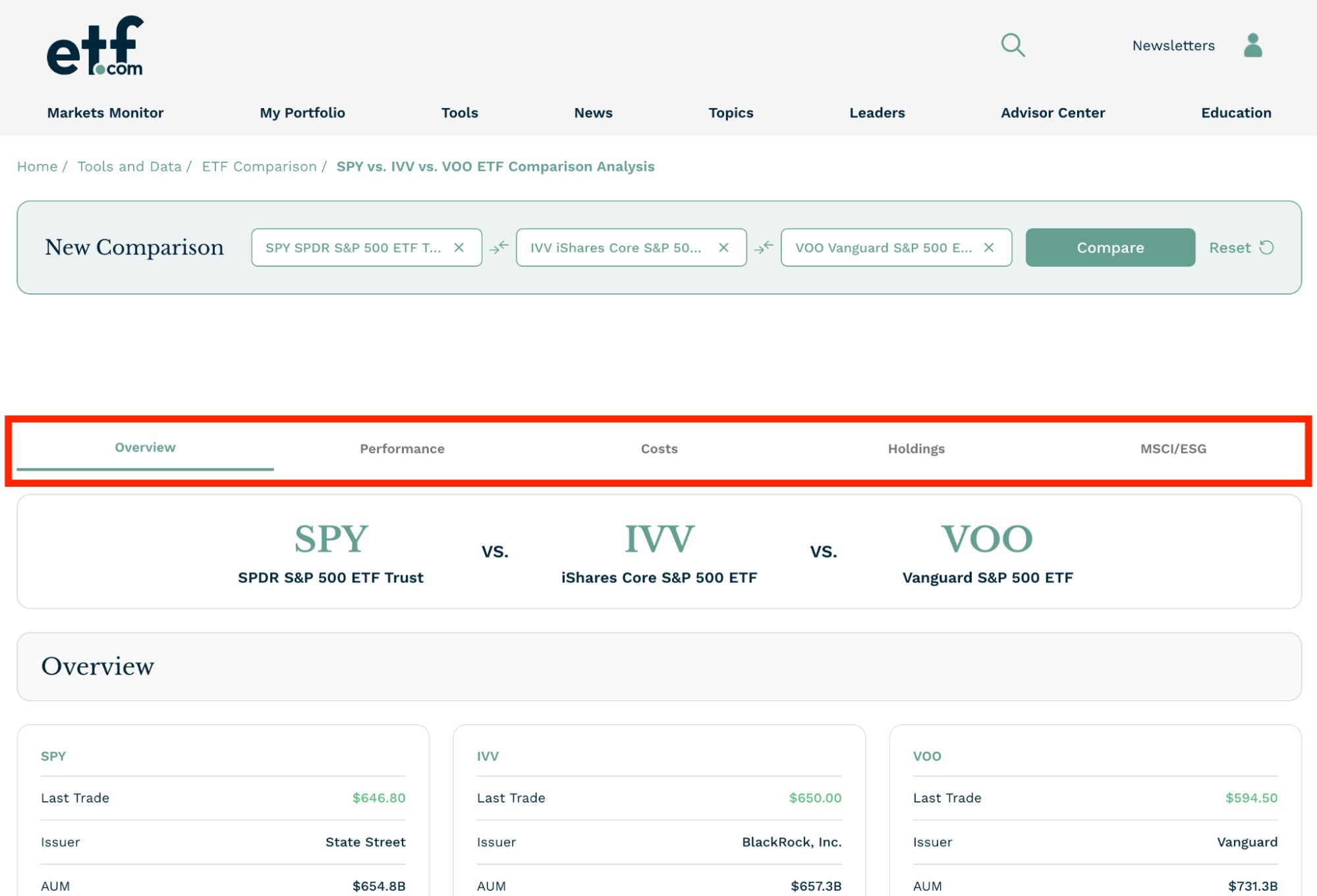

3. etf.com

- Rating:

- Best for: Detailed U.S. ETF data, free tools, and industry news

etf.com is another one of the most established platforms for ETF research.

The site provides detailed information for every U.S.-listed ETF, including fund profiles, daily flows, and performance. But its strength lies in the tools it provides to filter and compare funds.

Its Fund Comparison tool allows you to stack ETFs side by side and compare quote information, returns, fees, holdings data, and more.

This helps you quickly see which fund is more cost-effective or better suited for your portfolio, especially when you're choosing between similar products (like three S&P 500 ETFs).

Its ETF Screener gives you the power to sort through its entire universe of ETFs and filter based on expense ratio, issuer, asset class, performance, trading volume, and more, making it easy to surface funds that match very specific investment strategies.

The site also has educational resources for newer investors and a news section that tracks ETF launches, closures, and industry trends.

While I find the site harder to navigate than VettaFi and Stock Analysis, etf.com's free tools make it one of the best resources for narrowing down choices and making direct, apples-to-apples ETF comparisons.

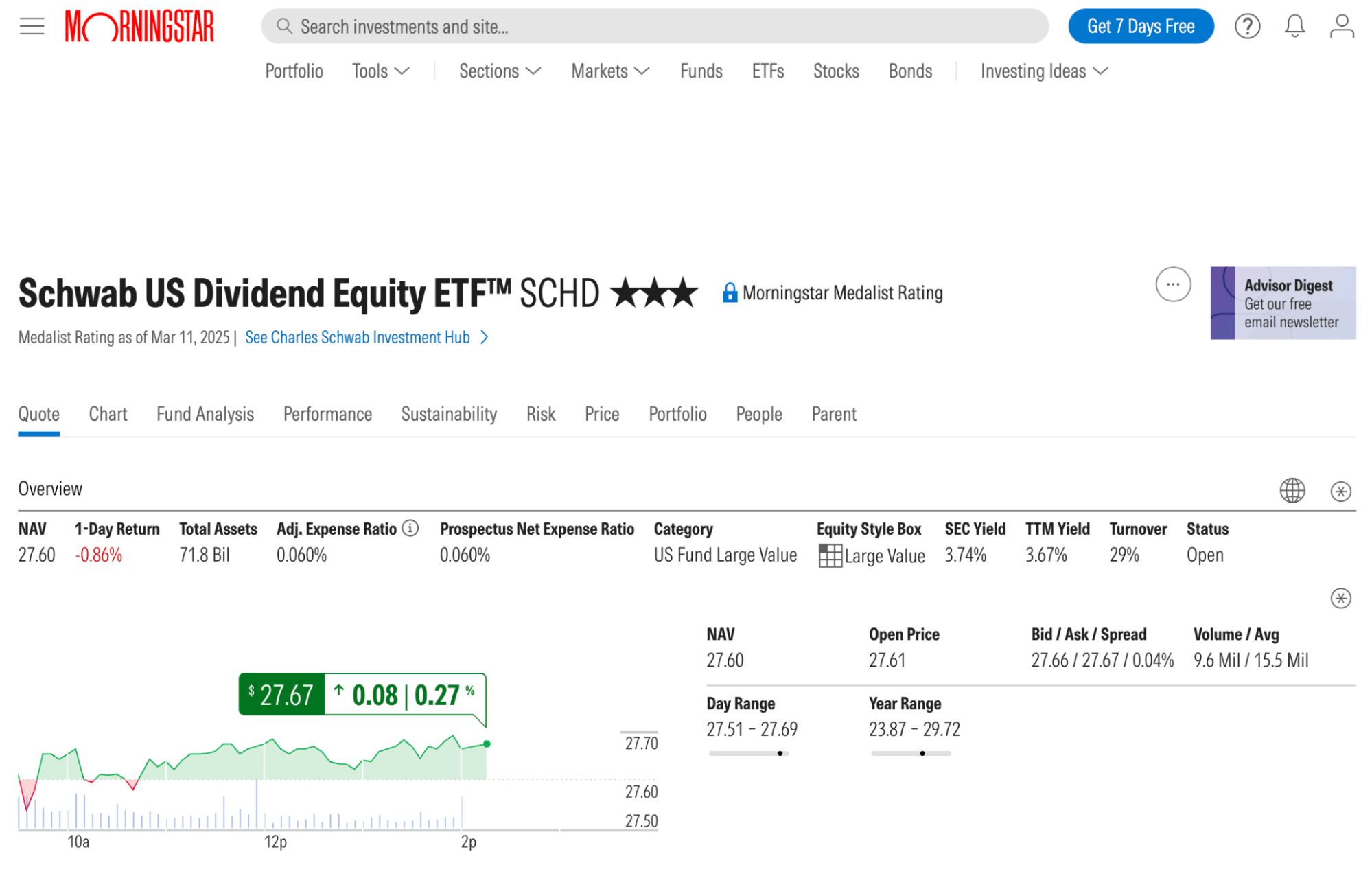

4. Morningstar

- Rating:

- Best for: Fund analysis and analyst commentary

Morningstar is widely regarded as the gold standard in independent fund research and is very popular among financial advisors and other investment professionals.

In addition to the usual data points like performance history, risk metrics, fees, and holdings, it offers analyst-driven ratings and in-depth reports that add crucial context that numbers alone can't provide.

Every ETF in the database is assigned a Morningstar Rating based on past risk-adjusted performance.

Many funds also receive a Morningstar Analyst Rating — Gold, Silver, Bronze, Neutral, or Negative — that reflects forward-looking conviction in the fund's strategy.

Alongside these ratings comes Morningstar's written commentary, which explains why a fund earns its rating. These narratives cover strengths (like low costs or strong stewardship) and potential risks (such as concentration or strategy limitations).

The downside is that all of this ratings data and the accompanying commentary are hidden behind a paywall for Morningstar Investor ($249/year after a 7-day free trial).

But for those who want expert, research-backed insights instead of raw data, Morningstar remains one of the most trusted sources.

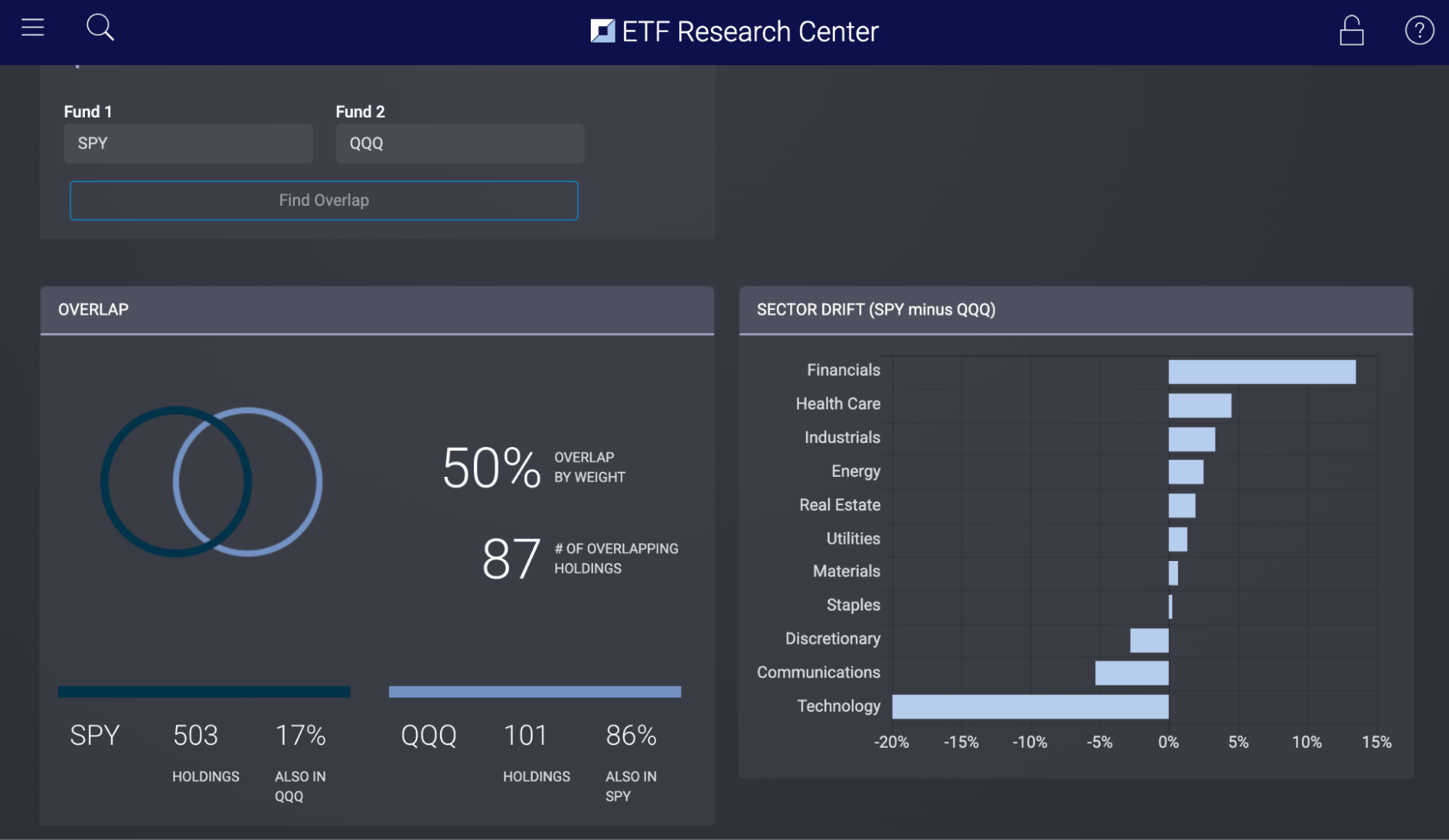

5. ETF Research Center

- Rating:

- Best for: Fund overlap analysis and diversification checks

ETF Research Center has a handful of features to help you research and analyze ETFs, the most popular being its Fund Overlap tool.

If you own multiple ETFs, chances are you hold some of the same underlying stocks more than once, which can create hidden concentration risks.

With the Fund Overlap tool, you can input two or more ETFs and instantly see how much of their holdings overlap. This is very useful for helping ETF investors avoid redundant exposure.

The site also has other tools for drilling down into a fund's profile, performance, and fundamentals, though the bulk of this data is hidden behind a paywall ($29/month for the cheapest plan).

But the Fund Overlap tool is still free to use and stands out as ETFRC's most unique and valuable feature.

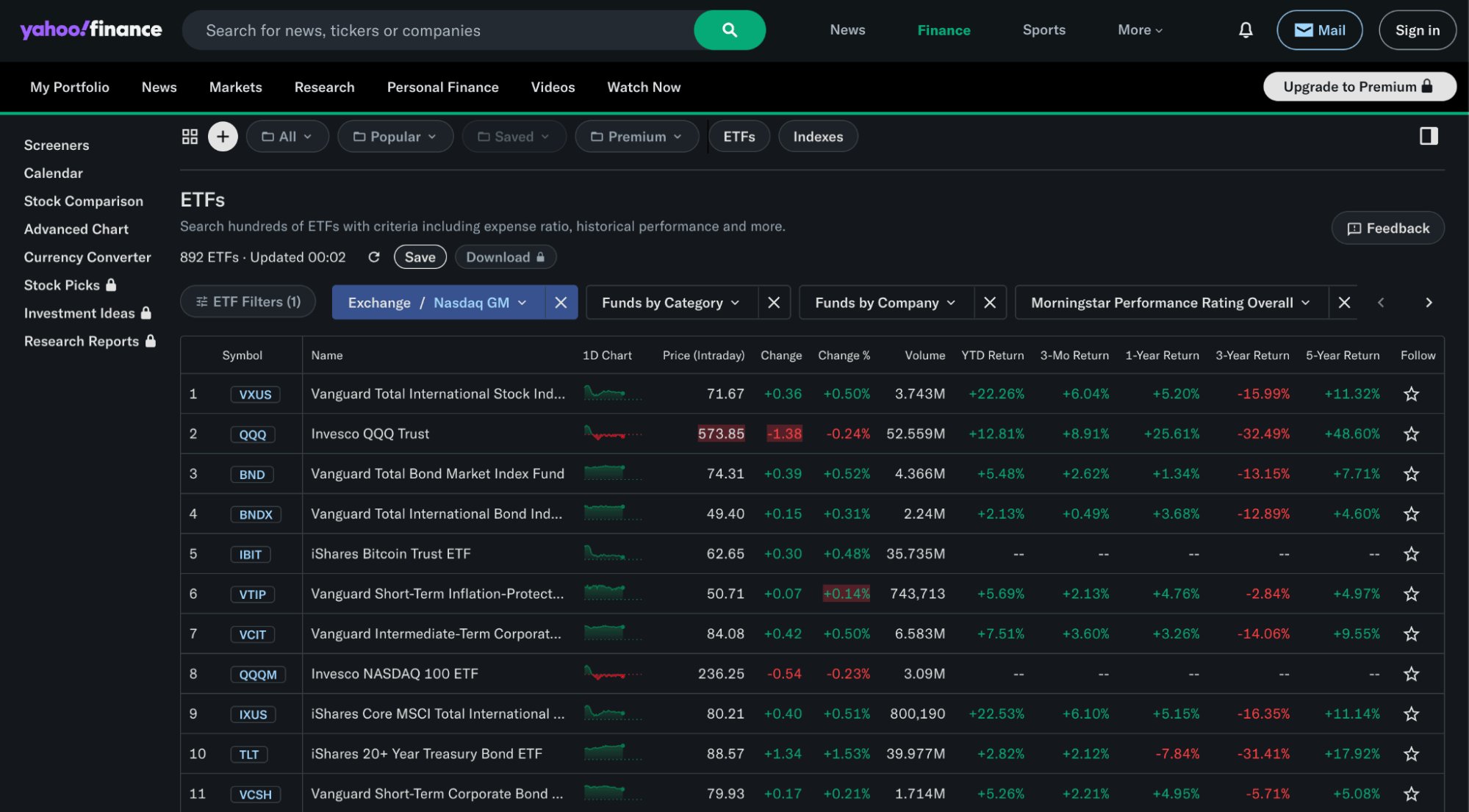

6. Yahoo Finance

- Rating:

- Best for: ETF screener

Yahoo Finance is one of the most widely used investing websites, and its ETF screener is a convenient starting point for quick fund research.

You can filter ETFs by asset class, issuer, expense ratio, performance, fund size, and trading volume. You can also apply preset filters like “Top Performing ETFs” or “Most Active ETFs” to quickly surface ideas without having to build custom screens.

Like with Stock Analysis, a huge benefit to using Yahoo's screener is that you can jump straight from the screener into a detailed profile page with historical charts, holdings breakdowns, analyst commentary, and news related to the fund.

While it's not as advanced as some dedicated ETF research platforms, Yahoo Finance's screener is free, intuitive, and works well for investors who want everything in one place.

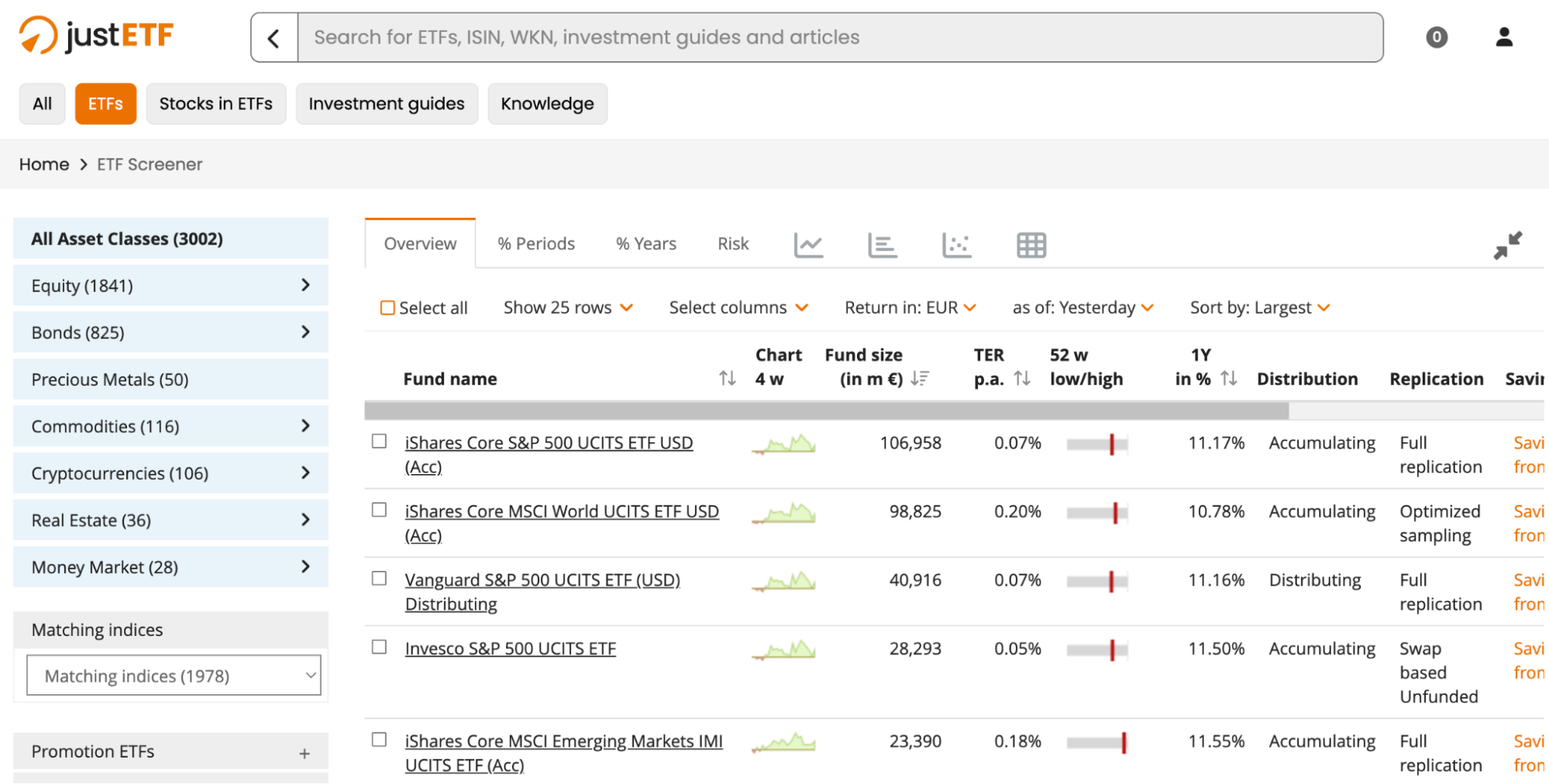

7. justETF

- Rating:

- Best for: European ETFs

justETF is Europe's leading ETF research platform. It's focused primarily on funds listed in the E.U. and U.K.

While most U.S.-based tools ignore all non-U.S. products, justETF fills the gap for European investors.

It has all of the same research data as its U.S.-focused counterparts, including fund overviews, charts, stats, returns, fees, and more.

But it also provides total expense ratio (TER), tax information, fund size, replication method, and currency, all of which are important considerations for cross-border investors in Europe.

For discovering new investments, you can search ETFs by region, issuer, asset class, investment theme, sector, and more.

Additionally, the site has an ETF screener, portfolio builder (which allows you to construct model portfolios and see how they would have performed historically), and educational content, all geared toward European markets.

justETF is the most comprehensive resource for anyone investing in ETFs across the E.U. and U.K.

How to research ETFs: 5 key factors to check

Now that you know the best websites for researching ETFs, the next step is understanding what to actually look for once you're on those sites.

Here are five key factors most ETF investors check before adding an ETF to their portfolio:

- Expense ratio: This is the annual fee you pay to own the fund, expressed as a percentage. All else equal, the lower this number, the better.

- Top holdings: An ETF is only as good as what it owns, and there can be a lot of variation between funds with similar investment themes. For example, one tech ETF might be heavily weighted toward Microsoft, Apple, and Meta while another is skewed toward Nvidia, Google, and Amazon. Check the top 10 holdings to see if they align with your overall investment strategy.

- Liquidity: Liquidity can be measured by trading volume and the width of bid-ask spreads. Stick with ETFs that trade actively so you can enter and exit easily and cheaply.

- Fund size (AUM): Larger funds tend to be more stable and less likely to shut down. Look for ETFs with at least $300+ million in assets.

- Tracking difference: ETFs should closely follow their benchmark index. Compare the fund's actual returns to the index to make sure it's doing its job.

These five factors likely cover 70–80% of what you need to evaluate in an ETF, though you can always dig deeper into things like taxes, dividends, or strategy, depending on your goals.

How we chose the best websites for ETF research

When evaluating websites for this list, we took the following into consideration:

- Core offering: How good the product or service is — i.e., how accurate the data is, how comprehensive the coverage is, how many features the site has (or any that are particularly valuable), and how much users like it.

- Cost: Overall price, how much of the site is available for free vs hidden behind a paywall, and overall value for money.

- Usability: What the interface looks like, how easy it is to navigate, design elements and features, and general accessibility.

- Audience: Who the product is for, the uses and applications, whether it actually works, if it's the best option available, and any limitations therein.

- Credibility: Quality of the data, as well as company and brand reputation.

Final verdict

Since each of these platforms brings something different to the table, most ETF investors use a combination of these sites during their research.

For instance, you might make VettaFi, Stock Analysis, or etf.com the main hubs of your research, and then layer in ETF Research Center's Fund Overlap tool to avoid overconcentration or Morningstar's analysis to make sure you're not missing anything.

By using multiple sites and the best tools from each, you'll be well-equipped to find the ETFs most suited for your portfolio and make sure they stay aligned with your strategy over time.