How to Invest in Addepar Stock in 2026

The odds of creating a billion-dollar company are incredibly low. Yet Joe Lonsdale has done it four times.

In 2002, Lonsdale started as an intern at PayPal, where he worked alongside Elon Musk and Peter Thiel. Since then, he's co-founded Palantir, OpenGov (a government software provider), and Affinity (a CRM platform for private equity groups).

Oh, and Addepar, a rapidly growing wealth management platform that was valued at $2.17 billion in 2021.

In this article, I cover what Addepar is, how to buy stock while it's still a private company, its IPO plans, and more.

What is Addepar?

While more and more wealth managers are embracing technology to improve the efficiency of their operations, the industry's software solutions remain highly fragmented.

Most advisors use a CRM software, a reporting software, a planning software, a risk-tolerance software, a portfolio rebalancing software, a client billing software, and a research software.

This leads to many advisors ending up with a mish-mash of different software that can't “talk” to each other.

For instance, an advisor might use Wealthbox for their CRM, Black Diamond for their reporting, and MoneyGuidePro for their planning — none of which integrate with any of the others.

Or, they can just choose Addepar, an all-in-one software solution for wealth management. It does reporting, trading, rebalancing, forecasting, billing and more.

Addepar primarily serves RIAs (financial advisors), private banks, and private offices.

The company's software manages over $6 trillion in assets, processes 8 million custody accounts daily, and supports over 100,000 users.

So, how can you invest in it?

How to buy Addepar stock

Addepar is a private company. It doesn't have a stock symbol, and it doesn't trade on a public exchange.

However, on Hiive, accredited investors can buy shares of privately held, VC-backed companies.

Addepar is one of the most active securities on Hiive right now. At the time of this writing, there are 33 listings of Addepar stock available:

Here's how to invest in Addepar stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “Addepar” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Learn more about Hiive in our full review, or click the button to register:

Can retail investors buy Addepar stock?

Since Addepar is a private company, retail investors cannot invest in its stock until it becomes publicly traded via an IPO.

Given the company's unique approach to data aggregation, analytics, and reporting — all of which are built into its robust platform — I couldn't find any publicly traded competitors to recommend buying instead.

At this point, retail investors are better off waiting for its public debut.

Addepar IPO

Addepar is backed by a host of private equity firms, including 8VC, D1 Capital Partners, Signatures Capital, Valor Equity Partners, and Thrive Capital.

When it raised its Series F in 2021, Addepar was tracking $2.7 trillion in assets and had been adding $15 billion per week since mid-2020.

Today, that figure has ballooned to over $6 trillion.

It took the company nine years to hit its first $1 trillion in assets tracked. It's now adding more than $1 trillion per year.

Still, that's nowhere near the $250 trillion CEO Eric Poirier has set as the company's target. After 15 years and $100 million in annual R&D spend, the team is more determined than ever.

While there's been no public mention of the Addepar IPO, given the company's lofty goals and Lonsdale's track record, it's hard to imagine one won't be coming in the near future.

When Addepar does become publicly traded, you'll need a brokerage account to buy its stock.

Addepar's founding story

Joe Lonsdale (Chairman, former CEO) founded Addepar in 2009 along with Jason Mirra (former CTO).

Lonsdale was an early employee at PayPal (PYPL), where he met Peter Thiel. After PayPal was sold to eBay in 2002 (it was spun off in 2015), Lonsdale and Thiel started working on their next company.

In the aftermath of 9/11, the pair sought to gather the country's top technical talent and create a system that could counteract terrorism and enhance national security. Palantir (PLTR) has since become a roughly $50 billion company.

In a similar manner, the 2008 Global Financial Crisis spurred Lonsdale to look for opportunities in financial data, analytics, reporting, and software.

He found a gap in the market — all-in-one wealth management software — and convinced Mirra to drop out of college and help him create Addepar.

In 2013, the two of them recruited Eric Poirier from his position at Palantir to become the CEO of Addepar.

How much is Addepar worth?

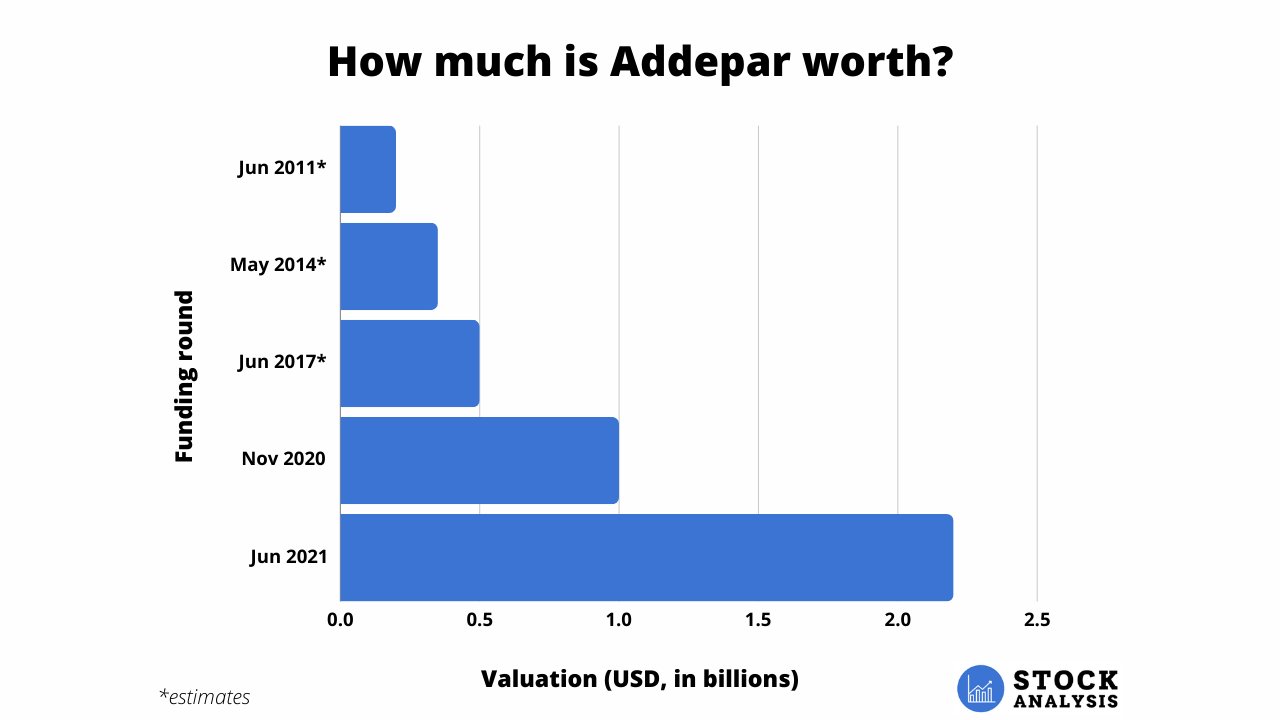

Addepar has raised $531 million over seven rounds.

The most recent round, its Series F, came in June 2021 and raised $166 million at a $2.17 billion valuation.

There isn't much public data on Addepar's funding rounds, but here's a look at how its valuation has changed over time:

Accredited investors can see Addepar's current valuation based on secondary markets transactions by registering for Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.