How to Invest in Attentive, the AI-powered Marketing Platform

Attentive is a marketing platform that allows companies to send hyper-personalized discounts, product offerings, abandoned cart sequences, and more to their customers via text message and email.

The platform uses a combination of artificial intelligence, machine learning, and its clients' first-party data to deliver 1:1 personalization at scale.

During Cyber Week 2023, 8,000 global businesses used Attentive's platform to send over 2.2 billion text messages, driving more than $1.8 billion in revenue for them.

The majority of the revenue driven by Attentive is accretive — meaning it wouldn't be generated without a service like this. For brands using Attentive, the product more than pays for itself.

Attentive's effectiveness and obvious value proposition make it an attractive company to invest in. It has raised a total of $863 million from the private equity market, most recently at a $6.97 billion valuation.

Can you buy Attentive stock?

Attentive is a private company, which means there's no Attentive stock symbol and no way to buy the company in your traditional brokerage account.

However, if you're an accredited investor, you can buy shares on Hiive.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform where accredited investors can buy shares of private, VC-backed, pre-IPO companies. In all, there are more than 2,000 private companies with shares available on Hiive, including Attentive.

Attentive is part of the Hiive50, a collection of the 50 most active securities on the platform.

At the time of this writing, there are 60 live orders for Attentive stock:

On Hiive, Attentive's stock has an aggregate price of $6.88 per share.

Hiive is a two-sided marketplace — similar to a regular stock exchange — where buyers connect directly with sellers. Sellers are often employees, venture capitalists, or angel investors.

Each seller creates their own listing by setting an asking price and quantity of shares available.

Buyers can accept a seller's asking price as listed, place bids and negotiate with sellers, or simply add a company to their watchlist to keep track of any new listings or transactions.

To see the complete order book — all bids, asks, and recent transactions — for Attentive, you can register for a free account:

Can retail investors buy Attentive stock?

Unfortunately, retail investors cannot invest in Attentive while it's a private company. You will have to wait for the company's IPO (more on this in the next section).

However, Attentive is not the only company in this space. You may be interested in investing in Klaviyo, which is one of Attentive's biggest competitors.

Like Attentive, Klaviyo (KVYO) offers an AI-based marketing platform that personalizes messages to potential and existing customers via email, SMS, and push notifications.

Klaviyo was founded in 2012, four years earlier than Attentive. It serves 157,000+ brands, which is almost 20x as many as Attentive. It became a public company in September 2023.

In the last twelve months, the company generated $868.9 million in revenue. It currently has a market capitalization of $12.97 billion and has a consensus “Buy” rating from Wall Street analysts.

While Klaviyo doesn't have the exact same product or solutions as Attentive, it is going after the same market with the same concept. If you're bullish on this segment of the market, buying Klaviyo stock may make sense.

Additionally, while they're not nearly as direct of competitors as Klaviyo, HubSpot (HUBS) and Salesforce (CRM) are both customer relationship management platforms that have begun offering AI-tailored marketing solutions.

Our #1 recommended brokerage

If you want to buy these companies, you'll need a brokerage account. We recommend Public. For more information, check out our article on the best brokerage accounts in 2026.

Given their existing customer bases, they won't have to work as hard to get their products in front of potential customers.

That said, Klaviyo and Attentive are likely better, more focused solutions for D2C companies than HubSpot or Salesforce.

Twilio (TWLO) is also somewhat of a competitor, although its focus is on providing API offerings for programmable messaging.

When will Attentive have its IPO?

After Klaviyo went public in September 2023 at a valuation of over $9 billion, executives at Attentive told staff in an all-hands meeting that they were optimistic about their own public debut.

A few months earlier, in May, Amit Jhawar was promoted to CEO. In the press release announcing his promotion, the company wrote they were looking “towards the prospect of an IPO in the next 12–18 months.”

However, their tone shifted by October after Klaviyo, Arm (ARM), Instacart (CART), and Birkenstock (BIRK) had all fallen below their IPO prices.

The company then announced it no longer planned to go public between May and October of 2024. Jhawar said their plans to become a public company hadn't changed, just the timing of it.

The company has not released an updated timeline since then.

Who founded the company?

Attentive was founded in 2016 by Andrew Jones, Brian Long, and Ethan Lo. This isn't the first time the team has created a successful company.

They previously co-founded TapCommerce, an adtech company that helps businesses retarget ads to users based on their previous activity. It was acquired by Twitter for $100 million in 2014 (see my article on how to invest in Twitter stock).

After working for Twitter for a couple of years, the team built Attentive in stealth mode for two years until it officially launched with a $13 million Series A in February 2018.

Today, the company has over 1,000 employees and has offices in New York City, San Francisco, London, and Sydney.

How much is Attentive worth?

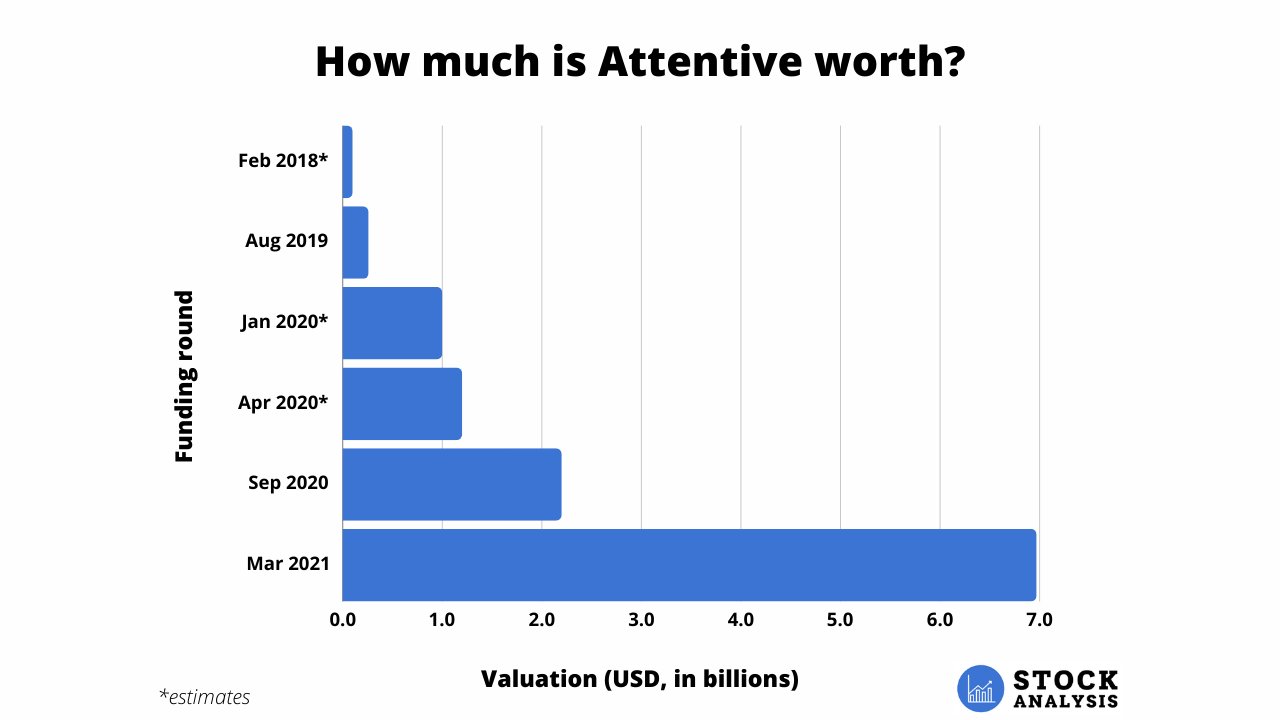

Attentive has raised $863 million over eight rounds.

Investors include Bain Capital Ventures, Sequoia Capital, Eniac Ventures, IVP, Tiger Global, Base 10, D1 Capital Partners, Coatue, High Alpha, and NextView Ventures.

Their most recent round raised $470 million at a $6.97 billion valuation, which is triple the $2.2 billion valuation it earned in September 2020.

Here's a look at how Attentive's valuation has changed over time:

Accredited investors can see its current valuation on the secondary market by registering for Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.