How to Buy Circle Stock in 2025

Circle is a prominent stablecoin issuer with active plans to IPO.

Circle manages USDC, the world's second-largest stablecoin. USDC is designed to hold at or near a price of $1 USD. Stablecoin is often used as an intermediary currency between volatile crypto assets and more stable traditional assets.

USDC makes it easier for both individuals and companies to conduct cross-border payments, provides global access to USD, and reduces risk and adds transparency for the crypto markets.

In a word, it's more fluid than current solutions. For that reason, Circle has the potential to change the way money is used around the world.

And in May 2025, Circle officially launched its IPO process. The company is aiming to sell $624 million worth of shares at a $5.65 billion valuation. It will trade on the NYSE under the ticker symbol CRCL. The estimated IPO date is June 5.

There was a way to invest in Circle before its IPO, while it was a private company.

Here are the details on that process.

How to invest in Circle as an accredited investor

Even though Circle is a privately held company — meaning it doesn't trade on a public exchange and there is no stock symbol — accredited investors can buy shares on Hiive.

Hiive is an investment platform where shares of VC-backed startups are traded. Right now, there are more than 2,000 private companies on Hiive.

That includes Circle, for which there are 25 listings:

Here's how to invest in Circle stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “Circle” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Learn more about Hiive in our full review or click the button to get started right away:

When will Circle IPO?

Circle has had a bumpy road to what now looks like an IPO offering sometime in 2025.

In February 2022, Circle planned to go public in July via a SPAC with blank-check company Concord Acquisition Corporation. The deal valued the company at $9 billion.

However, these plans fell through.

Following the scrapped SPAC, rumors surrounded the company about its plans to go public. Those rumors weren't satisfied until early 2024, when Circle filed for an IPO.

The IPO has been held up by U.S. regulators. After the SEC completes its review process, subject to market and other conditions, the company will go public.

Circle CEO Jeremy Allaire reaffirmed these intentions in October 2024, saying the company is "very committed to the path" of going public.

Additionally, after redomiciling from Ireland to the U.S. earlier this year, Circle is moving its corporate headquarters from Boston to New York City. This moves signals the company's intentions to become more ingrained with the world of traditional finance (which is centered in New York City).

When Circle does become a public company, you'll need a brokerage account to buy it. If you're in the market, check out our article on the best brokerage accounts in 2025.

Can retail investors buy Circle stock?

No, retail investors cannot buy Circle until its IPO.

Fortunately, this IPO seems to be coming soon. At this point, you'll likely just want to wait a few months for this to happen. You can check our IPO Calendar every few weeks to see the exact day it will go public.

If you're anxious to invest in cryptocurrency or Web3 companies, here are a few publicly traded companies you may be interested in:

- Coinbase (COIN) is the second-largest crypto exchange in the world (Binance is #1) in terms of trading volume. In 2023, Coinbase generated $3.1 billion in revenue on a trading volume of $468 billion. In 2023, Coinbase also took an equity stake in Circle, though the amount invested was not publicly disclosed.

- Marathon Digital Holdings (MARA) is a digital asset mining company that focuses on the bitcoin ecosystem. It generated $565 million of revenue in the last 12 months and is worth $5.65 billion.

- CleanSpark (CLSK) is also a large-scale bitcoin miner. In the last 12 months, the company has generated $342 million in revenue, and it has a market capitalization of $3.4 billion.

- Block (SQ) is a peer-to-peer payment provider and has been very public about its bullish stance on decentralized finance and digital payments. The company has TTM revenue of $23.5 billion and has a market cap of $47.6 billion.

You may also be interested in a few different crypto-themed ETFs, like the Schwab Crypto Thematic ETF (STCE), the Bitwise Crypto Industry Innovators ETF (BITQ), or the Fidelity Crypto Industry and Digital Payments ETF (FDIG).

None of these investments will be the same as getting direct exposure to Circle stock, but companies and assets in this space have been correlated in the past.

If you're very bullish on Circle, you may also be at least moderately bullish on one of these other investments.

Who founded Circle?

Circle was founded by Jeremy Allaire and Sean Neville in October 2013.

Allaire made a name for himself as a technologist after taking his former company, Allaire Corporation, public in 1999. The company was acquired by Macromedia in 2001, where Allaire served as CTO until he left to join VC firm General Catalyst in 2003.

From there, he founded Brightcove, an online video platform, which he successfully took public in 2012. In October 2013, Allaire announced the launch of Circle, where he still serves as CEO.

Sean Neville, who was previously Circle's President and CTO, serves on the board of directors.

He left his role at Circle to co-found Catena Labs, which improves financial and social interactions in commerce, gaming, and media. He serves as Catena Lab's CEO.

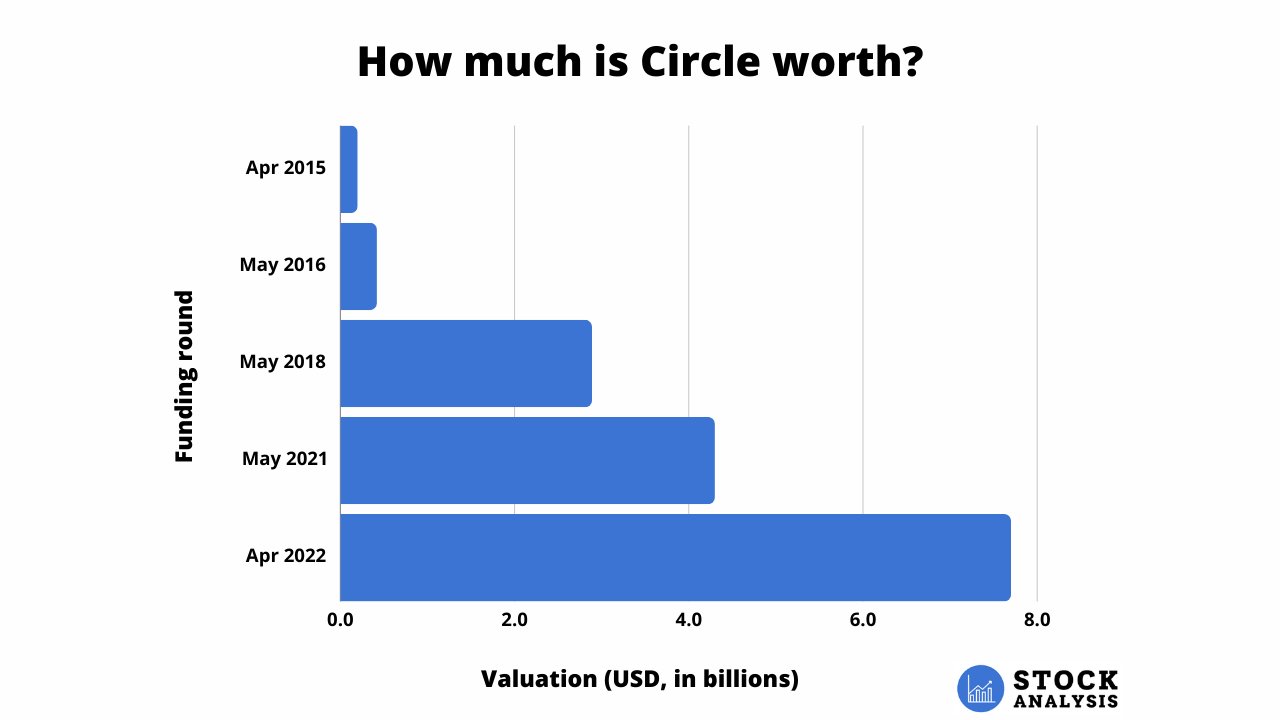

How much is Circle worth?

Circle raised $400 million at a $7.7 billion valuation back in April 2022. This round brought its total amount raised to a little over $1.1 billion.

Here's a look at how its valuation has changed over time:

Circle stock was trading at a valuation of between $5 billion to 5.25 billion in the secondary markets in July 2024.

Accredited investors can see its current valuation and buy its stock on Hiive.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. StockAnalysis is not a broker dealer or investment adviser. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investment involves risk, including the loss of principal and past performance does not guarantee future results. There is no guarantee that any statements or opinions provided herein will prove to be correct. StockAnalysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and member of FINRA / SIPC. Find Hiive on BrokerCheck.