How to Buy Ramp Stock in 2026

Ramp is an all-in-one banking and expense management platform for startups and small-to-medium-sized businesses.

With Ramp, businesses can issue corporate cards to employees, collect and categorize receipts, book and reimburse travel expenses, pay invoices, earn interest on cash balances, automate accounting tasks, and more.

Ramp isn't the only company in this space, but it's quickly become one of the most popular thanks to its ease of use, built-in automations, and broad suite of tools.

It now serves more than 45,000 businesses and crossed $1 billion in annualized revenue in October — about triple what it was earning 18 months ago.

And investors have been taking notice.

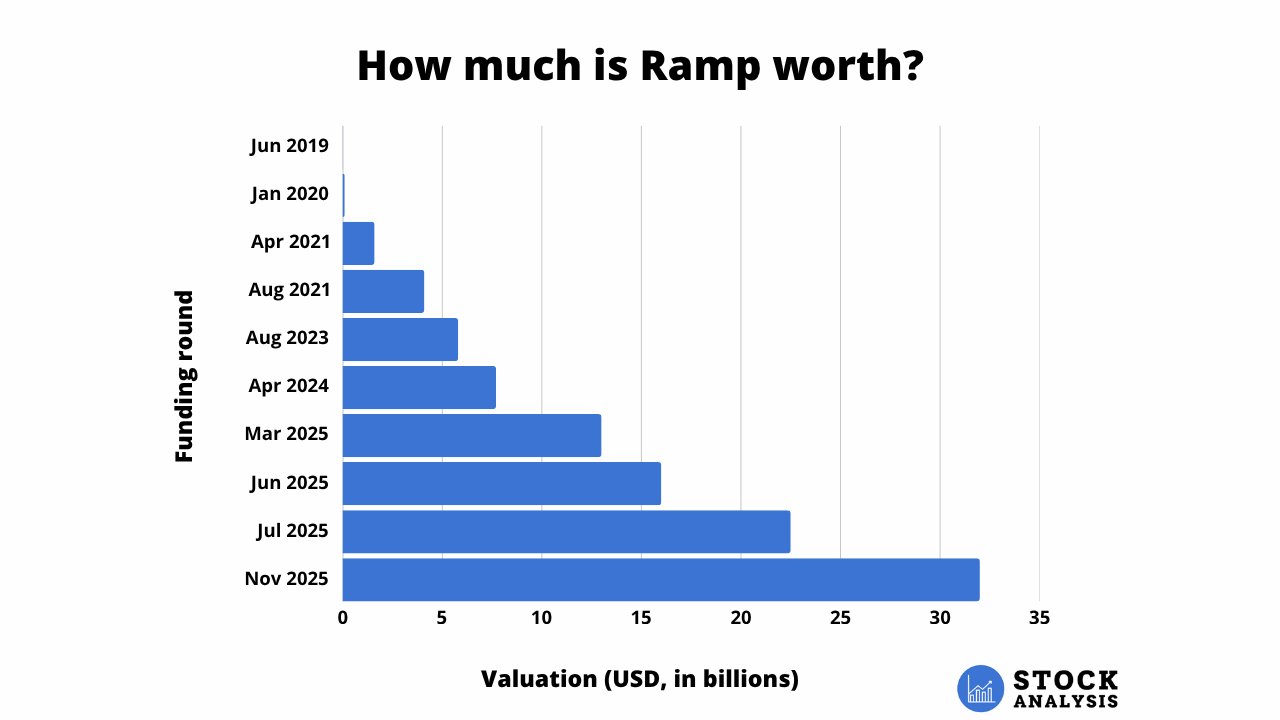

In November 2025, Ramp raised $300 million at a $32 billion valuation, up more than 40% from the $22.5 billion valuation it received just 3 months earlier.

Ramp raised money four times in 2025 and saw its valuation nearly triple throughout the year.

While Ramp is certainly on track for an IPO, it has not made any indication of when it will become publicly traded. Still, there are several ways you can invest before then.

Here's how.

Can you buy Ramp stock?

Ramp is a private company, which means there is no Ramp stock symbol and no way to buy it in your traditional brokerage account.

However, its shares do trade on Hiive, an investment platform where accredited investors can buy shares of pre-IPO companies.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

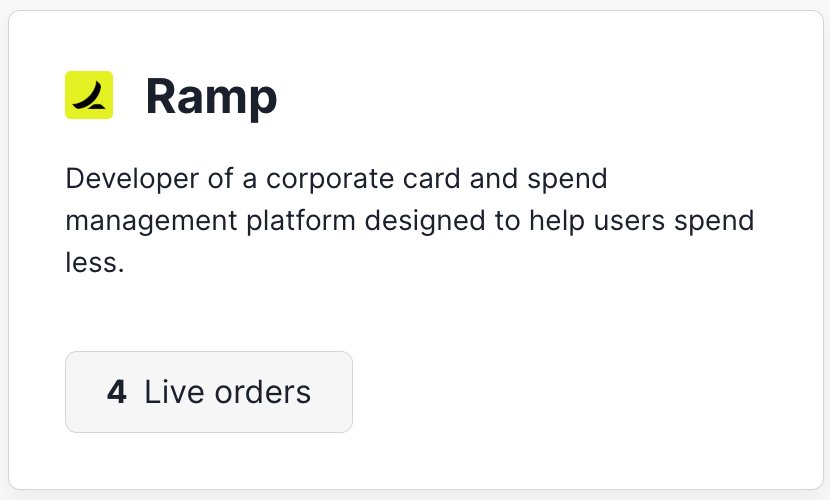

Some of the most actively traded companies on Hiive right now are Kraken, Scale AI, xAI, and Ripple Labs. There are also 4 live orders of Ramp stock currently listed:

How buying stock on Hiive works

Hiive connects existing shareholders — typically employees, venture capital firms, or angel investors — with accredited investors.

After a seller creates a listing, buyers can accept a seller's asking price as listed or place bids on the shares.

Once a buyer and seller agree on a price, Hiive's team facilitates the transaction.

To see all of the active listings for Ramp's stock, plus the 3,000+ other companies on Hiive, create an account for free with the button below:

Hiive is only available to accredited investors. If you're not an accredited investor, the next section is for you.

Can retail investors buy Ramp?

While Ramp is not publicly traded, there is a way for retail investors to gain exposure to it.

The Fundrise Innovation Fund is a venture capital fund that invests in high-growth, private technology companies.

The fund currently owns stakes in 19 companies, including OpenAI, Databricks, Anthropic, Canva, Anduril, and Ramp:

Fundrise was a customer of Ramp's for several years before investing in April 2025. Given the timing of the investment, the Innovation Fund's stake was likely purchased at a $13 billion valuation.

The Innovation Fund is available to all investors. It has a $10 minimum investment and a 1.85% annual management fee. You can access the fund on Fundrise's website.

However, while buying into the Innovation Fund will give you direct exposure to Ramp, the Ramp stake makes up just ~5% of the fund's portfolio.

While this portion may continue to grow over time (if Ramp continues to become more valuable or if the fund adds to its position), if you're interested in the fund, be sure you like the rest of its investments as well.

Alternatives to investing in Ramp

You may also be interested in investing in one of Ramp's publicly traded competitors, such as:

- Block (XYZ) offers payment processing, business banking, and financial tools through its Square platform. While best known for serving retail and service businesses, Block's expanding suite of business products — like cards, loans, and spend management — positions it as a viable alternative to Ramp.

- Intuit (INTU) is a software company best known for products like QuickBooks, TurboTax, and Mailchimp, which help individuals and small businesses manage their finances. While Intuit isn't a corporate card provider, its dominance in accounting and expense tracking places it in a prime position to compete with Ramp's offerings.

- Paychex (PAYX) is a payroll and HR solutions company that serves small and midsize businesses across the U.S. Paychex doesn't offer spend management or cards, but its strong foothold in back-office automation mirrors Ramp's mission of helping businesses run leaner and more efficiently.

While none of these companies are direct competitors to Ramp right now, they all have large customer bases and the resources to build their own version of Ramp's platform — so they're all potential threats.

You could also invest in a fintech ETF, such as the ARK Fintech Innovation ETF (ARKF) or the Global X FinTech ETF (FINX).

However, these funds own a broad portfolio of financial product and service companies — companies that are not necessarily in the B2B banking and expense management space.

You can invest in stocks and ETFs in your traditional brokerage account. If you need a brokerage account, we recommend Public.

Who founded Ramp?

Eric Glyman, Karim Atiyeh, and Gene Lee founded Ramp in March 2019.

Glyman and Atiyeh first met when they were students at Harvard. Before Ramp, they started Paribus, a price-tracking application that Capital One bought in 2016.

The first offerings on Ramp's platform were corporate credit cards with built-in expense management and receipt tracking.

This product was simple and elegant, but, more importantly, it solved a painful need, which is why the company's annualized revenue surged to $100 million by March 2022.

Ramp has continued to innovate quickly (200+ new features in 2024), regularly adding more time-saving products to its platform. And it's been rewarded.

Annualized revenue crossed $300 million in August 2023, $700 million in March 2025, and $1 billion in October 2025

Ramp is based in New York City. It has 45,000+ customers and 2,000+ employees.

It is backed by Peter Thiel's Founders Fund, ICONIQ, Coatue Management, General Catalyst, GIC, D1 Capital Partners, Altimeter Capital, A* Partners, Box Group, Contrary Capital, and others.

How much is Ramp worth?

Ramp's most recent funding round came in November 2025 and valued the company at $32 billion, up ~42% from the $22.5 billion valuation it had received just 3 months earlier.

Since being founded in 2019, Ramp has raised $2.2 billion in equity funding and $700 million in committed debt.

Here's a chart of how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)