How to Invest in Scale AI Stock in 2026

Data is the foundation of artificial intelligence (AI).

All AI systems draw insights from the datasets they're trained on. The accuracy and completeness of those datasets is of paramount importance. The better the data you feed it, the better the results the AI system will produce.

Scale AI is a startup that specializes in annotating, labeling, and curating data for AI applications. Its customers include companies such as OpenAI, Meta, Microsoft, Nvidia, and Toyota, as well as government agencies like the U.S. Department of Defense.

In June 2025, Meta invested $14.3 billion for a 49% stake in Scale AI at a valuation of $29 billion.

As part of the deal, Scale AI's 28-year-old founder and CEO Alexandr Wang joined Meta and is expected to play a prominent role in the tech giant's artificial intelligence strategy.

Meta's investment likely means the company will stay private for the foreseeable future. However, even though Scale AI is a private company, there is a way for you to invest in it right now — if you qualify as an accredited investor.

Here's how you can invest in Scale AI today.

Buy Scale AI stock from existing shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups from current shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Some of the most active companies on Hiive are SpaceX, Databricks, and Scale AI:

As of the time of writing, there are 86 unique listings of Scale AI stock on Hiive.

Each listing is made by a different seller who sets their own asking price and quantity of shares. Sellers may be current or former employees, venture capitalists, or angel investors.

Buyers can either accept a seller's asking price as listed or place their own bid and negotiate directly with sellers.

After registering for Hiive, you'll be able to see the complete order book of bids and asks for every company, as well as all of the recent transaction prices.

See the order book for Scale AI with the button below:

Alternatives to investing in Scale AI

Unfortunately, if you're not an accredited investor, there's no way for you to gain direct exposure to Scale AI at this time.

You could gain some exposure to Scale AI by investing in Nvidia (NVDA), Meta (META), and/or Amazon (AMZN), which all participated in its Series F funding round. But, given the size of these companies, their stakes in Scale AI are pretty inconsequential.

You could also invest in the company's publicly traded customers, which include:

- Microsoft (MSFT)

- Nvidia (NVDA)

- Meta Platforms (META)

- PayPal (PYPL)

- Toyota (TM)

- General Motors (GM)

- SAP SE (SAP)

- Chegg (CHGG)

Although this is an indirect way to invest, if Scale AI's solutions substantially improve the AI systems these companies are working on, their investors will benefit.

Since Scale's primary competitors — which include Surge AI, Sama, Labelbox, and Cloudfactory — are all private companies, there's no way for retail investors to invest directly in any company offering data labeling or model accuracy services.

You can also invest in various exchange-traded funds (ETFs), which have different objectives within the robotics and artificial intelligence industries.

ETFs you may be interested in include:

- Global X Artificial Intelligence & Technology ETF (AIQ)

- First Trust Nasdaq Artificial Intelligence & Robotics ETF (ROBT)

- WisdomTree Artificial Intelligence and Innovation Fund (WTAI)

- ROBO Global Artificial Intelligence ETF (THNQ)

- Themes Generative Artificial Intelligence ETF (WISE)

Be sure to keep in mind, though, that these ETFs will only give you general exposure to AI, generative AI, LLMs, and robotics. It's not the same as investing directly in Scale AI.

You may also be interested in our article on how to invest in AI.

And since that's not possible for retail investors at this time, you may be better off waiting for Scale AI's IPO.

Wait for the Scale AI IPO

Scale AI has not made any indication that it plans to go public in the near future.

Even before Meta's investment, Scale AI had raised $1.35 billion since 2016 and was projecting $2 billion of revenue in 2025 — it's not exactly strained for capital.

And now that Meta is a significant backer, the company is very unlikely to go public in the next couple of years.

But when it does go public, or if you've decided to buy one of the publicly traded companies above, you'll need a brokerage account. We recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, options, and cryptocurrencies on what I think is the most user-friendly brokerage available.

Who owns Scale AI?

Alexandr Wang founded Scale AI in 2016 at 19 years old. By age 24, thanks to his 15% stake in Scale, he became the world's youngest self-made billionaire.

In addition to Wang, who likely still owns around 5% of the company, some members of the company's board of directors, executive team, and strategic advisors, along with current and former employees, all likely own some percentage.

Meta Platforms (META) acquired 49% of the business in June 2025. Prior to its investment, there were 41 external investors (including private equity firms, venture capitalists, and angel investors), though it's unclear how many still own stakes.

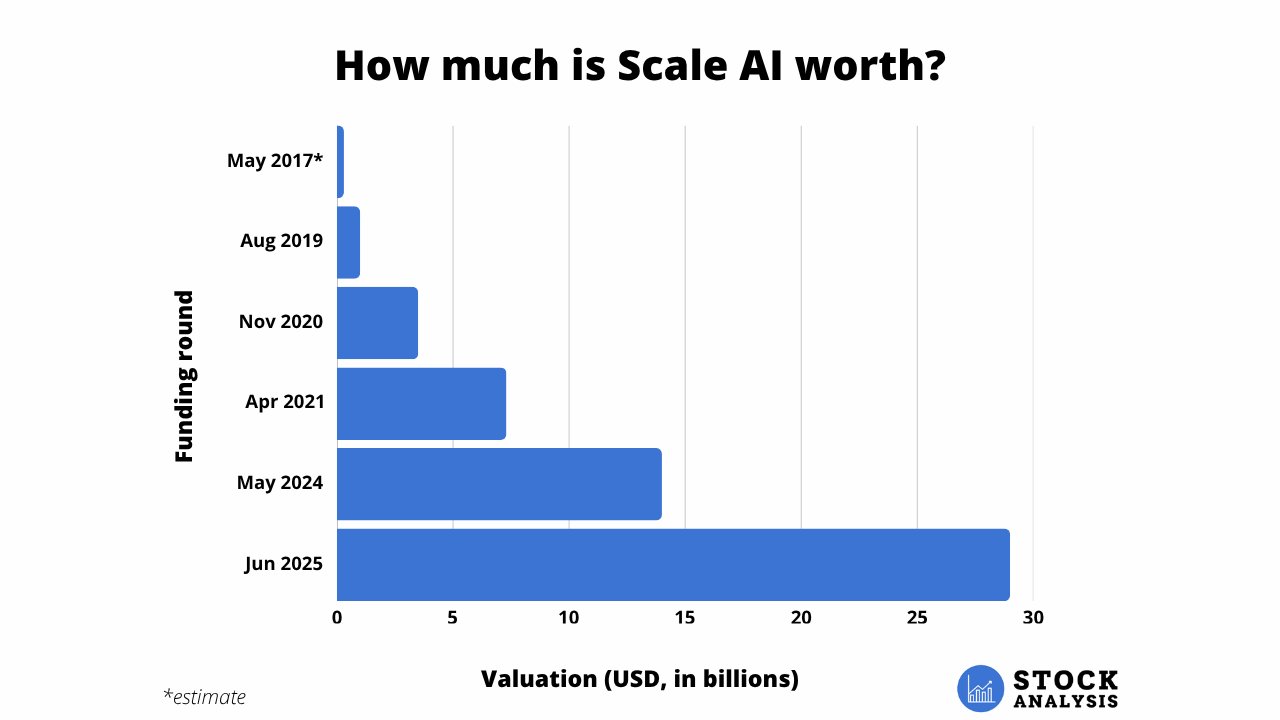

How much is Scale AI worth?

As mentioned above, Scale AI was valued at $29 billion by Meta in June 2025, up from the $14 billion valuation it received in its Series F in May 2024.

Here's a look at how its valuation has changed since the company was founded in 2016:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.