How to Buy Vuori Stock in 2026

In 2015, the clothing company Vuori was working out of a garage and struggling to sell product. At one point, it came within four weeks of running out of money.

Today, 10 years later, the company is a legitimate competitor to athleisure giants such as Lululemon and The Gap's Athleta brand. And investors are taking notice.

Vuori raised $825 million at a valuation of $5.5 billion in November 2024, making it one of the most highly valued private apparel retailers in the world.

All signs point to a future IPO, but the timeline is not yet known.

Still, you may be able to invest in its stock today, while it's still a private company.

How to buy Vuori stock

Vuori is a privately held company, not a publicly traded one. There is no Vuori stock symbol and no way for retail investors to invest.

However, accredited investors can buy shares on Hiive.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies.

There are over 2,000 companies with shares available on Hiive, including SpaceX, Epic Games, Twitter, Whoop, and Vuori:

On Hiive, existing shareholders — who may be employees, angel investors, or VC firms — can list their shares by setting an asking price and quantity of shares available.

Once the listing is active, buyers can see the price and quantity of shares and decide whether they want to place a bid.

Buyers can also keep tabs on certain companies by adding them to their watchlist and receiving notifications of any new listings or transactions.

After a buyer and seller agree on a price, Hiive helps facilitate the transaction and gets the shares transferred to the buyer.

You can create a Hiive account with the button below. Afterward, you'll be able to see all bids, asks, and recent transactions for every company listed on Hiive.

Can retail investors buy Vuroi stock?

Since Vuori is a private company, retail investors cannot buy its stock.

If you're not an accredited investor, you'll have to wait for the company's public offering to invest in it.

In the meantime, if you're bullish on the athleisure space, Vuori isn't the only investment prospect. Here are a handful of other stocks you may be interested in:

- Lululemon (LULU) is the largest retailer of athleisure apparel, premium activewear, footwear, and accessories. While Vuori has been stealing some market share, Lululemon still dominates the category — it generated over $10 billion in revenue in the last 12 months and has a market cap of $45.5 billion.

- The Gap (GAP) also has a large presence in the athleisure space through its Athleta and Banana Republic brands. The company earned $15 billion in revenue last year across all of its brands and has a market cap of $8.8 billion.

- Nike (NKE), the largest athletic retailer by revenue, has been expanding its own range of products in the athleisure segment. However, the company seems to have fallen out of favor with investors recently due to a lack of innovation and sales growth. After peaking at a market cap of more than $260 billion in late 2021, Nike trades at just over $100 billion today on annual sales of nearly $50 billion.

- Adidas (ADDYY), while still focused on sports, performance, lifestyle apparel, and footwear, has some overlap with Vuori's customer base via its Adidas Originals athleisure line. It trades at a $45 billion market cap on last year's sales of $25 billion.

While it may be more focused and growing faster than these other brands, Vuori is still a small player in the premium athleisure space.

Who founded Vuori?

Vuori was founded by Joe Kudla in 2015.

Kudla, then a consultant at Ernst & Young with a background in accounting, was an avid surfer, yogi, and meditator.

Not finding any high-quality activewear companies for his pursuits, Kudla started Vuori — a “Lululemon for men” — with $700,000 in funding from friends and family.

After some initial struggles, Kudla re-positioned the brand as clothing for all-day settings, not just athletic wear. The move worked.

By the end of 2017, Vuori was profitable. And analysts estimate the company currently generates around $1 billion in annual revenue.

While still just a fraction of the $431 billion global athleisure market, investors are excited by its growth.

As of the end of October 2024, sales had grown 23% year-over-year, significantly outpacing overall sportswear, which was expected to grow by just 4.3% in 2024.

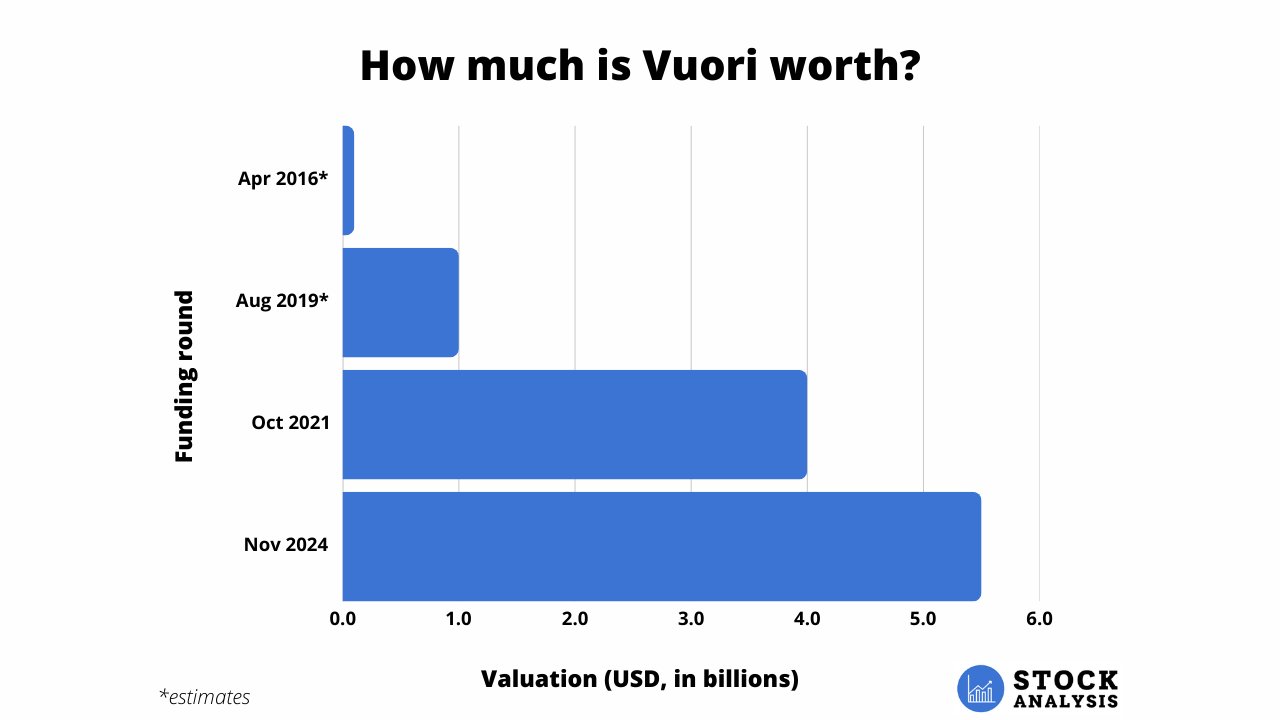

How much is Vuori worth?

Vuori has raised a total of $2.4 billion over four rounds since being launched in 2015.

Its most recent round came in November 2024, where it raised $825 million at a $5.5 billion valuation. The round was led by General Atlantic and Stripes, with participation from Norwest Venture Partners.

The $5.5 billion valuation was up 37.5% from the $4 billion valuation it received in October 2021.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.