Is Coinbase Safe? Security, Technology, & Regulation

In the ever-evolving world of cryptocurrency, one thing will always be a top concern for investors: safety.

Digital assets continue to grow in popularity — a trend that's unlikely to change anytime soon. The need for a secure platform to buy, sell, and store crypto assets has never been higher.

Coinbase is the biggest crypto exchange in the U.S. and the third-largest in the world by average daily volume. But how safe is it?

In this article, you'll learn about the various aspects of Coinbase's security infrastructure, including its technology, insurance, compliance, and regulation.

I cover everything Coinbase uses to protect its users and their assets, as well as the extra steps you can take to secure your account.

What is Coinbase?

Coinbase is an exchange that allows users to buy, sell, transfer, and store cryptocurrency. Users can invest in hundreds of cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin.

The platform also offers Coinbase Wallet, a self-custody wallet that allows users to store their crypto and have direct access to it, as well as Coinbase One, a premium membership that includes zero trading fees, rewards, and priority support.

The platform was founded by Brian Armstrong and Fred Ehrsam in 2012. Armstrong is currently the CEO, while Ehrsam is the Board Director. In 2014, the company crossed one million users.

Coinbase had its IPO in April 2021 and began trading on the Nasdaq under the symbol COIN. It's still the only publicly traded crypto exchange.

Coinbase reported having 115 million users in 2023. It's the third-largest crypto exchange in the world and the largest in the U.S. by trading volume.

But just because Coinbase is the biggest crypto exchange in the U.S. doesn't necessarily mean it's the safest. Read on to learn how the platform protects its users.

Disclaimer: Investing in cryptocurrency is volatile. Your investments are subject to loss. Understand the risks before investing.

Security features used by Coinbase

Coinbase deploys a wide range of technologies to maintain its platform and protect user accounts.

- Encryption: Coinbase uses bank-level AES-256 encryption to protect both user data and financial transactions. All communication between users and Coinbase support is also encrypted using Transport Layer Security (TLS).

- Two-Factor Authentication (2FA): Coinbase requires 2FA for all users. Users can choose between SMS or authentication apps like Google Authenticator. 2FA is also used internally for accessing sensitive data.

- Cold storage: The majority of customer funds are stored in cold wallets, which means they're offline and not connected to the internet. This significantly reduces the risk of hacking and online theft.

- Multi-Signature (multisig) Technology: Cold storage wallets utilize multisig technology, which requires multiple private keys to authorize a transaction. This prevents any single party from moving funds without additional approval.

- Biometric security: The Coinbase app allows users to log in via facial recognition or fingerprint, both of which are considered to be more secure than passwords.

- Internal monitoring: Coinbase employs a security team that monitors the platform for suspicious activity and threats. The team uses machine learning, AI, and behavioral analytics to detect unusual and potentially fraudulent activity.

- Compliance standards: Coinbase adheres to both Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which are set by international organizations to help prevent fraud and illegal activities.

- Insurance: Coinbase has insurance coverage for digital assets held in its custody, which protects it from losses due to security breaches and other events, providing an extra layer of security for user funds. The company also has FDIC insurance on U.S. dollar balances held in Coinbase accounts, up to $250,000 per user.

- Incident response: The company has a dedicated incident response team that manages and mitigates security breaches. They also have a set of protocols to follow in the case of an incident to protect user funds. They will also notify users and provide guidance on how they can secure their accounts.

- Regulatory requirements: As a publicly traded company, Coinbase is subject to intense regulatory oversight and reporting standards.

Collectively, these measures make Coinbase one of the most secure platforms in crypto and help it protect users and their assets from malicious activity.

Liquidity and market risk

The fraudulent actions, liquidity issues, and ensuing bank run at FTX in 2022 served as a stark reminder of how much the crypto market still resembles the Wild West.

At the time, FTX was one of the leading players in the cryptocurrency exchange space, attracting many high-profile endorsements and over $2 billion in funding.

After rumors of its financial instability were substantiated, liquidity problems became an issue almost immediately as millions of investors tried to withdraw their funds.

Although FTX's trading arm, Almeda Research, had been illegally using customer deposits — which was the root cause of the company's bankruptcy — additional importance has been placed on crypto exchange liquidity since then.

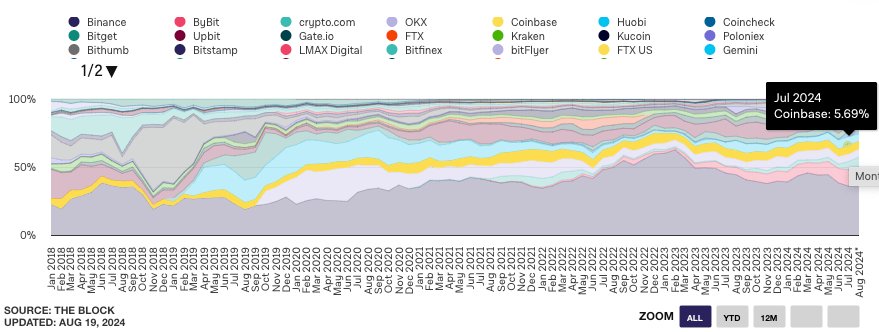

Coinbase's liquidity is not a concern. Its monthly market share by volume, which is an important indicator of liquidity, has stayed relatively stable at mostly around 5–6%:

Source: The Block

Similar to a bank holding U.S. dollars, another important liquidity factor is how much of each digital asset an exchange owns, especially the primary cryptocurrencies like Bitcoin and Ethereum.

Coinbase holds 3.3% of Bitcoin in circulation, the most of any exchange. it also holds 2.6% of Ethereum, the second most (behind Binance).

Additionally, since it's been around for 12 years, the company has lived through massive ups and downs, such as the crypto bubble burst in 2017–2018 or the FTX fallout. This type of durability is what you want to see in your crypto exchange.

Plus, as I cover in the next section, Coinbase is subject to more regulatory oversight than any other crypto exchange.

Regulatory compliance

As mentioned above — and something that makes Coinbase stand out from its peers — is that it's a publicly traded company.

Being a public company in the U.S. comes with a host of regulations, disclosure requirements, and accounting practices that Coinbase must adhere to at all times.

The company can also be subjected to audits by the SEC or a third party at any time.

Given these additional regulatory requirements, Coinbase has subjected itself to a level of transparency and oversight that's unmatched by any other crypto exchange.

In my opinion, this makes its entire business that much more credible.

Personal security protocols

Coinbase has a number of advanced security features to keep your account and assets safe. However, all this technology is only as safe as your own security measures.

Many crypto scams — and fraud in general — are the result of people being tricked into providing sensitive account information or wiring funds to a bad actor. Most “hacks” aren't hacks at all, just regular people failing to keep their accounts secure.

Because of its speed and worldwide accessibility, the cryptocurrency industry is rife with scams.

The best thing you can do, after choosing a secure platform like Coinbase, is to study the latest security materials on how to protect yourself from threats.

Coinbase itself provides several security tips, including:

- Use a strong and unique password: Avoid passwords that would be easily guessed and never reuse passwords across multiple accounts.

- Use two-factor authentication: Log in using a password and a second form of authentication, such as an authenticator app or SMS.

- Stay updated: Always update your software and apps to the latest version.

- Protect your seed phrase: Common in the crypto world, this is a phrase of 12–24 words that serves as the key to a non-custodial crypto wallet. Anyone who has the phrase has access to the crypto in that wallet. Write your seed phrase on a piece of paper and put it where only you know where it is.

- Keep things private: Be mindful about what you post online. The more information you post, the more data an attacker can use to target you.

There's nothing revolutionary about the items in this list — they're all pretty common recommendations. But doing these simple things right can make all the difference.

Final verdict

The cryptocurrency landscape is constantly changing.

Every day, there are new investment opportunities, tools for tracking and securing assets, and online communities posting about the future of crypto popping up.

Unfortunately, there are also always new types of hacks and scams being deployed. If you're going to invest in crypto, you need to make sure your assets are secure.

Using an exchange like Coinbase is a great place to start.

Coinbase is in the unique position of being one of the most liquid, technologically advanced, and regulated exchanges in the world.

Still, as outlined above, there are steps you need to take to keep your account safe. Use a strong password and 2FA. Beware of phishing scams. If you connect a wallet, make sure to write down your seed phrase and keep it in a secure location.

Do all these things, and you should find Coinbase to be a safe, secure, and reliable platform for handling your crypto investments.

.png)