Masterworks Review: How It Works, Safety, and Track Record

If you're looking to add some alternative investments to your portfolio, you're not alone.

Research shows that a portfolio of 40% stocks, 30% bonds, and 30% alternatives can have higher returns and lower volatility than a traditional 60/40 stock-bond portfolio.

One of the more popular options for that alternatives bucket is art, with platforms like Masterworks making it easier than ever to get exposure.

Historically, art has generated consistent returns, frequently held its value during periods of inflation, and provided a way to diversify outside of the stock market.

But is art the right investment — and is Masterworks the right platform — for you?

Here's everything you need to know about investing in art on Masterworks, including how it works, what you should expect, whether it's safe, who it's best for, and why I (personally) wouldn't invest more than 5–10% on the platform.

Masterworks review summary

- Overall rating:

- Asset type: Art

- Best for: Diversification, speculation

- Representative returns: 17.6%, 17.8%, and 21.5% annualized net returns among sold works held longer than one year

If you want to diversify your portfolio with alternative investments and like the idea of art, Masterworks is a solid starting point.

That said, art is an illiquid asset, and investors should expect to hold each piece for 5+ years. Art investing is also expensive, and the platform charges fees for sourcing, buying, storing, and selling art, which will reduce your net returns.

What is Masterworks?

Masterworks is an investing platform that enables all investors to invest in shares of fine art.

Art investing is not new. It has existed for hundreds of years as an alternative investment category.

Although artwork doesn't generate any cash flow like a typical business, prices for artwork have risen faster than inflation thanks to its collectible attributes.

Some pieces (like Andy Warhol's "Car Crash") have seen especially high returns thanks to the evolving reputation of the artist.

However, because pieces from notable artists can sell for millions of dollars, art investing has typically been reserved for the ultra-wealthy.

Masterworks makes art investing accessible to retail investors by "securitizing" high-value works into individual shares, lowering the entry point from millions of dollars to a few hundred.

It also stores, maintains, insures, and, when it's time, sells the artwork on behalf of the owners.

While there are other platforms that offer art investing, Masterworks is widely considered the leader in the space based on assets under management and its wide investment selection.

Key figures

- Number of users: 1,000,000+

- Artworks purchased: 500

- Amount invested on the platform: $1.2+ billion

- Average return: 11.2% per year (per The Masterworks All Art Index)

- Minimum investment: $15,000* (for first-time investors, $500 for returning investors)

- Investor fees: 1.5% management fee + 20% profit share + one-time expense allocation (roughly 10% of offering size)

All figures are as of September 2025.

*May be reduced. More on this in the "fees" chapter below.

Why invest in art?

As mentioned earlier, investors are buying alternatives to enhance their portfolios' returns and diversification. As an asset class, art checks both of these boxes.

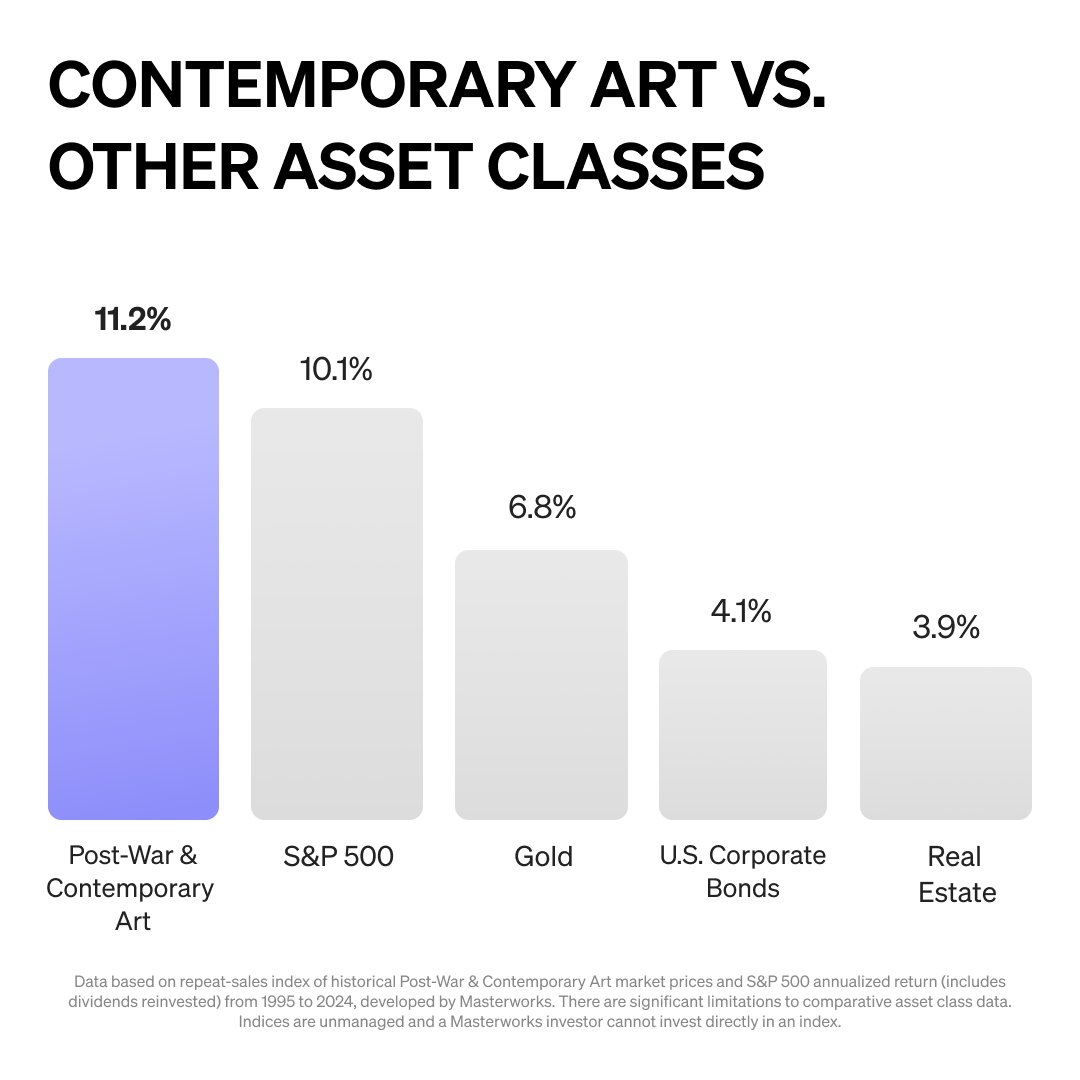

Between 1995 and 2024, Post-War and Contemporary art — the categories Masterworks focuses on — outperformed the S&P 500, gold, U.S. corporate bonds, and real estate (according to Masterworks' data):

Source: Masterworks

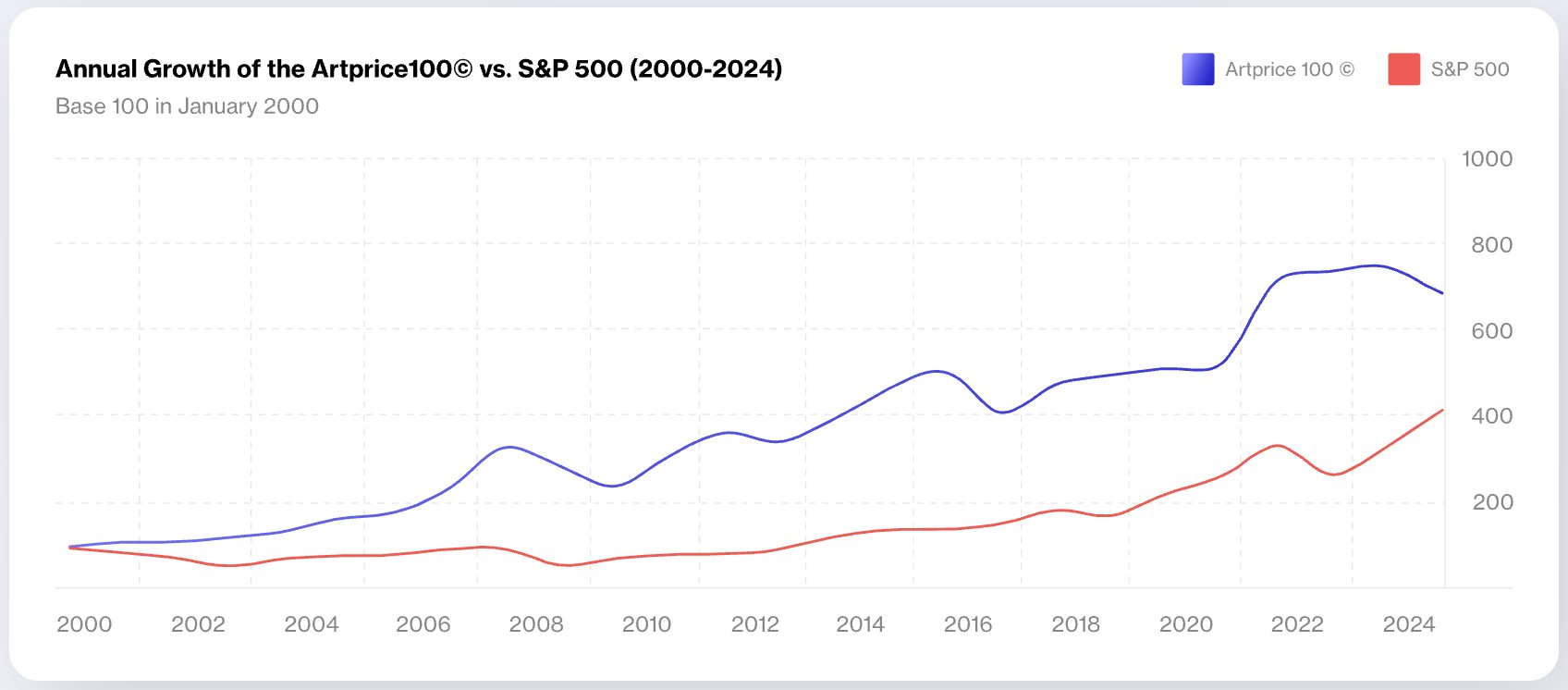

The Artprice 100 index, which is comprised of the art market's 100 most successful artists based on auction revenue over the previous five years, shows similar performance between 2000 and 2024:

Source: Masterworks

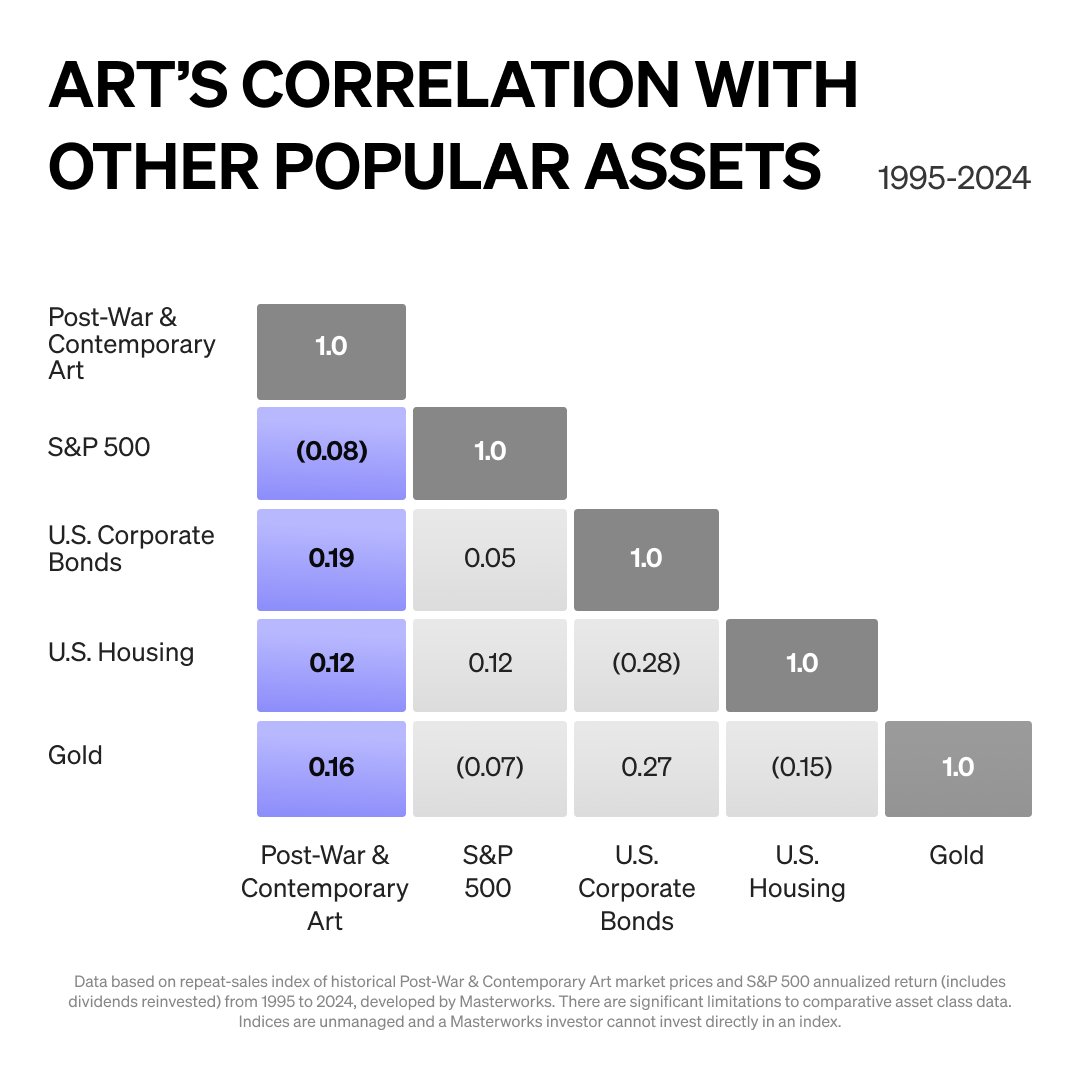

This performance is especially attractive given that art prices demonstrated a low correlation with other asset classes over the same period:

Source: Masterworks

The chart above shows how Post-War & Contemporary Art moved in relation to other major asset classes between 1995–2024.

The correlations are low (even slightly negative for the S&P 500), indicating art prices tended to move independently from traditional assets. This is part of what makes them useful as a diversification tool.

While past performance does not guarantee future returns, art's price appreciation and low correlation with other assets have made it a valuable asset for diversifying portfolios.

How does investing via Masterworks work?

Masterworks offers fractional investments in fine art, allowing investors to buy shares of million-dollar artworks for $20 each.

There are 5 steps to the process:

- Research. Masterworks' acquisition team leverages proprietary data to find artists with the most momentum. Then, the team looks at each individual artwork created by the artists on their list and tries to find the best pieces at fair prices. Fewer than 3% of artworks pass this due diligence process.

- Acquire. Once the team finds an artwork to purchase, they negotiate and buy the piece. Once purchased, the art is transferred to a secure storage facility where it is kept in a climate-controlled environment and insured for damage or loss.

- Securitize. Once the artwork has been stored, Masterworks creates a special-purpose LLC and "qualifies" it with the SEC, allowing individual investors to buy shares of the LLC (whose sole purpose is to hold and maintain that specific piece of art) on the Masterworks platform.

- Investors buy shares. Once an artwork is made available on the platform, investors can buy shares in the art's initial offering. Shares are sold for $20 each.

- Investors realize returns. There are two ways investors can sell their shares and realize returns:

- Masterworks sells the piece: The first way is to wait until Masterworks' private sales team sells the artwork out of its gallery. The platform will then distribute the proceeds of the sale, net of fees. Note: At purchase, Masterworks plans to hold each artwork for 3–10 years.

- Investors sell their shares: Masterworks offers access to an unaffiliated secondary market (powered by North Capital) for investors who want to buy and sell shares prior to an exit. That said, the Trading Market frequently lacks liquidity, so investors should plan on holding until Masterworks decides to sell the artwork.

Track record

Masterworks was launched in 2017 and has sold 23 artworks to date.

Each of those 23 sales has delivered a profit to its investors, including annualized net returns of +17.6%, +17.8% and +21.5% (among assets held 1+ year).

Its most recent sale (a Basquiat painting in 2024) sold for $8 million in a little under four years. For every $10,000 someone invested in that Basquiat, they earned over $2,600 in profit after fees (a ~6.3% net annualized return).

While these are strong results, it's safe to assume that Masterworks was opportunistic about these sales and only sold pieces where they'd earn a return for investors.

The average holding period of these sales was also around two years, less than the 3–10 years they tell investors to expect.

There is no external-facing pricing data for its unsold artworks.*

*For this reason, and because Masterworks has been in business for fewer than 10 years and has only sold ~5% of its purchased paintings, I've used its All Art Index's average return of 11.2% per year throughout this article.

This figure should also be taken with a grain of salt, however, as the art market is opaque and the index may not include every piece of art in its calculations.

Fees & investment minimums

Fees

While the fees may seem complex, they can be broken into three buckets:

- Annual fee. You will be charged a 1.5% annual management fee on all assets invested on the platform. This fee is distributed in the form of equity, which means your ownership stake(s) will be diluted over time (instead of you needing to pay the annual fee with cash).

- Profit share. Masterworks also takes a 20% profit share after the sale of an artwork. This fee is applicable to any amount the painting sells for in excess (if any) of the initial offering price.

- Acquisition fee. Finally, after acquiring a new piece, Masterworks adds an "expense allocation" to cover closing costs. This fee is based on the purchase price of the artwork and roughly works out to 10% of the offering size. You can think of this as a 10% trading fee whenever you buy shares of a new offering. The fee is not taken out of anyone's account, but is added to the cost of the painting before it is made available to investors.

There are many costs associated with art investing (such as sourcing, acquiring, transporting, storing, and selling) that Masterworks covers and attempts to earn a profit on top of.

Still, Masterworks essentially charges hedge-fund-level fees while requiring members to actively manage their own art portfolios.

These fees are higher than those of the average alternative investment platform, which are, in turn, higher than traditional investments like an index fund.

*Investment minimums

Masterworks' stated minimum investment is $15,000 for first-time investors. However, this minimum can be (and is often) reduced by one of Masterworks' dedicated advisors, depending on your portfolio size, risk tolerance, and financial goals.

Some members have made their first several investments with only a few hundred dollars.

It seems Masterworks leaves this to the discretion of your assigned advisor. If you tell them your situation and that you only want to allocate a certain percentage of your portfolio to art, they may potentially work with you.

Other potential drawbacks

In addition to its high-ish fees, lack of liquidity, long holding periods, and investment minimums, there are a few other things you should be aware of before investing.

Registration status

Masterworks is not registered as a broker-dealer or a member of the SEC or FINRA.

It does partner with SEC- and FINRA-registered companies to run its Trading Market and provide its advisory services, but the company itself is not held to the same level of scrutiny, reporting requirements, and return presentation standards.

As such, investors should use a bit more caution when investing on its platform. There simply isn't the same level of oversight or safety nets that would help cover your assets if Masterworks were to run into hard times.

Speculative nature

Art is a speculative investment. As a collectible, art's value solely relies on the taste and preferences of collectors, something that can change over time.

Low liquidity

Again, and this bears repeating — art is a highly illiquid asset. Art investors face the very real risk of not being able to find a buyer for the art that they own.

In Masterworks' own words, "Investors should be prepared to hold their investment for an indefinite period of time, as there can be no assurance that the shares or the artwork can be sold."

And while the Trading Market on Masterworks helps address this issue, to an extent, there's not much liquidity there either.

To be fair, this issue pertains to art investing as a whole — it's not just specific to Masterworks (the same can be said about the fees).

To their credit, Masterworks realizes liquidity is an issue and tries to align itself with its investors' interests by making one of its primary compensation forms a 20% profit share.

Bottom line: Masterworks is not for everyone. It's a long-term, alternative investment designed for diversification and capital appreciation, not short-term trading or yield.

Pros and cons of Masterworks

| Pros | Cons |

| Strong historical price appreciation | $15,000 minimum investment for first-time investors (may be negotiable) |

| Diversification | High fees, similar to hedge funds |

| Handles the sourcing, acquiring, storing, and selling on your behalf | Fairly illiquid |

| Has the best selection of art investments | Fairly speculative |

| Available to all investors | Required onboarding phone interview |

| Easy-to-use platform (desktop and mobile) |

How to become a member

Anyone can become a member and start investing in art on Masterworks — it is available to both U.S. and international investors (and so is the Trading Market).

After creating an account, you'll need to schedule an onboarding phone interview before you can invest on the platform. This is required to comply with regulatory obligations.

The call will last about 15 minutes and covers a few things:

- Know Your Client (KYC): This brief summary of your financial profile includes how much you are able to invest, when you want to invest, your profession, and a few other details.

- Suitability: Masterworks' advisor will walk you through its investment process and ensure you have a thorough understanding of the investment.

- First transaction: If art investing is deemed a fit for you, they will help you make your first investment purchase.

After your first investment, you will be able to invest independently of the Masterworks team.

Is Masterworks legit?

Yes, Masterworks is legit.

To securitize a piece, Masterworks must set up a special-purpose LLC. After it's filed and qualified with the SEC, shares are made available to investors.

Masterworks works closely with the SEC for this entire process and is subject to the SEC's oversight. Each investment must pass a number of regulatory hurdles before it becomes listed for purchase on the platform.

That said, SEC qualification does not mean the SEC passed upon or endorsed the merits of these investments.

In addition, Masterworks is not subjected to near the same level of scrutiny as a broker-dealer, and doesn't have the same safety nets as a FINRA-regulated, FDIC-insured U.S. brokerage.

Every investment on Masterworks is a real, physical piece of art. The platform does not invest in NFTs or other digital assets.

Furthermore, the Masterworks website notes that each artwork is expertly vetted before it is acquired and that fewer than 3% of all analyzed pieces are purchased.

However, art is a speculative investment. As a collectible, the value of art is based on the tastes and preferences of its collectors, which often change over time.

Final verdict

As a platform, Masterworks is best for investors who already have a portfolio of traditional assets and want to diversify further.

It can be exciting to invest in alternative assets like art because they can provide diversification and an alternative way to store wealth, and may (in some cases) appreciate sharply.

But, in my opinion, they should be kept in their rightful place — that is, as a minority component (think 5–10%) of an overall portfolio.

Furthermore, you should be aware of all of the risks you are taking when investing in art, regardless of which platform you invest on. This is a speculative asset class, and investing in it may result in a loss of some or all of your investment.

If you're comfortable with those risks and don't mind the lack of liquidity, you may be ready to join Masterworks and add some color to your portfolio.

Stock Analysis receives cash compensation for referring potential investors to Masterworks through this page. Masterworks reviewed the copy for factual accuracy but did not offer editorial input. Investing involves risk. Past performance is not indicative of future returns. See Important Regulation A Disclosures at masterworks.com/cd.