Morningstar Investor Review: Is It Worth the Money?

Morningstar Investor is one of the most underrated investment research platforms available to individual investors — that is, if you like its research style.

The site provides objective, proprietary analysis on 600,000+ mutual funds, ETFs, and stocks.

However, beyond surface-level data, you'll need to pay for a Morningstar Investor subscription to access the bulk of the site.

Is it worth it? Maybe.

For some, Morningstar Investor is like getting direct access to institutional-level research. For others, it's an expensive redundancy.

Here's how to determine which one it is for you.

Morningstar Investor review summary

- Overall rating:

- Service type: Investment research

- Best for: Objective stock, ETF, and mutual fund research

- Cost: $249/year ($199 first year + 7-day free trial with our links)

Because Morningstar's investment research is produced in-house and many of its data points (like its Ratings) are unique, you won't find them anywhere else. So if you like its brand of analysis and are regularly researching stocks or funds, you should subscribe.

Its other features — portfolio management tools, stock screener, and watchlists — are nice-to-haves, but they're definitely not worth the cost of the subscription, to me.

Fortunately, most investors can easily determine within the first few days if they're going to get value out of the subscription, and can utilize the 7-day trial to try the site for free.

What is Morningstar?

Founded in 1984 by Joe Mansueto,* Morningstar is a prominent provider of independent investment research. The site is best known for its comprehensive analysis and ratings of mutual funds, ETFs, and stocks.

*Mansueto got the idea for Morningstar while reviewing mutual fund reports as a stock analyst in 1982. The reports were hard to access and had inconsistent formatting, making the research process feel unnecessarily complex.

While you've likely heard of the company because of its consumer website — Morningstar.com — Morningstar (MORN) is a publicly traded company with a $10 billion market capitalization and more than $2.3 billion in annual revenue.

The bulk of its revenue is generated from providing research, data, tools, and asset management services to financial advisors, asset managers, and investment banks all over the world.

The company is deeply embedded in the institutional investing landscape.

By comparison, its consumer-facing products (the website and Morningstar Investor) represent only a small fraction of its revenue, but are powered by the same data and analysis used by asset managers and advisors worldwide.

And you can access it for just $249/year.

What is Morningstar Investor?

Morningstar Investor is the company's premium subscription service for individual investors that includes fund and stock research, ratings, screeners, and portfolio management tools.

While there are useful aspects of the portfolio tracking tools (which I cover below), none of them alone is worth the subscription cost, in my opinion.

However, Morningstar Investor gives retail investors access to a lot of the same research, data, and analysis that many institutional clients are paying millions of dollars to access every year.

So for investors who like its style of research, the $249/year is a no-brainer.

Here's what's all included in the subscription (more below on each):

- Investment research

- Morningstar ratings

- Portfolio tracking

- Other tools

1. Investment research

As mentioned above, the biggest draw to Morningstar Investor is its independent research.

Morningstar's core business is producing independent research and data for financial professionals. All of this research is produced in-house by Morningstar's own team of analysts.

Because the company doesn't earn money from trading fees or receive kickbacks from product issuers, its entire model depends on providing objective, unbiased, and useful insights.

A Morningstar Investor subscription unlocks this style of research through deep-dive reports, proprietary ratings, quantitative scoring, and in-depth data on hundreds of thousands of stocks, mutual funds, and ETFs.

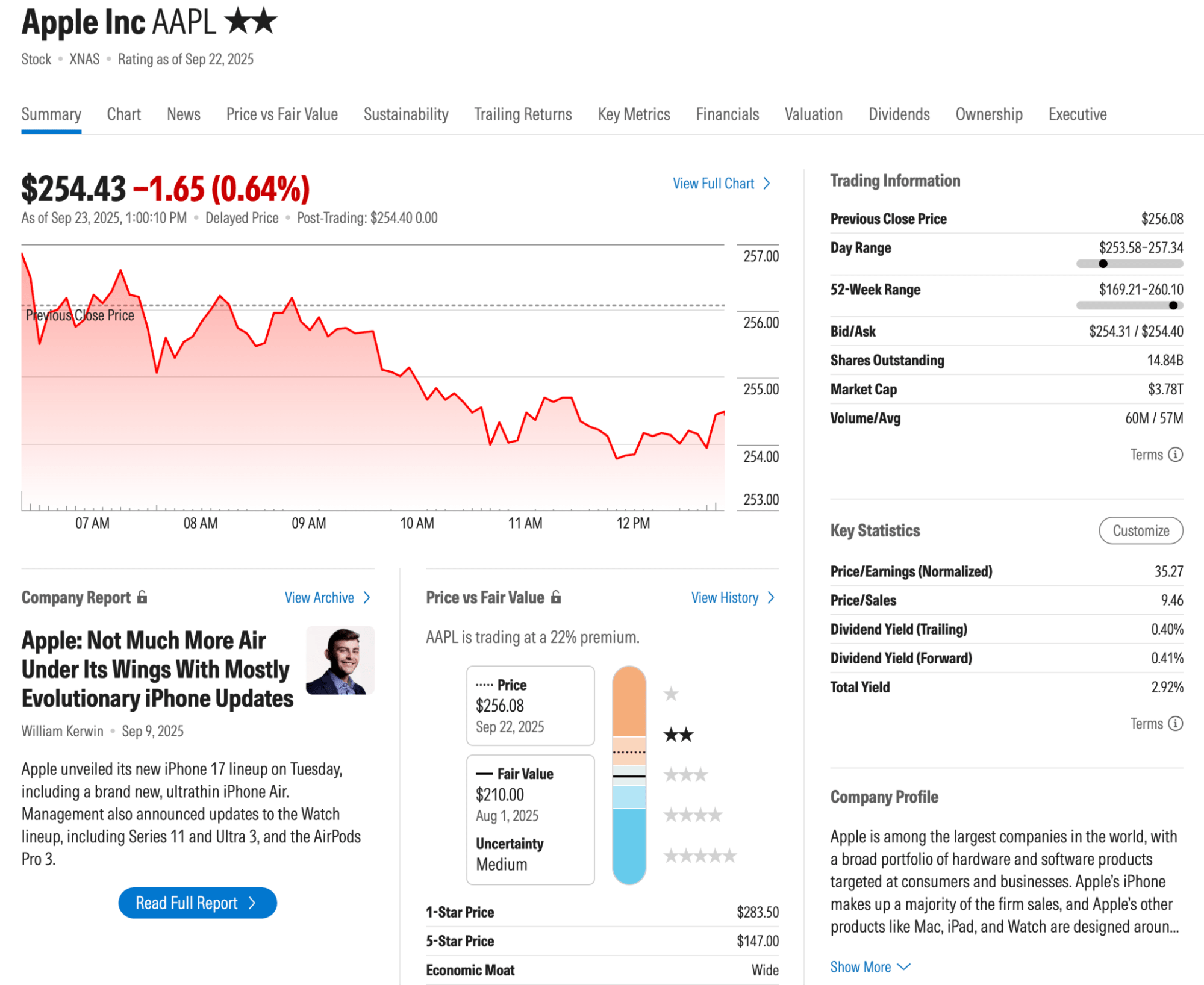

Here's a look at a stock page:

In addition to all of the typical information found on most stock research websites, Morningstar provides detailed analysis on a company's fair valuation, growth prospects, and risks through visualizations and company reports.

And for fund research, Morningstar is hard to beat.

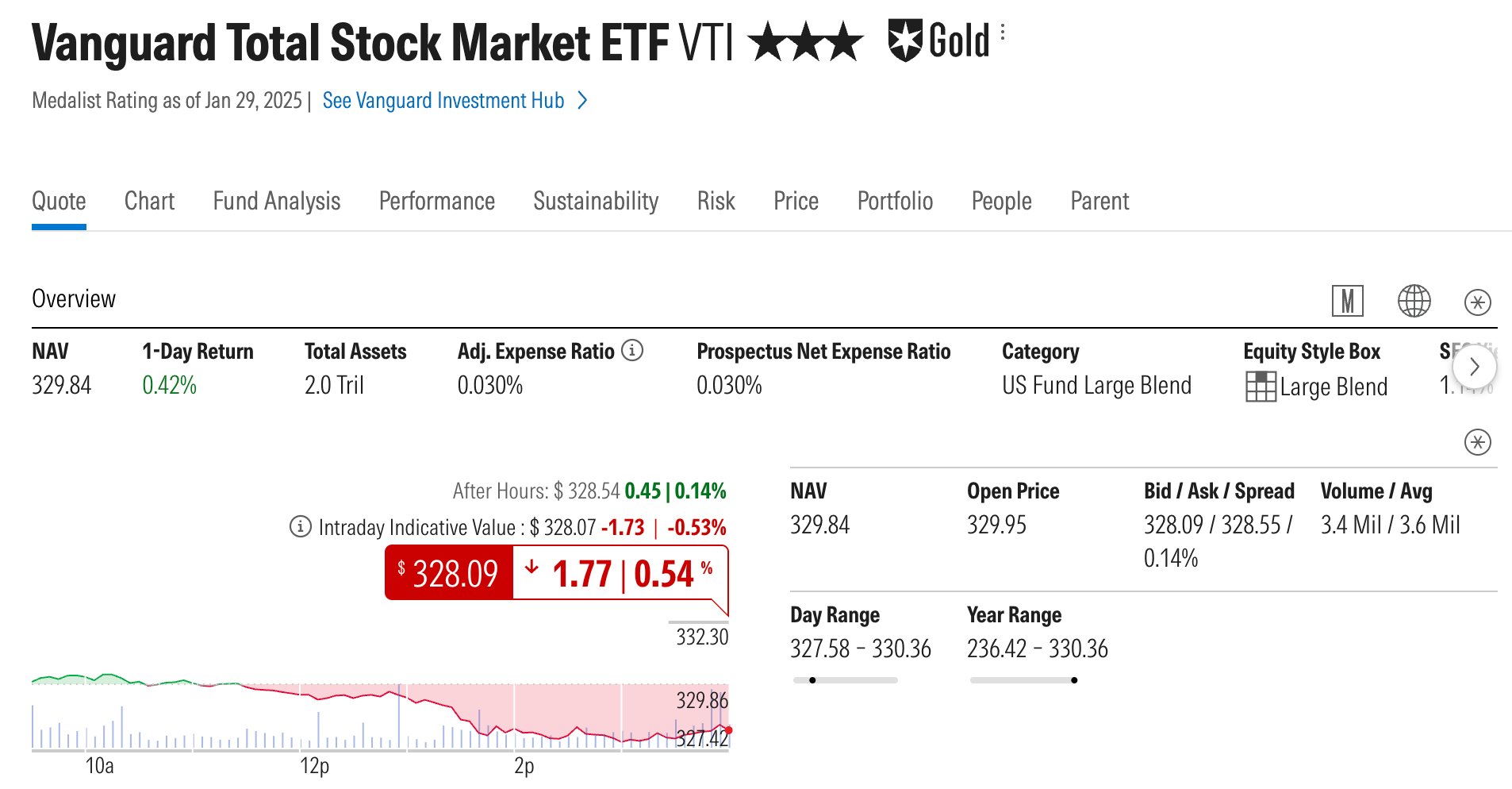

Outside of all the usual data points (performance, fees, and holdings), Morningstar has information on the funds' management, performance relative to its peers, risk measures, ESG, and parent company.

On top of that, most funds also have a “Fund Analysis” section that has written reports evaluating everything from a fund's strategy and fees to the track record of the managers.

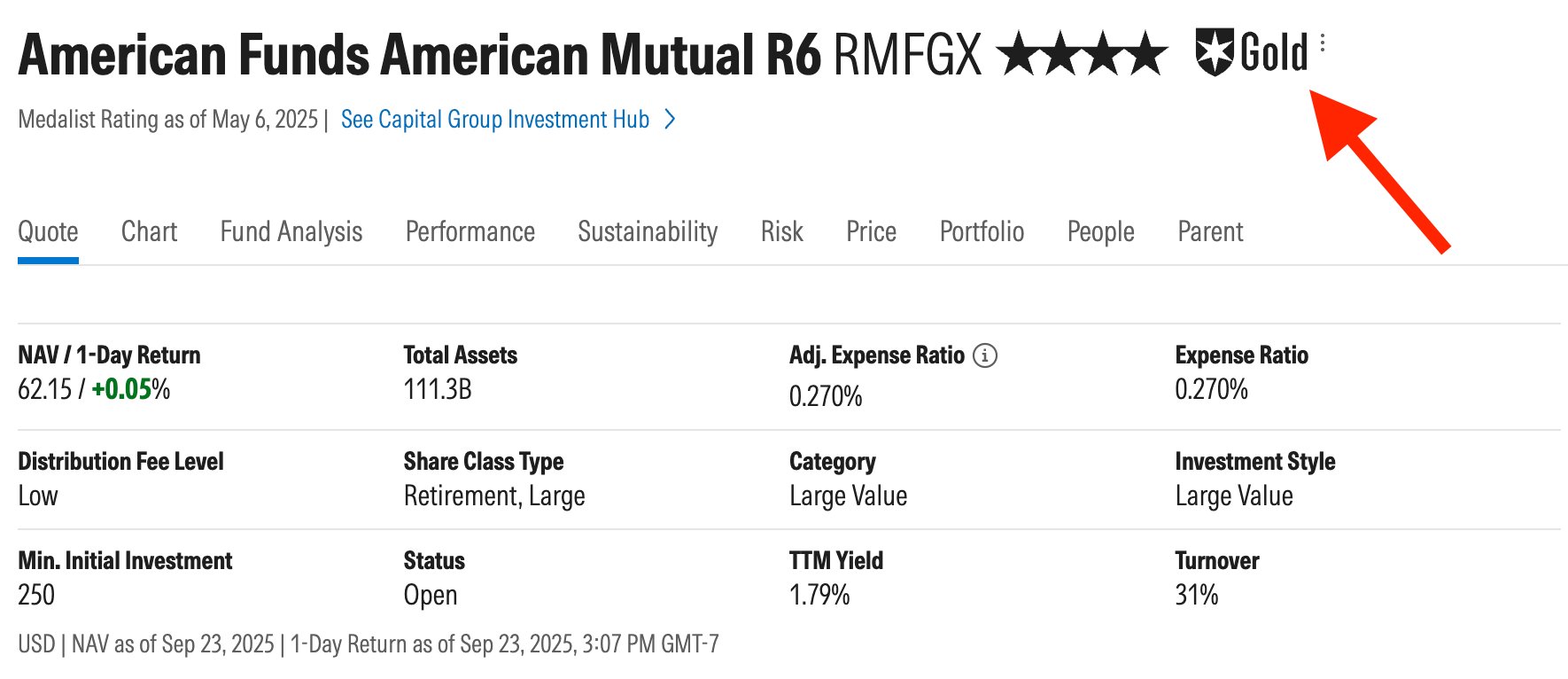

Each report concludes with a forward-looking Medalist Rating, giving investors a clear sense of what the author thinks of the fund's long-term prospects compared to its peers.

Speaking of ratings…

2. Morningstar Ratings

Morningstar Ratings is probably the company's most well-known feature. Its ratings are widely cited in the investing world and are quick signals of quality and performance.

Morningstar has two forms of ratings: Star Ratings and Medalist Ratings.

Star Ratings

Star Ratings are the most widely referenced form of Morningstar's ratings.

Stocks and funds are given a rating between one and five stars, although they're evaluated based on different criteria.

- Stocks: Stocks are evaluated based on their current price relative to their fair valuation (as determined by Morningstar's internal models). A 5-star stock is considered undervalued and to be trading at a discount relative to its fair value, while a 1-star stock is considered expensive.

- Funds: Funds are also given a rating between one and five stars, but these ratings are solely based on their risk-adjusted performance relative to their peers over the last 3 years.*

*Although the star system does serve its purpose of helping investors quickly assess the quality of a fund and compare its performance to others in the same category, I'd argue it places too heavy an emphasis on past performance.

Ratings should not be taken purely at face value.

In my opinion, the most useful way to use Star Ratings is when you've identified a sector poised for growth and want to find the funds in that space that have outperformed their peers in the past.

Most Star Ratings are updated monthly.

Medalist Ratings

Mutual funds and ETFs may also receive Medalist Ratings, which are forward-looking assessments of how analysts expect an investment to perform in the future.

These ratings are assigned by Morningstar's analyst team, which evaluates factors like management skill, strategy, and fees.

Funds are assigned Gold, Silver, Bronze, Neutral, or Negative “medals.” Gold-rated funds rank in the top 15% of their category and are deemed the most likely to outperform their peers on a risk-adjusted basis.

For funds without direct analyst coverage, Morningstar uses quantitative models to extend the system, so nearly every fund has a Medalist Rating.

Most Medalist Ratings are also updated monthly, although some may be re-evaluated on an annual basis, and many of the quantitatively derived Medalist Ratings update more frequently.

A note on ratings

Investors should exercise caution when using Morningstar's Star and Medalist Ratings.

These ratings are based on the firm's best judgment, but there are no guarantees that well-rated stocks or funds will outperform their peers, let alone the market as a whole.

In my opinion, investors should use these ratings as one part of their larger toolkit.

3. Portfolio tracking

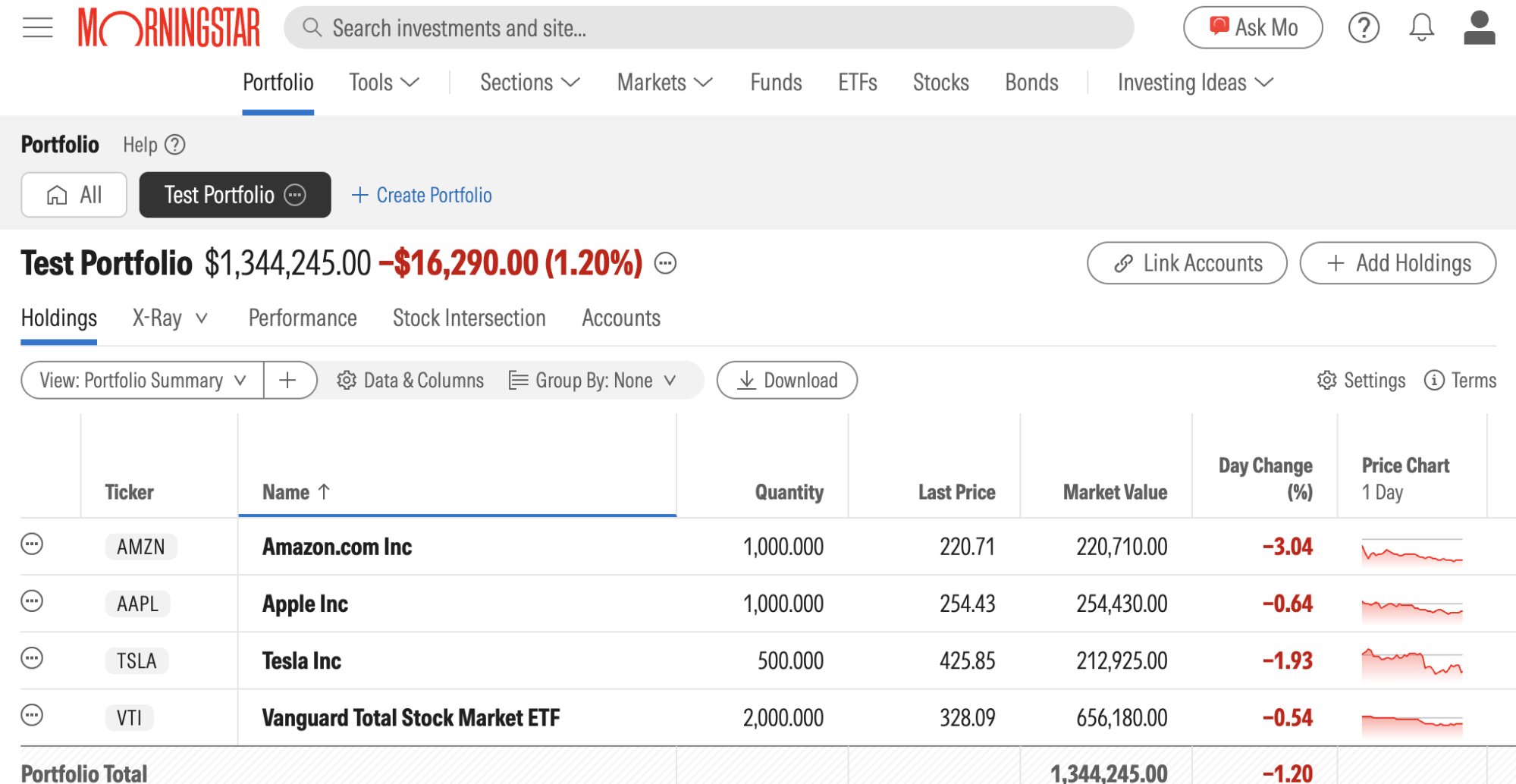

Morningstar Investor comes with a fairly robust portfolio tracker, which is easily customizable across hundreds of data points, columns, and views.

The ability to create your own views and add any of Morningstar's detailed stock- or fund-specific data is the most powerful aspect of its portfolio tracker, and my favorite feature outside of its investment research.

Here are a few more popular features within the tool.

X-Ray

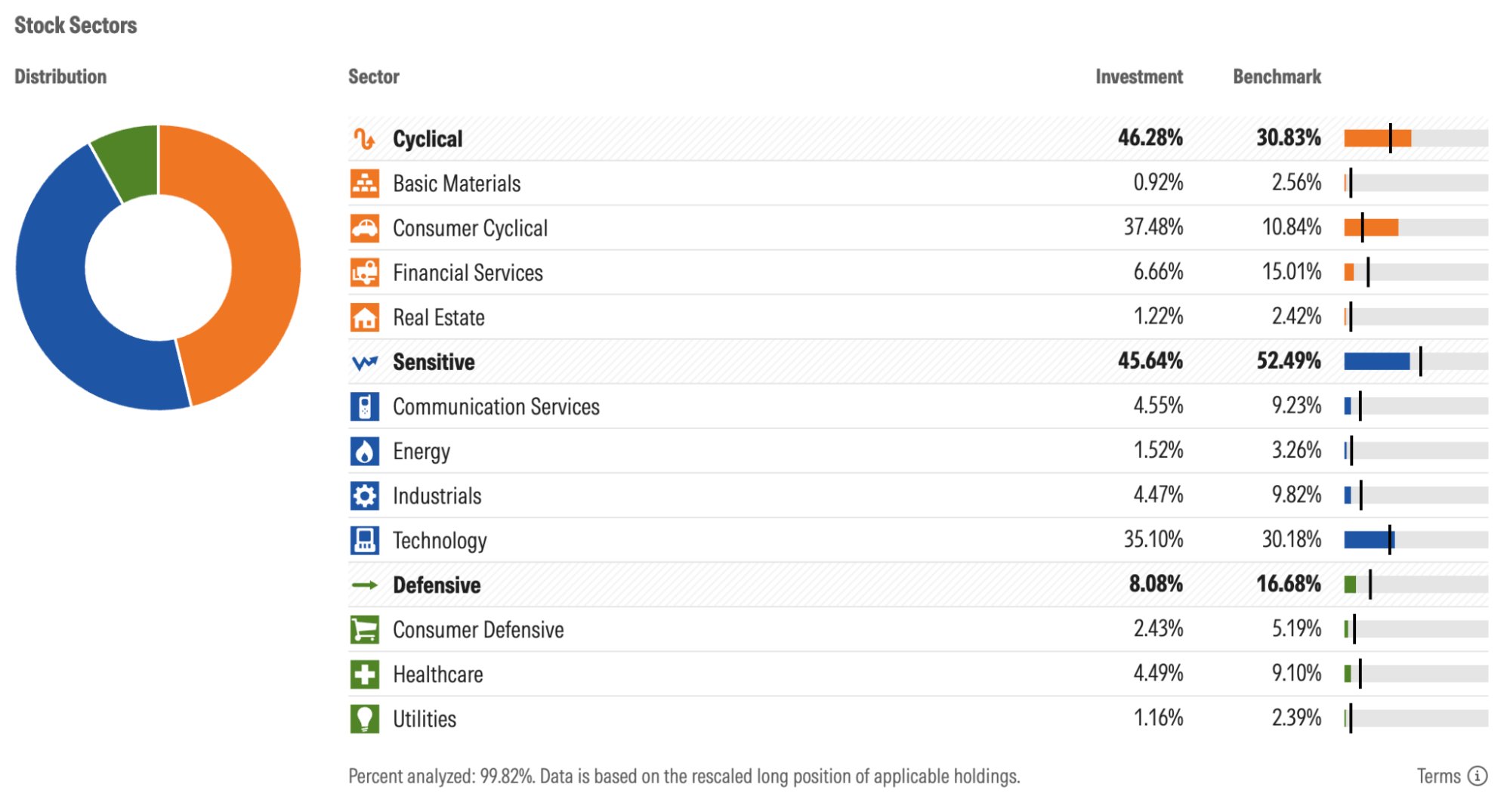

X-Ray is an asset allocation tool that allows you to evaluate your holdings from every angle, and is particularly useful for portfolios that hold multiple funds or a blend of stocks and bonds.

You can see how your portfolio is divided across asset classes, sectors, regions, stock styles, and more, compared against any benchmark.

In an instant, you can get a visual representation of your portfolio and where you're overweight or underweight.

Stock Intersection

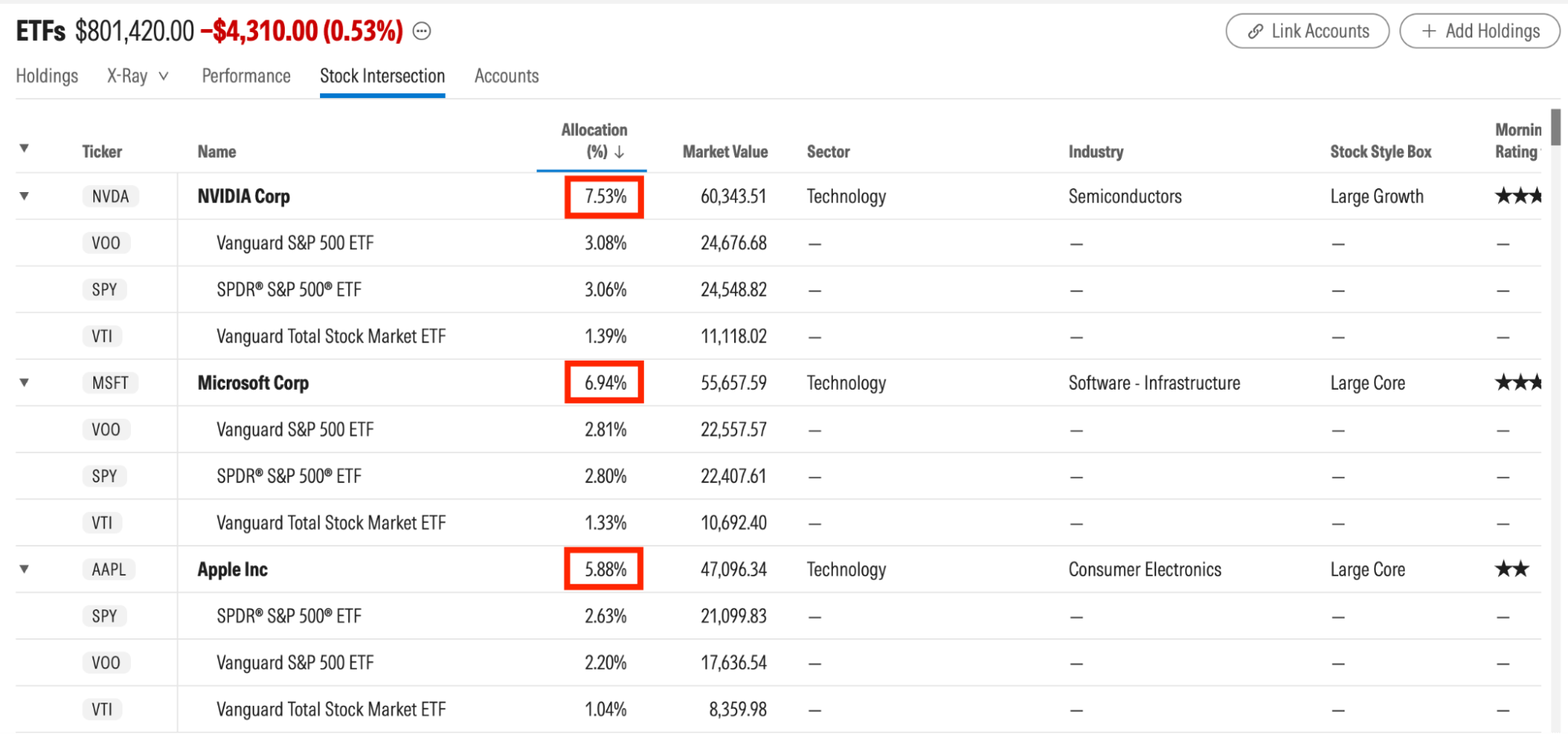

For portfolios with multiple ETFs or mutual funds, the Stock Intersection tool will identify where holdings overlap and help you find areas of over-concentration.

For example, an investor who owns VTI, VOO, and SPY might think they're diversified between three funds, but the Stock Intersection will show just how much overlap there is between these funds.

Despite owning three separate funds, 20% of this example portfolio is in just three stocks — not very diversified.

Performance

You can automatically link accounts to pull in your holdings, but this will not bring in transaction-level details (like cost basis or purchase date), so you will not get performance data.

To get performance data, you must manually add holdings one at a time. This means you will also need to manually add any transactions that happen after your initial setup to keep your performance information accurate.

I've never seen this with any other portfolio tracker that has automatic linking, and it is a severe limitation to Morningstar's portfolio tracking. For me, it renders the performance section basically useless.

If you're looking for a free portfolio tracker that automatically tracks performance, check out Empower.

4. Other tools

A premium subscription also comes with watchlists, a stock screener, technical charts, and an Investing Ideas section, though none of these features are particularly noteworthy, in my opinion.

What is the site like to use?

Morningstar's website is functional and information-dense — it's useful, but it doesn't feel especially polished compared to more modern investing platforms.

The layout is heavy on text, tables, and drop-down menus, which can make it feel more like a database than an application.

In fairness, the utilitarian design reflects Morningstar's focus on objective data, ratings, and analysis rather than visual flair.

However, one big downside to the site is the advertising.

Even after upgrading to Morningstar Investor, you'll still see ads scattered throughout the site. Granted, they only promote other Morningstar products and services, but they still feel distracting and out of place on a premium product.

How much does Morningstar Investor cost?

Morningstar Investor is the company's only premium service for individual investors and can be purchased on a monthly or annual subscription:

- Annual: $249/year (equivalent to $20.75/month)

- Monthly: $34.95/month

The annual plan is the more popular of the two.

New subscribers can get their first year of Morningstar Investor for $199/year after a 7-day free trial by using any of the links in this article.

You can get started with the button below:

Who it's for

Morningstar Investor is built for long-term investors who invest in stocks, ETFs, mutual funds, or some combination of the three.

Its independent stock and fund coverage, and many of its data points (including the Ratings), are features you won't find anywhere else. For retail investors, it's a rare glimpse into the analysis used by institutional investors.

If this style of research fits your investment approach, Morningstar Investor is an excellent option.

But if you're an active trader, only want a portfolio tracker, make infrequent changes to your portfolio, or don't value its brand of independent research, Morningstar Investor is not a good fit.

For more options, see my article on Motley Fool vs Seeking Alpha vs Morningstar vs Zacks.

Pro and con summary

| Pros | Cons |

| Comprehensive, independent research on 600,000+ stocks, mutual funds, and ETFs | Almost all of its research is paywalled |

| Professional-grade analysis | Reports can be a bit dense |

| Stock and fund ratings | So-so portfolio tools |

| 7-day free trial |

How to access Morningstar for free

There are a few ways to access some of Morningstar's research without paying for a subscription.

Some public libraries subscribe to the Morningstar Investment Research Center (aka “Library Edition”), which gives cardholders access to analyst reports, ratings, and other tools.

Additionally, several brokers (including Fidelity and Charles Schwab) provide Morningstar reports inside their client portals. Access varies by firm, but most legacy brokers have some Morningstar research on stocks' and funds' research pages.

While these routes will give you some free access to the data, there are quite a few limitations, so don't expect to get every feature included in a full Morningstar Investor subscription.

Final verdict

For long-term, fundamental investors looking for objective investment research, Morningstar Investor is an obvious choice.

The most valuable features of this subscription are the investment research and analysis for both stocks and funds, its Star and Medalist Ratings, and a couple of tools inside its Portfolio tracking section (X-Ray and Stock Intersection).

My recommendation: Try it for a week and see if it becomes your go-to place for research. If it does, subscribe. If not, keep looking.