The 7 Best Options Trading Alert Services in 2026

There's no shortage of option alert services to choose from, but they're not all created equal.

Some are run by seasoned traders with years of experience and a real track record. Others are nothing but bold promises and flashy marketing.

Your first filter should be credibility. How long has the service been around? Is the person behind it a legit trader?

After verifying they're credible, you can ask questions like:

- How profitable are the trades?

- What's the trading strategy or investing style?

- How expensive is the service, and what size account do you need?

With those things in mind (credibility, profitability, investing style, and cost), here are the best options-picking services in 2026.

Summary view

- Best overall: Stock Market Guides

- Best for beginners: Mindful Trader

- Best for large accounts: Delta Options

- Best for simple options selling: Motley Fool Options

- Best for fast-moving swing trades: The Trading Analyst

- Best for high-leverage, long-term trades: The Speculator

- Best for very active, advanced options traders: Market Chameleon

I cover the costs, strategies, and what to expect from each of these services in more detail below.

By the end, you should know which one is best suited for your goals.

Disclaimer: Ratings are my opinion. Actual results may vary, and past performance does not guarantee future results. All investors should do their own due diligence.

1. Best overall: Stock Market Guides

- Overall rating:

- Strategy: Buying calls for swing and longer-term trades

- Cost: $69/month or $575/year

Stock Market Guides does two things really well, earning it the top spot on this list.

First, it sends frequent and easily implementable trade alerts. The format of each alert is simple and easy to understand for anyone who's new to options trading — it's just the strike price, expiration date, and how long you can expect to hold the trade.

You'll receive between one and three of these trade alerts most days, and you can choose to get them via email or text.

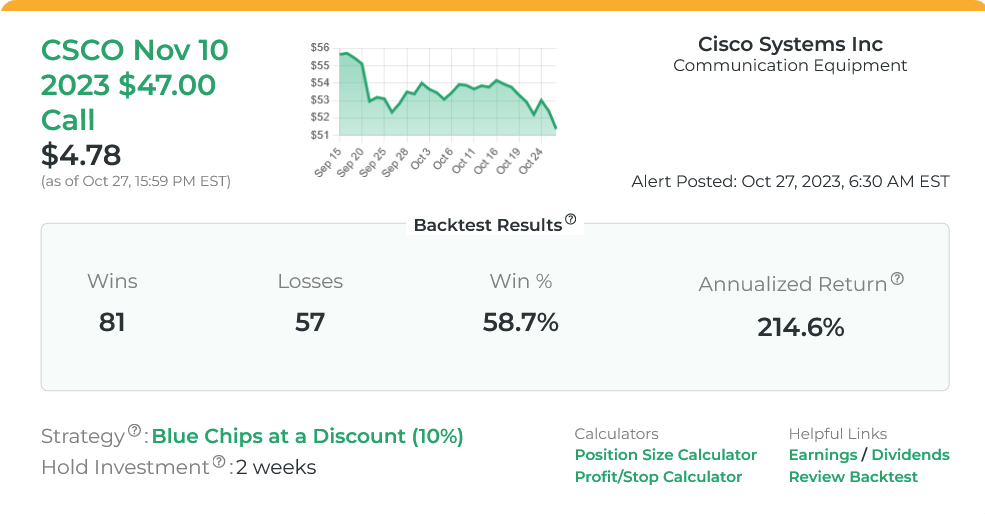

For the second thing that makes it stand out, take another look at the trade alert above. You can see:

- The strategy being used ("Blue Chips at a Discount")

- The historic win rate of that strategy (58.7%)

- The historic annualized return of that stock in that strategy (214.6%)

Every trade alert sent by Stock Market Guides is backed by this level of backtested research.

The team ran hundreds of thousands of simulations to build a rules-based trading system, identifying the stock and pattern combinations with the highest historical win rates and returns.

Whenever one of those setups appears in real-time, the system sends an alert.

Of course, historical price action isn't a perfect predictor of future movement. But stocks often trade in similar patterns, and knowing those patterns ahead of time can be a big advantage.

2. Best for beginners: Mindful Trader

- Overall rating:

- Strategy: Swing trading with calls

- Cost: $47/month or $397/year

Mindful Trader is run by Eric Ferguson, a Stanford graduate who spent years researching and analyzing stock price tendencies.

He took those results and built a trading system that he uses daily. Whenever he takes a new trade, he posts it on his website and sends an alert to subscribers.

Eric swing trades simple call options, a very beginner-friendly way of trading. He usually sends 1-3 trade alerts per day (though it's not uncommon for him not to send any). Each of the trade alerts is clear and easy to follow.

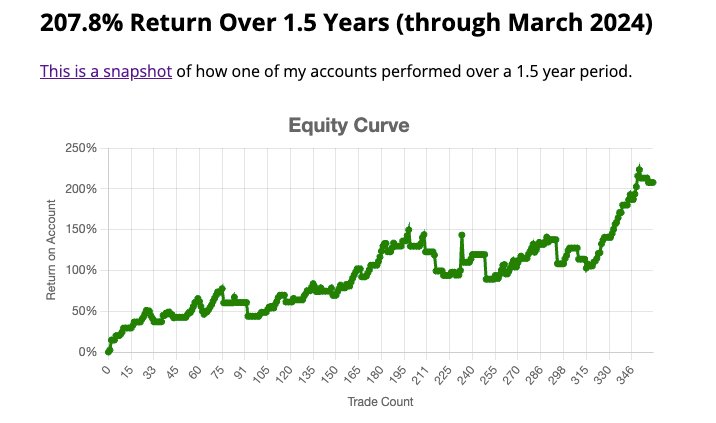

As far as returns go, one particularly good 18-month stretch led to returns of over 200%:

Like other swing trading services, Mindful Trader's win rate is just above 50%. But, because its average win is larger than its average loss, the service can be quite profitable.

Eric is transparent about his results and doesn't make false promises. He also genuinely cares about his members, which isn't the case for many services in this space.

Altogether, Mindful Trader is an excellent alert service for beginner options traders.

3. Best for large accounts: Delta Options

- Overall rating:

- Strategy: Momentum trading

- Cost: $119/month or $949/year

Delta Options is a momentum-based options picking service that takes a unique approach.

The team follows a typical momentum strategy by finding stocks that are outperforming their industries and seeing if their stock price increases are justified by improving fundamentals.

But unlike typical momentum services — which simply buy stocks — Delta Options buys deep-in-the-money call options on these stocks.

Each option has an expiration date at least one year in the future. These contracts simulate owning regular shares but require significantly less capital.

For example, AAPL is trading at $210 per share at the time of this writing, while the $180 call expiring January 15, 2027, is trading for $59.30.

With a delta of 0.85, buying this call is similar to owning 85 shares of Apple, which would cost $17,850 if you were to buy its stock. The call option costs just $5,930.

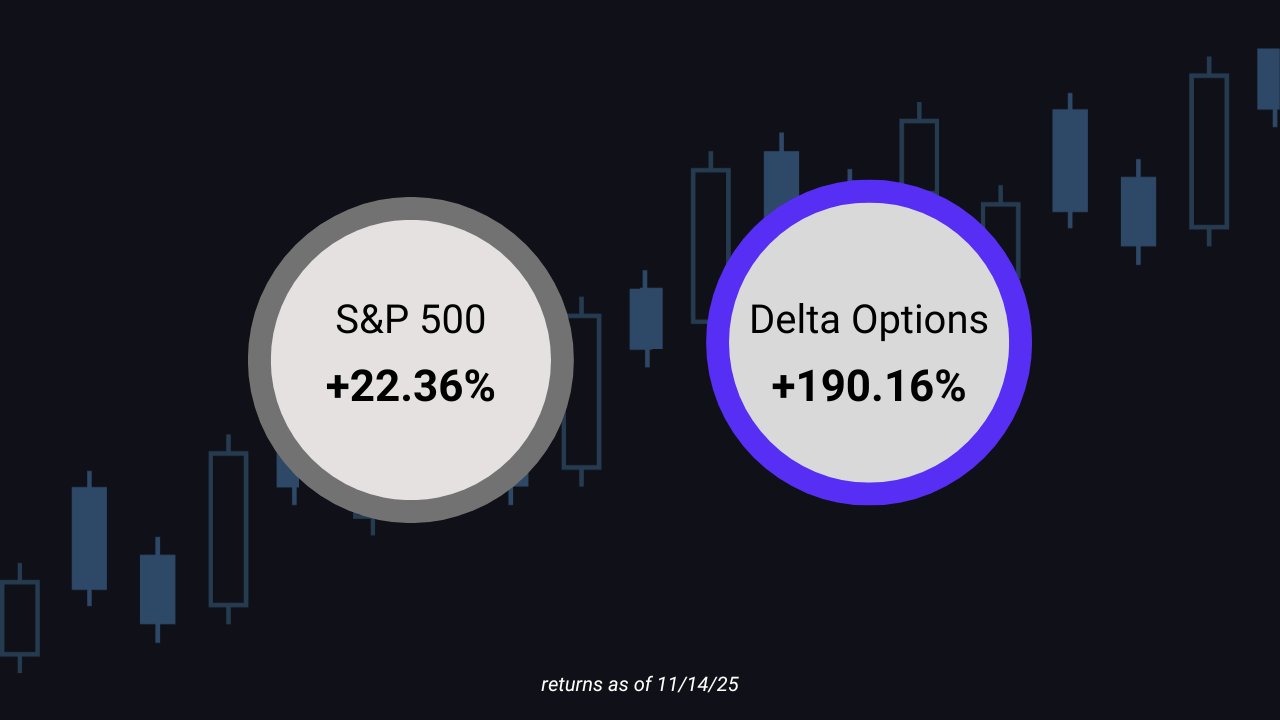

The built-in leverage of options can increase the returns, assuming the right stocks are selected. The website boasts returns of over 8x the S&P 500 since the service's inception:

On the flip side, the built-in leverage can also create quite a bit of volatility. Plus, most of the call options the team buys are between $1,000–$2,000 per contract, meaning this is not a strategy for small accounts.

Delta Options sends two new trade alerts per month. The team typically holds positions for 1–3 years, depending on how the underlying stock is performing relative to its peer group.

4. Best for simple options selling: Motley Fool Options

- Overall rating:

- Strategy: Selling OTM puts

- Cost: $1,999/year (via Epic Plus)

Motley Fool Options — which is available through its Epic Plus subscription level — has one simple strategy: it sells out-of-the-money put options.

This is a high-probability trading strategy, which allows traders to regularly generate extra income. Of note, 86% of its trades make money. The service sends 2–3 new trade alerts per month.

However, because Motley Fool Options is only available through The Motley Fool's Epic Plus, the service is quite expensive. It costs $1,999 per year ($1,399 for new members' first year).

That said, the service also comes with several other products, including Stock Advisor and Rule Breakers — two of The Motley Fool's most popular services.

In all, Epic Plus subscribers get nine new trade alerts per month, spread across stocks and options picks.

If you're also in the market for a stock recommendation service, Epic Plus might be exactly what you're looking for.

5. Best for fast-moving swing trades: The Trading Analyst

- Overall rating:

- Strategy: Swing trading

- Cost: $147/month or $787/year

The Trading Analyst is a swing trading service that focuses on breakout trades.

A breakout trade is one where a stock that has been trading in a narrow range suddenly breaks out from that range on heavy trading volume.

According to their site, this strategy has a modest win rate of 52.7%, but its average win of $4,324 is much larger than its average loss of $2,603.*

This disproportionate profit factor has led its model portfolio to increase from $100,000 to $771,000 since July 2018.

*This isn't uncommon. Most successful trading strategies only win slightly more than 50% of the time, but have something like a 3:1 profit-to-loss ratio. If you can't handle frequent losses, trading may not be for you.

The service sends 2–5 alerts per week via email, text, or Telegram Messenger, making it one of the most active on this list.

6. Best for high-leverage, long-term trades: The Speculator

- Overall rating:

- Strategy: Buying LEAPs

- Cost: $3,000/year

If you're an aggressive investor and are looking for options alerts with a lot of upside, The Speculator may be the service for you.

The Speculator is run by Eric Fry, a fairly well-known stock picker. In this service, Fry tries to identify stocks with a lot of upside and buy them using options.

A LEAPs option is an options contract with an expiration date more than one year in the future. By buying out-of-the-money LEAPs, Fry can make small bets that could result in large payoffs.

Subscribers should expect a win rate of less than 50%, but winning trades should more than offset the smaller losing trades.

The downside? It's expensive.

Fry makes between two and four new alerts per month, meaning the cost of the service is around $83 per pick. And since most of the recommended options contracts are quite expensive, it's not a good option for small accounts.

7. Best for very active, advanced options traders: Market Chameleon

- Overall rating:

- Strategy: Many different options strategies to choose from

- Cost: $99/month

Market Chameleon isn't an alert service — it's a platform for analyzing options trades.

Note: Stock Market Guides recently released its scanner technology that powers its trade alerts, so its members can also take a more hands-on approach.

The reason it's still on this list is that the software generates a ton of trade ideas, and you can set it to notify you of trades to take based on your custom criteria. It's a bit more hands-on, but the end result is the same as an alert service.

Its screener allows you to find trade ideas by stock or by strategy. You can also add stocks or strategies to your watchlist and receive alerts when it finds trades matching your criteria.

The main benefit of using Market Chameleon over a traditional options picking service is that you can develop your own trading style and strategies, which you can use to generate hundreds of trade ideas per year.

How we chose the best options alert services

When evaluating investing products and services, we take the following into consideration:

- Credibility: Track record, quality of advice, and brand reputation.

- Profitability: How profitable are the alerts? How much money will a new member make in their first year and beyond?

- Audience: Who the product is for, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Usability: How easy is the service to follow? Are the trade alerts simple to read and implement?

- Cost: Overall price, value for money, average cost per month, and how that compares to competitors.

You may also be interested in our article on the best day trading computer setup.

Final verdict

The right options trading service for you is the one that fits your investment style and consistently makes profitable trades.

That said, it's hard to know for sure whether a service is a good fit for you without getting firsthand experience.

Hopefully, this list gives you a good jumping off point, but you're best bet for finding a service you like is by trying one for yourself.