The 6 Best Options Trading Alert Services in 2024

There are hundreds of options alert services to choose from.

These services, typically operated by experienced industry professionals, notify you about option trading opportunities via a newsletter or app.

However, this information doesn't come cheap, and you don't want to waste money on services that aren't a good fit for your investment style and goals.

Fortunately, it's really easy to determine which services are good and which aren't — you just need to know if their trades are consistently profitable.

From there, you can narrow the profitable services down further by finding one that matches your investing style and budget.

With those things in mind, here's my list of the best options picking services in 2024.

Summary view

- Best overall: Stock Market Guides

- Best for swing trading: The Trading Analyst

- Best for small accounts: Benzinga Options

- Best for simple options selling: Motley Fool Options

- Best for high-upside trades: The Speculator

- Best for experienced traders: Market Chameleon

I cover the costs, strategies, and what to expect from each of these services in more detail below.

Disclaimer: Ratings are my opinion. Actual results may vary, and past performance does not guarantee future results. All investors should do their own due diligence.

1. Best overall: Stock Market Guides

- Overall rating:

- Strategy: Buying calls for swing and longer-term trades

- Cost: $69/month

Stock Market Guides does two things really well, earning it the top spot on this list.

First, it sends frequent and easily implementable trade alerts. The format of each alert is simple and easy to understand for anyone who's new to options trading — it's just strike price, expiration date, and how long you can expect to hold the trade.

You'll receive between 1–3 of these trade alerts most days, and you can choose to get these alerts by email or text.

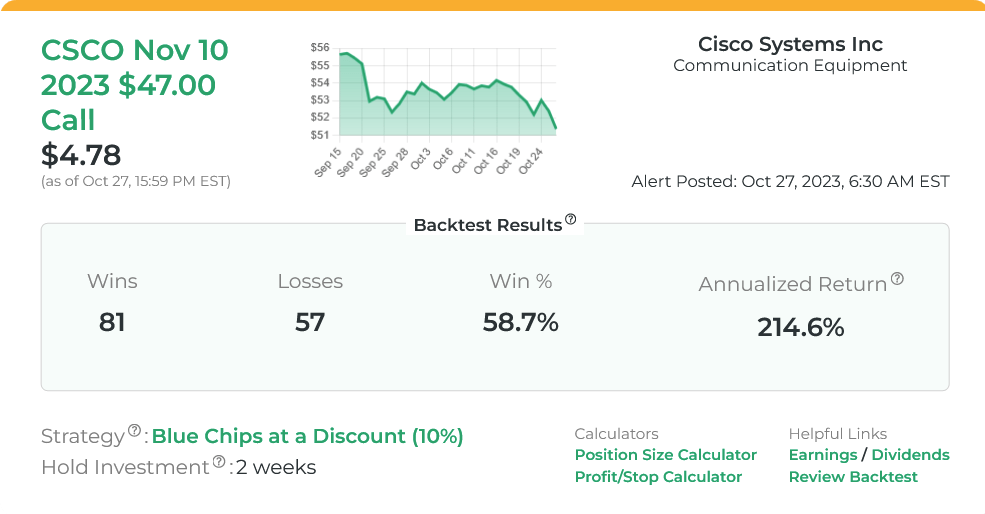

For the second thing that makes it stand out, take a close look at the trade alert below:

In the image above, you can see the strategy being used — Blue Chips at a Discount — and the estimated holding period — two weeks. It also shows the expected win rate of 58.7% and how profitable this strategy is on an annualized basis, at 214.6%.

The strategies used by the Stock Market Guides team to find new trade ideas were developed with seven years of backtested data. Not only do they use this data to develop their trading system, but they also implement it into their trade alerts.

All of these figures are from when that stock exhibited similar price behavior in the past. Historical price action isn't a perfect predictor of future movement, but it sometimes behaves similarly.

2. Best for swing trading: The Trading Analyst

- Overall rating:

- Strategy: Swing trading

- Cost: $147/month or $787/year

The Trading Analyst is a swing trading service that focuses on breakout trades.

Their methodology includes finding stocks that have been trading in a consolidated range and then break out from that range on heavy trading volume.

According to their site, this strategy has a relatively low win rate of 52.7%, but its average win of $4,324 is much larger than its average loss of $2,603.

This disproportionate profit factor has led its model portfolio to increase from $100,000 to $771,000 since July 2018.

Given their win rate of ~53%, you should expect to lose money frequently. If you can't handle losses, you should choose another service with a different strategy.

If you can stomach the frequent losses, this is an easy service to follow.

The service sends just 2–5 alerts per week via email, text, or Telegram Messenger, allowing you to easily take most trades they post without missing any.

3. Best for small accounts: Benzinga Options

- Overall rating:

- Strategy: Buys and sells individual contracts and spreads

- Cost: $297/year

Benzinga Options is run by Nic Chahine, a highly profitable trader who's been trading options for over 10 years.

Every trade is one Chahine is taking with his own money. He buys and sells both calls and puts, which may be single- or multi-leg trades. He explains his rationale for taking each trade and will educate you on why he's using each particular strategy.

Chahine only takes very high-probability trades — the service boasts a 91% win rate. The majority of his trades involve selling options, mostly puts and credit spreads.

It's also slow-moving. There are only 2–3 new trades per month.

The service's low cost, high win rate, and slant toward providing education makes it an excellent choice for new options traders and those with small accounts.

4. Best for simple options selling: Motley Fool Options

- Overall rating:

- Strategy: Selling OTM puts

- Cost: $999/year

Motley Fool Options also has a very high win rate of 86%.

Its strategy is even simpler than Chahine's — it only sells out-of-the-money put options. Since most options expire worthless, members regularly pocket cash.

It also sends 2–3 new trade alerts per month.

The service is more than 3x the cost of Benzinga's, though. This cost is prohibitive for smaller accounts, as the cost per alert eats into the profits from each trade, so it's better for those with larger account balances.

It's also been around for a lot longer than most of the other services on this list. Motley Fool Options was launched in 2009.

5. Best for high-upside trades: The Speculator

- Overall rating:

- Strategy: Buying LEAPs

- Cost: $1,499/year

If you're an aggressive investor and are looking for options alerts with a lot of upside, The Speculator may be the service for you.

The Speculator is run by Eric Fry, a fairly well-known stock-picker. In this service, Fry tries to identify stocks with a lot of upside and buy them using options.

A LEAPs option is an options contract with an expiration date more than one year in the future. By buying out-of-the-money LEAPs, Fry can make small bets that could result in large payoffs.

Subscribers should expect a win rate of less than 50%, but winning trades should more than offset the smaller losing trades.

Fry makes between 2–4 new alerts per month, meaning the cost could be as high as $62 per pick. It's likely not a good option for small accounts.

6. Best for experienced traders: Market Chameleon

- Overall rating:

- Strategy: Many different options strategies to choose from

- Cost: $828/year

Market Chameleon isn't an alert service; it's a platform for analyzing options trades.

The reason it's still on this list is because the software generates a ton of trade ideas, and you can set it to notify you of trades to take based on your custom criteria. It's a bit more hands-on, but the end result is the same as an alert service.

Its screener allows you to find trade ideas by stock or by strategy. You can also add stocks or strategies to your watchlist and receive alerts when it finds trades matching your criteria.

The main benefit of using Market Chameleon over a traditional options picking service is that you can develop your own trading style and strategies, which you can use to generate hundreds of trade ideas per year.

How we chose the best alert services

When evaluating investing products and services, we take the following into consideration:

- Core offering: How profitable are the alerts? How much money will a new member make in their first year and beyond?

- Price/fees: Overall price, value for money, average cost per month, and how that compares to competitors.

- Usability: How easy is the service to follow? Are the trade alerts simple to read and implement?

- Credibility: Track record, quality of advice, and brand reputation.

- Audience: Who the product is for, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

The right options trading service for you is the one that fits your investment style and consistently makes profitable trades.

One of the biggest benefits of these types of services is that you will pick up on how these services trade and what types of setups they're looking for.

That way, if you ever decide to trade options on your own, you'll have a solid foundation of strategies to choose from.