Percent Review: Is Private Credit Investing Right for You?

Income-seeking investors have traditionally turned to bonds and dividend stocks for steady cash flow.

But these days, it's tough to find high-quality bonds yielding over 6%, or dividend-paying stocks with more than 4% yields. Even junk bonds aren't paying much more.

That's why many investors are looking beyond traditional income sources.

Enter: private credit — a $3.1 trillion market known for offering high yields, short-term durations, and relatively low default rates.

Private credit has long been a favorite among institutions like pension funds and endowments. And now, platforms like Percent are making it possible for individual accredited investors to access this once-exclusive asset class.

In this review, we'll break down how Percent works, what makes it unique, and what to consider before investing in private credit.

Percent review summary

- Overall rating:

- Asset type: Private credit

- Best for: Yield-focused, accredited investors

- Average return: 14.47% (on matured deals, as of September 2025)

- Average deal duration: 16.6 months (as of September 2025)

Percent is a secure, easy-to-use platform that specializes in private credit investments. It has low minimum investments and fees, plus a wide range of available deals.

As you'll read later on, investing in private credit involves a certain level of risk, so it's extremely important for private credit investors to build a well-diversified portfolio.

And for that, there's no better platform than Percent.

For these reasons, Percent is a great option for accredited investors looking to generate double-digit returns and consistent income via private credit.

What is private credit investing?

Private credit is an alternative asset class consisting of privately negotiated loans and debt financing from non-bank lenders.

Many private companies, which don't have access to public markets, must turn to private credit markets to finance their operations and growth.

Most private credit borrowers are "middle market companies" — businesses with annual profits ranging from $25 million to $75 million. This makes them too big to borrow from traditional banks.

Since their financing is harder to come by, private credit deals typically offer favorable terms, including:

- Higher yields: Matured deals on Percent have averaged a 14.47% annualized return. Current offerings are even higher, with an average weighted APY of 16.72%.

- Shorter durations: Most deals range from 10 to 20 months, giving you flexibility to reinvest or adjust your portfolio more frequently.

- Stability: Private credit has historically been less volatile than public markets. Adding it to your portfolio can provide a buffer during periods of stock and bond market turbulence.

- Diversification: Private credit offers a new source of uncorrelated returns. With Percent, you can diversify across deal types like corporate loans, asset-based lending, litigation financing, merchant cash advances, and more.

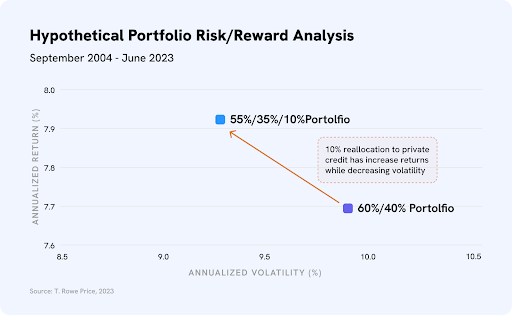

Because of these characteristics, research has shown that allocating 10% a portfolio to private credit has historically reduced volatility while raising annualized returns:

Source: Percent

For these reasons, private credit has become an extremely popular asset class among institutional investors and is now a $3.14 trillion market.

And now, accredited investors can also invest in private credit through certain investment platforms, like Percent.

What is Percent?

Percent (formerly known as Cadence) is an alternative investment platform that gives accredited investors access to the multi-trillion-dollar private credit market.

Since being founded in 2018, Percent has funded more than $1.68 billion in private credit deals.

Importantly, Percent offers one of the widest selections of private credit deals, making it easy for investors to own highly diversified portfolios of deals, tailored to their individual risk tolerance.

Key figures

All figures are as of September 2025:

- Amount invested: $1.68 billion

- Deals funded: 917

- Average return: 14.47% annualized interest rate (APY) on matured deals

- Average investment term: 16.6 months

- Default rate: 3.00%

- Minimum investment: $500

- Investor fees: Varies, ~1-2%

- Retention: Over 89% of investors re-invest after their first deal

- Welcome bonus: Up to $500

What are Percent's investment offerings?

There are four main sub-asset classes to invest in on Percent: asset-based securities, corporate loans, limited partner investing, and blended notes.

1. Asset-based securities

- Best for: Downside protection (collateralized risk)

Asset-based securities (aka asset-based finance or asset-based lending) are short-term notes in which repayment comes from cash flows generated by a particular asset that also serves as direct collateral.

For example, a loan to a construction company might be secured by a specific piece of equipment, with repayments coming from the income it generates.

Other examples include financing for a fleet of rental cars backed by rental revenue, or loans to small businesses secured by their receivables or inventory.

Percent also offers consumer loans and advances such as residential mortgages, personal loans, installment loans, student loans, payday loans, litigation finance, and other types of consumer debt.*

*However, Percent typically offers consumer debt investments as entire loan portfolios rather than individual loans.

Because of their short durations, high risk-adjusted returns, and variety of offerings, asset-based securities are extremely popular on Percent. More than 80% of Percent's deals fall into this category.

2. Corporate loans

- Best for: Most common private credit offering

The next most common form of deal on Percent is corporate loans, which come in the form of cash-flow lending or venture debt.

In cash-flow lending, well-established businesses with predictable cash flows borrow money to help expand operations, replenish inventory, or take on new projects.

These are typical loans, but the companies are too large to qualify for traditional bank financing, so they turn to the private credit market instead.*

*This is the most common form of private credit investment.

Venture debt, on the other hand, is a special type of debt financing taken out by venture-backed companies to bridge the gap between funding rounds or other liquidity events (like an IPO).

This allows companies to maintain liquidity without needing to dilute existing shareholders.

3. Limited Partner investing

- Best for: Professional management

Percent also offers Limited Partner investing, which allows you to participate in a managed private fund set up and managed by a General Partner (GP, the fund manager).

Each fund has its own investing strategy and invests in a basket of assets that meet that strategy.

As an investor, this is a passive investment with specific expected returns that generally yield income and/or periodic distributions.

The minimum investment is typically between $50,000 and $100,000.

4. Percent Blended Notes

- Best for: Instant diversification

Instead of constructing your own portfolio of private credit deals, you can invest in Percent Blended Notes (PBNs), which provide diversified exposure across multiple sub-asset classes in one investment.

Each PBN has its own set of criteria and allocation rules that determine which deals from Percent's marketplace are selected.

This allows you to invest in a basket of investments that meet your selection criteria without needing to evaluate each deal individually.

Plus, PBNs automatically reinvest capital into newly available deals, so you don't need to think about reinvesting your proceeds.

Percent's PBNs target annual returns between 10–16% net of fees with durations of 1–3 years.

5. Separately Managed Accounts (SMAs)

- Best for: Further personalization

For high-net-worth investors, Percent also offers Separately Managed Accounts (SMAs).

These accounts are tailored portfolios of private credit deals managed by Percent's team.

Investors with $50,000–$250,000 can choose between three Model Portfolios: Conservative, Moderate, and Aggressive. Investors with more than $250,000 can be assigned a dedicated account manager to build a more customized portfolio.

SMA clients also get access to select private deals and priority to oversubscribed deals.

The importance of diversification

Before going further, it's important to highlight just how critical diversification is in private credit.

Even with a relatively low default rate of 3%, that still means around 1 in every 33 deals will miss a payment.* And while most defaults don't lead to total losses, some do.

*A deal is considered “in default” if it fails to make a full payment within 5 business days of its due date.

Private credit carries unique risks tied to individual borrowers, industries, and asset types. If you're only in a few deals, a single default can have a meaningful impact on your portfolio.

That's why spreading your capital across a wide range of deals is essential. It reduces the impact of any one issuer and helps smooth returns over time.

Percent makes diversification really easy:

- High deal volume: It has more offerings than any other private credit platform, so you're not stuck with limited options.

- Low investment minimums: Minimums start as low as $500, allowing you to diversify broadly without overcommitting.

- Easy diversification opportunities: Percent Blended Notes (PBNs) let you invest in pre-built baskets of private credit deals, giving you instant diversification.

- Transparent data and proactive communication: Percent gives you detailed issuer performance data, including on-time payment history. They also alert investors of any delayed payments and provide ongoing updates on how the situation is being managed.

If you're serious about investing in private credit, diversification isn't optional. And when it comes to building a diversified portfolio, Percent stands out.

Who can invest with Percent?

Only 1) U.S. citizens with 2) U.S. bank accounts who 3) qualify as accredited investors can invest in private credit on Percent's marketplace.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

- You are a qualifying financial professional

There are no tests or certifications required to become an accredited investor — you just need to meet one of the three criteria listed above.

After creating an account, Percent's customer support team will verify your status as an accredited investor.

What are the fees on Percent?

Percent charges variable fees depending on the investment product.

- Single note offerings: Percent charges no management fees, but it does charge a percentage of the yield (typically 10%). For example, if a deal paid 15% interest and the fee was 10% of the yield, your effective return would be 13.5%.

- Blended Notes and other managed products: Percent charges a 1% management fee plus a percentage of the yield (typically 10%). So, if a blended note paid 15% interest and the fee was 10% of the yield, your effective return would be 12.5%.

These fees are slightly below industry standards, and Percent is also more transparent than other platforms regarding how they charge fees.

Is Percent legit and safe?

Yes, Percent is legit.

Here are a few factors that confirm its legitimacy:

- Regulatory compliance: The company operates in compliance with all SEC and other applicable financial regulations.

- Track record: Since being founded in 2018, the company has funded more than $1.68 billion in private credit deals and has paid out $95+ million in interest. To date, the average annualized interest rate on matured deals is over 14% and the default rate is 3%.

- Due diligence: Each deal listed on Percent must first pass its team's strict due diligence process, which ensures originators meet strict requirements and have substantial industry experience.

- Transparency: Each investment provides all the relevant information about the borrower, past deal performance, and any applicable fees.

- User experience: Percent has received numerous positive reviews touting its wide selection of investments, transparency, and customer service. And 89% of Percent's investors have invested in more than one deal.

- Security: Percent uses bank-level encryption to protect your information and complies with all the relevant financial regulations. Your funds are not mixed with other investors' money until the investment is fully subscribed and ready to be distributed. Additionally, each account is FDIC insured up to $250,000.

While all investments carry a degree of risk, Percent has prioritized creating a secure, reliable platform for curated private credit investment opportunities.

Nevertheless, you should perform your own due diligence and be sure private credit is a fit for your portfolio based on your risk tolerance and financial goals.

How does Percent compare to Willow Wealth?

Only two platforms have made private credit available to individual investors: Percent and Willow Wealth (formerly Yieldstreet).

While Percent is focused solely on private credit, Willow Wealth offers it as one of ten asset classes available.*

*Willow Wealth is the biggest player in alternative investing and ranks first on my list of the best alternative investment platforms.

Here's a breakdown of Willow Wealth vs Percent:

| Percent | Willow Wealth | |

| Asset classes | Private credit | Private credit, real estate, art, venture capital, and 7 others |

| Amount invested | $1.68+ billion | $6+ billion |

| Average returns | ~14% | ~9% |

| Minimum investment | $500 | $10,000 |

| Accreditation requirement | Accredited only | Primarily accredited |

| Sign up links | Learn more | Learn more |

If you're solely interested in private credit, Percent has a wider selection and slightly lower fees.

If you want access to the many different types of alternative assets, then Willow Wealth may be a better option.

Additionally, if you're not an accredited investor, Willow Wealth's Alternative Income Fund is one of the easiest ways to invest in a diversified set of alternative assets.

Percent pro and con summary

| Pros | Cons |

| Large selection of private credit investments | Only available to accredited investors |

| High average historical returns ( >14%) | Only available to U.S. investors |

| Short-term durations | |

| Diversification outside of public markets | |

| Low, transparent fees | |

| Low minimum investment ($500) | |

| Welcome bonus of up to $500 |

Final verdict

If you want to gain access to the world of private credit investing, Percent is one of your best options.

Its low minimums, transparent fees, and easy-to-use marketplace make it easy to invest in your first private credit deal and start generating income.

Plus, its deal approval team, security, and credit protections have resulted in very low default rates.

If you're an accredited investor looking for high yields and diversification outside of public markets, Percent should be near the top of your list.

.png)