Percent Review: Is Private Credit Investing Right for You?

Bonds, dividends, and real estate aren't the only assets that generate income — private credit is also an option.

Private credit is a $1.9 trillion market that is best known for its rare combination of high yields, short-term durations, and low default rates. These three characteristics make it a favorite investment for many institutional investors.

And now, thanks to the SEC changing some of its regulations, Percent has made it possible for individual investors to invest in private credit.

Keep reading to learn more about Percent and what you need to know before investing with them.

Percent Review Summary

- Overall rating:

- Asset type: Private credit

- Best for: Yield-focused, accredited investors

- Average return: 13.17% (on matured deals, as of Nov. 30, 2023)

Private credit investing offers high yields with short durations and provides diversification compared to typical stock and bond investments.

Percent is an easy-to-use and secure platform that specializes in private credit deals. It has low minimum investments, low fees and a wide range of available deals.

These factors make Percent a great option for accredited investors looking to generate income via private credit.

What is private credit investing?

Private credit is an alternative asset class consisting of privately negotiated loans and debt financing from non-bank lenders.

Private companies, which don't have access to public markets, must turn to private credit markets to finance their operations and growth. Borrowers include small businesses, startups, and others.

Most private credit investments are secured by an asset such as a loan portfolio, a business, trade receivables, or assets with other cash flows or value associated.

These investments are largely uncorrelated with public stock and bond markets, and also offer higher yields and shorter durations than most debt investments.

Put simply, investing in private credit allows you to lend money to small and medium-sized businesses, usually with a relatively high interest rate.

Percent is a company that connects the lenders (you) and borrowers, and handles all of the legal details and complexities involved. More on that next.

What is Percent?

Percent (formerly known as Cadence) was founded in 2018.

It is an alternative investment platform that gives accredited investors access to private credit, a $1.9 trillion market.

The company connects underwriters, borrowers, and investors for transacting a variety of private credit investments.

Historically, private credit was reserved for institutional-level investors and hedge funds.

However, due to updated SEC regulations, Percent was able to pave the way for individual investors to fund short-term loans with high average interest rates and relatively low default rates, all with just $500 in minimum investment.

Thanks to Percent, yield-focused investors now have access to debt investments outside the highly competitive and increasingly volatile public bond market.

Key figures

All figures are as of November 30, 2023:

- Amount invested: $936 million

- Deals funded: 495

- Average return: 13.17% annualized interest rate (APY) on matured deals

- Average investment term: 9 months

- Default rate: 1.75%

- Minimum investment: $500

- Investor fees: Varies, ~2%

- Retention: 89% of Percent customers choose to invest again after their first deal

- Welcome bonus: Up to $500

Investment offerings on Percent

There are three main sub-asset classes to invest in on Percent: asset-based securities, corporate loans, and limited partner investing.

Below is information on each, plus an example offering on Percent.

1. Asset-based securities

These are short-term bonds, or “notes,” in which repayment comes from cash flows generated by a particular asset that also serves as direct collateral.

This collateral can come in the form of a portfolio of underlying loans, receivables, advances, or contracts with future cash flows associated with them.

The main asset-based securities on Percent are:

- Small- and medium-sized business financing: Loans, merchant advances, leases, and discounted receivables

- Consumer loans: Residential mortgages, personal loans, installment loans, credit cards, etc.

- Consumer advances: Payday advances, litigation finance, etc.

Instead of buying individual notes, you can invest in Percent's Blended Notes, which give you exposure to multiple notes across different asset classes, geographies, and more, all in a single investment.

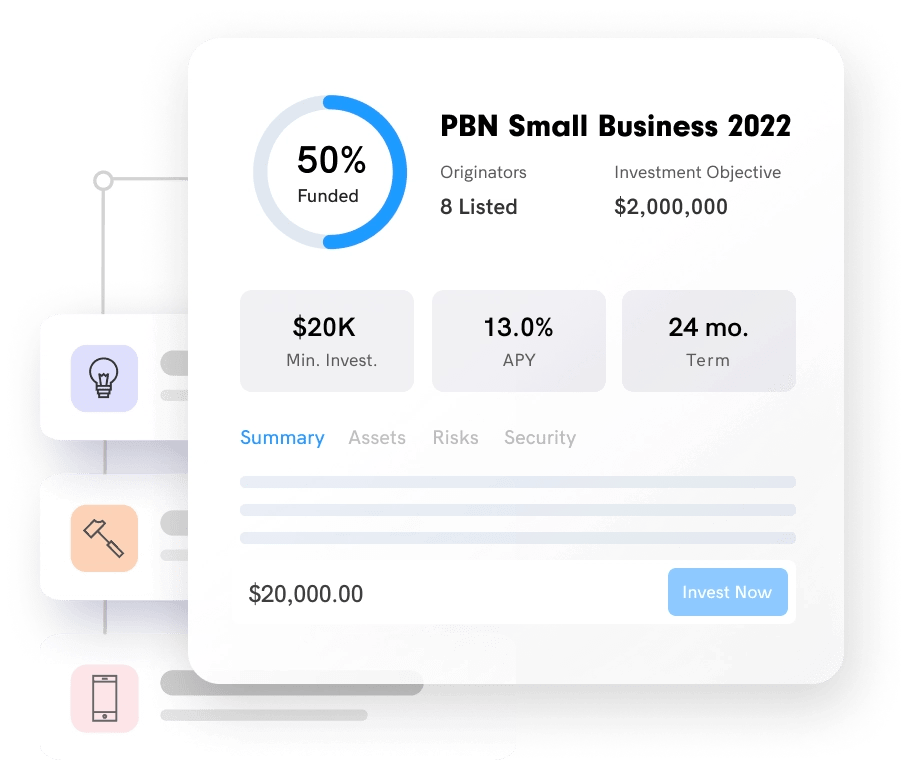

A Blended Note offering on Percent

2. Corporate loans

These are debt securities that high-growth companies use to fund operations and expansion or to bridge the gap between funding rounds.

3. Limited Partner investing

Percent also offers Limited Partner (LP) investing, which allows you to participate in a managed private fund — composed of a variety of private assets — set up by a manager.

Each fund has its own investing strategy.

As an investor, this is a passive investment that generally yields income and/or periodic distributions, with specific expected returns outlined by the managers.

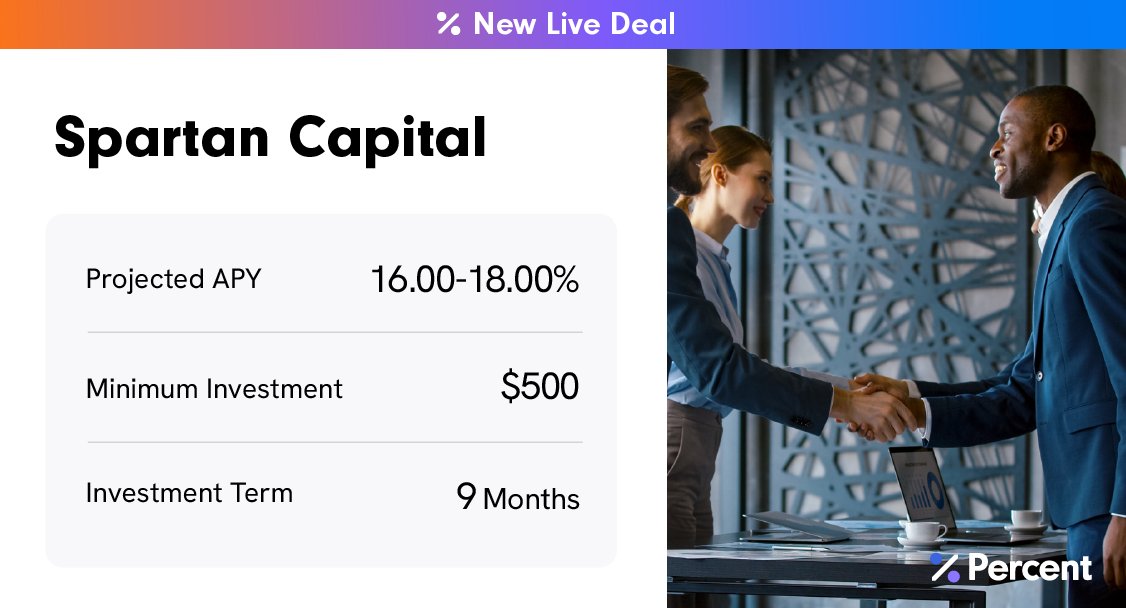

Example investment

Here's an investment currently being offered on Percent:

- Borrower: Spartan Capital

- Expected return (APY): 16–18%

- Minimum investment: $500

- Loan duration: 9 months

About the investment: Spartan Capital provides revenue-based financing that is specifically tailored to meet the needs of small- and medium-sized businesses.

In this deal, you (as a lender on Percent) are loaning money to Spartan Capital (the originator), which will be lending that money to several businesses (the borrowers) that need loans to fulfill orders, make payroll, or buy equipment.

Is private credit investing right for you?

Private credit is a $1.9 trillion market and is extremely popular among institutional investors.

Because the capital is harder to come by, borrowers offer favorable terms for the lenders to secure funding. These terms typically include:

- Higher yields: Matured deals on Percent have had an average annualized interest rate of 13.06%, though current deals are averaging 18.72%.

- Shorter durations: The average term length on Percent is 9 months. These term lengths allow you to regularly re-assess and adjust your portfolio based on market conditions and your personal goals.

- Stability: Private credit deals are not subject to the same level of volatility as public markets. Private credit is less liquid, has short-term durations, and is primarily owned by savvy investors, so it is less likely to experience the large swings in price that are commonplace in the stock and bond markets.

- Diversification: Many deals are also backed by assets, loan portfolios, or other corporate debt.

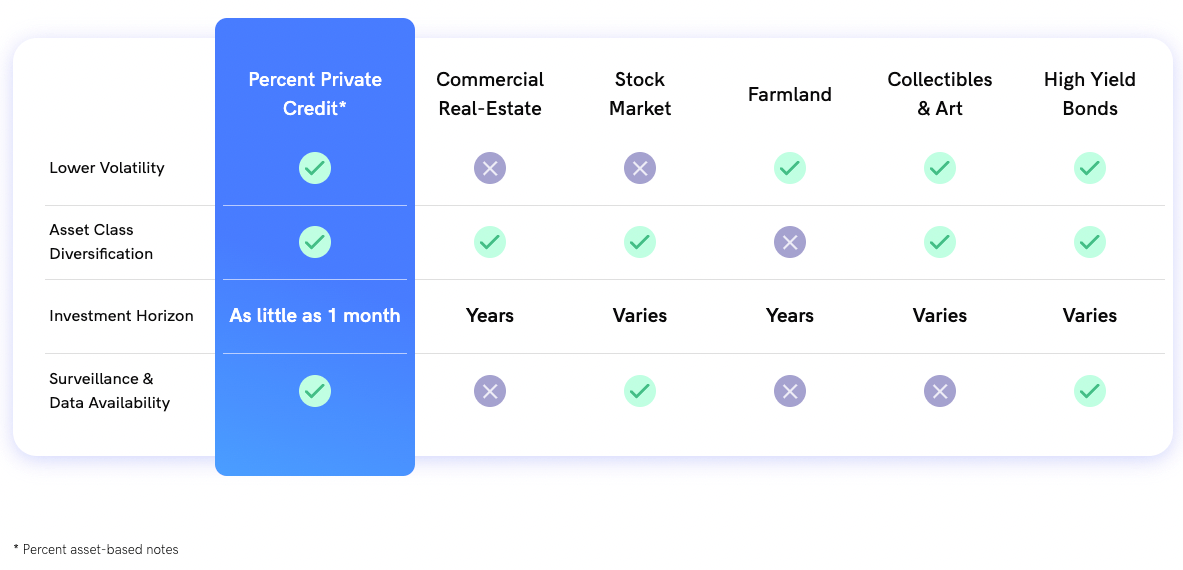

Furthermore, here's how private credit stacks up against other asset classes:

Source: Percent

What are the risks of investing in private credit?

Like any investment, there are downsides and risks to investing in private credit.

Here are a few risks to consider before making an investment:

- Credit risk: This is the risk of the borrower defaulting on its obligation to repay the loan. Credit risk exists in any debt investment. Default rates on Percent have averaged 1.81% historically, but could change in the future.

- Liquidity risk: Unlike stocks and bonds, investments on Percent are illiquid and cannot be sold before the maturity date.

- Platform risk: While Percent has a strong track record and complies with all financial regulations, there is still risk involved when investing on the platform. Despite being FDIC-insured, it could be difficult to recover an investment if the platform goes bankrupt.

- Economic risk: Changes in the economic environment, such as changes in interest rates or a recession, could affect the performance of your investments.

- Diversification risk: If you invest a large portion of your portfolio in a small number of offerings, you may face a higher risk than you would by otherwise spreading your portfolio across a range of offerings and asset classes.

Worth noting, most of these risks are not specific to Private credit investing. They also affect public market stock and bond investments.

However, before investing, you should always do your own due diligence and be sure investing in private credit is right for you given your risk tolerance and financial goals.

Percent pro and con summary

| Pros | Cons |

| Largest selection of private credit investments | Only available to accredited investors |

| High average returns (>13%) | Only available to U.S. investors |

| Short-term durations | |

| Diversification outside of public markets | |

| Low, transparent fees | |

| Low minimum investment ($500) |

You can get a welcome bonus of up to $500 if you buy through any of our links, depending on the size of your initial deposit.

Who can invest on Percent?

Because of SEC regulations, only accredited investors can invest in private credit.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

- You are a qualifying financial professional

There are no tests or certifications required to become an accredited investor — you just need to meet one of the three criteria listed above.

To start investing on Percent, you first need to create an account and then its customer support team will verify your status as an accredited investor.

Additionally, only U.S. citizens with U.S. bank accounts are eligible to invest on Percent.

Percent fees

Percent charges variable fees depending on the investment product.

- Single note offerings: Percent charges no management fees but it does charge a percentage of the yield (typically 10%). For example, if a deal paid 15% interest and the fee was 10% of the yield, your effective return would be 13.5%.

- Blended notes and other managed products: Percent charges a 1% management fee plus a percentage of the yield (typically 10%). For example, if a blended note paid 15% interest and the fee was 10% of the yield, your effective return would be 12.5%.

These fees are in line with or slightly below industry standards, though Percent is more transparent than other platforms regarding how they charge fees.

Is Percent legit and safe?

Yes, Percent is legit.

Here are a few factors that confirm its legitimacy:

- Regulatory compliance: Percent operates in compliance with all SEC and other applicable financial regulations.

- Track record: Since being founded in 2018, the company has funded more than $936 million in private credit deals and has paid out $37 million in interest. To date, the average annualized interest rate on matured deals is over 13% and the default rate is less than 2%.

- Due diligence: Each deal listed on Percent must first pass its team's strict due diligence process, which ensures originators meet strict requirements and have substantial industry experience.

- Transparency: Each investment provides all the relevant information about the borrower, past deal performance, and any applicable fees.

- User experience: Percent has received numerous positive reviews touting its wide selection of investments, transparency, and customer service. And 89% of Percent's investors have invested in more than one deal.

- Security: Percent uses bank-level encryption to protect your information and complies with all the relevant financial regulations. Your funds are not mixed with other investors' money until the investment is fully subscribed and ready to be distributed. Additionally, each account is FDIC insured up to $250,000.

While all investments carry a degree of risk, Percent has prioritized creating a secure, reliable platform filled with quality investment opportunities.

Nevertheless, it's worth mentioning again that you should perform your own due diligence and be sure private credit is a fit for your portfolio based on your risk tolerance and financial goals.

Percent vs. Yieldstreet

Only two platforms have made private credit available to individual investors: Percent and Yieldstreet.

While Percent is focused solely on private credit, Yieldstreet offers it as one of eleven asset classes available. Yieldstreet is the biggest player in alternative investing and ranks first on my list of the best alternative investment platforms.

Here's a breakdown of Yieldstreet vs Percent:

| Percent | Yieldstreet | |

| Asset classes | Private credit | Private credit, real estate, art, venture capital, and 7 others |

| Amount invested | $900+ million | $4 billion |

| Average returns | ~13% | ~9% |

| Minimum investment | $500 | $10,000 |

| Accreditation requirement | Accredited only | Primarily accredited |

| Sign up links | Learn more | Learn more |

If you're solely interested in private credit, Percent has a wider selection and slightly lower fees.

If you want access to the many different types of alternative assets, then Yieldstreet may be a better option. Furthermore, if you're not an accredited investor, the Yieldstreet Prism Fund is one of the easiest ways to invest in a diversified set of alternative assets.

Final verdict

If you want to gain access to the world of private credit investing, there's no better platform than Percent.

Its low minimums, transparent fees, and easy-to-use marketplace make it easy to invest in your first private credit deal and start generating income.

Plus, its deal approval team, security, and credit protections have resulted in very low default rates.

If you're an accredited investor looking for high yields and diversification outside of public markets, Percent should be at the top of your list.

.png)