Public.com Review: Should You Try It?

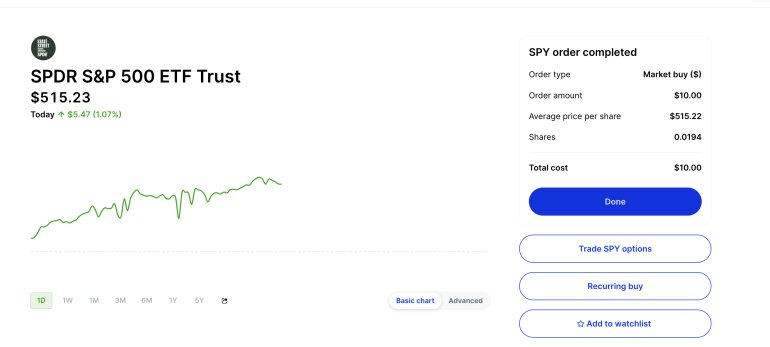

Public.com is a stock brokerage geared toward long-term investors. It has a well-designed website and mobile app.

Its range of available investments, combined with its commission-free trading, transparency, high interest rates on cash balances, and easy-to-use interface, make it a solid brokerage for anybody in their “wealth accumulation” phase.

Public combines much of the sophistication in investment options of legacy brokers like Fidelity, Vanguard, and Schwab with the simplicity in design of new brokers like Robinhood and Webull.

However, it does come with a few limitations.

This is our complete review of Public's pros, cons, plans, fee structure, and more.

Public review summary

- Overall rating:

- Best for: Long-term investors

- Assets: Stocks, ETFs, options, cryptocurrencies, Treasury bills, corporate bonds, and alternative investments

- Fees: $0 commissions (for U.S. stock, ETFs, and options trades)

In my mind, Public most appeals to someone in their “wealth accumulation” phase who is working hard at a job and earning enough money to save and invest.

If that describes you, you're probably most interested in investing in stocks and ETFs, which you can do commission-free on Public.

You may also want to add some risk to your portfolio with options and cryptocurrencies, which you can do from the same account.

Additionally, if you're saving up for a new car, house, or some other large expense, you can take advantage of Public's built-in high-yield savings account (HYSA).

There are no fees, no minimum balance requirements, and unlimited transfers and withdrawals. And right now, Public's HYSA is paying 4.6%.

All of this comes in one of the most user-friendly and well-designed brokerages available.

About Public.com

Public is an investing platform and stock brokerage company headquartered in New York.

The platform was launched in 2019. It was founded by Jannick Malling, Matt Kennedy, Peter Quinn, and Sean Hendelman.

Today, millions of investors (3 million as of 2023, according to Forbes and Inc.) use Public as their go-to investing platform.

On it, you can invest in stocks, ETFs, cryptocurrencies, fixed income, and more. There are no account minimums and no commissions for U.S. stock, ETFs, and option trades.

How does Public make money?

Public makes money from its Premium service, options PFOF, “tips,” and other account fees. These are all covered in more detail below.

Although unessential for the vast majority of investors, Public also offers Premium, an $8-per-month service with enhanced trading features, extra customer support, advanced data, and portfolio management tools.

Accounts with more than $50,000 in assets can get Premium for free.

Public.com's assets, account types, and plans

Below is an overview of Public's available assets, account types, and investment plans.

Assets

Because of its wide range of investment options, Public markets itself as an all-in-one investing platform.

On Public, you can invest in:

- Stocks: Public has over 9,000 U.S.-listed stocks available, including 300 OTC stocks.

- ETFs: Instead of buying many individual stocks to diversify your portfolio, you can invest in a few ETFs that cover specific industries, sectors, or markets.

- Fixed income: You can invest in U.S. government Treasuries and municipal and corporate bonds.

- Options: Plan and execute options trades on Public. For every contract traded, you will earn a rebate of up to $0.18 per contract.

- Cryptocurrencies: Through its partnership with Bakkt Crypto, you can buy, sell, and hold crypto via your Public account. Public currently supports 7 cryptocurrencies, including bitcoin, ethereum, litecoin, and dogecoin.

- Alternative investments: Access collectibles such as rare sneakers, fine art, NFTs, trading cards, and more.*

*A note on alternatives

If you do decide to invest in alternatives, be sure to check how actively liquid they are beforehand, or you may have a hard time finding a buyer when you want to sell. Also, be sure you're comfortable with the fairly high fees charged, which I've outlined in more detail below.

This is one of the most complete asset offerings of any brokerage, and Public is the only brokerage to offer a range of alternative investments and collectibles.

Account types

Unfortunately, Public only offers regular brokerage accounts; it does not offer retirement accounts like traditional or Roth IRAs.

This is, in my opinion, the biggest downside to using Public.

If you want to open one of these types of accounts, I'd recommend Fidelity. You may also be interested in our list of the best brokerage accounts in 2026.

Of note, on Public, you can change your brokerage account from a margin account to a cash account. If you're an active trader, this enables you to avoid the pattern day trader (PDT) rule while having less than $25,000 in your account.

While the lack of retirement accounts can be somewhat inhibiting, Public is continuously innovating and making updates, so this is something that could change in the future.

Investment Plans

With Public's “Investment Plans,” you can invest in pre-built portfolios, which cover a range of investing styles and risk tolerances.

For example, you can invest in a portfolio for moderately conservative investors, different bond strategies, or a portfolio focused on investing in artificial intelligence.

You can also create your own Investment Plan from scratch and include stocks, ETFs, and/or crypto and schedule contributions to invest in your portfolio on a recurring basis.

Public.com pros and cons

Below is a summary of the pros and cons of investing with Public.

| Pros | Cons |

| Wide variety of assets available | Does not provide IRAs |

| Commission-free stocks, ETFs, and options trading | Some alternative investments can be very illiquid |

| No payment for order flow on stocks and ETFs | For U.S. investors only |

| Built-in high-yield savings account | Not built for day traders |

| Simple, well-designed user interface |

Commissions and fees

Public has a unique commission and fee structure based on which assets you're trading and other characteristics of your account.

Here is a breakdown of the fees Public charges.

Stocks and ETFs

These are commission-free. Additionally, unlike most brokerages, Public doesn't participate in payment for order flow (PFOF) on standard equities trades.

PFOF is the practice of market makers paying a small commission (usually fractions of a penny) to brokers for sending trades to them. This allows brokerages to make money while still being “commission-free.”

Since Public does not participate in PFOF, they are able to get the best possible price per trade for their customers.

Options

These are also commission-free. However, Public does generate PFOF on options trades, though it shares up to 50% of the revenue it receives from these with you.

That means, in addition to not paying per-contract fees to Public, you will get a rebate of up to $0.18 per contract traded.

Cryptocurrency

Public charges a 1–2% markup on cryptocurrency transactions.

Treasuries

If you invest in Treasuries, there is also a flat 0.05% per month fee charged on the balance of your Treasury investments.

Alternative investments

Public charges a 2.5% transaction fee on its alternative assets.

The firm that manages Public's alternative investments, Otis Wealth (which is owned by Public), also takes a 0–5% sourcing fee, an annual management fee of 2%, a 10% fee on any profits, and 5% of any cash flow.

If an asset does not generate cash flow, Otis may take a management fee of 2% paid in shares.

These fees are largely in-line with industry standards.

Investment Plans

If you use one of Public's Investment Plans or customize your own, there is a fee for each deposit or withdrawal ranging from $0.49–$1.99.

This fee is waived if you're a Premium subscriber, which you can be for free if your account balance is at least $50,000.

OTC and after-hours trades

These cost $2.99 per trade.

Inactivity fee

Public charges $3.99 every 6 months on accounts 1) with balances less than $70 and 2) no activity in the last 6 months.

Tipping

Instead of generating revenue from PFOF, Public asks for tips on every order. You can disable this feature in your account settings.

Other service fees

- Instant withdrawals: 3.5% ($1 minimum)

- All broker-assisted phone trades: $30

- Domestic wire transfer: $25

- Domestic overnight check: $35

- Returned check, ACH, write, and recall/stop payments: $30

- Outgoing ACAT: $75

- Paper statements: $5

You can see Public's complete fee schedule here.

As mentioned before, this is a unique and somewhat complex fee schedule. It could add up to a significant sum, depending on what you're doing on the platform.

Public's Premium service

As mentioned above, Public offers a paid subscription service called Premium, which costs $96 per year or $8 per month.

Subscribers get fee-free extended hours trading, recurring investment capabilities, detailed performance metrics, Morningstar research, Premium-only content, and VIP account management.

Some other fees, like those charged on Investment Plans, are also waived.

Personally, I wouldn't pay $8 per month for this, but accounts with at least $50,000 invested on the platform automatically get access to Premium for free.

Is Public safe?

Public prides itself on security, transparency, and aligning its incentives with yours.

As a U.S. brokerage and a member of FINRA, Public is highly regulated and is held to the highest security standards.

It protects your account using bank-level encryption (AES 256-bit encryption and TLS 1.2 or newer) and other financial-grade security measures, including two-factor authentication.

And, thanks to SIPC insurance, securities in your account are automatically protected up to $500,000. Furthermore, Public has partnered with 20 banks, which gives its investors combined FDIC insurance coverage of $5 million.

Public is also headquartered in New York and has U.S.-based customer support.

Public's bonus offer

Public is currently offering a bonus to new and existing members who move their assets from one brokerage into Public.

The bonus received is dependent on the transfer amount.

Here's the breakdown of how much you can earn based on the size of your transfer:

| Transfer amount | Bonus amount |

| $5,000–$24,999 | $150 |

| $25,000–$99,999 | $250 |

| $100,000–$249,999 | $600 |

| $250,000–$499,999 | $1,000 |

| $500,000–$999,999 | $2,000 |

| $1,000,000–$4,999,999 | $4,000 |

| Over $5,000,000 | $10,000 |

To earn the bonus, you'll need to enter your name and email with Public, and then link your existing brokerage to Public via Plaid or Mesh.

After linking the two accounts, you'll see a list of your eligible stocks, ETFs, and cash that can be transferred to Public. To see your reward offer, simply select which assets you'd like to transfer.

Your transferred assets must remain on the platform for one year before you'll be eligible to receive your bonus.

How Public.com compares to competitors

I find Public sits somewhere in between Robinhood and Fidelity.

Public is more sophisticated than the more beginner-friendly Robinhood, but has a similarly clean user experience. If you're older, or a more advanced investor, you may prefer a legacy broker such as Fidelity.

Here's my side-by-side comparison of Public, Robinhood, and Fidelity:

| Robinhood | Public.com | Fidelity | |

| Rating | |||

| Best for | New investors | Young to middle-aged, long-term investors | Experienced investors |

| Assets | Stocks, ETFs, options, and cryptocurrencies | Stocks, ETFs, options, fixed income, cryptocurrencies, and collectibles | Stocks, ETFs, mutual funds, options, fixed income, cryptocurrencies, and more |

| Commissions | $0 | $0 | $0 for stocks and ETFs, $0.65 per options contract |

New to investing? Check out my article on how to invest $100k.

Final verdict

If you're still on the fence about Public, I'd recommend just trying it.

Opening an account is easy, and you'll get a better feel for what you like or dislike about the platform once you're inside.

Overall, I find Public is best-suited for long-term investors aged 20–50.

This type of investor is most likely to appreciate the simple design and invest in a wide range of the assets available, without needing or wanting anything more complex.