The Truth About Safe Withdrawal Rates

The safe withdrawal rate is one of the most important — and often most misunderstood — components of retirement planning.

The safe withdrawal rate, or SWR for short, is the amount of money you can withdraw from your portfolio each year without running the risk of depleting your assets.

Investors preparing for retirement can use the SWR to calculate how much money they will need to accumulate before they can retire.

For example, if you want to withdraw $35,000 per year from your portfolio and your SWR is 3.5%, you will need to save $1,000,000 before retiring.

However, while the safe withdrawal rate is a useful concept, it has limitations.

Since your future returns and your retirement length are unknown, it's impossible to calculate your exact SWR. There is no precise answer, like 3.67% or 4.16%.

Instead, the answer to “What is a safe withdrawal rate?” is closer to “Around 4%, probably in the 3–6% range.” (I explain these numbers in more detail below.)

And since failure means running out of money in retirement, most investors choose a conservative SWR that's toward the bottom end of this range — e.g., 3.5%.

That said, the math also shows that the vast majority of retirees should be able to increase their withdrawal rate over time, to 4% or higher.

Here's everything you need to know about safe withdrawal rates and how to determine your own SWR.

Disclaimer: Anything written about the safe withdrawal rate uses past performance to simulate future returns. This is no guarantee of future results.

The 4% Rule

A commonly cited SWR is 4% — this is known as the 4% Rule — which stemmed from a study conducted by William Bengen.

The study concluded that investors could withdraw 4% of their investment portfolios each year (adjusted for inflation) with a ~95% chance of not running out of money.

However, the study made two large assumptions:

- A 30-year retirement: The length of your retirement has a significant impact on the resulting SWR — the longer the retirement period, the lower the SWR (and vice versa). Using a 30-year retirement isn't a problem; you just need to be careful about extrapolating the results onto longer time periods (which has become common practice in early retirement communities).

- Investments in U.S. stocks and bonds: The main problem with this study is that it used a 50/50 stock-bond portfolio that was invested entirely in U.S. markets. Over the period studied, U.S. markets outperformed the global average by a wide margin. If Bengen would have used a globally diversified portfolio, the resulting SWR would have been lower.*

*Another study, which used returns based on a broad sample of developed markets, found the SWR may be closer to 2.26%. However, this study invested in 38 developed markets equally (not weighted based on market capitalization) which may have understated returns and lowered the SWR.

While only using U.S. return data in the study may have caused Bengen to overestimate the safe withdrawal rate, the math also shows that 4% may be an exceptionally safe withdrawal rate.

Here's the math behind safe withdrawal rates and where these numbers come from.

The math behind safe withdrawal rates

The underlying question of the SWR is this: "How confident do you want to be that your money will last?"

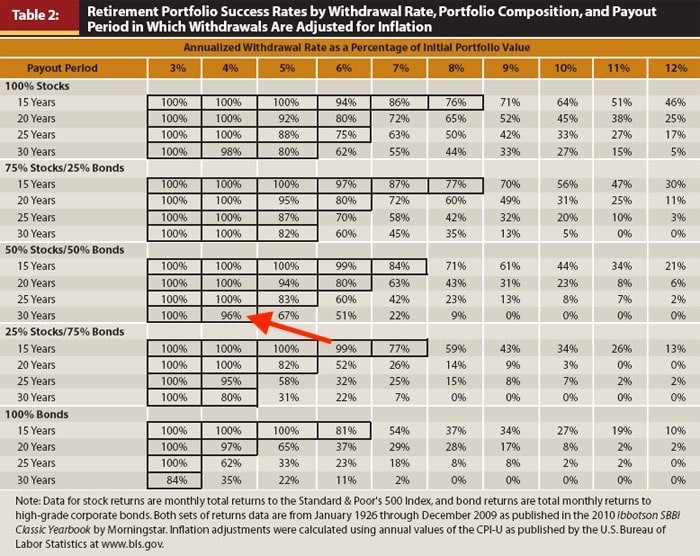

In the now famous Trinity Study, researchers looked at U.S. stock and bond returns over various time periods (15, 20, 25, and 30 years) and various asset allocations (100% bonds to 100% stocks).

They then examined withdrawal rates from 3–12% to determine what percentage of the time the portfolio “survived” — i.e., showed an ending balance of > $0.

Here are the results:

Source: 2010 Ibbotson SBBI Classic Yearbook

This study* found a 30-year portfolio with a 50/50 stock-bond portfolio and a 4% withdrawal rate survived 96% of the time, confirming the research done four years earlier by William Bengen.

*This study also only used U.S. stock and bond data, and suffers from the same problem mentioned above — U.S. markets performed exceptionally well over this period and it may not accurately represent future returns.

But that wasn't all.

Not only did the portfolio survive 96% of the time, but it had a 90% chance of leaving more than 100% of the starting balance. Said another way, a retiree using the 4% rule finished with less than their original portfolio size just 10% of the time.

Furthermore, the portfolio finished the 30-year time horizon with more than double the starting principle nearly 70% of the time. The median wealth at the end — after taking 4% withdrawals adjusted for inflation — was almost 2.8x the starting balance.

In other words, based on this data, it's overwhelmingly more likely that a retiree will be able to increase their spending higher than 4% than it is that they will need to spend a fixed 4% for the duration of their retirement.

If that's the case, why can't the withdrawal rate be higher to begin with? Why does the success rate fall off so dramatically when increasing the withdrawal rate to 6%, 7%, or higher?

The answer: sequence of returns risk.

Sequence of returns risk (SORR)

At the time of the Trinity Study, financial advisors told clients that if their portfolio earned an average of 8% per year, that's also what they could spend without running out of money.

The problem, however, is that this thinking did not address the sequence of returns risk.

The sequence of returns risk (SORR) is when, despite yielding adequate average returns during retirement, a portfolio will run out of money if it generates below-average returns early in retirement.

Withdrawing a large chunk of change at this time can destroy a portfolio and make it impossible to recover when the good market years show up.

Here's an illustration with a $1,000,000 portfolio:

| S&P returns | Withdrawal | Portfolio balance | |

| Year 0 | $1,000,000 | ||

| Year 1 | -25% | -$80,000 | $670,000 |

| Year 2 | -10% | -$80,000 | $523,000 |

| Year 3 | 0% | -$80,000 | $440,000 |

| Year 4 | 35% | -$80,000 | $514,000 |

| Year 5 | 40% | -$80,000 | $639,600 |

Despite an average return of 8% per year and withdrawing 8%, the portfolio has fallen by -36.04% in the first five years of retirement, a completely unsustainable path.

For this reason, SORR is often the largest risk to retirement spending.

Your portfolio needs to survive the first part of retirement, which means starting with a withdrawal rate low enough that your assets are not irreparably depleted if your retirement begins in a string of down years.

How long is the first part of retirement? About 10 years.

The importance of the first decade

In research that looked at the most important factors when it comes to portfolio longevity, it was found that the first 10 years of retirement matter the most.

“It turns out 10 years really is the ‘sweet spot' for sequence of returns risk,” the study describes. “A bad decade at the start of retirement is more predictive than 1-year returns and is also more predictive than 30-year returns.” — Michael Kitces.

So, if the first 10 years of retirement go well, meaning the market generates average or better returns and/or you start with a low withdrawal rate of 3–4%, you'll likely have plenty of money left after you die.

Or, you can increase your spending over time.

If your first decade goes poorly, meaning the market has an extended period of bad performance and/or your withdrawal rate is too high, you may deplete too much of your portfolio early on and may be on the path to running out of money.

Fortunately, there are steps you can take to insulate your portfolio from market volatility — such as the use of a flexible withdrawal strategy.

You can track your net worth and forecast retirement projections for free with Empower's free wealth management tools. Learn more about them in our Empower review.

The Guyton-Klinger Strategy

A variable withdrawal plan adjusts the withdrawal rate according to the returns generated by the portfolio.

The Guyton-Klinger Strategy, a variable SWR system, uses “guardrails” for spending, meaning retirees change their withdrawal rates based on the performance of the market, like so:

- In poor market conditions, the “Capital Preservation Rule” kicks in

- In strong market conditions, the “Prosperity Rule” kicks in

Let's say you have a plan to spend X dollars per year in retirement, but only a portion of that will go to necessities such as food, clothing, and shelter. The rest of it will go to new cars, hobbies, vacations, and other discretionary categories.

Based on these portions, you can determine — after accounting for social security and other sources of income — how much you'll need from your portfolio just to cover the necessities.

If this number equates to 2.5%, you'll know you can cut back significantly if needed in the case of a market downturn, high inflation, or some unpredictable “Black Swan” event. This gives you the flexibility for when you need to preserve capital.

On the other hand, if the markets are performing well, you can safely increase your withdrawal rate and spend money you didn't plan to have when you began retirement.

You can get a cheat sheet of the Guyton-Klinger Strategy here and watch a video about it here.

A simple rule for safe withdrawal rates

While the Guyton-Klinger Strategy can help establish a rules-based system to follow, many retirees find it to be overly cumbersome and impractical.

Remember, the primary risk to your retirement strategy is SORR.

If you earn terrible returns in the first few years of retirement, you will need to stick to a number like 4% or less. On the other hand, if the stock market rallies for the first few years of your retirement, you may be able to spend 5% or 6% and be fine.

Here's a simple rule for retirement withdrawal rates:

Start at something like 3.5% or 4% and adjust (probably higher) as you go.

Don't be fooled into thinking you need to stick with the same withdrawal rate for 30 years. You can adjust your spending to your income during your retirement years, just like you did in your working years.

Safe withdrawal rates for early retirement

To this point, this article has covered SWRs for 30-year retirements. But what about people retiring in their 30s and 40s with 50–60+ years of life left? How do SWRs change?

It turns out, not that much.

Research shows that increasing the time horizon from 30 years to 45 years reduces the safe withdrawal rate from 4.1% to 3.5%.

However, extending the time horizon beyond 45 years did not require any further reduction in SWR (again, based on U.S. returns data).

Why do longer time horizons not require lower SWRs? It goes back to the sequence of returns.

The researcher explains:

“Over long time horizons, even balanced portfolios generate returns significantly higher than 3.5% and, consequently, the primary constraint of safe withdrawal rates is just having a withdrawal rate low enough to survive an early 1–2 decade stretch of poor returns. If the withdrawal rate is low enough to survive the first two decades of bad returns, then eventually the good returns arrive, the client recovers and gets ahead, and adding more years to the time horizon is no longer a risk.” — Michael Kitces.

So 3.5% is the floor, no matter how long you expect your retirement to be.

Additionally, early retirees can choose to take higher withdrawal rates and take on more risk (lower survival rates) for several reasons:

- Early retirees can easily go back to work

- Early retirees can allocate more of their portfolios to stocks

- Early retirees can be more flexible with their spending and live very cheaply

If you can accept a lower survival rate and are willing to be flexible if the need arises, you may be able to use a withdrawal rate of 4% or more.

The final word

There is a lot of information in this article.

Here's a quick summary:

- The safe withdrawal rate is a useful concept, but don't let it trick you into a false sense of precision. No amount of math will be able to predict the length of your retirement or the returns your portfolio will generate.

- The 4% rule is very safe for a 30-year retirement. 3.5% is even safer.

- The sequence of real returns, especially during the first decade of retirement, is very important.

- You should not start with too high of a withdrawal rate, but odds are you will be able to increase your withdrawal rate over time.

- After retirement, remain flexible and adjust spending every few years when necessary.

Personally, I will plan for and start at a withdrawal rate of 3.5%, then adjust as I go.