Seeking Alpha PRO Review: Is It Worth the Money vs Premium?

If you've spent time on Seeking Alpha, you've probably noticed that many of the most advanced investment ideas are hidden behind the PRO paywall.

Seeking Alpha offers two paid plans: Premium and PRO.

While Seeking Alpha Premium gives investors full access to contributor research, Quant Ratings, and Factor Grades, a PRO subscription unlocks the site's highest level of stock research, the PRO Quant Portfolio, and exclusive analysis.

But at more than 8x the annual cost of Premium, you're probably wondering if a PRO subscription is worth it.

In this review, I break down what's included with Seeking Alpha PRO, how it compares to Premium, and whether it provides enough value to justify the upgrade.

Seeking Alpha PRO review summary

- Overall rating:

- Service type: Advanced stock research and analysis

- Cost: $2,400/year (get a 1-month trial for just $89 with our link)

For most investors, Seeking Alpha Premium offers far more value than PRO. It has the key features most investors need — in-depth analysis, quantitative tools, and fundamental data — at a fraction of the cost.

PRO simply adds another layer on top of Premium — it's effectively Premium plus extra sets of high-conviction trade ideas from the site's top analysts and its head of quantitative research.

Given the high cost and the nature of its features, to me, Seeking Alpha PRO only makes sense if you have a portfolio of at least $250,000 and want to take a fairly active, research-heavy approach to managing it.

Read on to see my full review.

If you're still interested in subscribing to PRO after reading this review, you can get a 1-month trial for $89. By the end of that period, you'll know for sure if you're going to get enough value out of the subscription to justify the cost.

What is Seeking Alpha?

Seeking Alpha is an investment research website that's best known for its crowdsourced stock analysis.

Thousands of contributors — including analysts, fund managers, and experienced individual investors — publish research reports covering stocks, bonds, sectors, and macro trends.

Most reports include valuation models, potential catalysts, risk factors, and the author's recommendation (a price target and a buy, sell, or hold call).

Beyond user-generated content, Seeking Alpha offers data-driven tools to help you quickly evaluate companies. Each stock page includes:

- Quant Ratings: Algorithmic buy, hold, or sell ratings based on factors like valuation, growth, profitability, momentum, and earnings revisions.

- Factor Grades: Letter-grade assessments (A–F) across those same dimensions, allowing for quick, side-by-side comparisons between peers.

- Dividend Grades: Letter-grade assessments (A–F) of a stock's dividend based on factors like safety, growth, yield, and consistency.

- Analyst and Author Ratings: Summaries of Wall Street and Seeking Alpha contributor sentiment.

- Company Financials and Key Metrics: Full income statements, balance sheets, and cash flow data for both U.S. and international stocks.

In addition, the platform provides real-time stock news, portfolio tracking tools, and screeners that tie directly into its research ecosystem.

However, almost all of the website is locked behind a paywall.

To access full articles, quant ratings, and other advanced tools, you must subscribe to one of Seeking Alpha's paid tiers — Premium or PRO.

Seeking Alpha Premium vs PRO

Here's a comparison of Seeking Alpha's paid service tiers:

| Premium ($299/year) | PRO ($2,400/year) | |

| Expert investor content | ✅ | ✅ |

| Quant Ratings | ✅ | ✅ |

| Factor & Dividend Grades | ✅ | ✅ |

| Analyst & Author Ratings | ✅ | ✅ |

| Financial data | ✅ | ✅ |

| Portfolio tracking | ✅ | ✅ |

| Stock & ETF screeners | ✅ | ✅ |

| PRO Quant Portfolio | ❌ | ✅ |

| Top Analyst Ideas | ❌ | ✅ |

| Short Ideas | ❌ | ✅ |

| Exclusive coverage | ❌ | ✅ |

| Offer | $269/year after a 7-day free trial | 1-month trial for just $89 |

Seeking Alpha PRO

Seeking Alpha PRO is the site's highest available subscription tier, built for investors who want to take a more hands-on investment approach.

While Premium caters to long-term, fundamental investors, PRO targets those who prefer managing a larger number of positions and want a steady flow of new trade ideas.

In addition to everything included with Premium (shown above*), here are the key features unlocked with a PRO subscription.

*You can read more about these features in more detail in my Seeking Alpha Premium review.

1. PRO Quant Portfolio

Although it was just launched in May 2025, the PRO Quant Portfolio (PQP) is one of the biggest differentiators between PRO and Premium.

The PQP is a model portfolio built and maintained by Steven Cress, Seeking Alpha's Head of Quantitative Strategy.* The portfolio showcases the highest-conviction stocks according to the platform's proprietary Quant Ratings system.

*Cress also manages Alpha Picks, a momentum-based stock picking service that's strong performance and resulting demand ultimately led to the creation of PRO Quant Portfolio.

Each week, PRO members typically receive two new trade alerts (one buy and one sell).

Additionally, unlike most stock-picking services, the PRO Quant Portfolio uses a fixed-capital, equal-weight approach. Each week when the portfolio updates, every position is rebalanced based on the current total balance.

For example, if you're tracking the strategy with $10,000 and there are 50 active stocks, each one would hold $200. The next week, if your portfolio grows to $10,500 and the service expands to 52 positions, you'd simply redistribute ~$202 to each stock.

The advantage is that you never have to add new money — the portfolio rebalances using whatever you already have.

The tradeoff is that it requires frequent trading, since every position should be adjusted during the weekly rebalance if you want to adhere perfectly to the service's approach.

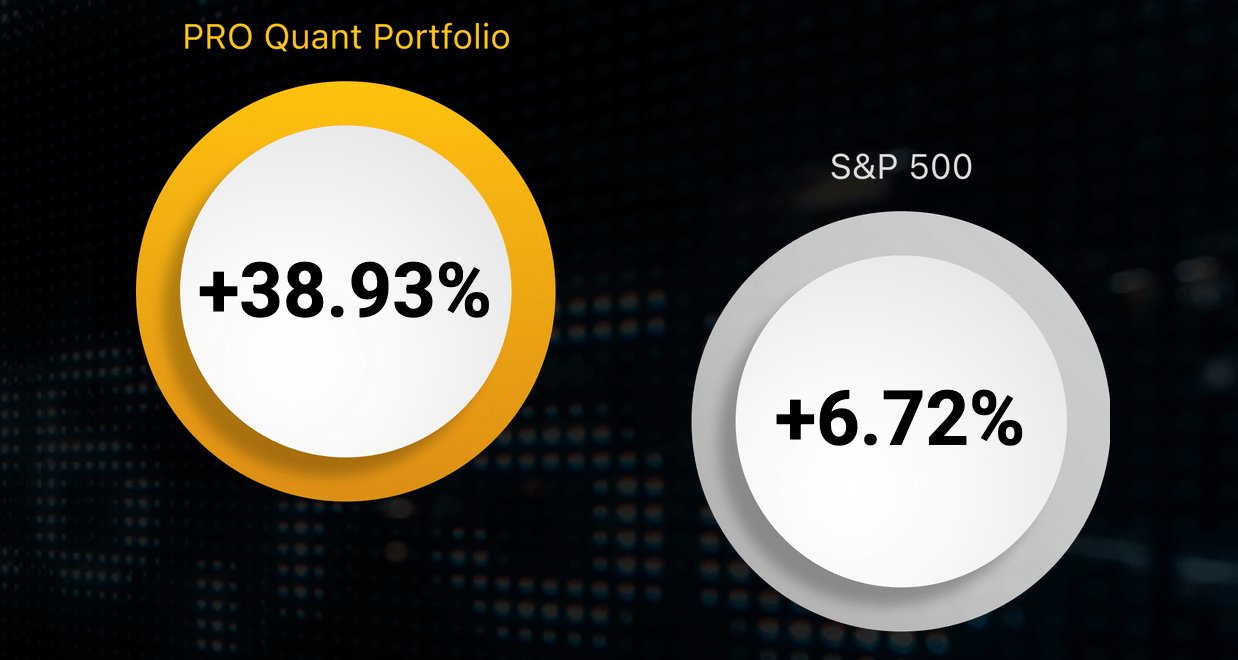

In the six months since its launch, the PRO Quant Portfolio has returned +38.93% vs +6.72% for the S&P 500 EWI.*

*Disclaimer: Returns as of November 4, 2025. Past performance does not guarantee future results.

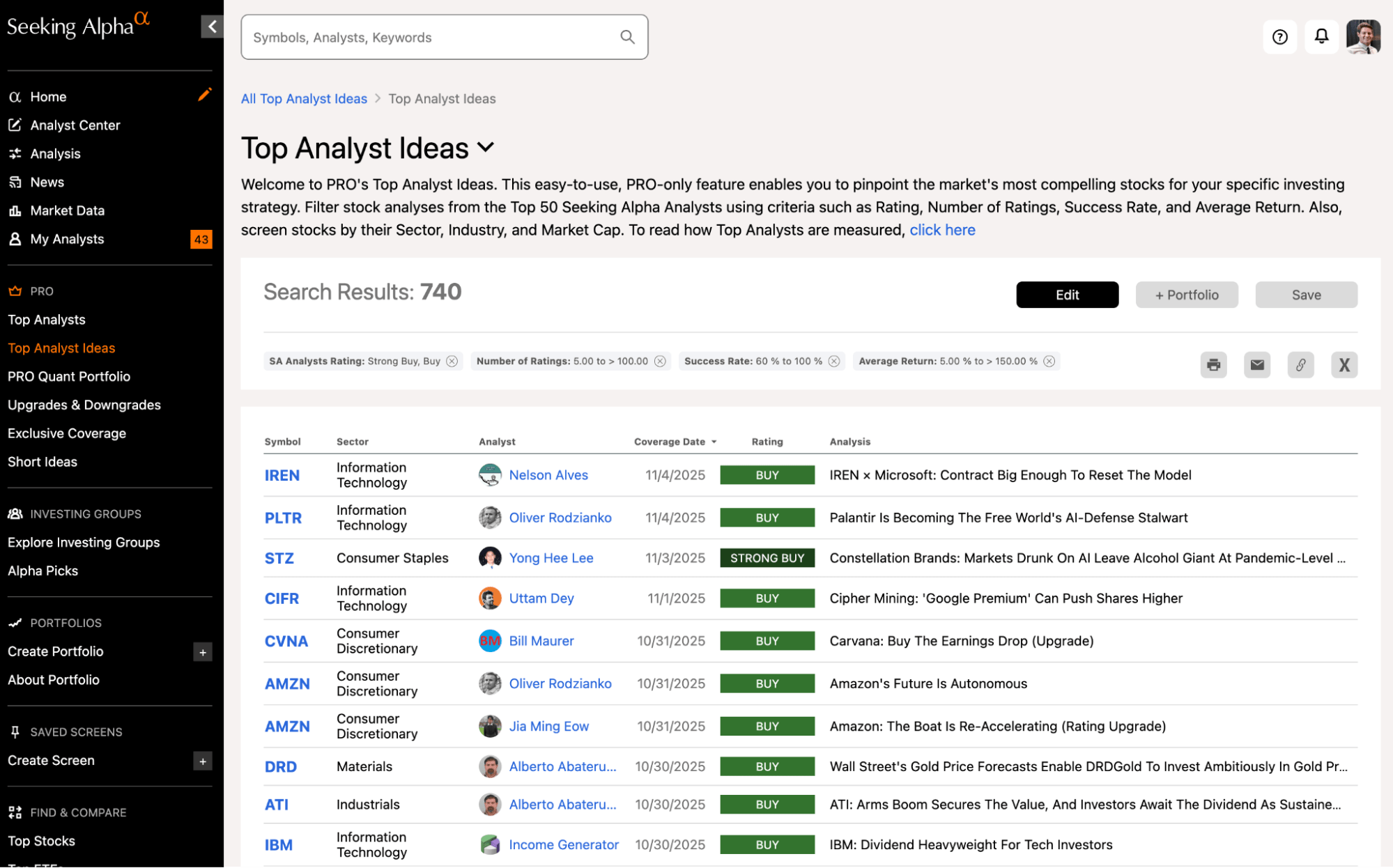

2. Top Analyst Ideas

Top Analyst Ideas is a curated feed of stock recommendations from Seeking Alpha's highest-performing contributors.

Seeking Alpha ranks its analysts based on a combination of success rate, average return, conviction, and number of eligible picks over the trailing 12 months.

The top 50 analysts are considered Top Analysts, and their reports are shown on the Top Analyst Ideas page as of their published date.

This section serves as a shortcut for identifying which contributors have consistently delivered results, so you can focus your attention on the site's most credible analysts.

3. Upgrades and Downgrades

Speaking of shortcuts, the Upgrades and Downgrades feed gives PRO subscribers real-time visibility into rating changes made by Seeking Alpha's quant system, its contributors, and Wall Street analysts.

Each update lists the stock, the previous and new rating (e.g., hold → buy), and a link to the report behind the change. You can also filter by sector, market cap, or direction (positive or negative).

This tool makes it easy for you to spot changes in sentiment and which companies or parts of the market are seeing meaningful revisions in their outlook or fundamentals.

4. Short Ideas

The Short Ideas section highlights the recent bearish research reports published by Seeking Alpha's contributors. These pieces focus on overvalued companies, accounting red flags, or deteriorating fundamentals that may lead to future price declines.

As with a typical report, each idea includes a detailed thesis outlining the company's prospects and the reason for the author's sell or strong sell rating.

The feature serves as both a risk-management and opportunity tool. Even if you don't plan on shorting stocks directly, these reports can help you spot potential weaknesses in the market.

5. Exclusive Coverage

Lastly, the Exclusive Coverage section gives PRO users access to research reports on companies without Wall Street coverage, typically smaller-cap or underfollowed companies.

It may seem like a small and somewhat unnoteworthy feature, but it's a key feature for investors who are looking for early opportunities and underdiscussed investment ideas.

How much does Seeking Alpha PRO cost?

Here are the key details regarding Seeking Alpha PRO's cost and terms:

- Price: $2,400/year

- Trial period: There is no free trial, but new members can get a 1-month paid trial for just $89.

- Refund policy: Most of Seeking Alpha's subscriptions are non-refundable, including PRO.

- Cancellation policy: You can cancel your subscription at any time from your profile, and the cancellation will take effect at the end of the current billing cycle.

Seeking Alpha PRO: Pro and con summary

| Pros | Cons |

| Includes the PRO Quant Portfolio | Expensive |

| Additional access to exclusive investment ideas (Top Analyst Ideas, Short Ideas, and Exclusive Coverage) | No free trial or refunds |

| VIP customer service | Overkill for most investors |

| 1-month paid trial for $89 |

PRO vs Premium: Which level is right for you?

Here's a clear breakdown of who each plan is best for.

Premium

For the vast majority of investors, Seeking Alpha Premium is the right choice, in my opinion.

It offers everything most people need: full access to articles, Quant Ratings, Factor & Dividend Grades, screeners, portfolio tracking tools, and unlimited stock research.

If you're a long-term, fundamentals-driven investor, Premium gives you plenty of analytical depth at a fraction of the cost of PRO.

It's ideal for investors who want to make informed decisions, validate their own research, and stay updated on company performance without paying for hundreds of extra stock ideas they won't use.

PRO

Seeking Alpha PRO is designed for slightly more active, research-intensive investors who are managing larger portfolios and trading frequently enough to justify the higher price.

On top of Premium, it adds the PRO Quant Portfolio, curated trade ideas, exclusive reports, and short ideas for professionals or very engaged retail investors who want a constant stream of actionable opportunities.

However, for most people, PRO will be overkill.

Unless you're managing at least $250,000+, making frequent trades, and dedicating significant time each week to market research, you'll get better value from Premium — in my opinion.

For more options, see my article comparing Motley Fool, Seeking Alpha, Morningstar, and Zacks.

Final verdict

As a long-time subscriber, I've found Seeking Alpha to be an extremely valuable part of my research process. It's one of the most comprehensive investment research platforms available to individual investors.

It has two paid tiers: Premium and PRO. In my opinion, Premium is a much better value.

Premium offers everything most investors need — in-depth analysis, quantitative tools, and fundamental data — at a reasonable cost.

PRO goes further, but its incremental benefits make sense only for those managing larger portfolios. It's best viewed as a niche upgrade for investors who want a constant flow of new ideas.