The Top 7 Alternatives to Yahoo Finance

Yahoo Finance used to be the go-to resource for stock quotes, financial statements, and company-related news.

But its most recent update has made the site almost unusable. The layout is bad, and the number of ads has made the page load speed worse than ever.

If you've found yourself frustrated by the new experience, you're not alone. Many former users are ditching Yahoo Finance for simpler, faster alternatives.

That's why I made this list.

Here's my list of the best Yahoo Finance alternatives in 2026.

Summary view

- Best overall: Stock Analysis

- Best for in-depth analysis: Seeking Alpha

- Best for researching ETFs & mutual funds: Morningstar

- Best for charts and technical analysis: TradingView

- Best real-time newsfeed: Benzinga

- Best stock screener: FINVIZ

- Best API alternative: EODHD

For more information on each of these, keep reading.

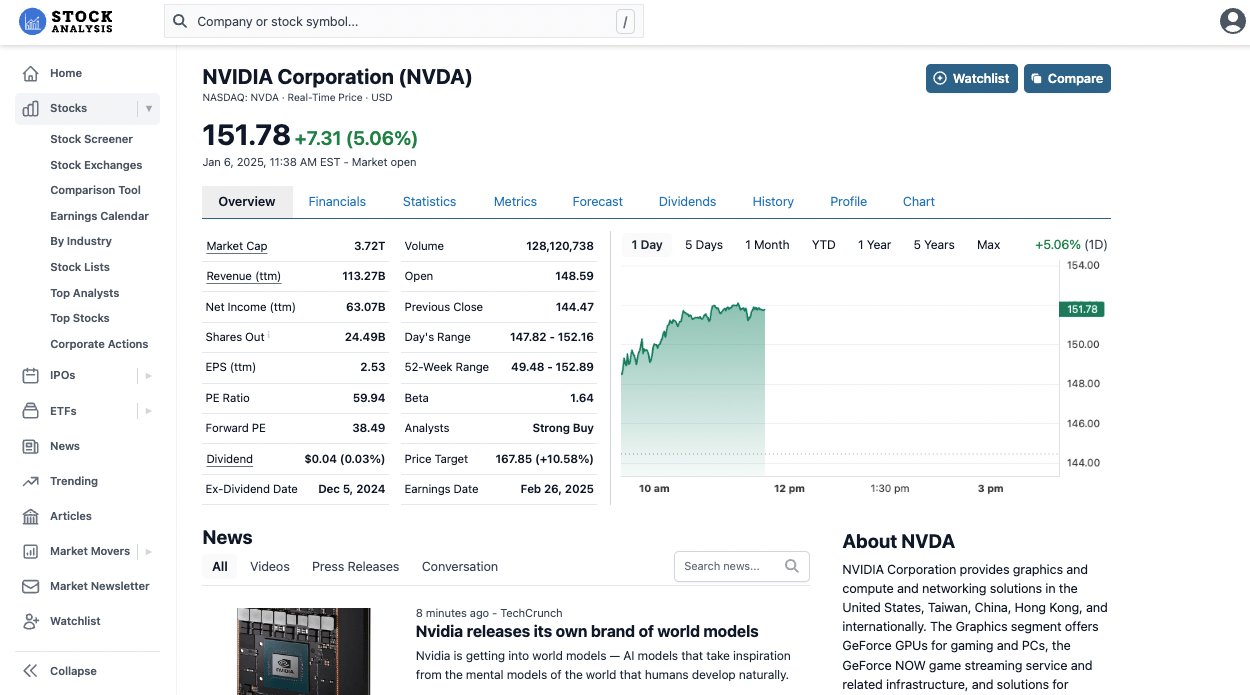

1. Best alternative overall: Stock Analysis

- Overall rating:

- Pricing: Free

Stock Analysis has stock quotes, financial statements, statistics, business metrics, dividend data, charts, and news for 100,000+ stocks and funds.

Best of all, it's simple to use, clutter-free, and lightning-fast.

Beyond exploring individual stock information, you can also:

- Find new stock ideas with our stock lists, stock screener, and ETF screener.

- Dig deeper into specific companies with our analyst ratings, price forecasts, Top Analysts, and other stock research tools.

- Stay up to date with our heatmap, earnings calendar, IPO calendar, live news feed, and free daily newsletter.

You can also create watchlists after registering for a free account. The watchlists are completely customizable with over 200 filters, so you can easily stay on top of whatever metrics or historical financial data matter most to you.

While we try to provide as much as we can for free, some of our data providers require us to keep certain data behind a paywall.

To unlock unlimited access to all of our data and tools, including downloads, you can upgrade to Stock Analysis Pro for just $79 per year (or $9.99/month).

But don't worry — you can use almost all of the site completely free without ever bumping into a paywall.

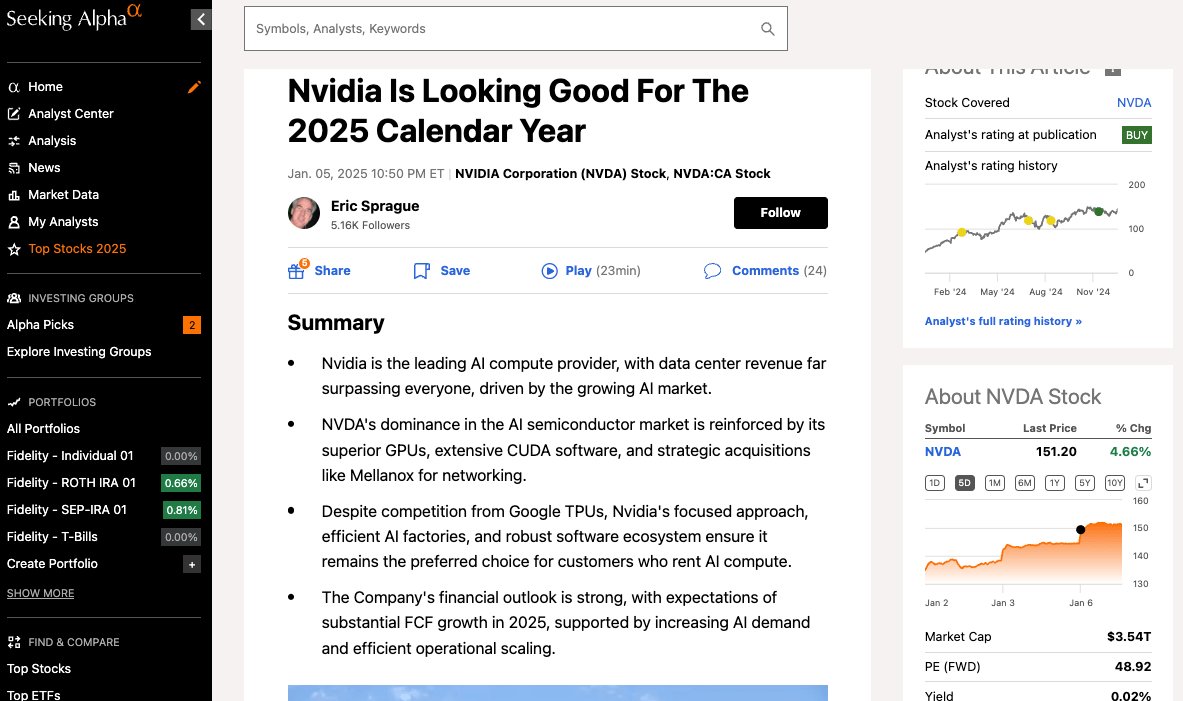

2. Best for in-depth analysis: Seeking Alpha

- Overall rating:

- Pricing:

$299/year$269/year after a 7-day free trial

Seeking Alpha also has stock quotes, financial statements, and other objective data, but that's not what makes it one of the most popular investing websites in the world.

Open up Seeking Alpha, and you'll find thousands of exclusive investment research reports written by investors from all over the world.

Each report covers a specific investment idea, a rating (buy, sell, or hold), and a price target:

Inside each report, you'll find thoughtful analysis about the company in question and data to support the author's argument.

Long-term investing is really about thinking through different scenarios and trying to determine which one is most likely to happen. As investors, we construct narratives around companies and make buy/sell decisions based on those assumptions.

Seeking Alpha's articles make it so you don't have to do all that work for yourself.

In addition to the opinionated research, I also frequently use Seeking Alpha's scorecards. The two I use the most are:

- Ratings: These show the aggregate ratings of Seeking Alpha analysts, Wall Street analysts, and Seeking Alpha's quantitative algorithm.

- Factor Grades: These rate stocks based on their valuation, growth, profitability, momentum, and revisions.

For dividend investors, there are also Dividend Grades, which rate dividends by safety, growth, yield, and consistency.

In my opinion, Seeking Alpha Premium is well worth the $299/year price tag (I've been a paying subscriber for more than six years).

And right now, you can get Premium for $269/year and a 7-day free trial using our links.

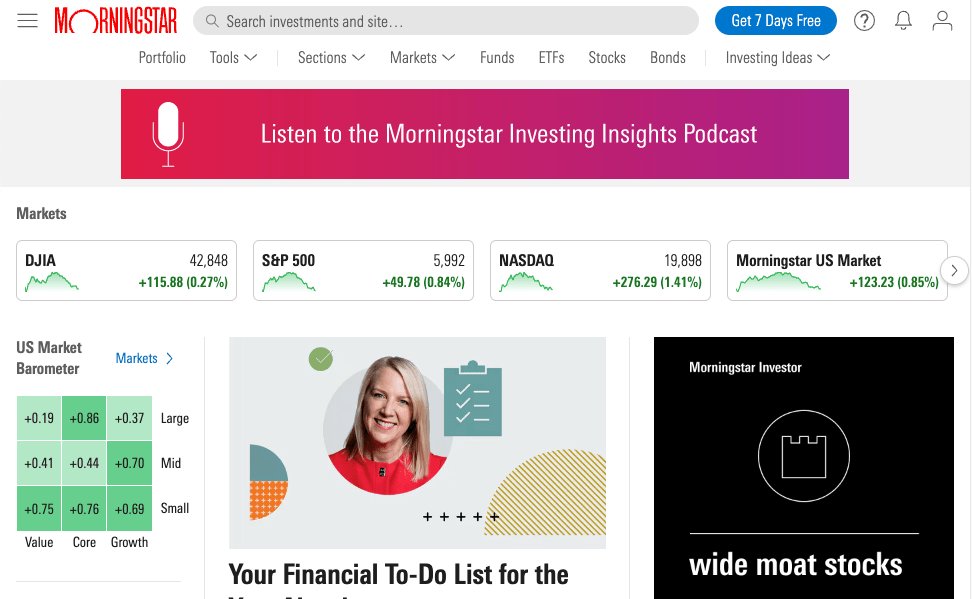

3. Best for researching ETFs & mutual funds: Morningstar

- Overall rating:

- Pricing: Free

Morningstar is another investing website that, in my opinion, doesn't get mentioned enough.

A couple of things I really like about it are:

- Mutual fund data: Includes NAV, investment style, expense ratio, yield, turnover, and performance.

- Market Barometer: (Pictured above) shows how each category of stocks is performing today.

- News feed: Full of objective, smart, opinionated, and well-researched write-ups.

- Content: Articles on personal finance, retirement planning, alternative investments, and more.

For these reasons, Morningstar is a trusted resource for many financial advisors.

Morningstar does have a paid service, Morningstar Investor, which unlocks its proprietary rating system and subscriber-only analysis. You'll also unlock portfolio management tools that break down your portfolio's composition, risk, and performance.

But, like StockAnalysis.com, most people can use Morningstar without ever needing to upgrade to a paid plan.

4. Best for charts and technical analysis: TradingView

- Overall rating:

- Pricing: $14.95/month (after a 30-day free trial)

Yahoo Finance has never had the best charts, but they were good enough for long-term investors looking at general entry/exit points.

If that's all you use charts for, you can use Stock Analysis's advanced charts. But anyone who's more serious about day trading should use a more powerful tool.

My recommendation: TradingView.

TradingView is the best website for charts and technical analysis. But you don't have to take my word for it — TradingView has over 100 million users on its platform.

Here are some of the features you'll find:

- 17 chart types

- 400+ indicators

- 110+ drawing tools

- Custom timeframes

- Multiple charts per tab

- Bar Replay (which allows you to quickly practice trading on real charts)

- And much more

Moreover, it's all on one of the best-looking, simple-to-use interfaces I've ever seen.

You can try TradingView for free, but you won't be able to use it for long before needing to upgrade to a paid plan.

I recommend Essential or Plus, which are $16.95/month and $33.95/month, respectively, after a 30-day free trial.

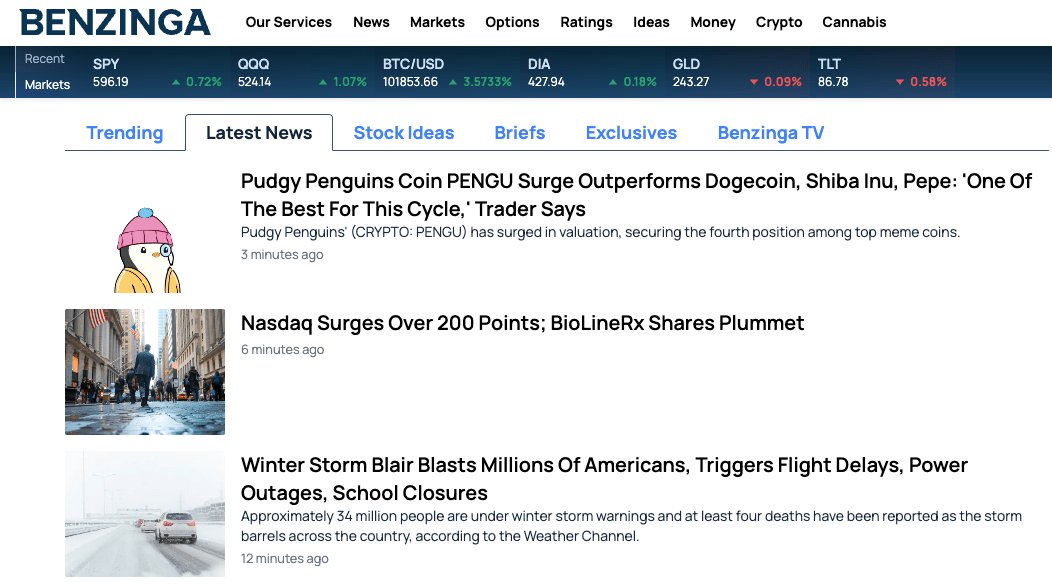

5. Best real-time newsfeed: Benzinga

- Overall rating:

- Pricing: $37/month

For the news-centric trader, Benzinga Pro is the best option.

Benzinga is known for being one of the fastest news providers in the industry and will keep you informed of breaking developments as they happen. As you're well aware, a few seconds can mean the difference between a profit and a loss.

Not only is the feed faster, but the information is also provided in a way that makes it easier for you to act fast. The headlines are concise and relevant, helping you identify opportunities and make decisions without needing to read the entire article.

Benzinga also aggregates analyst ratings, upgrades and downgrades, earnings announcements, economic reports, and more.

However, the free version of Benzinga is not as good as it used to be, and most of the news is now behind a paywall. You'll need to upgrade to Benzinga Pro (for $37/month) for a more useful tool.

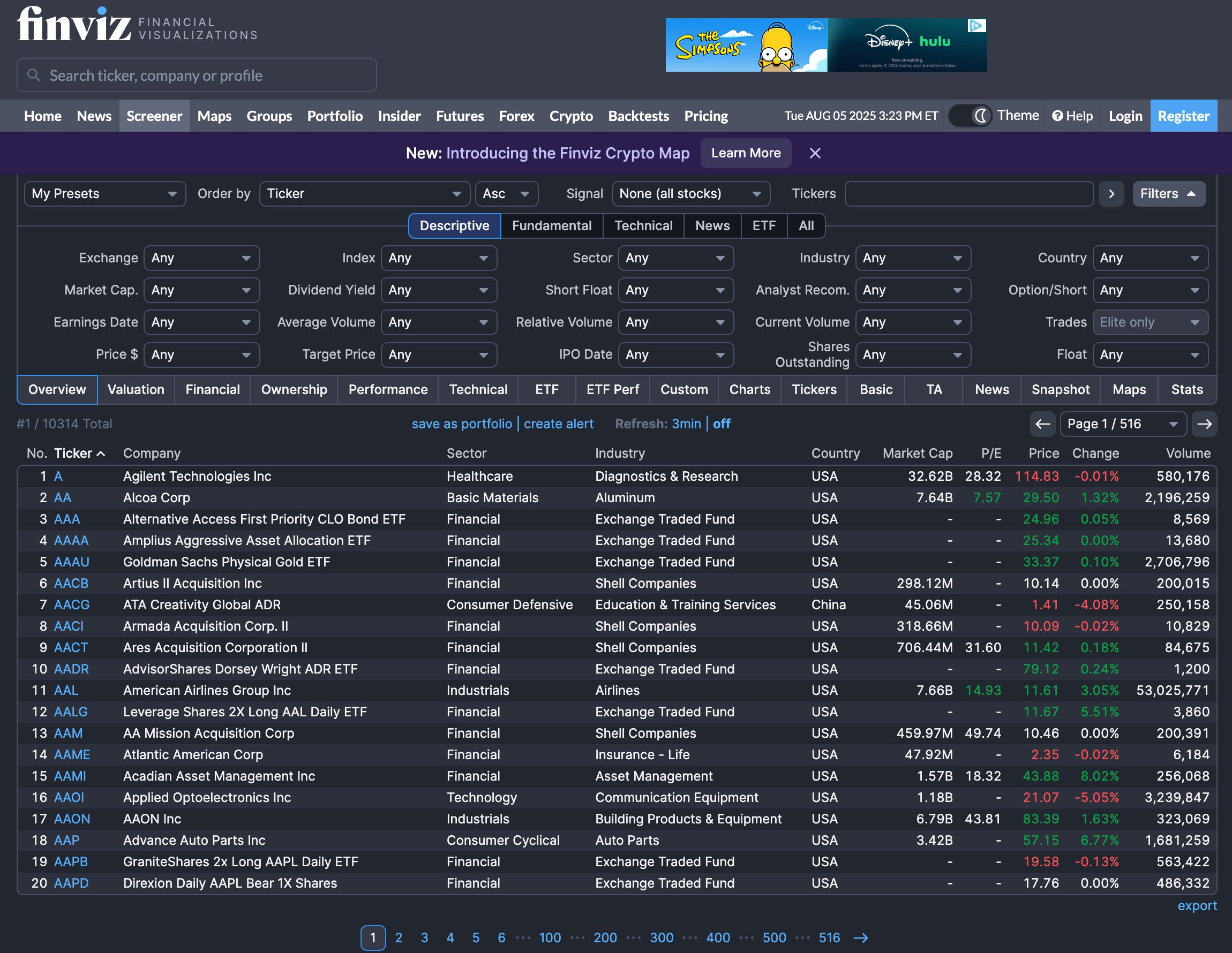

6. Best stock screener: FINVIZ

- Overall rating:

- Pricing: Free

FINVIZ is the best standalone stock screener.

You can filter through over 10,000 stocks based on sector, market cap, P/E ratio, growth rate, short float, or pretty much any other datapoint you can think of.

If you're looking for a needle-in-a-haystack type of investment or an extremely undervalued stock with high insider ownership, FINVIZ is a great place to do your research.

For a more robust screener, advanced charting, custom notifications, and more, you can upgrade to FINVIZ Elite ($39.50/month after a 7-day free trial).

But the free version is good enough for most investors.

7. Best API alternative: EODHD

- Overall rating:

- Pricing: $19.99/month

If you're using Yahoo Finance's API and are looking for an alternative, you should check out EODHD.

What's an API?

An API (which stands for Application Programming Interface) is a set of protocols that allow different software applications to communicate and exchange data with each other.

In this case, developers can use EODHD's API to pull financial data into their applications, saving them the trouble of aggregating all of the data themselves.

EODHD's API offers a wide range of financial data, including end-of-day stock prices, historical market data, financial statements, and more.

Beyond stocks, EODHD also supports data for cryptocurrencies, forex, ETFs, mutual funds, and a variety of other financial instruments, covering over 70,000 symbols globally.

The platform is well-documented, with clear guides and examples to help you get started quickly.

You can access basic end-of-day data for free, while paid plans — which unlock more advanced features and higher usage limits — start at $19.99/month.

How we chose the best Yahoo Finance alternatives

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good the product or service is — i.e., how accurate the data is, how many features the site has, and how much users like it.

- Cost: Overall price and value for money.

- Usability: What the interface looks like, how easy it is to navigate, design elements and features, and general accessibility.

- Credibility: Quality of the data, as well as company and brand reputation.

- Audience: Who the product is for, its uses and applications, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

You might also be interested in my list of the best Bloomberg Terminal alternatives.

Final verdict

That's my list of the top Yahoo Finance alternatives in 2026.

Stock Analysis is the clear winner when it comes to a true Yahoo Finance replacement. It has everything Yahoo Finance offers (and more) but is easier to use, has a cleaner layout, and is much faster.

After Stock Analysis, Seeking Alpha is the next best alternative. It's not free, but it comes with thousands of in-depth research reports you won't find anywhere else.

For researching ETFs and mutual funds, as well as some of the most well-researched and objective news and articles on personal finance, retirement, and more, there's Morningstar. And for screening stocks for investment ideas, FINVIZ is excellent.

TradingView is the best option for traders who need a charting platform, and Benzinga provides the most actionable real-time newsfeed.

For developers looking for a new API, EODHD is the best overall option.