Banco Bradesco S.A. (BVMF:BBDC3)

Brazil · Delayed Price · Currency is BRL

Brazil · Delayed Price · Currency is BRL | Market Cap | 205.91B +67.4% |

| Revenue (ttm) | 89.27B +13.2% |

| Net Income | 23.67B +37.2% |

| EPS | 2.24 +37.7% |

| Shares Out | n/a |

| PE Ratio | 8.70 |

| Forward PE | 7.18 |

| Dividend | 1.11 (6.15%) |

| Ex-Dividend Date | Mar 3, 2026 |

| Volume | 2,383,900 |

| Average Volume | 7,509,705 |

| Open | 18.07 |

| Previous Close | 18.03 |

| Day's Range | 18.03 - 18.52 |

| 52-Week Range | 10.28 - 18.97 |

| Beta | 0.30 |

| RSI | 58.33 |

| Earnings Date | Feb 5, 2026 |

About Banco Bradesco

Banco Bradesco S.A., together with its subsidiaries, provides various banking products and services in Brazil and internationally. The company operates in two segments, Banking and Insurance. It engages in banking operations, including investment, national, international, and private banking, as well as investment fund management, consortium administration, middle market and corporate activities, and leasing. The company also provides retail banking products, such as demand, savings, and time deposits, as well as mutual funds, foreign exchange ... [Read more]

Financial Performance

In 2025, Banco Bradesco's revenue was 89.27 billion, an increase of 13.16% compared to the previous year's 78.89 billion. Earnings were 23.67 billion, an increase of 37.21%.

Financial StatementsNews

Bombardier Inc. (BBD.B:CA) Q4 2025 Earnings Call Transcript

Bombardier Inc. (BBD.B:CA) Q4 2025 Earnings Call Transcript

How Is The Market Feeling About Bank Bradesco SA?

Bank Bradesco SA's (NYSE: BBD) short interest as a percent of float has fallen 6.06% since its last report. According to exchange reported data, there are now 32.61 million shares sold short , which ...

Bradesco: The Re-Rating Case Is Still Alive Heading Into 2026

Bradesco has moved past the credit shock of recent years. 4Q25 proved that BBD is growing again, with risk under control and profitability steadily normalizing. Even after the strong rally over the pa...

Banco Bradesco S.A. (BBD) Q4 2025 Earnings Call Transcript

Banco Bradesco S.A. 2025 Q4 - Results - Earnings Call Presentation

Banco Bradesco Is No Longer Broken, But It's Too Early To Get Aggressive

Banco Bradesco is rated HOLD, reflecting operational improvements but insufficient ROAE to justify a re-rating. BBD's recurring net income reached R$6.2B in 3Q25, with ROAE at 14.7%, showing gradual i...

Stock Market Today, Jan. 27: Banco Bradesco Rises Ahead of Brazilian Central Bank Meeting

Expand NYSE: BBD Banco Bradesco Today's Change (-0.12%) $-0.01 Current Price $4.13 Key Data Points Market Cap $22B Day's Range $4.13 - $4.20 52wk Range $1.79 - $4.20 Volume 1.2M Avg Vol 35M Dividend Y...

Stock Market Today, Jan. 27: Banco Bradesco Rises Ahead of Brazilian Central Bank Meeting

Expand NYSE: BBD Banco Bradesco Today's Change (4.41%) $0.17 Current Price $4.14 Key Data Points Market Cap $21B Day's Range $4.10 - $4.17 52wk Range $1.79 - $4.17 Volume 1.6M Avg Vol 34M Dividend Yie...

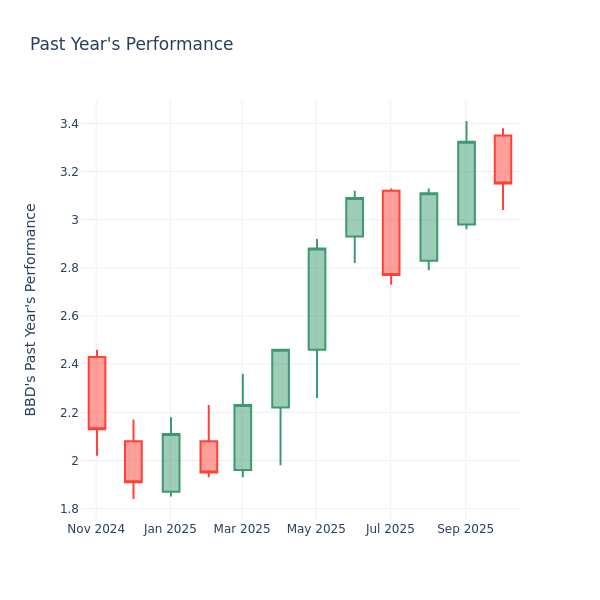

Banco Bradesco Reaches Analyst Target Price

In recent trading, shares of Banco Bradesco SA (Symbol: BBD) have crossed above the average analyst 12-month target price of $3.54, changing hands for $3.57/share. When a stock reaches the target an a...

What's Driving the Market Sentiment Around Bank Bradesco SA?

Bank Bradesco SA's (NYSE: BBD) short interest as a percent of float has risen 87.23% since its last report. According to exchange reported data, there are now 46.31 million shares sold short , which ...

How Do Investors Really Feel About Bank Bradesco SA?

Bank Bradesco SA's (NYSE: BBD) short interest as a percent of float has fallen 18.97% since its last report. According to exchange reported data, there are now 24.65 million shares sold short , which...

Banco Bradesco S.A. declares $0.0032 dividend

Banco Bradesco (BBDO) declares $0.0032/share dividend. Learn about payout dates, yield, and growth.

Bombardier Inc. (BBD.B:CA) Q3 2025 Earnings Call Transcript

Bombardier Inc. ( BBD.B:CA) Q3 2025 Earnings Call November 6, 2025 8:00 AM EST Company Participants Francis Richer de La Fleche - Vice President of Financial Planning & Investor Relations Eric Martel...

Q3 2025 Banco Bradesco SA Earnings Call Transcript

Q3 2025 Banco Bradesco SA Earnings Call Transcript

Arcos Dorados Holdings (ARCO) Downgraded to Neutral by Banco Bradesco BBI | ARCO Stock News

Arcos Dorados Holdings (ARCO) Downgraded to Neutral by Banco Bradesco BBI | ARCO Stock News

Banco Bradesco Reaches Analyst Target Price

In recent trading, shares of Banco Bradesco SA (Symbol: BBD) have crossed above the average analyst 12-month target price of $3.38, changing hands for $3.40/share. When a stock reaches the target an a...

Bradesco Q3 Earnings Preview: Expectation Of Further Improvements

Bradesco remains a buy ahead of Q3 2025 earnings, driven by resilient credit growth and effective NPL control amid a challenging macro backdrop. Expectations for Banco Bradesco include a credit portfo...

P/E Ratio Insights for Bank Bradesco

In the current market session, Bank Bradesco Inc. (NYSE: BBD) share price is at $3.15, after a 1.94% increase. Moreover, over the past month, the stock decreased by 1.87% , but in the past year, incr...

Banco Bradesco Is Growing In Rural And SME Into A Credit Tightening Cycle

Bradesco's strong 2Q25 results and attractive valuation are overshadowed by rising risk from aggressive SME and rural lending amid Brazil's credit crunch. Revenue and net income growth are robust, dri...

Banco Bradesco S.A. (BBD) Q2 2025 Earnings Conference Call Transcript

Banco Bradesco Deepens Its Recovery, But The Market Still Waits

Bradesco delivered strong Q2 growth in earnings, credit, and profitability, outpacing sector averages and consolidating its operational recovery. Despite improving fundamentals, Bradesco's stock still...

Bradesco Q2: Great Results And Recommendation Reiterated

Bradesco's loan portfolio grew 11.7% year-over-year, led by strong gains in personal and MSME lending, aligning with the bank's strategic focus. Non-performing loans remained stable at 4.1%, with annu...

Bank Bradesco's Earnings Outlook

Bank Bradesco (NYSE: BBD) is set to give its latest quarterly earnings report on Wednesday, 2025-07-30. Here's what investors need to know before the announcement. Analysts estimate that Bank Bradesc...

Banco Bradesco S.A. declares $0.0021 dividend

Brazil reforestation firm re.green gets fresh financing in deal with BNDES, Bradesco

Brazilian reforestation startup re.green has obtained 80 million reais ($14.13 million) in financing from state development bank BNDES, it said on Monday, in a deal that also involved lender Bradesco ...