Global Payments Inc. (FRA:GLO)

Germany · Delayed Price · Currency is EUR

Germany · Delayed Price · Currency is EUR | Market Cap | 19.59B -28.3% |

| Revenue (ttm) | 6.56B -0.4% |

| Net Income | 1.19B -10.8% |

| EPS | 4.93 -6.1% |

| Shares Out | n/a |

| PE Ratio | 16.43 |

| Forward PE | 6.14 |

| Dividend | 0.87 (1.28%) |

| Ex-Dividend Date | Dec 12, 2025 |

| Volume | n/a |

| Average Volume | 64 |

| Open | 68.32 |

| Previous Close | 68.94 |

| Day's Range | 68.32 - 68.32 |

| 52-Week Range | 56.84 - 101.95 |

| Beta | n/a |

| RSI | 62.48 |

| Earnings Date | Feb 18, 2026 |

About Global Payments

Global Payments Inc. provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific. It operates through two segments, Merchant Solutions and Issuer Solutions. The Merchant Solutions segment offers authorization, settlement and funding, customer support, chargeback resolution, reconciliation and dispute management, terminal rental, sales and deployment, payment security, and consolidated billing and reporting services. This segment also provides an array of enterprise... [Read more]

Financial Performance

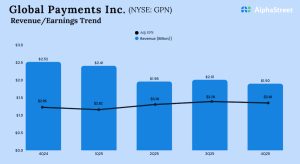

In 2025, Global Payments's revenue was $7.71 billion, a decrease of -0.39% compared to the previous year's $7.74 billion. Earnings were $1.40 billion, a decrease of -10.84%.

Financial numbers in USD Financial StatementsNews

RBC Capital Raises Price Target for Global Payments (GPN) to $97 | GPN Stock News

RBC Capital Raises Price Target for Global Payments (GPN) to $97 | GPN Stock News

Wells Fargo Raises Price Target for Global Payments (GPN) to $105 | GPN Stock News

Wells Fargo Raises Price Target for Global Payments (GPN) to $105 | GPN Stock News

Global Payments Inc. (GPN) Announces $550 Million Accelerated Share Repurchase Program

Global Payments Inc. (GPN) Announces $550 Million Accelerated Share Repurchase Program

Vanguard S&P 500 Value Index Fund Sells 242 Shares of Global Payments Inc (GPN)

Vanguard S&P 500 Value Index Fund Sells 242 Shares of Global Payments Inc (GPN)

Zacks Industry Outlook Highlights Visa, Mastercard, Fiserv, Fidelity National Information Services and Global Payments

Visa, Mastercard, Fiserv, Fidelity National Information Services and Global Payments have been highlighted in this Industry Outlook article.

Global Payments (GPN) Maintains Dividend, Sets Ambitious EPS Target

Global Payments (GPN) Maintains Dividend, Sets Ambitious EPS Target

Global Payments declares $0.25 dividend

Why Global Payments Stock Blasted Nearly 17% Higher on Wednesday

The company believes it will boost its bottom line at a double-digit rate in 2026.

Global Payments: Result Reaction Underpins Low Expectations Thesis

GPN Crosses Above Key Moving Average Level

In trading on Wednesday, shares of Global Payments Inc (Symbol: GPN) crossed above their 200 day moving average of $80.16, changing hands as high as $81.67 per share. Global Payments Inc shares are cu...

Global Payments (GPN) Reports Strong Q4 and Strategic Progress

Global Payments (GPN) Reports Strong Q4 and Strategic Progress

Global Payments Inc. (GPN) Q4 2025 Earnings Call Transcript

Global Payments Inc (GPN) Q4 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic ...

Global Payments Inc (GPN) Q4 2025 Earnings Call Highlights: Strong Revenue Growth and Strategic Acquisitions

Q4 2025 Global Payments Inc Earnings Call Transcript

Q4 2025 Global Payments Inc Earnings Call Transcript

Global Payments Inc (GPN) Trading 13.63% Higher on Feb 18

Global Payments Inc (GPN) Trading 13.63% Higher on Feb 18

Global Payments: Deeply Undervalued With Multi-Bagger Potential

Global Payments remains a Strong Buy, driven by robust fundamentals, the completed Worldpay acquisition, and strong guidance for 2026. Click here to know more.

Global Payments (GPN) Stock Rises on Strong 2026 Outlook and Buyback Plan

Global Payments (GPN) Stock Rises on Strong 2026 Outlook and Buyback Plan

Global Payments (GPN) Sees Notable Stock Surge

Global Payments (GPN) Sees Notable Stock Surge

Global Payments stock surges after introducing strong guidance, $2.5B buyback

Global Payments (GPN) stock jumps on a $2.5B buyback and bullish 2026 EPS outlook after Worldpay deal.

Global Payments Stock Heads for Largest Percent Increase Since Early 2025. What's Fueling the Gains.

The payments software provider posted fourth-quarter earnings that narrowly topped estimates, but full-year guidance was strong.

Global Payments Issues Strong Profit Outlook, Unveils $2.5 Billion Stock Buyback

Global Payments Inc. (NYSE: GPN) stock rose Wednesday after the company reported fourth-quarter fiscal 2025 results . Earnings Snapshot Adjusted earnings per share rose 12% year over year to $3.18, s...

Global Payments Inc. reports Q4 revenue growth in constant currency; full-year 2025 earnings improve after portfolio reshaping

Global Payments Inc. (NYSE: GPN) reported fourth-quarter and full-year 2025 results, reflecting steady constant-currency revenue growth, margin expansion and higher... The post Global Payments Inc. re...

Highlights of Global Payments’ (GPN) Q4 FY25 earnings report

Financial technology company Global Payments Inc. (NYSE: GPN) on Wednesday reported an increase in adjusted earnings for the fourth... The post Highlights of Global Payments’ (GPN) Q4 FY25 earnings re...

Here's What Key Metrics Tell Us About Global Payments (GPN) Q4 Earnings

The headline numbers for Global Payments (GPN) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Stree...