China International Capital Corporation Limited (HKG:3908)

Hong Kong · Delayed Price · Currency is HKD

Hong Kong · Delayed Price · Currency is HKD | Market Cap | 151.19B +26.5% |

| Revenue (ttm) | 29.00B +35.0% |

| Net Income | 9.52B +113.4% |

| EPS | 2.15 +169.8% |

| Shares Out | 4.83B |

| PE Ratio | 8.97 |

| Forward PE | 7.23 |

| Dividend | 0.20 (1.04%) |

| Ex-Dividend Date | Nov 4, 2025 |

| Volume | 15,305,400 |

| Average Volume | 15,086,693 |

| Open | 19.13 |

| Previous Close | 19.30 |

| Day's Range | 18.32 - 19.13 |

| 52-Week Range | 11.68 - 24.34 |

| Beta | 0.97 |

| RSI | 30.18 |

| Earnings Date | Mar 28, 2026 |

About HKG:3908

China International Capital Corporation Limited provides financial services in Mainland China and internationally. It operates in six segments: Investment Banking; Equities; Fixed Income, Commodities, and Currencies (FICC); Asset Management; Private Equity; and Wealth Management. The Investment Banking segment provides investment banking services, including equity and debt financing, and asset securitization services; sponsorship and underwriting of listings and refinancings; underwriting of domestic and overseas fixed income instruments; and f... [Read more]

Financial Performance

In 2024, HKG:3908's revenue was 19.63 billion, a decrease of -8.34% compared to the previous year's 21.42 billion. Earnings were 5.00 billion, a decrease of -9.05%.

Financial numbers in CNY Financial StatementsNews

Mandelson lobbying firm sought work with Russia and China state companies, Epstein emails show

Peer and Benjamin Wegg-Prosser met disgraced financier before formal foundation of Global Counsel Boss of lobbying firm founded with Peter Mandelson quits Peter Mandelson’s former lobbying firm sought...

China wants chips, US needs power: divergent AI growth paths emerge amid bubble concerns

China’s government-led push into artificial intelligence (AI) contrasts with the US’ private sector-led approach, with the world’s two largest economies advancing along divergent paths, according to C...

Baidu's AI Chip Unit Eyes Hong Kong IPO

Baidu Inc. (NASDAQ: BIDU) is moving closer to taking its artificial-intelligence chip unit public, as its Kunlunxin division hires banks to prepare for a Hong Kong IPO that could raise up to $2 billi...

Chinese brokerage CICC announces share swap merger details with Dongxing and Cinda

China International Capital Corporation (CICC) has unveiled details of its merger with two smaller state-owned rivals that will create an entity with combined assets of more than 900 billion yuan (US$...

CICC to absorb 2 smaller rivals to create US$140 billion brokerage

China International Capital Corp (CICC) plans to absorb two smaller brokerages to create a new entity worth 1 trillion yuan (US$140 billion) in assets, as a state-led consolidation gathers pace to mee...

Hong Kong IPO market to extend hot streak in 2026, CICC says

China International Capital Corporation (CICC) forecasts that Hong Kong’s initial public offering (IPO) market will remain vibrant through 2026, fuelled by listings from high-end manufacturing and tec...

China's investment bank CICC targets Southeast Asia

HONG KONG — Significant shifts in the global political and economic landscape are driving China International Capital Corp (CICC) to focus strategically on international growth, targeting the burgeoni...

CICC targets Southeast Asia and Middle East as global shifts reshape landscape

Significant shifts in the global political and economic landscape are driving China International Capital Corp (CICC) to focus strategically on international growth, targeting the burgeoning markets o...

Alibaba's Stock Comeback Has More Room To Run, Say Analysts

Alibaba Group Holding Ltd. (NYSE: BABA) stock climbed on Monday as strong performance in its cloud business and advances in artificial intelligence models offset investor concerns over escalating U.S...

Hong Kong’s capital market bounces back with diverse listings

In the Capital Connectors series, exclusive interviews with six influential Chinese and global bankers reveal the opportunities and challenges for Hong Kong in its evolution as an international financ...

China’s Emissions May Start to Slide in 2030 on Green Investment

China’s emissions could decline by 1.6 billion tons by 2030 if the country manages to mobilize 17.5 trillion yuan ($2.5 trillion) in green investments over the next five years, according to the China ...

China’s exporters ahead in tariff game, paying estimated 9% share of costs

Chinese exporters appear to hold significant bargaining power in their trade with the United States, according to an estimate from one of Beijing’s top investment banks, carrying 9 per cent of the cos...

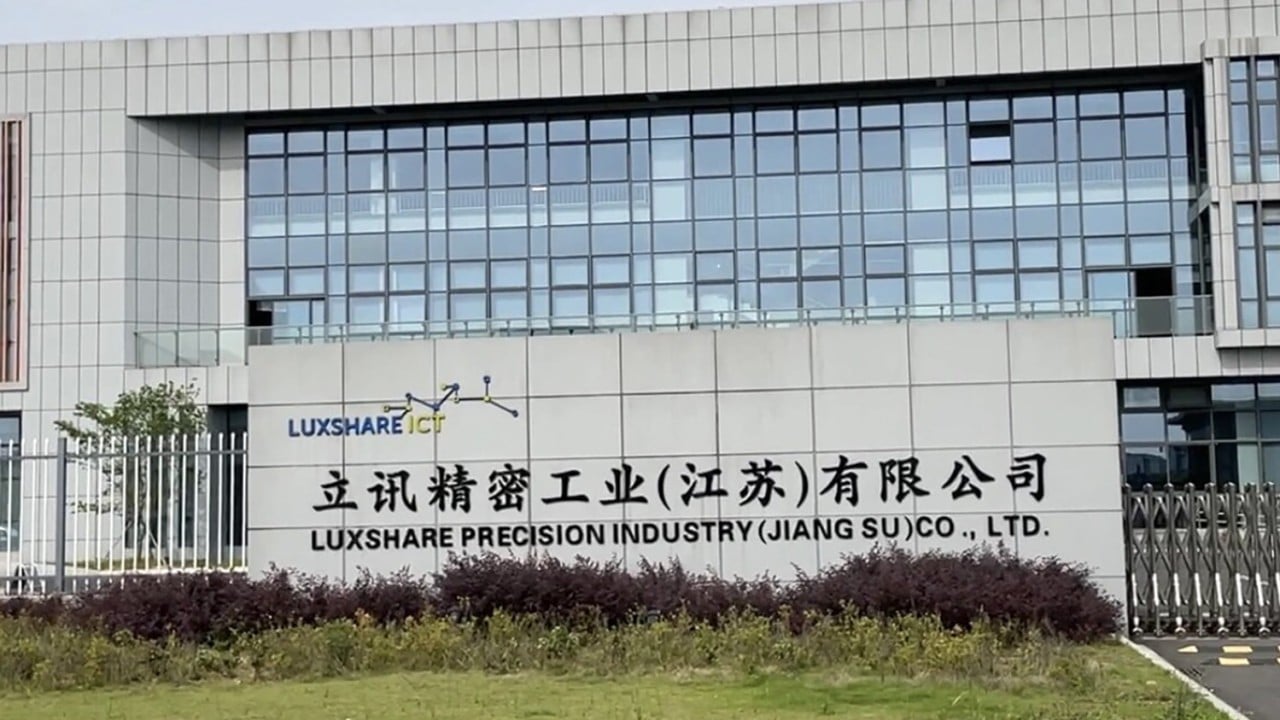

Apple supplier Luxshare joins mainland tech firms seeking Hong Kong IPOs

Apple supplier Luxshare Precision Industry has filed for a Hong Kong initial public offering (IPO), joining a wave of mainland Chinese technology firms seeking to raise funds in the world’s top listin...

Rocketing to riches: China’s cash-hungry aerospace firms aim for IPOs

A recent surge of Chinese commercial aviation companies, either formulating or reviving listing plans, highlights the sector’s strong appetite for funding, according to analysts, as Beijing steps up s...

Chinese AI agent firms lag US, but seek to close gap amid OpenAI’s latest push

China’s AI agents currently lag behind the US in commercialisation but adoption is speeding up, according to new research on the heels of OpenAI’s launch of a ChatGPT agent that is set to push the bar...

MiniMax, the ‘world-class’ AI start-up lauded by Nvidia’s Huang, plans IPO

MiniMax, the artificial intelligence (AI) start-up backed by two of China’s largest technology conglomerates, has confidentially applied for a Hong Kong initial public offering (IPO), according to peo...

Global economy jitters grow after Trump’s Iran strikes, Strait of Hormuz fears

Surging uncertainty in the Middle East has clouded the outlook for global markets, with analysts warning that a potential shutdown of the Strait of Hormuz could send crude prices higher, intensify US ...

Why remaining tariffs could clip Chinese airlines’ wings, and Boeing’s

Despite recent tariff cuts, remaining duties on imports from the US could force Chinese buyers of Boeing jets to pay millions of US dollars more than before and, along with worldwide delivery delays, ...

China’s CICC Eyes Middle East, Southeast Asia in Global Push

China International Capital Corp., one of the nation’s largest brokerages, is seeking to tap growing demand for cross-border financial services in the Persian Gulf and Southeast Asia as the firm pushe...

Undervalued CICC Banks On Hong Kong IPO Activity Pickup

China's largest underwriter of Hong Kong listings helped its clients to raise $3.84 billion last year, as it reportedly gets set to sponsor another blockbuster IPO by battery giant CATL Key Takeaways:...

52Toys taps China's designer toy boom in play for Hong Kong IPO

As China's collectible toy market surges, the company is hoping to fund an aggressive expansion and build iconic IPs with a new listing Key Takeaways: 52Toys has hired investment banks for a planned H...

China’s No 2 carmaker Chery files Hong Kong IPO application

China’s second-largest carmaker lists China International Capital Corp, Huatai Securities and GF Securities as joint IPO sponsors.

Sauce Maker Haitian Is Said to Hire Banks for Hong Kong Listing

Foshan Haitian Flavouring & Food Co., one of China’s biggest condiment makers, has hired China International Capital Corp., Goldman Sachs Group Inc. and Morgan Stanley to work on a second listing in H...

Chery Is Said to Pick Banks for Auto Unit’s Hong Kong IPO

Chery Holding Group Co. has picked China International Capital Corp., GF Securities Co. and Huatai International Ltd. to work on a potential initial public offering of its automotive unit, people fami...

Ant's IPO pushes CICC to No 2 in global league tables for new listings

China International Capital Corporation (CICC) has broken into the world's top two investment banks for new listings for the first time since the global financial crisis due to its role leading in fin...