Alaska Air Group, Inc. (LON:0HC3)

London · Delayed Price · Currency is GBP · Price in USD

London · Delayed Price · Currency is GBP · Price in USD | Market Cap | 4.87B -31.1% |

| Revenue (ttm) | 10.58B +21.3% |

| Net Income | 74.30M -74.7% |

| EPS | 0.62 -73.1% |

| Shares Out | n/a |

| PE Ratio | 65.53 |

| Forward PE | 10.51 |

| Dividend | n/a |

| Ex-Dividend Date | n/a |

| Volume | 1,170 |

| Average Volume | 2,108 |

| Open | 57.50 |

| Previous Close | 58.76 |

| Day's Range | 55.24 - 59.12 |

| 52-Week Range | 37.70 - 77.96 |

| Beta | 1.17 |

| RSI | 61.47 |

| Earnings Date | Jan 22, 2026 |

About Alaska Air Group

Alaska Air Group, Inc., through its subsidiaries, operates airlines. It operates through three segments: Alaska Airlines, Hawaiian Airlines, and Regional. The company offers scheduled air transportation services on Boeing jet aircraft for passengers and cargo in the United States, and in parts of Canada, Mexico, Costa Rica, Belize, Guatemala, and the Bahamas; and for passengers across a shorter distance network within the United States, Canada, and Mexico. Alaska Air Group, Inc. was founded in 1932 and is based in Seattle, Washington. [Read more]

Financial Performance

In 2025, Alaska Air Group's revenue was $14.24 billion, an increase of 21.34% compared to the previous year's $11.74 billion. Earnings were $100.00 million, a decrease of -74.68%.

Financial numbers in USD Financial StatementsNews

Aloha to Big Rewards: Millions of Atmos™ Rewards Points Up for Grabs for Hawaiian Airlines World Elite Mastercard® Cardmembers in 2026

Hawaiian will award more than 44 million Atmos Rewards points to cardmembers through December Hawaiʻi resident cardmembers will earn a 50% bonus on Atmos Rewards points per $1 spent on all purchases u...

Alaska Air Group: A Look Back At The Past Year

Alaska Air stock has struggled as the airline deals with slowing consumer demand. Click here to read why investors should take a second look at ALK.

Alaska Air Group Inc (ALK) Shares Down 4.32% on Jan 30

Alaska Air Group Inc (ALK) Shares Down 4.32% on Jan 30

A new home for training excellence: Alaska Airlines unveils state-of-the-art Global Training Center

New 660,000-square-foot facility brings training for multiple workgroups under one roof $200 million investment strengthens the airline's transformation into country's fourth global airline SEATTLE, J...

Alaska Air Group: Attractive Earnings Outlook

Alaska Air Group is rated Buy, driven by recovering corporate demand, rising premium mix, and a revamped loyalty program post-Hawaiian Airlines acquisition. ALK's Q4 earnings exceeded guidance, with s...

Alaska Air Group Inc (ALK) Shares Up 3.37% on Jan 27

Alaska Air Group Inc (ALK) Shares Up 3.37% on Jan 27

Looking Into Alaska Air Group Inc's Recent Short Interest

Alaska Air Group Inc's (NYSE: ALK) short interest as a percent of float has fallen 8.84% since its last report. According to exchange reported data, there are now 7.37 million shares sold short , whi...

Alaska Air Is A Value Stock Worth Buying

Alaska Air is initiated at a buy rating, citing resilient Q4 results and attractive valuation despite a challenging year. Unit revenue growth outperformed major peers, and cost control improved, with ...

Alaska Air Group Inc (ALK) Q4 2025 Earnings Call Highlights: Navigating Challenges and ...

Alaska Air Group Inc (ALK) Q4 2025 Earnings Call Highlights: Navigating Challenges and Capitalizing on Growth Opportunities

Q4 2025 Alaska Air Group Inc Earnings Call Transcript

Q4 2025 Alaska Air Group Inc Earnings Call Transcript

Alaska Airlines CEO on potential impact to flights from massive winter storm

Ben Minicucci, Alaska Airlines CEO, discusses the potential impact to flights as a massive winter storm sweeps across the U.S. with heavy snow and sleet in the forecast, followed by bitter cold.

Alaska Air Group, Inc. (ALK) Q4 2025 Earnings Call Transcript

Alaska Air Group, Inc. (ALK) Q4 2025 Earnings Call Transcript

Alaska Air Group, Inc. 2025 Q4 - Results - Earnings Call Presentation

2026-01-23. The following slide deck was published by Alaska Air Group, Inc.

Alaska Air (ALK) Beats Earnings Expectations Despite Mixed Results

Alaska Air (ALK) Beats Earnings Expectations Despite Mixed Results

Alaska Airlines CEO: California refineries are a big risk for us going forward

Ben Minicucci, Alaska Airlines CEO, joins 'The Exchange' to discuss the company's quarterly earnings results, its outlook for demand and much more.

Alaska Air expects 'meaningful' improvement in 2026 EPS

Alaska Air Talks Up Demand, But Issues Cautious Profit Outlook

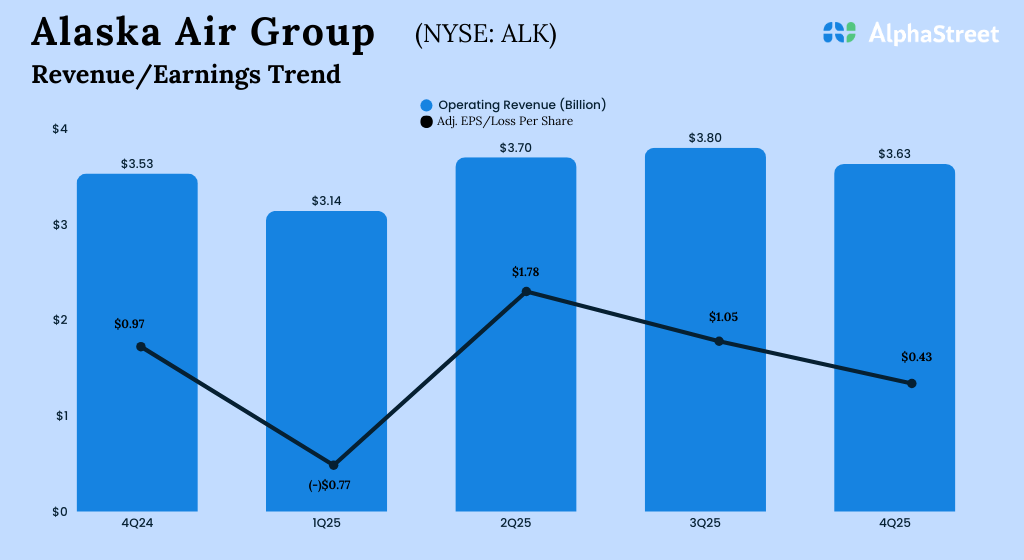

Alaska Air Group, Inc. (NYSE: ALK) on Thursday reported mixed fourth-quarter fiscal 2025 results. The company reported sales growth of 3% year over year (Y/Y) to $3.63 billion, which slightly missed ...

Alaska Air Group (ALK) Earnings: 4Q25 Key Numbers

Alaska Air Group Inc. (NYSE: ALK) reported its earnings results for the fourth quarter of 2025. Total operating revenue increased 3% year-over-year to $3.6 billion. GAAP net income was $21 million, or...

Alaska Air Non-GAAP EPS of $0.43 beats by $0.32, revenue of $3.63B misses by $10M

Alaska Air (ALK) Reports Q4 Earnings: What Key Metrics Have to Say

The headline numbers for Alaska Air (ALK) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street est...

Alaska Air Group (ALK) Projects Capacity and Capital Expenditure Growth for FY26

Alaska Air Group (ALK) Projects Capacity and Capital Expenditure Growth for FY26

Alaska Air Group (ALK) Forecasts Steady Growth Despite Economic Challenges

Alaska Air Group (ALK) Forecasts Steady Growth Despite Economic Challenges

Alaska Air Group (ALK) Eyes Future Growth Despite Slight Revenue Miss

Alaska Air Group (ALK) Eyes Future Growth Despite Slight Revenue Miss

Alaska Air Group Inc. Reveals Decline In Q4 Profit

(RTTNews) - Alaska Air Group Inc. (ALK) reported earnings for fourth quarter that Drops, from last year