SEGRO Plc (LON:SGRO)

London · Delayed Price · Currency is GBP · Price in GBX

London · Delayed Price · Currency is GBP · Price in GBX | Market Cap | 10.79B +12.4% |

| Revenue (ttm) | 699.00M -4.8% |

| Net Income | 621.00M |

| EPS | 0.46 |

| Shares Out | 1.35B |

| PE Ratio | 17.42 |

| Forward PE | 21.29 |

| Dividend | 0.30 (3.75%) |

| Ex-Dividend Date | n/a |

| Volume | 2,536,107 |

| Average Volume | 2,809,264 |

| Open | 795.60 |

| Previous Close | 798.00 |

| Day's Range | 794.00 - 806.60 |

| 52-Week Range | 586.85 - 805.60 |

| Beta | 1.00 |

| RSI | 67.73 |

| Earnings Date | Feb 20, 2026 |

About SEGRO

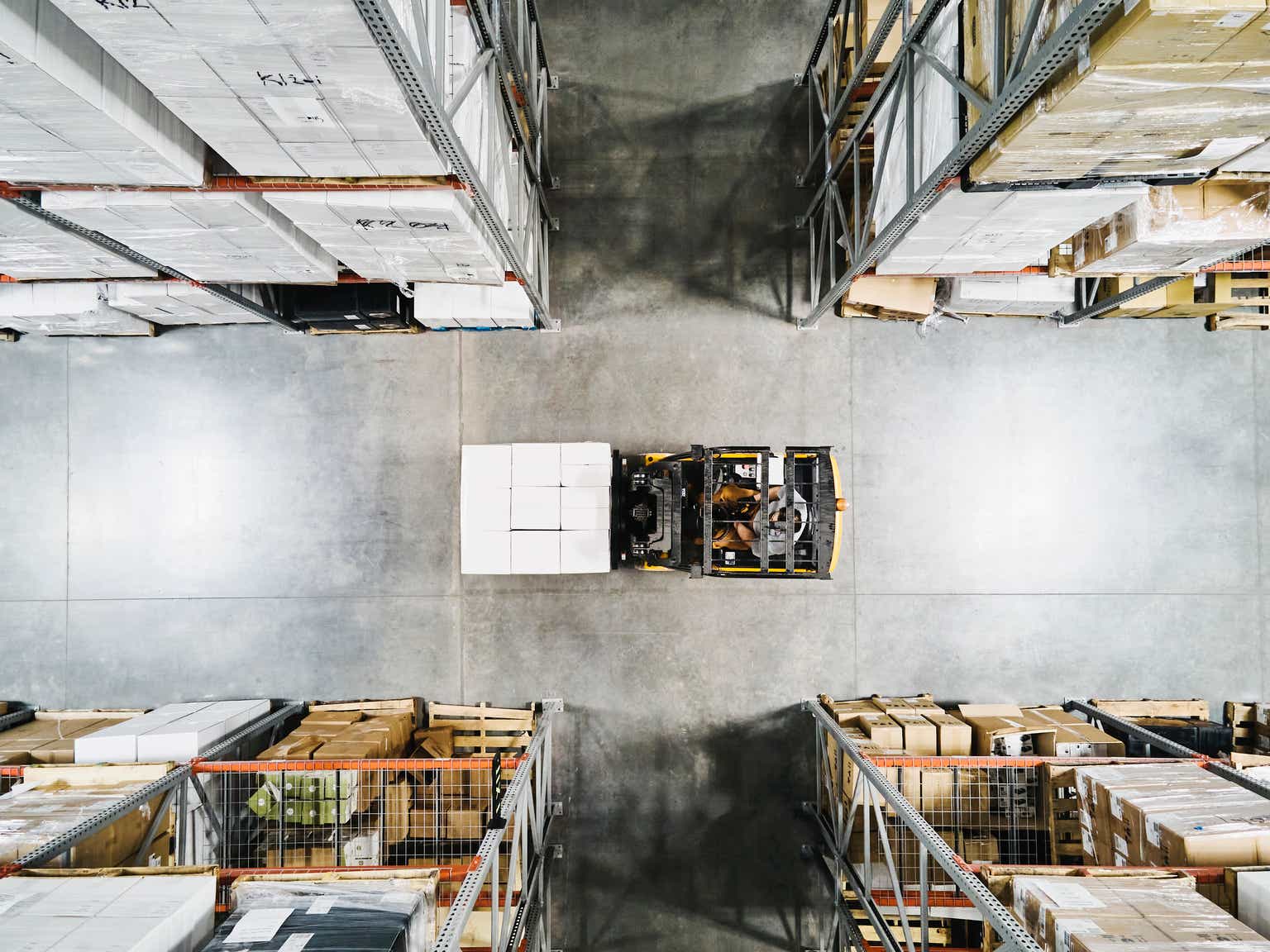

SEGRO is a UK Real Estate Investment Trust (REIT), listed on the London Stock Exchange and Euronext Paris, and is a leading owner, manager and developer of modern warehouses, industrial property and data centres. It owns or manages 10.8 million square metres of space (116 million square feet) valued at £21.4 billion serving customers from a wide range of industry sectors. Its properties are located in and around major cities and at key transportation hubs in the UK and in seven other European countries. For over 100 years SEGRO has been creatin... [Read more]

Financial Performance

Financial StatementsNews

Why I Am Picking Segro Over Prologis For The AI Boom

Segro (SEGXF) stands out among industrial REITs with strong European growth, data centre potential, and attractive valuation. See more analysis here.

Only 3 REITs For The Next 10 Years

Quality and growth dictate long-term returns. Industrial, data centers, self-storage, and co-working are great property sectors for long-term-oriented investors. If I had to pick just 3 REITs for the ...

Segro seeks planning permission for lucrative data centre joint venture

Property developer Segro is betting on data centres to power returns next year and beyond, as the AI revolution supercharges demand for critical infrastructure.

FTSE 100 Rises as Banks Rebound and Wall Street Gains Boost Sentiment

FTSE 100 opens higher as Wall Street gains, Segro leads, BPS debt pressures linger in UK. The post FTSE 100 Rises as Banks Rebound and Wall Street Gains Boost Sentiment appeared first on Investomania ...

UK Stock Market News: Coca Cola, Unilever, SEGRO

Coca Cola share buybacks suspended, Magnum demerger faces delay amidst US govt shutdown, solid Q3 from SEGRO as rental income keeps rising

Deep Undervaluation Makes SEGRO A Potential Acquisition Target

SEGRO Plc 2025 Q2 - Results - Earnings Call Presentation

The following slide deck was published by SEGRO Plc in conjunction with their 2025 Q2 earnings call.

SEGRO Plc (SEGXF) Q2 2025 Earnings Call Transcript

SEGRO: Line-Of-Sight To Significant Future Growth

SEGRO is a top-tier European REIT now trading at a significant discount to NAV, despite robust fundamentals and strong structural tailwinds. The company boasts stable occupancy, embedded rent growth p...

Segro: Leaning Towards Data Centers For Growth

Segro's investment in converting a London warehouse into a 56 MW data center will be 10x the rental, leveraging existing assets for higher returns. The joint venture with Pure Data Centers minimizes c...

Segro partners with Oaktree-owned Pure on £1bn data centre in London

Attractive returns lure landlords to build fully serviced facilities as AI fuels fast-expanding sector

Segro PLC (SEGXF) (Q4 2024) Earnings Call Highlights: Strong Rent Commitments and Strategic ...

Segro PLC (SEGXF) (Q4 2024) Earnings Call Highlights: Strong Rent Commitments and Strategic Growth Initiatives

Full Year 2024 Segro PLC Earnings Call Transcript

Full Year 2024 Segro PLC Earnings Call Transcript

UK's Segro plans data centre strategy shift as AI booms

Segro , which has historically offered data centres equipped only with power connections, plans to develop full-fledged facilities to directly serve major cloud providers like Amazon, Microsoft , and ...

Segro Swings to Pretax Profit, Rental Income Rises

UK Stock Market News: NatWest, SEGRO, Wood Group

NatWest dividends up 26%, govt stake now below 7%, SEGRO mgmt hail trading momentum, "Disappointing" performance from Wood Group

Segro: Beating The Odds In A Struggling European Market

Segro is the UK's largest real estate firm with solid growth and a 4% dividend yield. See why SEGXF stock is a "buy" with a target price of GBX 890.

The More It Drops, The More I Buy

The stock market just suffered a dip, and I am buying it. The long-term outlook has not changed and therefore, the more it drops, the more I will buy. I discuss why and highlight 3 quick picks I'm buy...

SEGRO: Silver Linings Amid The Latest Drawdown

SEGRO’s cyclical downturn may soon reverse with favorable trends. Discover why SEGXF stock, at a deep discount, could be a great buy now.

Segro fails in Tritax EuroBox takeover after Brookfield strikes deal

On Monday, Segro said that its all-share takeover deal for Tritax EuroBox, which it agreed in early September, ‘has lapsed’.

Brookfield and Segro to split Tritax EuroBox in €470mn deal

Canadian asset manager agrees to sell warehouse assets after triumphing in takeover bid

Ikea sales slump after Swedish retailer cuts prices

In an escalation of the bidding war for Tritax Eurobox, the commercial landlord snubbed Segro and backed a new £1.1bn offer from Brookfield Asset Management.

Brookfield Outbids Segro With $728 Million Deal to Buy Tritax EuroBox

Tritax EuroBox—a London-listed, continental Europe-focused investment trust specializing in logistics real estate—last month warned it faced challenges remaining as an independent company.

Brookfield Makes £557 Million Tritax Eurobox Bid, Topping Segro

Brookfield Corp. edged ahead of Segro Plc in the battle to buy warehouse landlord Tritax EuroBox Plc with a recommended cash offer that values the company at £557 million ($729 million).

Tritax bid battle takes fresh twist with new £1.1 bn cash offer from Brookfield

Canadian property giant makes all cash offer at a 6% premium to previous agreed Segro deal