PJSC LUKOIL (MOEX:LKOH)

Russia · Delayed Price · Currency is RUB

Russia · Delayed Price · Currency is RUB | Market Cap | 2.53T |

| Revenue (ttm) | 7.89T -8.8% |

| Net Income | 545.30B -53.8% |

| EPS | 828.89 -51.4% |

| Shares Out | 647.94M |

| PE Ratio | 4.72 |

| Forward PE | n/a |

| Dividend | 553.00 (14.14%) |

| Ex-Dividend Date | n/a |

| Volume | 359,490 |

| Average Volume | 511,395 |

| Open | 3,959.50 |

| Previous Close | 3,956.00 |

| Day's Range | 3,902.50 - 3,980.00 |

| 52-Week Range | 3,019.50 - 7,525.00 |

| Beta | 0.18 |

| RSI | 40.69 |

| Earnings Date | Mar 13, 2026 |

About PJSC LUKOIL

PJSC LUKOIL, together with its subsidiaries, explores for, develops, and produces oil and natural gas in Russia and internationally. It operates in Exploration and Production, and Refining and Distribution segments. The company offers petroleum products, natural and liquified petroleum gases, petrochemicals, lubricants, biofuel blends, jet fuels, fuel and lubes for vessels, bunkering services in ports, and fuel cards. It is also involved in the hydrocarbons refining operations; transportation and trading; wholesale and retail sales of oil and p... [Read more]

Financial Performance

In 2024, PJSC LUKOIL's revenue was 8.62 trillion, an increase of 8.74% compared to the previous year's 7.93 trillion. Earnings were 848.51 billion, a decrease of -26.51%.

Financial StatementsNews

Bulgaria's Lukoil Refinery Slashes Costs By $8 Million

Bulgaria’s Lukoil Neftohim Burgas refinery has saved $8 million in just two months after dropping its Swiss-based trading intermediary Litasco SA, with Special Commercial Administrator Rumen Spetsov t...

Chevron Stays in the Hunt for Lukoil’s International Assets

A consortium comprising Chevron and a group led by an investment bank continues negotiations with Lukoil and U.S. officials to buy the Russian firm’s international assets, even as Lukoil has signed a ...

Ukraine war briefing: Kyiv and Moscow hold major prisoner exchange

Whitkoff says ‘significant work remains’ as second day of US-led peace talks in Abu Dhabi concludes: What we know on day 1,444 Ukraine and Russia concluded a second round of US-brokered talks in Abu D...

Private Equity’s Quiet Pivot Into Sanctioned Energy Space

Geopolitics are clearly again at play in the ongoing story surrounding Russia’s Lukoil international asset sale. The return of geopolitics, as clearly evident in energy markets, is putting investors o...

Russia's Lukoil Reaches Tentative Deal To Sell Most Overseas Assets To US Private Equity Firm Carlyle Amid Sanctions

Russia’s second-largest oil producer Lukoil reached a tentative agreement on Thursday to sell the majority of its international assets to U.S. private equity firm Carlyle Group , as Western sanctions ...

Reliance Industries Slashes Russian Crude Imports Under U.S. Sanctions Pressure

India’s largest private refiner, Reliance Industries, will import about 150,000 barrels per day (bpd) of non-sanctioned Russian crude from February, as it limits intake from Russia and complies with t...

Lukoil agrees to sell most of its foreign assets to US investment group

The Carlyle deal does not include Lukoil's assets in Kazakhstan and is still subject to approval by the U.S. Treasury Department, the Russian energy giant said.

Lukoil Signs Agreement With Carlyle To Sell International Assets

(RTTNews) - PJSC Lukoil (LKOH.ME), on Thursday, said it has signed an agreement with U.S. investment firm The Carlyle Group Inc. (CG, CGABL) to sell Lukoil International GmbH, its wholly owned subsidi...

Lukoil (LUKOY) Agrees to Sell International Assets to Carlyle Group

Lukoil (LUKOY) Agrees to Sell International Assets to Carlyle Group

Lukoil Agrees to Sell Most Foreign Assets to Carlyle Group

Russia’s Lukoil PJSC agreed to sell most of its international assets to US private equity giant Carlyle Group.

Russia's Lukoil to sell international subsidiary to Carlyle

Chevron Eyes Lukoil’s Iraqi Oilfield—but Only on Better Terms

Following the U.S. sanctions on Russia’s Lukoil, which operated one of Iraq’s largest oilfields, Baghdad temporarily took control over the West Qurna 2 project, which accounts for 10% of all Iraqi oil...

Kazakhstan Seeks U.S. Approval to Buy Lukoil’s Kazakh Assets

Kazakhstan has filed a formal bid with the U.S. Treasury seeking authorization to buy out the Kazakh assets of Russia’s sanctioned oil firm Lukoil, Kazakhstan’s Energy Minister Yerlan Akkenzhenov said...

Chevron seeks better terms from Iraq before taking over Lukoil oilfield, Reuters’ sources say

U.S. oil major Chevron is pushing Iraq to improve returns on the giant West Qurna 2 oil field as a condition for buying the project from Russia’s Lukoil, three sources familiar with the matter said.

Lukoil Asks Moscow for Aid as Oil Sells at Steep Discounts

Lukoil has approached the Russian government seeking changes to the oil tax formula as discounts on Russian crude exceed $20 per barrel, a level that would force producers to make net payments into th...

Lukoil’s international assets and potential buyers

The U.S. Treasury has extended the deadline for sanctioned Russian oil firm Lukoil to negotiate the sale of the bulk of its international assets until Feb. 28.

Ukraine war briefing: Zelenskyy declares state of emergency as cities shiver from energy attacks

Night-time temperatures dip close to -20C; minister outlines major problems with desertion and conscription evasion. What we know on day 1,422 Volodymyr Zelenskyy is to declare a state of emergency in...

Is Iraq About to Make Its Biggest Geopolitical Pivot in Years?

Following the Iraq Oil Ministry’s recent dispatch of exclusive invitations to several major U.S. energy firms to develop the country’s huge West Qurna 2 oilfield after the forced exit of Russian oil n...

Ukraine war briefing: Nightfall – Britain races to develop ballistic missile for Kyiv

UK government starts contest to have deep-strike prototypes delivered within 12 months; heat-starved Kyiv under Russian attack again. What we know on day 1,419 Britain is to develop a new deep-strike ...

Ukraine strikes Russian oil rigs in the Caspian sea

Ukraine struck three Russian oil rigs operating in the Caspian Sea on Sunday following Moscow’s large-scale bombardment over the weekend that left thousands without heat or power in Kyiv. Footage rele...

Lukoil’s Fire Sale and the New Era of Sanctions-by-Ownership

Even as geopolitical developments, such as Venezuela and Iran, are making headlines, another major energy-related issue is currently being unwound. At present, the fire sale of Russian oil and gas gia...

Russian Oil Production Dips as U.S. Sanctions Bite

Russia’s crude oil production dipped to 9.326 million barrels (bpd) in December, down by over 100,000 bpd from November and nearly 250,000 bpd lower than Moscow’s OPEC+ quota, sources familiar with cl...

Iraq Moves to Take Over Operations at West Qurna 2

The Iraqi government has approved a move to take over operations at the West Qurna 2 oilfield under provisions in its technical service contract with Russia’s Lukoil, following the company’s declarati...

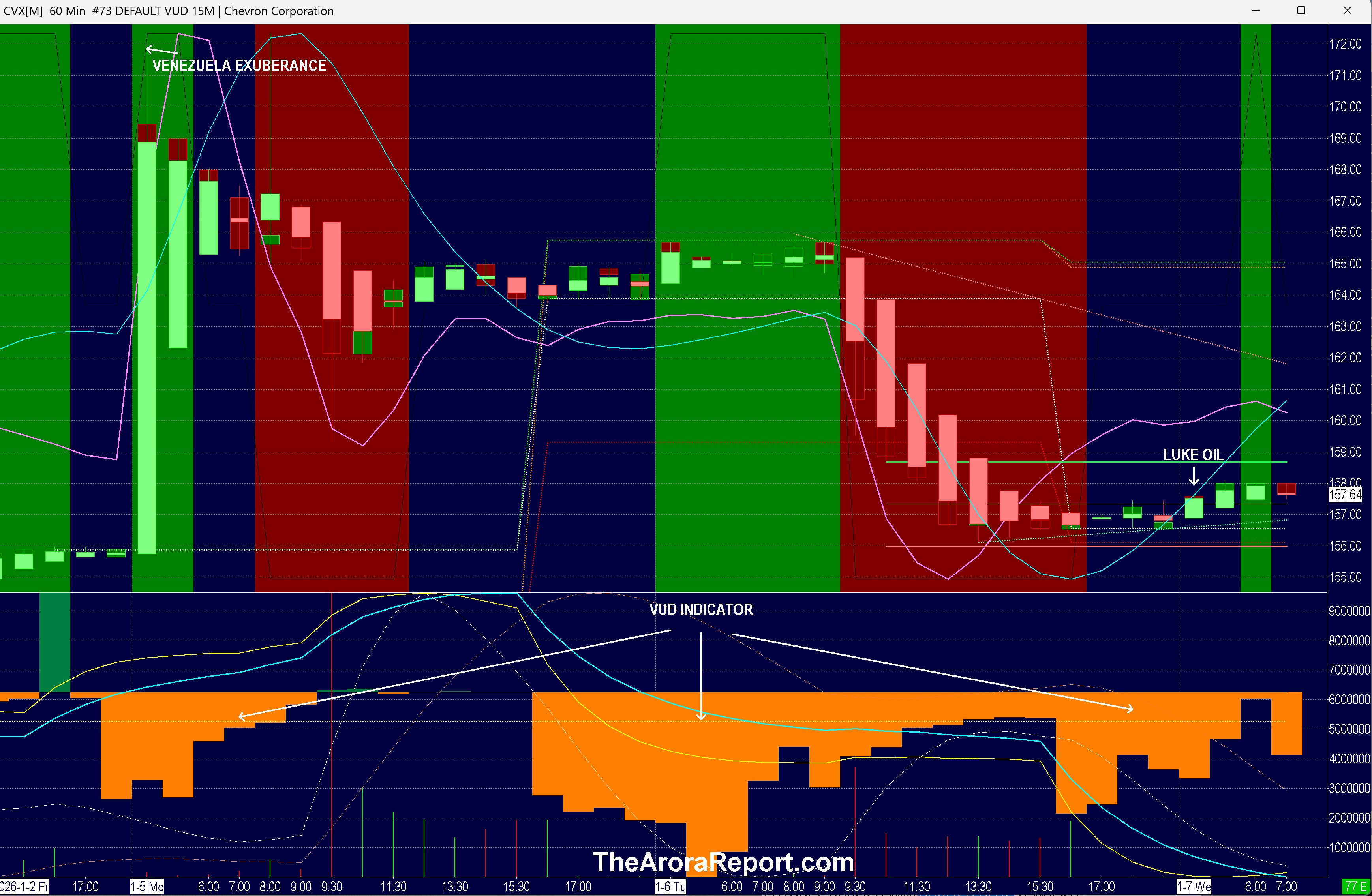

Nvidia Triggers Mania In Micron And SanDisk; Momo Loses in Chevron Euphoria; Supreme Court's Tariff Decision Ahead

NAND Mania Please click here for an enlarged chart of Chevron Corp (NYSE: CVX). Note the following: The chart shows that on the morning of January 5th, Chevron (CVX) traded as high as $172 in the pre...

Chevron and Quantum Energy Partners Eye Lukoil's International Assets

Chevron and Quantum Energy Partners Eye Lukoil's International Assets