Fanuc Corporation (FANUY)

| Market Cap | 25.29B |

| Revenue (ttm) | 5.32B |

| Net Income (ttm) | 985.37M |

| Shares Out | n/a |

| EPS (ttm) | 1.05 |

| PE Ratio | 25.67 |

| Forward PE | n/a |

| Dividend | 0.64 (4.95%) |

| Ex-Dividend Date | Mar 28, 2025 |

| Volume | 28,350 |

| Average Volume | 414,296 |

| Open | 13.20 |

| Previous Close | 13.59 |

| Day's Range | 13.20 - 13.62 |

| 52-Week Range | 10.54 - 15.50 |

| Beta | 0.51 |

| RSI | 55.09 |

| Earnings Date | Jul 25, 2025 |

About Fanuc

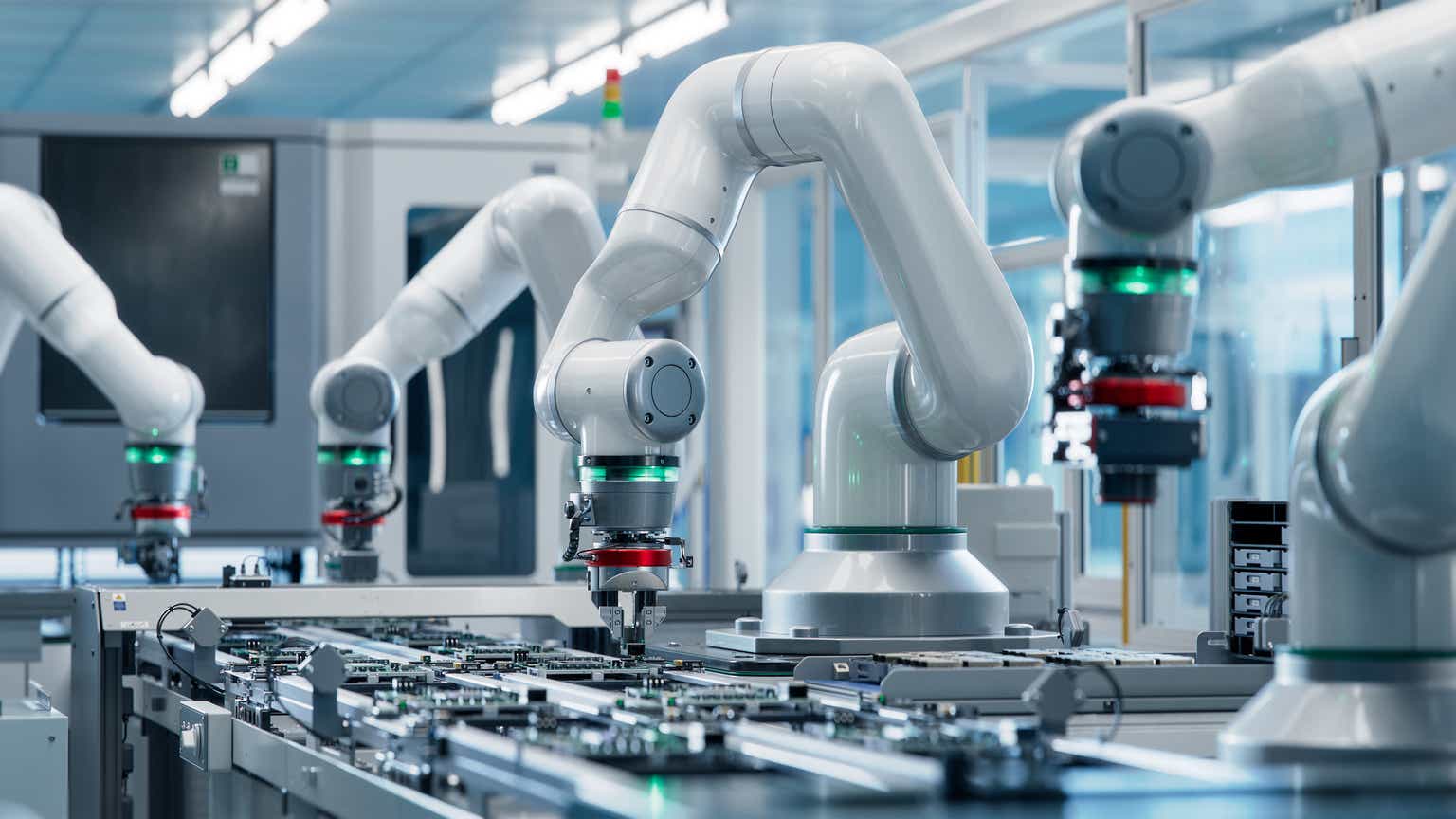

Fanuc Corporation provides factory automation products in Japan, the Americas, Europe, China, the rest of Asia, and internationally. The company offers CNC series products, servo motors, lasers, robots, compact machining centers, electric injection molding machines, wire electrical discharge machines, and ultra-precision machines. It also provides FANUC intelligent edge link and drive system, an open platform for the manufacturing industry. Fanuc Corporation was incorporated in 1950 and is headquartered in Yamanashi, Japan. [Read more]

Financial Performance

In 2024, Fanuc's revenue was 797.13 billion, an increase of 0.23% compared to the previous year's 795.27 billion. Earnings were 147.56 billion, an increase of 10.81%.

Financial numbers in JPY Financial StatementsNews

FANUC Introduces Enhanced, Next-Gen ROBOGUIDE Robot Simulation Software

The future of robot simulation is here, with the most advanced iteration of offline robot programming and simulation—FANUC’s ROBOGUIDE V10—featuring more performance and significantly improved user ex...

Innovating Tomorrow: FANUC to Showcase Cutting-Edge Robotics and Automation Solutions at Automate 2025

From collaborative robots to advanced vision technologies, FANUC showcases groundbreaking innovations designed to maximize efficiency and transform manufacturing processes. ROCHESTER HILLS, Mich. — FA...

Fanuc: Bullish For The Short Term And The Long Run

Fanuc is a leader in the US robot market, with strong segment growth. Read why FANUF stock is a Buy, priced attractively relative to its peers.

Fanuc: A Robotics Company Too Volatile For My Preference; Instead, I Would Consider An ETF

Despite a strong market position and a clean balance sheet, Fanuc's inability to improve margins amid revenue growth is troubling. Explore more details here.

Fanuc Corporation: Brighter Outlook With Eyes On China, India

Investors should consider buying Fanuc Corporation as analysts and management raise forecasts, with growth potential in China and India markets.

A New Era of FANUC’s ROBODRILL Vertical Machining Center with More Offerings than Ever

The new FANUC ROBODRILL α-D28LiB5ADV Plus Y500 features a larger table, more tools, new capabilities, all in the same space-saving footprint. ROCHESTER HILLS, Mich. — FANUC America, a global industria...

Transforming the World Through Automation: FANUC’s Innovative Solutions at IMTS 2024

New Robots, Cobots, Materials Joining and Controller Technologies to Debut Sept. 9-14 ROCHESTER HILLS, Mich. — FANUC, a global industrial automation leader, is set to unveil its latest lineup of robot...

Fanuc Corporation: Turning Bullish On Potential Results Beat (Rating Upgrade)

I anticipate that Fanuc Corporation's financial performance for the first quarter of the new fiscal year will surpass the sell side's expectations. Fanuc Corporation's shares are undervalued based on ...

Why Japan's stock market could keep soaring — plus three stock picks there

Christian Heck of First Eagle makes the case that Japan's stock market is still inexpensive as its companies improve

International Wide-Moat Stocks On Sale - The February 2024 Heat Map

Our 3-step process focuses on wide-moat stocks (as per Morningstar's rating). We are only interested in those targets that are attractively valued in historical comparison.

Five-star fund manager bets on cheap AI, beer and China plays

What are big money managers worried about? “The problem is we're priced for a soft landing.

Fanuc Corporation: Watch Capital Return And Financial Prospects

Fanuc Corporation pays out a reasonably high proportion (60%) of its earnings as dividends, and the company is targeting to achieve JPY50 billion of share repurchases for full-year FY 2023. The compan...

Fanuc: Inventory Overhang In The Spotlight

The consensus financial estimates for Fanuc Corporation have been revised downwards, despite the fact that the company's recent quarterly results were better than what the market anticipated. Inventor...

International Wide-Moat Stocks On Sale - The October 2023 Heat Map

Our 3-step process focuses on wide-moat stocks (as per Morningstar's rating). We are only interested in those targets that are attractively valued in historical comparison. We share the heat map of th...

International Wide-Moat Stocks On Sale - The August 2023 Heat Map

Our 3-step process focuses on wide-moat stocks (as per Morningstar's rating). We are only interested in those targets that are attractively valued in historical comparison. We share the heat map of th...

Fanuc Is Worth Buying If This Economic Slowdown Provides A Dip

Fanuc is in an industry expected to witness sustained tailwinds. The company has a reputation for making products that are strong, rugged, and precise.

Final Trades: Delta Air Lines, MSCI & more

The "Halftime Report" traders give their top picks to watch for the second half.

Fanuc Corporation Has A Balanced Risk-Reward Profile (Rating Upgrade)

The key positives for Fanuc Corporation are its attractive valuations and the favorable change in analyst sentiment. Fanuc's key negatives relate to its modest pricing power and the challenges in cros...

Fanuc: A Peek At This Leader In Industrial Robotics

A leader within industrial robotics and CNC machinery based out of Japan. Fanuc is consistently a profitable company, but also one with volatility in performance despite operating in a high growth ind...

The Fanuc Story Is Getting More Interesting

Fanuc beat sales, profit, and order expectations in the fiscal third quarter, with management raising guidance and sounding relatively bullish on orders.

Fanuc: Improving Profitability And Strong Order Visibility

Fanuc's FY3/2021 results highlighted high free cash flow generation driven by normalizing capex and improving profitability. The book-to-bill order outlook driven by China demand is the highest seen o...

Final Trades: Zynga, Becton Dickinson & more

The "Halftime Report" investment committee give their top picks to watch for the second half.

Fanuc - Free Cash Flow Generation To Recover

Free cash flow generation at Fanuc is set to improve significantly, after completing a five-year investment period which cost over ¥700 billion. The business model has high underlying profitability, w...

Fanuc Corporation Trying To Maintain Its Industry Position

I am still neutral on Fanuc due to its reliance on the automobile industry, but I see potential growth as the company is less dependent on one region.

FANUC Group - Zelkova Trees And Reasons To Think FY '20 Could Be Better Than Estimates

Despite Q1 FY ’20 results sending the ADR 4% lower, FANUC is up more than 50% since April 1.