Grainger plc (GRGTF)

| Market Cap | 1.93B -1.5% |

| Revenue (ttm) | 353.12M -9.4% |

| Net Income | 272.33M +549.4% |

| EPS | 0.37 +550.0% |

| Shares Out | n/a |

| PE Ratio | 7.07 |

| Forward PE | 12.12 |

| Dividend | n/a |

| Ex-Dividend Date | n/a |

| Volume | 500 |

| Average Volume | 4,669 |

| Open | 2.615 |

| Previous Close | 2.800 |

| Day's Range | 2.615 - 2.615 |

| 52-Week Range | 2.300 - 3.075 |

| Beta | 0.77 |

| RSI | 48.64 |

| Earnings Date | May 14, 2026 |

About Grainger

Grainger plc designs, builds, develops, owns and operates rental homes in the United Kingdom. The company operates through Private rented sector (PRS), Reversionary, and Others segments. The PRS segment includes stabilized PRS assets, as well as private rented under construction due to direct development and forward funding arrangements. The Reversionary segment includes regulated tenancies, as well as CHARM, a portfolio of residential mortgages. The Other segment includes legacy strategic land and development arrangements. The company was form... [Read more]

Financial Performance

In fiscal year 2025, Grainger's revenue was 262.70 million, a decrease of -9.45% compared to the previous year's 290.10 million. Earnings were 202.60 million, an increase of 549.36%.

Financial numbers in GBP Financial StatementsNews

Q4 2025 WW Grainger Inc Earnings Call Transcript

Q4 2025 WW Grainger Inc Earnings Call Transcript

Grainger outlines 2026 revenue outlook of $18.7B–$19.1B as AI and supply chain expansion drive momentum

Grainger shares rise to 13-month high on revenue beat

Grainger (GWW) Q4 2025 Earnings Call Transcript

Grainger (GWW) Q4 2025 Earnings Call Transcript

Grainger (GWW) Reports Solid Q4 Revenue Amid Challenging Conditions

Grainger (GWW) Reports Solid Q4 Revenue Amid Challenging Conditions

Iconic Equities, Shoreline Capital, and Overlook Ventures Break Ground on Pineville Distribution Center, a 194,232 Square-Foot Industrial Development in Charlotte, NC

Strategic Infill Project Marks Final Undeveloped Site in Pineville Industrial Corridor PINEVILLE, N.C. , Jan. 26, 2026 /PRNewswire/ -- In partnership with LaSalle Investment Management (LaSalle), co-d...

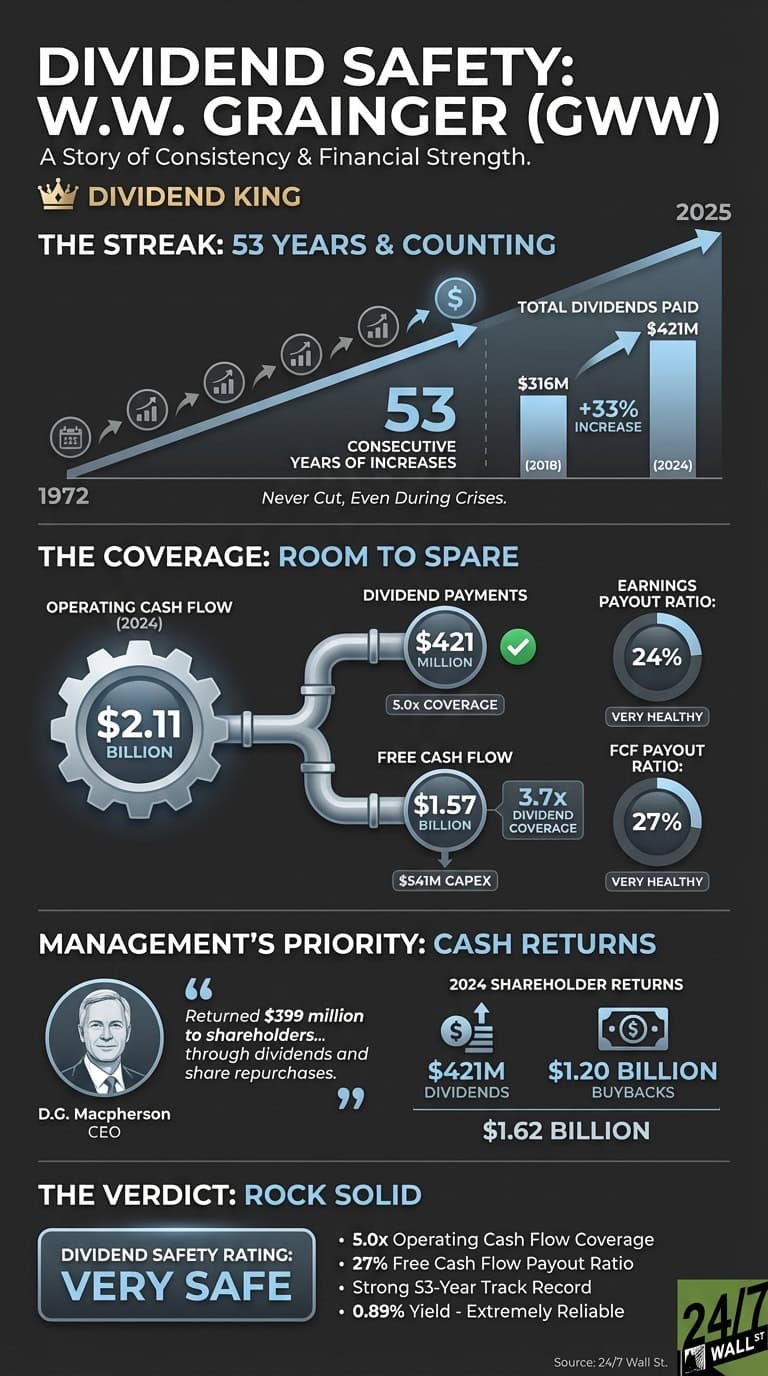

Grainger Generates Five Dollars of Cash for Every Dollar Paid to Shareholders

W.W. Grainger Inc. (NYSE: GWW) pays an annual dividend of $8.62 per share with a yield of 0.89%. The company has raised its dividend for 53 consecutive years, placing it among the elite Dividend Kings...

Grainger plc (GRGTF) Q4 2025 Earnings Call Transcript

Grainger plc (GRGTF) Q4 2025 Earnings Call Transcript

Full Year 2025 Grainger PLC Earnings Presentation Transcript

Full Year 2025 Grainger PLC Earnings Presentation Transcript

Grainger PLC (GRGTF) Full Year 2025 Earnings Call Highlights: Strong Growth Amidst Regulatory ...

Grainger PLC (GRGTF) Full Year 2025 Earnings Call Highlights: Strong Growth Amidst Regulatory Challenges

Full Year 2025 Grainger PLC Earnings Call Transcript

Full Year 2025 Grainger PLC Earnings Call Transcript

Grainger plc (GRGTF) Q4 2025 Earnings Call Transcript

Grainger plc 2025 Q4 - Results - Earnings Call Presentation

Grainger: Positioned To Capitalize On B2B Industry Consolidation

Grainger (GWW) Q3 2025 Earnings Call Transcript

Grainger (GWW) Q3 2025 Earnings Call Transcript

Q3 2025 WW Grainger Inc Earnings Call Transcript

Q3 2025 WW Grainger Inc Earnings Call Transcript

Grainger outlines 4.4%–5.1% 2025 sales growth target as company exits U.K. market

Grainger (GWW) Reports Strong Q3 Revenue Surpassing Expectations

Grainger (GWW) Reports Strong Q3 Revenue Surpassing Expectations

Grainger Ready to Report Q3 Earnings: What's in Store for the Stock?

GWW's Q3 results are likely to reflect steady sales growth, led by High-Touch and Endless Assortment gains, though costs are anticipated to have pressured margins.

Grainger Welcomes Renters' Rights Bill, Citing Alignment With Build To Rent Strategy

(RTTNews) - Grainger plc. (GRI.L), UK-listed provider of private rental homes with a strong presence in the Build to Rent or BTR sector, announced that it has welcomed the progress of the Renters' Rig...

UK Stock Market News: HSBC, Grainger, Greencore

HSBC to book $1.1bn provision in Q3, Grainger finds upside in UK rent reform, Greencore’s Bakkavor bid largely passes CMA’s first inspection

Grainger (GWW) Divests Cromwell Business and Plans Zoro U.K. Closure

Grainger (GWW) Divests Cromwell Business and Plans Zoro U.K. Closure

Grainger (GWW) Sells U.K. Cromwell Business to AURELIUS

Grainger (GWW) Sells U.K. Cromwell Business to AURELIUS

Grainger announces agreement to divest cormwell

Grainger exits UK market, selling Cromwell to Aurelius and closing Zoro UK. Learn why this strategic move affects investors and what to expect next.

Barclays Assigns Underweight Rating to Grainger (GWW) with $963 Target

Barclays Assigns Underweight Rating to Grainger (GWW) with $963 Target