Shin-Etsu Chemical Co., Ltd. (SHECY)

| Market Cap | 66.76B +3.4% |

| Revenue (ttm) | 16.36B +1.8% |

| Net Income | 3.10B -11.1% |

| EPS | 1.63 -7.0% |

| Shares Out | n/a |

| PE Ratio | 21.55 |

| Forward PE | n/a |

| Dividend | 0.70 (3.88%) |

| Ex-Dividend Date | Mar 30, 2026 |

| Volume | 5,012 |

| Average Volume | 725,849 |

| Open | 18.09 |

| Previous Close | 17.85 |

| Day's Range | 18.00 - 18.11 |

| 52-Week Range | 11.88 - 18.75 |

| Beta | 1.10 |

| RSI | 59.28 |

| Earnings Date | Jan 27, 2026 |

About Shin-Etsu Chemical

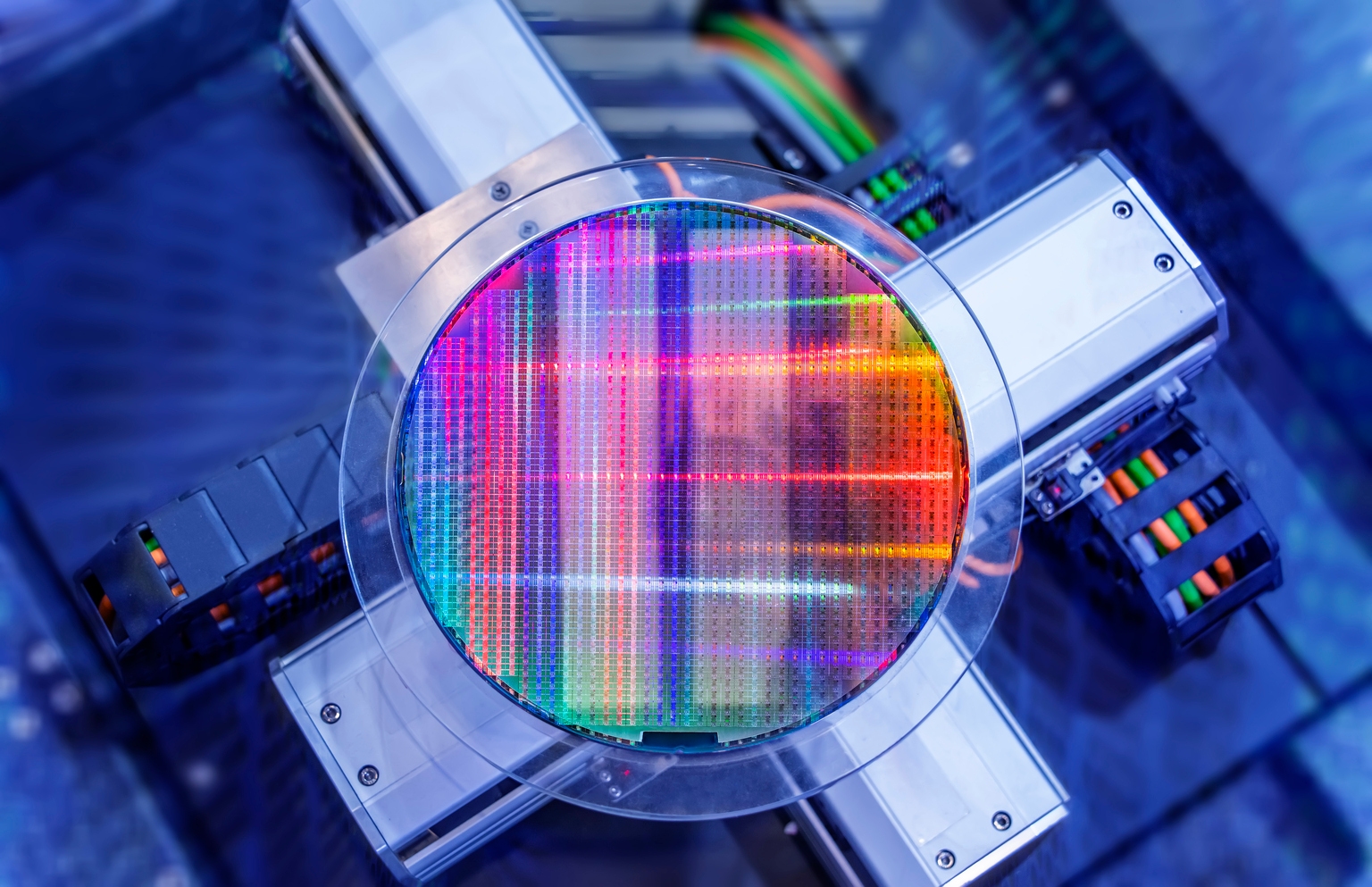

Shin-Etsu Chemical Co., Ltd. provides infrastructure, electronics, and functional materials in Japan. The company operates through Infrastructure Materials, Functional Materials, Electronics Materials, and Processing & Specialized Services segments. It offers polyvinyl chloride resin, caustic soda, methanol, chloromethanes, and polyvinyl alcohol; and semiconductor silicon, rare earth magnets, semiconductor encapsulating materials, LED packaging materials, photoresists, photomask blanks, and synthetic quartz products. The company also sells sili... [Read more]

Financial Performance

In fiscal year 2025, Shin-Etsu Chemical's revenue was 2.56 trillion, an increase of 6.06% compared to the previous year's 2.41 trillion. Earnings were 534.02 billion, an increase of 2.67%.

Financial numbers in JPY Financial StatementsNews

Silicone Market worth $33,246.3 Million by 2030, at a CAGR of 5.2%, says MarketsandMarkets™

Delray Beach, FL, Feb. 03, 2026 (GLOBE NEWSWIRE) -- The Silicone Market was worth USD 24,502.4 million in 2024 and is projected to reach USD 33,246.3 million by 2030, at a CAGR of 5.2%, as per the rec...

Methyl Cellulose Market worth $5.88 billion by 2030, at a CAGR of 10.0%, says MarketsandMarkets™

Delray Beach, FL, Jan. 20, 2026 (GLOBE NEWSWIRE) -- The Methyl Cellulose Market size is valued at USD 3.64 billion in 2025 and is expected to reach USD 5.88 billion by 2030, at a CAGR of 10.0% during ...

Shin-Etsu Chemical: Grinding Through A Persistent Downturn (Downgrade)

Shin-Etsu Chemical stock is a "Buy" amid buybacks and an attractive valuation. Learn more about the company's outlook and potential upside.

Rare Earth Magnets Market worth $30.01 billion by 2030 at 6.4%, says MarketsandMarkets™

Delray Beach, FL, Dec. 02, 2025 (GLOBE NEWSWIRE) -- In terms of value, the Rare Earth Magnets Market size is projected to be USD 21.98 billion in 2025 and reach USD 30.01 billion by 2030, at a CAGR of...

Shin-Etsu Chemical: Look Past The Quarterly Miss

I rate Shin-Etsu a "Buy," with recent underperformance considered temporary and a turnaround expected. The weakness for the Infrastructure Materials segment was driven by FX headwinds and weak U.S. PV...

Silicone Market worth $33,246.3 million by 2030, at a CAGR of 5.2%, says MarketsandMarkets™

Delray Beach, FL, Oct. 20, 2025 (GLOBE NEWSWIRE) -- The Silicone Market was worth USD 24,502.4 million in 2024 and is projected to reach USD 33,246.3 million by 2030, at a CAGR of 5.2%, as per the rec...

Shin-Etsu Chemical Is Undervalued As It Battles Through Uncertainty And Volatility

Shin-Etsu is a proven high-quality specialty material producer leveraged to low-cost PVC production. Click here to find out why SHECY stock is a Strong Buy.

Cyclical Worries Open A Window Of Opportunity With Shin-Etsu Chemical

Shin-Etsu Chemical to Develop a QSTTM Substrate for 300-mm GaN

TOKYO--(BUSINESS WIRE)--Shin-Etsu Chemical Co., Ltd. (TOKYO: 4063)(Head Office: Tokyo; President: Yasuhiko Saitoh; hereinafter, “Shin-Etsu Chemical”) has created a 300-mm (12-inch) QSTTM substrate, wh...

Shin-Etsu Chemical Remains A Superior Operator And Well-Leveraged To End-Market Recoveries

Shin-Etsu Chemical had a challenging FY'24, as the company saw weaker housing activity hit PVC demand as well as a sharp correction in semiconductor materials and other construction/industrial chemica...

Shin-Etsu Chemical: Developing Equipment to Manufacture Semiconductor Package Substrates for the Back End Process and Pursuing a New Manufacturing Method

TOKYO--(BUSINESS WIRE)--Shin-Etsu Chemical Co., Ltd. (TOKYO: 4063) (Head Office: Tokyo; President: Yasuhiko Saitoh; hereinafter, “Shin-Etsu Chemical”) has developed equipment to manufacture semiconduc...

Eight stock picks in AI, obesity drugs, e-commerce and other growth areas beyond the S&P 500

It is understandable for U.S. investors to be focused on the largest technology companies that have driven such strong performance for the S&P 500 over the past decade. But learning about strategies t...

Shin-Etsu Chemical to further drive forward its QST® substrate business for implementation in GaN power devices

TOKYO--(BUSINESS WIRE)--Shin-Etsu Chemical Co., Ltd. (Head Office: Tokyo; President: Yasuhiko Saitoh) has determined that QST® (Qromis Substrate Technology) substrate*1 is an essential material for th...

Cycle Worries Have Opened A Window Of Opportunity At Shin-Etsu Chemical

Shin-Etsu shares have lagged on worries about the housing-driven PVC business and the impact of weaker electronics demand on the semiconductor and silicone products businesses. PVC prices have correct...

Shin-Etsu Going Through A Choppy Bit, But Still Attractive

Shin-Etsu is likely to see near-term weakness in PVC/Chlor-alkali and Silicon, even as the semiconductor industry recovers and construction activity remains fairly healthy.