Thungela Resources Limited (TNGRF)

| Market Cap | 913.88M -4.1% |

| Revenue (ttm) | 1.89B +1.8% |

| Net Income | 144.00M -24.1% |

| EPS | 1.08 -20.6% |

| Shares Out | n/a |

| PE Ratio | 6.35 |

| Forward PE | n/a |

| Dividend | n/a |

| Ex-Dividend Date | n/a |

| Volume | 16,400 |

| Average Volume | 8,374 |

| Open | 6.80 |

| Previous Close | 6.58 |

| Day's Range | 6.71 - 7.20 |

| 52-Week Range | 4.25 - 7.20 |

| Beta | -0.89 |

| RSI | 63.57 |

| Earnings Date | Mar 23, 2026 |

About Thungela Resources

Thungela Resources Limited engages in the mining and production of thermal coal in South Africa and Australia. It owns interests in and produces its thermal coal from mining operations, consisting of underground and open cast mines in the Mpumalanga province of South Africa, including Goedehoop colliery, Greenside colliery, Isibonelo colliery, Khwezela colliery, Zibulo colliery, and Mafube colliery. It also holds 85% of the Ensham Mine located in Queensland, Australia. The company also exports its products to Indian, Asian, Southeast Asian, the... [Read more]

Financial Performance

In 2024, Thungela Resources's revenue was 35.55 billion, an increase of 16.06% compared to the previous year's 30.63 billion. Earnings were 3.59 billion, a decrease of -30.41%.

Financial numbers in ZAR Financial StatementsNews

Thungela Resources: Dividend Expectations Might Leave Investors In The Ash

Thungela Resources (TNGRF) faces weak coal prices and margin pressure; dividend risk is rising.

Thungela Resources Limited (TNGRF) Discusses CFO Pre-Close Statement and Production Performance Update Transcript

Thungela Resources Limited (TNGRF) Q2 2025 Earnings Call Transcript

Thungela Resources GAAP EPS of R 1.92, revenue of R 14.81B; reaffirms FY outlook

Thungela Resources Is A Tempting Value Trap

Thungela Resources Limited (TNGRF) Q4 2024 Earnings Call Transcript

Thungela Resources Limited (OTCPK:TNGRF) Q4 2024 Results Conference Call March 17, 2025 6:00 AM ETCompany ParticipantsHugo Nunes - Head of IRJuly Ndlovu -...

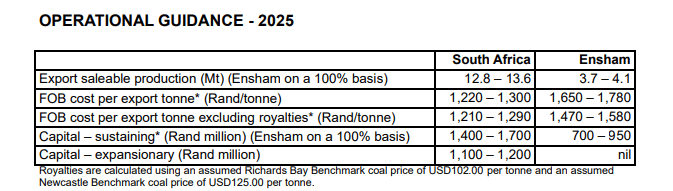

Thungela Resources Non-GAAP EPS of R25.59, revenue of R35.55B; initiates FY25 outlook

Thungela Resources press release (TNGRF): FY Non-GAAP EPS of R25.59. Revenue of R35.55B (+16.1% Y/Y). The Group generated adjusted EBITDA of R6.3 billion.

Thungela Resources Ltd (TNGRF) (Q2 2024) Earnings Call Transcript Highlights: Strong Production ...

Thungela Resources Ltd (TNGRF) (Q2 2024) Earnings Call Transcript Highlights: Strong Production Growth Amidst Softer Coal Prices

Half Year 2024 Thungela Resources Ltd Earnings Call Transcript

Half Year 2024 Thungela Resources Ltd Earnings Call Transcript

Thungela Resources Limited 2024 Q2 - Results - Earnings Call Presentation

Thungela Resources Limited (TNGRF) Q2 2024 Earnings Call Transcript

Thungela Profit Slumps on Lower Coal Prices and Rail Bottlenecks

South African coal exporter Thungela Resources Ltd. said first-half profit slumped almost 60% due to lower prices and rail disruptions.

Thungela: Let's Have A Nudge?

We think Thungela Resources Limited's systematic headwinds are baked into its stock price. Investors might shift their focus to the firm's nimble execution and alluring price multiples. Thungela forec...

Thungela Resources Limited (TNGRF) Q4 2023 Earnings Call Transcript

Thungela Resources Limited (TNGRF) Q4 2023 Earnings Call Transcript

Glencore stock: Lessons from Anglo American and Thungela Resources

Glencore (LON: GLEN) share price has moved sideways in the past few months as investors focus on the company's change of strategy and its implication. The stock was trading at 450p on Friday, its lowe...

Thungela: Is A Tactical Bet In Play?

A tactical bet on Thungela Resources Limited's stock might yield significant returns. Key metrics imply that coal prices have overshot to the downside. Thungela's softened production is likely priced ...

Thungela Resources Limited (TNGRF) Q2 2023 Earnings Call Transcript

Thungela Resources Limited (OTCPK:TNGRF) Q2 2023 Earnings Conference Call August 21, 2023 6:00 AM ET Company Participants Ryan Africa - Head of Investor Relations July Ndlovu - Chief Executive Officer...

Thungela Resources Limited (TNGRF) First Half 2023 Earnings Call Transcript

Thungela Resources Limited (OTCPK:TNGRF) First Half 2023 Earnings Conference Call June 12, 2023 5:00 AM ET Company Participants Ryan Africa - IR Contact Gideon Smith - CFO & Executive Director Confere...

Thungela Resources: Huge Dividends, But Wait For Coal To Bottom

Thungela Resources is a South African coal miner. The company has a very good balance sheet, and the significantly lower EPS this year seems to be already priced in.

Thungela Resources Ltd (TNGRF) Q4 2022 Earnings Call Transcript

Thungela Resources Ltd (OTCPK:TNGRF) Q4 2022 Earnings Conference Call March 27, 2023 6:00 AM ET Company Participants Ryan Africa - IR Contact July Ndlovu - CEO & Executive Director Gideon Smith - CFO ...

Thungela: Stay The Course

Thungela's share price has declined sharply, following thermal coal prices. Despite temporary headwinds, the company is extremely cheap, even at $135 per tonne.

Thungela Resources: Insanely Profitable (Rating Upgrade)

Production and sales volumes have both been severely hampered by Transnet reduced performance. This has led to a further downward revision of guidance.

Thungela Resources: A Money-Printing Machine, Only For The Brave

Thungela Resources is a cheap cash machine. Even after a 50% decline in coal prices, Thungela Resources Limited can produce a free cash flow in excess of 30% under conservative assumptions.

Thungela: 200% Year-To-Date And Going

Thungela's more than 200% year-to-date return and its 26.66% dividend yield seem justified. The company's profiting from an energy crisis, which has called on coal as a stopgap.

Thungela Resources: Pure Play Coal Cash Machine

Thungela Resources is South Africa's premier coal miner listed on London & Johannesburg exchanges. Coal has posted mammoth returns amidst widespread geopolitical volatility.