Kweichow Moutai Co., Ltd. (SHA:600519)

China · Delayed Price · Currency is CNY

China · Delayed Price · Currency is CNY | Market Cap | 1.84T +1.3% |

| Revenue (ttm) | 178.58B +8.1% |

| Net Income | 90.03B +8.9% |

| EPS | 71.75 +9.0% |

| Shares Out | 1.25B |

| PE Ratio | 20.43 |

| Forward PE | 20.41 |

| Dividend | 51.63 (3.46%) |

| Ex-Dividend Date | Dec 19, 2025 |

| Volume | 3,216,016 |

| Average Volume | 6,690,069 |

| Open | 1,466.99 |

| Previous Close | 1,466.21 |

| Day's Range | 1,455.02 - 1,476.21 |

| 52-Week Range | 1,322.01 - 1,657.99 |

| Beta | 0.60 |

| RSI | 51.34 |

| Earnings Date | Apr 17, 2026 |

About Kweichow Moutai

Kweichow Moutai Co., Ltd., together with its subsidiaries, produces and sells liquor products in China and internationally. The company offers liquors under the Kweichow Moutai, Moutai Wangzi liquor, Moutai 1935 liquor, Han Jiang liquor, and Lai Mao liquor brands. It also engages in the production and sale of beverage, food, and packaging materials; development of anti-counterfeiting technology; research and development of information industry related products; operation and management of hotel, accommodation, catering, entertainment, bathing, ... [Read more]

Financial Performance

In 2024, Kweichow Moutai's revenue was 170.90 billion, an increase of 15.71% compared to the previous year's 147.69 billion. Earnings were 86.23 billion, an increase of 15.38%.

Financial StatementsNews

Spirits rise as baijiu shares rally on Lunar New Year demand

Chinese liquor stocks jumped on Thursday ahead of Lunar New Year, with retailers reportedly building inventories of spirits typically consumed at family reunions and corporate banquets. Shares of Kwei...

Horse power: Chinese brands look to boost sales with Lunar New Year items

As the Chinese zodiac’s Year of the Horse approaches, distiller Kweichow Moutai has released a limited promotional line of its baijiu sorghum liquor commemorating the occasion as it seeks to bounce ba...

CATL surpasses Kweichow Moutai to become China’s third-largest stock by market value

Contemporary Amperex Technology (CATL) overtook liquor maker Kweichow Moutai on Thursday to become China’s third-largest locally listed stock by market value, driven by a strong outlook for battery de...

Wuliangye Yibin’s profit slump mirrors rival Kweichow Moutai’s woes

Wuliangye Yibin, China’s second-largest liquor distiller, reported its slowest earnings growth in a decade, reflecting the impact of an intensified anti-corruption campaign on ostentation and a slowin...

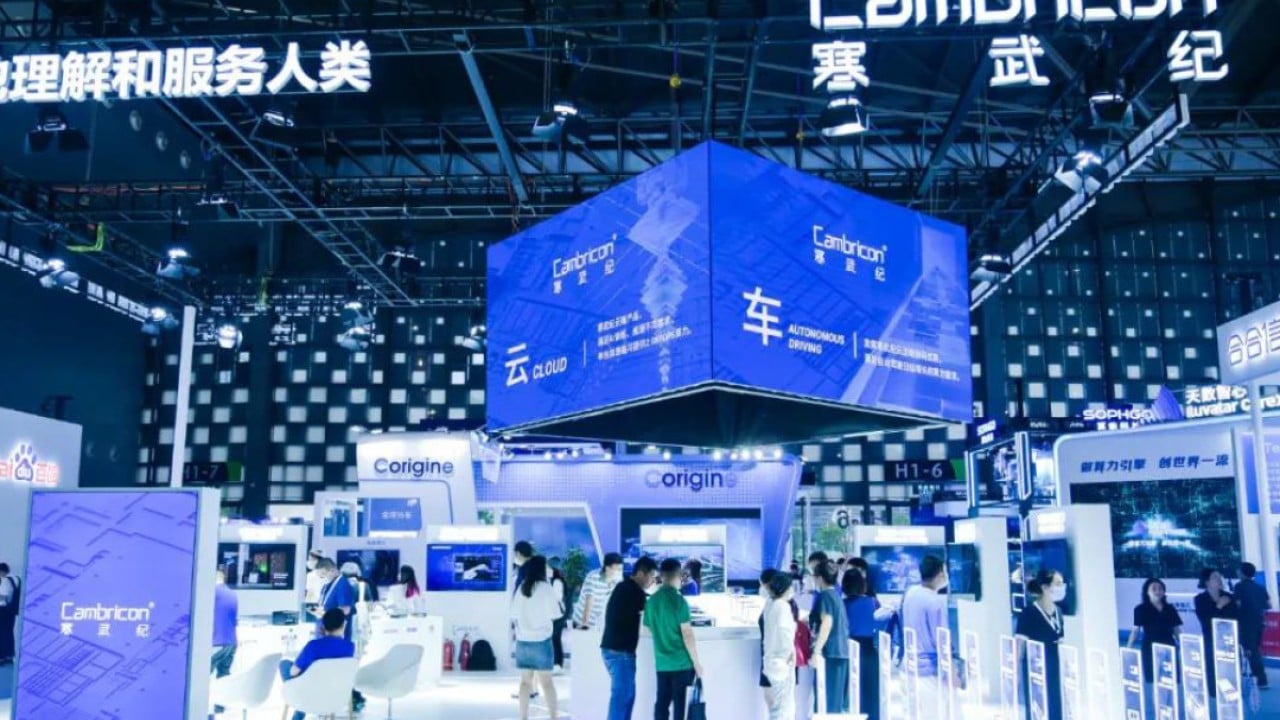

Cambricon tops Moutai as China’s costliest stock as chips beat liquor

Cambricon Technologies became the costliest stock in mainland China’s equities market, as the Beijing-based chipmaker replaced the liquor distiller Kweichow Moutai in a sign of the rising significance...

Moutai, China’s premier liquor brand, may find austerity rules hard to swallow

China’s premier liquor distiller Kweichow Moutai – a brand that had, over decades, become synonymous with sumptuous feasts – is heeding a renewed mandate for austerity from Beijing, distancing its pro...

Ebbing demand for Maotai, China’s favourite baijiu, adds to debt concerns

A persistent slump in sentiment has taken the wind out of Kweichow Moutai’s share price and the price of its preemium spirit known as baijiu.

VEA vs VEU: Which International Vanguard ETF Is the Better Buy Today?

If you were asked what did Samsung Electronics, Saudi Aramco and Kweichow Moutai have in common, besides being 3 of the largest companies in the world? Surprisingly, the answer is this: none of them h...

Kweichow Moutai Expects to Meet Revenue Growth Target Despite China Market Woes

Chinese liquor giant Kweichow Moutai expects to meet its revenue growth target for 2024 despite subdued consumer sentiment and slumping wholesale prices in its home market.

'Fast And Furious Rally' Pushes Chinese Stocks To Double S&P 500 Performance Year To Date

Chinese equities have staged a dramatic comeback in the past few weeks on the back of policy stimulus, with the MSCI China Index, tracked by the iShares MSCI China ETF (NYSE: MCHI), surging over 35% ...

Kweichow Moutai seeks to prop up flagging shares with first-ever repurchase programme

Kweichow Moutai will launch its first-ever stock repurchase plan, as it seeks to prop up its shares amid tepid spending on the mainland.

Hong Kong customs makes largest haul of fake liquor in 2 decades with 1,300 bottles seized

Industrial site raid uncovers HK$2.9 million of supplies bearing brand names such as Kweichow Moutai, Hennessy and Macallan, Post learns.