ASML Holding N.V. (ASML)

| Market Cap | 569.03B +94.8% |

| Revenue (ttm) | 38.36B +15.6% |

| Net Income | 11.28B +26.9% |

| EPS | 29.01 +28.4% |

| Shares Out | 386.50M |

| PE Ratio | 50.43 |

| Forward PE | 42.63 |

| Dividend | $6.55 (0.44%) |

| Ex-Dividend Date | Feb 10, 2026 |

| Volume | 1,281,595 |

| Open | 1,471.40 |

| Previous Close | 1,469.59 |

| Day's Range | 1,462.00 - 1,493.01 |

| 52-Week Range | 578.51 - 1,493.48 |

| Beta | 1.46 |

| Analysts | Buy |

| Price Target | 1,475.86 (-0.68%) |

| Earnings Date | Jan 28, 2026 |

About ASML

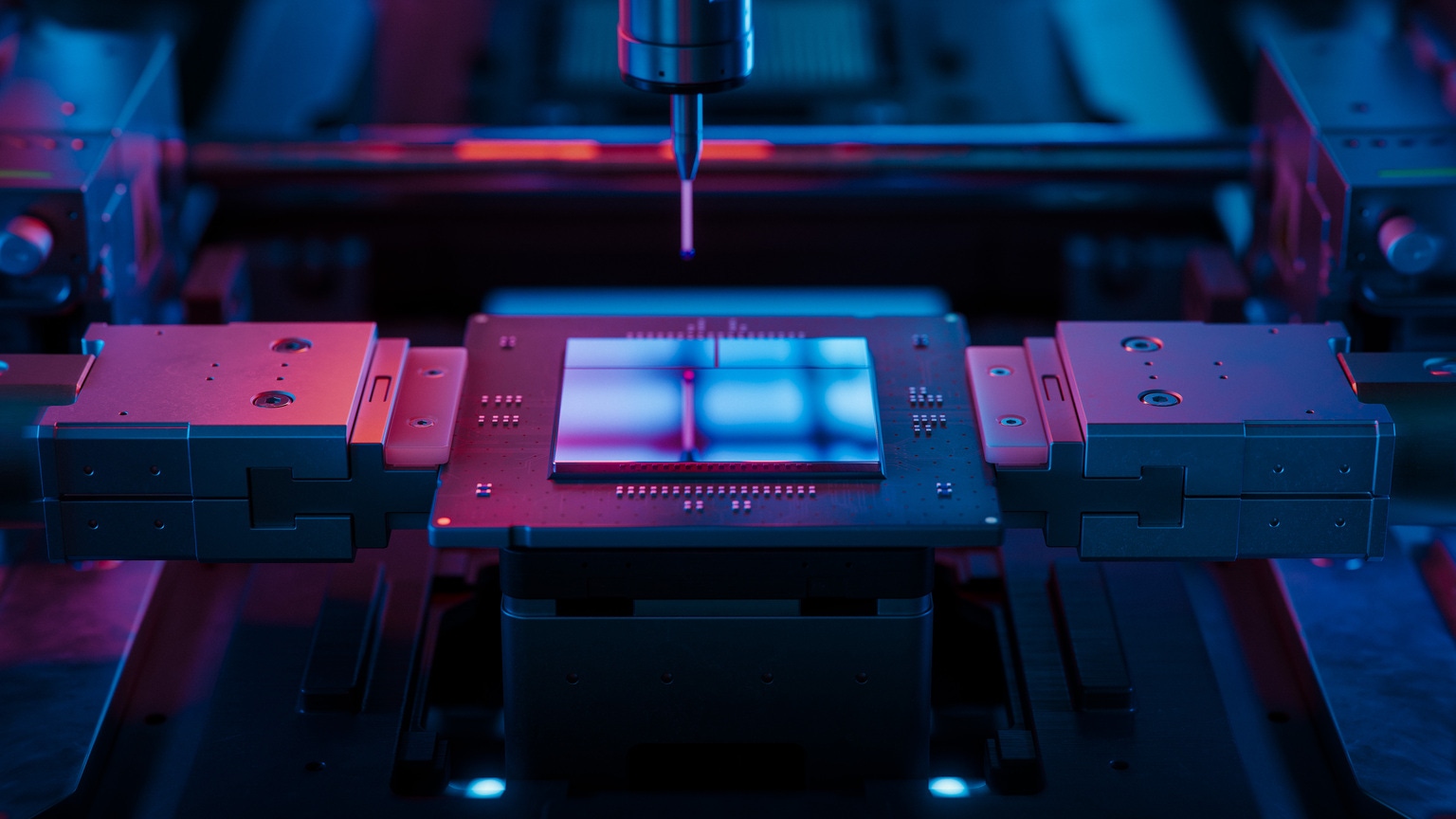

ASML Holding N.V. provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems. It offers lithography, metrology, and inspection systems. The company also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography systems solutions to manufacture various range of semiconductor nodes and technologies. In addition, it offers metrology and inspection systems, including YieldStar optical ... [Read more]

Financial Performance

In 2025, ASML Holding's revenue was 32.67 billion, an increase of 15.58% compared to the previous year's 28.26 billion. Earnings were 9.61 billion, an increase of 26.91%.

Financial numbers in EUR Financial StatementsAnalyst Summary

According to 10 analysts, the average rating for ASML stock is "Buy." The 12-month stock price target is $1,475.86, which is a decrease of -0.68% from the latest price.

News

ASML (ASML) Advances EUV Technology with Significant Power Boost

ASML (ASML) Advances EUV Technology with Significant Power Boost

ASML shows off new light advance that could boost chip production by 50%: report

ASML's Breakthrough to Boost Chip Production by 50% by 2030

ASML's Breakthrough to Boost Chip Production by 50% by 2030

Top Wide-Moat Stocks to Invest in for Long-term Growth

LRCX, NVDA, ASML and MCO use strong moats to fend off rivals and deliver consistent returns amid market shifts.

Exclusive: ASML unveils EUV light source advance that could yield 50% more chips by 2030

Researchers at ASML Holding say they have found a way to boost the power of the light source in a key chip making machine to turn out up to 50% more chips by decade's end, to help retain the Dutch com...

ASML reports transactions under its current share buyback program

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback...

Prediction: 3 Stocks That'll Be Worth More Than Walmart 5 Years From Now

ExxonMobil can rake in high free cash flow and return capital to shareholders even at oil prices below current levels. Visa is a compelling value for such an elite business model.

Amazon, ASML lead tech sector layoffs in 2026 as total crosses 26,000

ASML, IBD Stock Of The Day, Gets Rock Star Treatment

ASML is the IBD Stock Of The Day as demand remains sky high for its advanced photolithography gear for making cutting-edge, AI-enabled chips.

3 Artificial Intelligence Stocks You Can Buy and Hold for the Next Decade

Apple's slow start in AI could work in its favor. ASML Holding should continue to see strong demand for its one-of-a-kind EUV machines.

2 Unstoppable Growth Stocks to Buy Right Now for Less Than $1,000

The current memory shortage isn't just limited to DRAM. NAND memory is in short supply as well, with one pure-play company clearly reaping the benefit.

FEZ, ASML, SAP, SAN: Large Outflows Detected at ETF

Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel, one standout is the SPDR EURO STOXX 50 ETF (Symbol: FEZ) where we have detected an approxi...

If You Invested $100 In ASML Holding Stock 5 Years Ago, You Would Have This Much Today

ASML Holding (NASDAQ: ASML) has outperformed the market over the past 5 years by 8.18% on an annualized basis producing an average annual return of 20.24%. Currently, ASML Holding has a market capita...

Dow Jones Futures: S&P 500 Rises To Resistance As Nvidia, ASML Lead; Carvana Dives Late, Walmart Due

The stock market extended a bounce as ASML, Micron and Nvidia led, but the S&P 500 hit resistance. Walmart earnings loom.

Prediction: 2 Stocks That Will Be Worth More Than ASML Holding 1 Year From Now

The chip manufacturing equipment specialist could soon be overtaken by Micron Technology and Oracle.

ASML Holding NV (ASML) Shares Up 3.64% on Feb 18

ASML Holding NV (ASML) Shares Up 3.64% on Feb 18

The Zacks Analyst Blog NVIDIA, Taiwan, ASML and Applied Materials

NVIDIA and Taiwan Semiconductor stand at the heart of a near-$1T chip boom as AI spending and defense backlogs power 2026's top sectors.

ASML reports transactions under its current share buyback program

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback...

ASML: EUV Orders Explode, The Setup Into 2026-2028 Just Improved

ASML Holding delivered mixed Q4 results, but order momentum and AI-driven demand support a constructive outlook. Read why ASML stock is a buy.

Prediction: ASML's Stock Price Will Hit $2,000 by This Time

ASML's impressive backlog and order inflow suggest that it can soon hit the $2,000 milestone.

Could Buying ASML Stock Today Set You Up for Life?

Major hyperscalers are planning to spend $625 billion this year on AI infrastructure. ASML's unique technology and process give it a huge competitive moat in this space.

Baird Chautauqua International Growth Fund: Q4 2025 Winners, Laggards, Buys & Sells

Baird Chautauqua International Growth Fund underperformed its benchmark as stock selection in health care and consumer discretionary detracted most from relative returns. Fanuc reported September quar...

Bold Prediction: ASML Is About to Soar. Here's Why.

This Dutch semiconductor equipment maker has a bright future.

54 Stocks, 9 Megatrends: My Favorite Places To Be While Capital Is 'Forced'

My top-down strategy targets 'mission-critical' sectors where capital is forced by secular and cyclical tailwinds—data centers, energy, AI, defense, and infrastructure. AI-driven data center and energ...

Want to invest like a Catholic? The Vatican has a new stock index for that.

Vatican Bank announced indexes for both the European and US markets that align with Catholic teachings. Holdings include Meta, Nvidia, Amazon, and ASML.