ASML Holding N.V. (ASML)

| Market Cap | 512.56B +75.4% |

| Revenue (ttm) | 38.36B +15.6% |

| Net Income | 11.28B +26.9% |

| EPS | 29.01 +28.4% |

| Shares Out | 385.42M |

| PE Ratio | 45.43 |

| Forward PE | 39.08 |

| Dividend | $6.55 (0.48%) |

| Ex-Dividend Date | Feb 10, 2026 |

| Volume | 1,807,709 |

| Open | 1,284.79 |

| Previous Close | 1,292.80 |

| Day's Range | 1,276.11 - 1,359.00 |

| 52-Week Range | 578.51 - 1,547.22 |

| Beta | 1.46 |

| Analysts | Buy |

| Price Target | 1,475.86 (+8.73%) |

| Earnings Date | Apr 15, 2026 |

About ASML

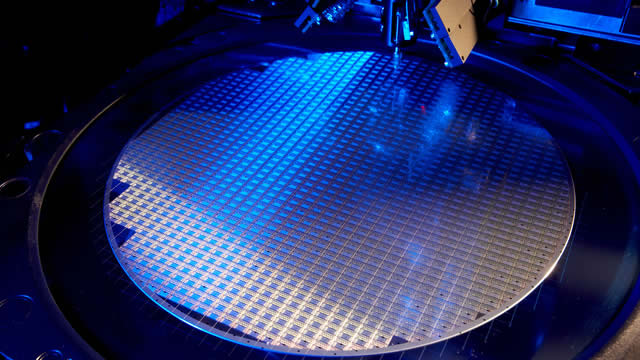

ASML Holding N.V. provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems. The company offers lithography, metrology, and inspection systems. It also provides extreme ultraviolet lithography systems; and deep ultraviolet lithography systems comprising immersion and dry lithography systems solutions to manufacture various range of semiconductor nodes and technologies. In addition, the company offers metrology and inspection systems, including YieldStar... [Read more]

Financial Performance

In 2025, ASML Holding's revenue was 32.67 billion, an increase of 15.58% compared to the previous year's 28.26 billion. Earnings were 9.61 billion, an increase of 26.91%.

Financial numbers in EUR Financial StatementsAnalyst Summary

According to 10 analysts, the average rating for ASML stock is "Buy." The 12-month stock price target is $1,475.86, which is an increase of 8.73% from the latest price.

News

Prediction: The Artificial Intelligence (AI) Pick-and-Shovel Trade Isn't Over. Here Are 2 Stocks to Buy for 2026

Several big tech companies are increasing their spending on AI hardware dramatically. Taiwan Semiconductor Manufacturing is the leader in chip manufacturing globally and all data centers need semicond...

SMH, TSM, ASML, ADI: ETF Outflow Alert

Looking today at week-over-week shares outstanding changes among the universe of ETFs covered at ETF Channel, one standout is the VanEck Semiconductor ETF (Symbol: SMH) where we have detected an appro...

ASML reports transactions under its current share buyback program

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback...

What's Going On With ASML Stock Friday

What's Going On With ASML Stock Friday

China's Semiconductor Makers Unite In Call To 'Build China's ASML'

China’s leading semiconductor executives are calling for a nationwide effort to create a homegrown alternative to ASML Holding N.V. (NASDAQ: ASML) as U.S. restrictions tighten on advanced chip tools....

Semiconductor Opportunity Is Here

In markets, 2026 has been the year of the stock picker. And among the successful equities targets this year, semiconductor stocks have been some of the biggest winners.

ASML (ASML) Poised for Gains Amid Potential Export Ban Easing

ASML (ASML) Poised for Gains Amid Potential Export Ban Easing

Prediction: 3 Well-Known Stocks That Could Struggle if a Bubble Pops in 2026

The stock market's very biggest company, Nvidia, could be sellers' biggest target in an uncertain environment. ASML, a crucial player in the tech sector, may find its usual customers balking at its hi...

Top chip leaders urge national drive to ‘build China’s ASML’ amid US curbs

China’s top semiconductor executives have called for a nationwide push to build a domestic alternative to Dutch chip-equipment giant ASML, urging the industry to “abandon illusions and prepare for str...

China's top chip bosses urge supportive policies to create 'China's ASML'

Top Chinese semiconductor executives have called for a coordinated national effort to develop operational lithography systems during the 2026-2030 period, underlining Beijing's push for greater tech...

2 Artificial Intelligence (AI) Stocks That Wall Street Loves but Most Investors Haven't Heard Of

ASML calls itself "the most important company you've never heard of" -- with good reason. Innodata's information business has emerged from decades of relative obscurity thanks to AI.

Taiwan Semiconductor's AI Breakthroughs Don't Calm Wall Street—Profits Are The Flashpoint

Taiwan Semiconductor Manufacturing Company Ltd (NYSE: TSM) stock extended its selloff on Tuesday in tandem with the broader semiconductor index, Invesco PHLX Semiconductor ETF (NASDAQ: SOXQ) Investo...

ASML Holding NV (ASML) Shares Down 6.02% on Mar 3

ASML Holding NV (ASML) Shares Down 6.02% on Mar 3

4 Factor Dividend Growth Strategy Remains Ahead Of Its Benchmark

The 4-Factor Dividend Growth Portfolio, a rules-based alternative to SCHD, targets high-quality, growth-oriented dividend stocks using four equally weighted metrics. Since inception, the strategy has ...

ASML Moves Beyond EUV As AI Chip Arms Race Heats Up

ASML Holding N.V. (NYSE: ASML) is charting a new course in the chipmaking industry by venturing into advanced packaging solutions for artificial intelligence (AI) chips. On Monday, the company reveal...

Nvidia Stock, Biotech Put This Line In Focus Amid U.S.-Iran Attacks

As U.S.-Iran tensions escalated into attacks over the weekend, Nvidia, ASML and other leaders showed resilience Monday.

ASML Expands Beyond EUV to Capture AI Chip Growth

ASML Expands Beyond EUV to Capture AI Chip Growth

ASML Expands AI Chip Technology and Advanced Packaging

ASML Expands AI Chip Technology and Advanced Packaging

ASML reports transactions under its current share buyback program

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback...

ASML Expands Product Line Amid AI Chip Market Growth

ASML Expands Product Line Amid AI Chip Market Growth

Exclusive: ASML plots future of chipmaking tools for AI beyond EUV

ASML Holding has ambitious plans to expand its line of chipmaking equipment into several new products to capture more of the rapidly growing market for artificial intelligence chips, a senior executiv...

Hyperscalers Plan to Spend $700 Billion on AI This Year. These 2 Stocks Are the Biggest Beneficiaries.

TSMC's role as the biggest semiconductor foundry puts it in a terrific position to capitalize on the AI spending boom. ASML makes the machines that help TSMC make advanced AI chips, and that could hel...

ASML's $400 Million Beast Arrives To Power The Next AI Leap

With a $400 million price tag and years of development behind it, ASML Holding N.V. (NASDAQ: ASML) says its High-NA EUV machines are now prepared for mass production, promising to simplify chip manuf...

ASML Says High-NA EUV Tools Ready for Mass Production

ASML Says High-NA EUV Tools Ready for Mass Production

ASML's Next Tool Could Quietly Change Chipmaking

ASML's Next Tool Could Quietly Change Chipmaking