AUO Corporation (AUOTY)

| Market Cap | 3.15B |

| Revenue (ttm) | 8.80B |

| Net Income (ttm) | 112.88M |

| Shares Out | n/a |

| EPS (ttm) | 0.01 |

| PE Ratio | 27.91 |

| Forward PE | 46.47 |

| Dividend | 0.26 (5.33%) |

| Ex-Dividend Date | Aug 6, 2024 |

| Volume | 1,567 |

| Average Volume | 38,453 |

| Open | 4.880 |

| Previous Close | 4.900 |

| Day's Range | 4.780 - 4.900 |

| 52-Week Range | 3.990 - 6.400 |

| Beta | 0.89 |

| RSI | 41.88 |

| Earnings Date | Aug 13, 2025 |

About AUO Corporation

AUO Corporation researches, develops, produces, and sells thin film transistor liquid crystal displays (TFT-LCDs) and other flat panel displays for various applications. It operates through two segments, Display and Energy. The company designs, manufactures, and sells ingots, solar wafers, and solar modules, as well as provides technical engineering and maintenance services for solar system projects. It also sells and leases content management system and related hardware; designs digital signage content and field curation solutions; plans, desi... [Read more]

Financial Performance

In 2024, AUO Corporation's revenue was 280.25 billion, an increase of 13.02% compared to the previous year's 247.96 billion. Losses were -3.06 billion, -83.17% less than in 2023.

Financial numbers in TWD Financial StatementsNews

AUO Corporation (AUOTY) Q1 2025 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q1 2025 Earnings Conference Call April 30, 2025 2:00 AM ETCompany ParticipantsPaul Peng - Chairman and Group Chief Strategy...

AUO Corp (AUOTY) Q4 2024 Earnings Call Highlights: Navigating Challenges and Capitalizing on ...

AUO Corp (AUOTY) Q4 2024 Earnings Call Highlights: Navigating Challenges and Capitalizing on Growth Opportunities

Q4 2024 AUO Corp Earnings Call Transcript

Q4 2024 AUO Corp Earnings Call Transcript

AUO Corporation (AUOTY) Q4 2024 Earnings Call Transcript

The Evolution of Displays: Market Dynamics, Challenges, and Opportunities from 2024 to 2029

Delray Beach, FL, Dec. 11, 2024 (GLOBE NEWSWIRE) -- The global display market size is expected to reach USD 173.7 billion by 2029 from USD 135.2 billion in 2024, growing at a CAGR of 5.1 % during the ...

AUO Corporation (AUOTY) Q3 2024 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q3 2024 Earnings Conference Call October 31, 2024 2:00 AM ETCompany ParticipantsJerry Su - Senior Director for Investors...

AUO Corporation reports Q3 results

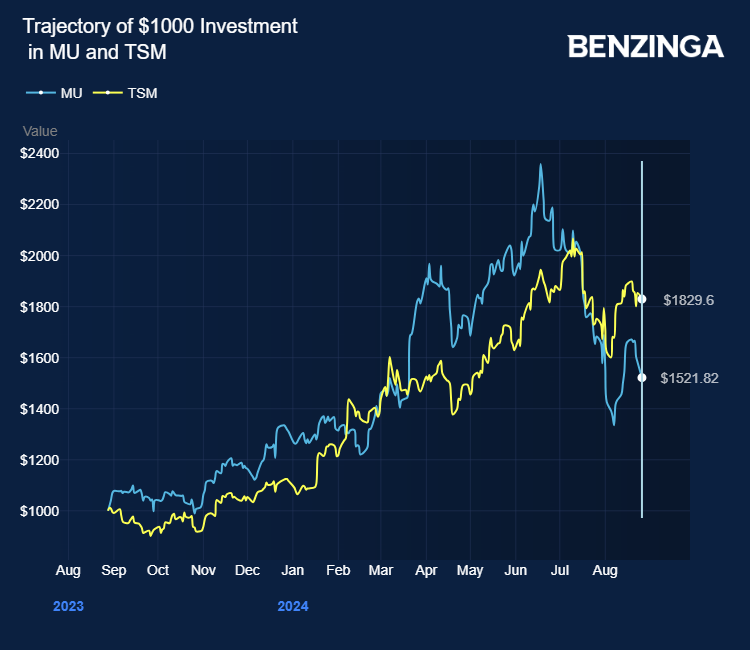

Micron Tech Eyes AUO Plant Acquisition as Taiwan Semi Expands Chip Packaging Tech

Micron Technology Inc (NASDAQ: MU) is reportedly considering acquiring two facilities owned by AUO Corp, mirroring Taiwan Semiconductor Manufacturing Co’s (NYSE: TSM) recent deal to purchase a plant...

AUO Corporation (AUOTY) Q2 2024 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q2 2024 Results Conference Call July 31, 2024 2:00 AM ET Company Participants David Chang - CFO Paul Peng - Chairman and Group Strategy Officer Frank Ko - CEO James Chen ...

AUO Corporation (AUOTY) Q1 2024 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q1 2024 Results Conference Call April 30, 2024 2:00 AM ET Company Participants Julia Chao - IR Ben Tseng - CFO Paul Peng - Chairman and Group Strategy Officer Frank Ko - ...

AUO Corporation (AUOTY) Q3 2023 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q3 2023 Earnings Conference Call October 31, 2023 2:00 AM ET Company Participants Julia Chao - Investor Relations Ben Tseng - Chief Financial Officer Paul Peng - Chairman...

AUO Offers Building-Integrated Photovoltaic Solutions, Establishing New Pillars for Net-Zero Cities

Delivering Optimized SunSteel Integrated Photovoltaic Corrugated Roofing Sheets to Create New Energy Applications; and EnLink Data Collectors for Energy Management HSINCHU, Oct. 17, 2023 /PRNewswire/ ...

AUO Corporation (AUOTY) Q2 2023 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q2 2023 Results Earnings Conference Call July 27, 2023 2:00 AM ET Company Participants Julia Chao - Investor Relations Ben Tseng - Chief Financial Officer Paul Peng - Cha...

AUO Corporation (AUOTY) Q1 2023 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q1 2023 Results Conference Call April 27, 2023 2:00 AM ET Company Participants Julia Chao - IR Paul Peng - Chairman and Group Chief Strategy Officer Frank Ko - CEO and Pr...

AUO Corporation (AUOTY) Q4 2022 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q4 2022 Results Conference Call February 8, 2023 1:00 AM ET Company Participants Julia Chao - IR Ben Tseng - CFO Shuang Peng - Chairman and CEO Fu-Jen Ko - COO Chien-Pin ...

AUO Corporation (AUOTY) Q3 2022 Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q3 2022 Earnings Conference Call October 26, 2022 2:00 AM ET Company Participants Julia Chao – Investor Relations Officer Ben Tseng – Chief Financial Officer Paul Peng – ...

AUO Corporation (AUOTY) CEO Paul Peng on Q2 2022 Results - Earnings Call Transcript

AUO Corporation (OTCPK:AUOTY) Q2 2022 Results Conference Call July 28, 2022 2:00 AM ET Company Participants Julia Chao - Investor Relations Paul Peng - Chairman & Chief Executive Officer Frank Ko - Pr...

AU Optronics Corp. (AUOTY) CEO Paul Peng on Q4 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUOTY) CEO Paul Peng on Q4 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q3 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q3 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q2 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q2 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q1 2021 Results - Earnings Call Transcript

AU Optronics Corp. (AUO) CEO Paul Peng on Q1 2021 Results - Earnings Call Transcript

Tesla Supplier AU Optronics In Talks To Manufacture Car Displays In North America: Report

Taiwan-based AU Optronics Corp. (Pink: AUOTY), which is Tesla, Inc.'s (NASDAQ: TSLA) major supplier of displays, is exploring the possibility of expanding its manufacturing outside of Taiwan and China...