Himalaya Shipping Ltd. (HSHP)

| Market Cap | 666.01M +214.7% |

| Revenue (ttm) | 131.90M +6.7% |

| Net Income | 17.70M -15.9% |

| EPS | 0.38 -20.7% |

| Shares Out | 46.65M |

| PE Ratio | 37.63 |

| Forward PE | 9.98 |

| Dividend | $0.75 (5.10%) |

| Ex-Dividend Date | Feb 20, 2026 |

| Volume | 175,705 |

| Open | 14.62 |

| Previous Close | 14.48 |

| Day's Range | 14.62 - 14.95 |

| 52-Week Range | 4.29 - 14.95 |

| Beta | 0.88 |

| Analysts | n/a |

| Price Target | n/a |

| Earnings Date | Feb 10, 2026 |

About HSHP

Himalaya Shipping Ltd. provides dry bulk shipping services worldwide. The company serves major commodity trading, commodity and energy transition, and multi-modal transport companies. As of December 31, 2024, it owned and operated through a fleet of 12 Newcastlemax dry bulk vessels, each with capacity in the range of 210,000 dead weight tons. The company was incorporated in 2021 and is based in Hamilton, Bermuda.

Financial Performance

In 2025, Himalaya Shipping's revenue was $131.90 million, an increase of 6.73% compared to the previous year's $123.58 million. Earnings were $17.70 million, a decrease of -15.89%.

Financial StatementsNews

Himalaya Shipping: I Missed The Boat - Upgrade To Buy

Himalaya Shipping Ltd (HSHP) Q4 2025 Earnings Call Highlights: Record Profits and Strategic ...

Himalaya Shipping Ltd (HSHP) Q4 2025 Earnings Call Highlights: Record Profits and Strategic Market Positioning

Q4 2025 Himalaya Shipping Ltd Earnings Call Transcript

Q4 2025 Himalaya Shipping Ltd Earnings Call Transcript

Himalaya Shipping's Q4 Profit Surges On Higher Charter Rates, FY25 Earnings Decline

(RTTNews) - Himalaya Shipping Ltd. (HMLS), a player in the shipping industry, reported a sharp increase in its fourth-quarter profit on Tuesday.

Himalaya Shipping Ltd (HSHP) Q3 2025 Earnings Call Highlights: Navigating Market Challenges ...

Himalaya Shipping Ltd (HSHP) Q3 2025 Earnings Call Highlights: Navigating Market Challenges with Strategic Moves

Q3 2025 Himalaya Shipping Ltd Earnings Call Transcript

Q3 2025 Himalaya Shipping Ltd Earnings Call Transcript

Price Over Earnings Overview: Himalaya Shipping

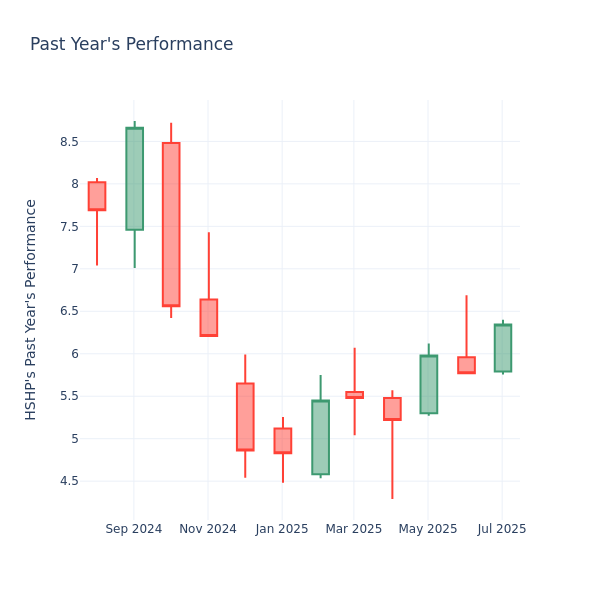

In the current market session, Himalaya Shipping Inc. (NYSE: HSHP) share price is at $6.24, after a 1.42% decrease. Over the past month, the stock went up by 1.20% , but over the past year, it actual...

Himalaya Shipping: Top-Spec Fleet And Macro Tailwinds At An Attractive Discount

With Newbuild Fleet, Himalaya Shipping Is Worth Keeping An Eye On

Himalaya Shipping, a newcomer in the dry bulk sector, operates 12 new Newcastlemax vessels, focusing on dual fuel with liquid natural gas and pays variable monthly dividends. Himalaya Shipping's commi...

Top 3 Industrials Stocks You'll Regret Missing In December

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

Himalaya Shipping: Speculative Bet On Strong Capesize Market

Himalaya Shipping delivered strong 2Q24 results with increased revenue, and operating income. HSHP's fleet, consisting of 12 Newcastlemax vessels with dual-fuel LNG propulsion, ensures higher TCE rate...

Himalaya Shipping: Newcastlemax-Only Play For Shipping Growth Investors

Himalaya Shipping is a top pick for shipping growth stocks. The company owns a top-notch fleet of Newcastlemax bulk carriers built in 2023/2024 with dual-fuel LNG propulsion plants. The bulk carriers ...

Himalaya Shipping: High Risk, Potentially Higher Reward

Himalaya is a new player in the dry bulk industry with high leverage and potential for exceptional returns in a bull market. Having taken delivery of a majority of its fleet of 12 newly-built Newcastl...

Himalaya Shipping: A Superior Way To Play The Dry Bulk Market

Himalaya Shipping Ltd. is in a strong position to capitalize on the dry bulk shipping market, which is largely inelastic due to a low orderbook for new ships and aging existing fleet. The management t...

Himalaya Shipping Proposes U.S. IPO Terms

Himalaya Shipping Ltd. has filed proposed terms for a $45 million U.S. IPO. The firm is planning to provide dry bulk shipping services on Pacific Ocean routes.