MPLX LP (MPLX)

| Market Cap | 59.84B +11.6% |

| Revenue (ttm) | 11.82B +6.2% |

| Net Income | 4.91B +13.8% |

| EPS | 4.82 +14.5% |

| Shares Out | 1.02B |

| PE Ratio | 12.23 |

| Forward PE | 12.94 |

| Dividend | $4.31 (7.34%) |

| Ex-Dividend Date | Feb 9, 2026 |

| Volume | 1,165,649 |

| Open | 59.00 |

| Previous Close | 58.66 |

| Day's Range | 58.47 - 59.23 |

| 52-Week Range | 44.60 - 59.44 |

| Beta | 0.56 |

| Analysts | Buy |

| Price Target | 58.29 (-1.1%) |

| Earnings Date | Feb 3, 2026 |

About MPLX

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Crude Oil and Products Logistics; and Natural Gas and NGL Services. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products and renewables; and sale of resi... [Read more]

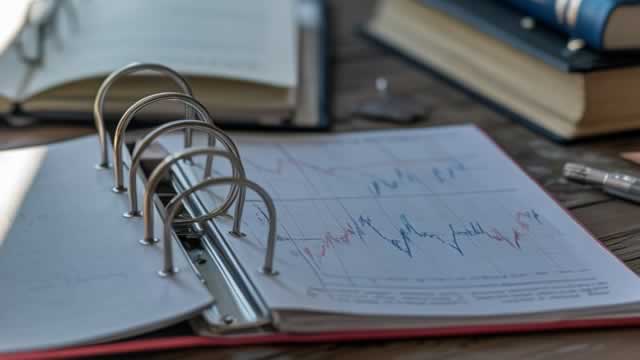

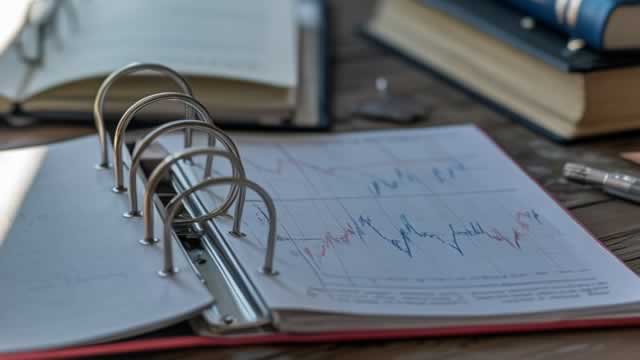

Financial Performance

In 2025, MPLX LP's revenue was $11.82 billion, an increase of 6.16% compared to the previous year's $11.13 billion. Earnings were $4.91 billion, an increase of 14.74%.

Financial StatementsAnalyst Summary

According to 8 analysts, the average rating for MPLX stock is "Buy." The 12-month stock price target is $58.29, which is a decrease of -1.10% from the latest price.

News

MPLX LP files 2025 Form 10-K

FINDLAY, Ohio, Feb. 26, 2026 /PRNewswire/ -- MPLX LP (NYSE: MPLX) today filed with the U.S. Securities and Exchange Commission its Annual Report on Form 10-K for the year ended Dec. 31, 2025. The fili...

MPLX: 12% Distribution Growth For Years To Come

MPLX LP remains a "Buy," underpinned by robust U.S. natural gas demand and a focused $2.4 billion organic growth capex plan for 2026. MPLX's distribution yield is nearly 8%, with a 1.4x coverage ratio...

MPLX Vs. Western Midstream: Choosing The 2026 Energy Renaissance Yield Leader

MPLX LP and Western Midstream Partners are often compared, but diverge significantly in strategy, asset focus, and growth prospects. MPLX aggressively expands its gas business, targeting data centers ...

I Wouldn't Want To Retire Without The 3 Most Undervalued Income Machines

Three income powerhouses are trading at very compelling valuations right now. Each offers attractive income with substantial upside potential. Here's why I'm overweighting them while the market is sti...

MPLX: Locking In Hefty Yield While AI Bubble Fears Mount

MPLX remains a 'Strong buy' due to robust fundamentals, attractive valuation, and a nearly 8% forward distribution yield. Capital allocation is heavily focused on natural gas and NGL projects, positio...

6%-8% Yields: 2 Of The Best Retirement Income Machines

High yield is easy; sustaining it is the real challenge. Two overlooked income machines quietly solve a major retirement problem. Why inflation may matter far less than most investors think.

High-Yield Wreck Your Retirement? Here Is Your Path To Recovery

The yield that looks safe today may be your biggest long-term risk. Dividend cuts can be more damaging than market pullbacks. A better income strategy most retirees overlook.

5 Relatively Secure And Cheap Dividend Stocks, Yields Up To 8% (February 2026)

This article is part of our monthly series where we highlight five large-cap, relatively safe, dividend-paying companies offering significant discounts to their historical norms. We go over our filter...

14 Ideal 'Safer' Dividend Buys From 29 Of 69 February Graham Value All-Stars (GVAS)

February's top Large Cap Value (GASV) stocks offer 27.69% to 69.77% net gains by February 2027, based on analyst targets. Fourteen of twenty-nine 'safer' lowest-priced GASV 'dogs' are currently buyabl...

MPLX LP prices $1.5 billion senior notes offering

FINDLAY, Ohio, Feb. 5, 2026 /PRNewswire/ -- MPLX LP (NYSE: MPLX) announced today that it has priced $1.5 billion in aggregate principal amount of unsecured senior notes in an underwritten public offer...

The Dark Side Of High-Yield Investing Few Retirees Understand

Many retirees invest in high-yielding funds where the income looks irresistible, but the risk is hiding in plain sight. One overlooked factor can quietly destroy long-term retirement income. There is ...

My Dividend Growth Income: January 2026 Update

January delivered a robust 2.47% monthly increase in forward dividend income, reaching $6,442.40 and positioning the portfolio ahead of 2026 growth targets. Initiated a new position in Agree Realty fo...

MPLX LP Common Units (MPLX) Q4 2025 Earnings Call Transcript

MPLX LP Common Units (MPLX) Q4 2025 Earnings Call Transcript

MPLX LP Reports Fourth-Quarter and Full-Year 2025 Results

FINDLAY, Ohio, Feb. 3, 2026 /PRNewswire/ -- Full-year 2025 net income attributable to MPLX of $4.9 billion and adjusted EBITDA of $7.0 billion Full-year 2025 growth investments of $5.5 billion and cap...

MPLX LP Announces Quarterly Distribution

FINDLAY, Ohio, Jan. 29, 2026 /PRNewswire/ -- The board of directors of the general partner of MPLX LP (NYSE: MPLX) has declared a quarterly cash distribution of $1.0765 per common unit for the fourth ...

2 Highest Yielding Quality MLPs To Include In Retirement Portfolios

Midstream MLPs offer high single-digit yields with strong defensive characteristics, making them attractive for retirement income portfolios. The yield-to-risk ratio in MLPs is compelling, even compar...

I'm Betting Big On These 8-10% Yields For Early Retirement

The biggest risk most early retirees completely underestimate. Why these yields look far safer than the market believes. The income strategy that changed how I view retirement planning.

The Best Risk-Adjusted Way To Bet On Energy Right Now

One energy investment is far less risky than investors think. Others look increasingly speculative despite strong headlines. This overlooked high-yielding opportunity keeps quietly compounding cash.

A Golden Buying Opportunity: 7-11% Yields Income Investors Are Missing

Two elite income machines are trading like second-rate assets. A misunderstood inflection point could change everything. The market panic may be creating a rare gift for income investors.

The One Data Point That Changed My Dividend Growth Strategy

A long-held dividend investing assumption just quietly broke down. One overlooked sector is rewriting the rules on yield and growth. This shift completely changed how I allocate my capital.

MPLX: AI Beneficiary, Rich Distributions, Compelling Valuations, And Outsized Growth Prospects

MPLX is a compelling dividend Buy, benefiting from the AI-driven data center demand and the robust pipeline expansion in natural gas/NGL services. The growing backlog/joint ventures through 2028 provi...

My Ultimate Dividend ETF Combo For 5%+ Yield And 10%+ Annual Growth

A golden yield-and-growth combo is something most investors assume they'll rarely find. Defensive income machines keep quietly compounding at double-digit rates. This trio could change how you think a...