The 7 Best Algorithmic Trading Platforms

Algorithmic trading isn't just for hedge funds anymore.

Thanks to a growing list of tools and platforms, individual traders and programmers can now build, test, and deploy their own trading strategies without Wall Street-level resources.

With the right software, you can stream market data, run simulations, and automate trades based on predefined rules, all with minimal manual oversight.

Whether you're a developer looking to build your own algorithmic trading strategy from scratch or a non-programmer hoping to leverage someone else's work, there's a platform for you.

Below are the best algorithmic trading tools available today, each with its own strengths, use cases, and ideal audience.

Summary of the best algorithmic trading software

Note: Most of the pricing listed is for monthly plans, but many of these tools also offer (discounted) annual pricing.

| Our Pick | Best For | Cost |

| TradeStation | Best overall | Free |

| Stock Market Guides | Best for non-programmers | $29+/month |

| QuantConnect | Best open-source platform | $60+/month |

| Interactive Brokers | Runner-up for best algo brokerage | Free |

| NinjaTrader | Best for futures trading | Free |

| Mindful Trader | Best algorithm-based trade alert service | $47/month |

| Your own infrastructure | Best for full customization and control | Varies |

Many of these platforms offer some features for free but paywall others, so I made a note of what you can get for free and which paid plan I'd recommend for each tool.

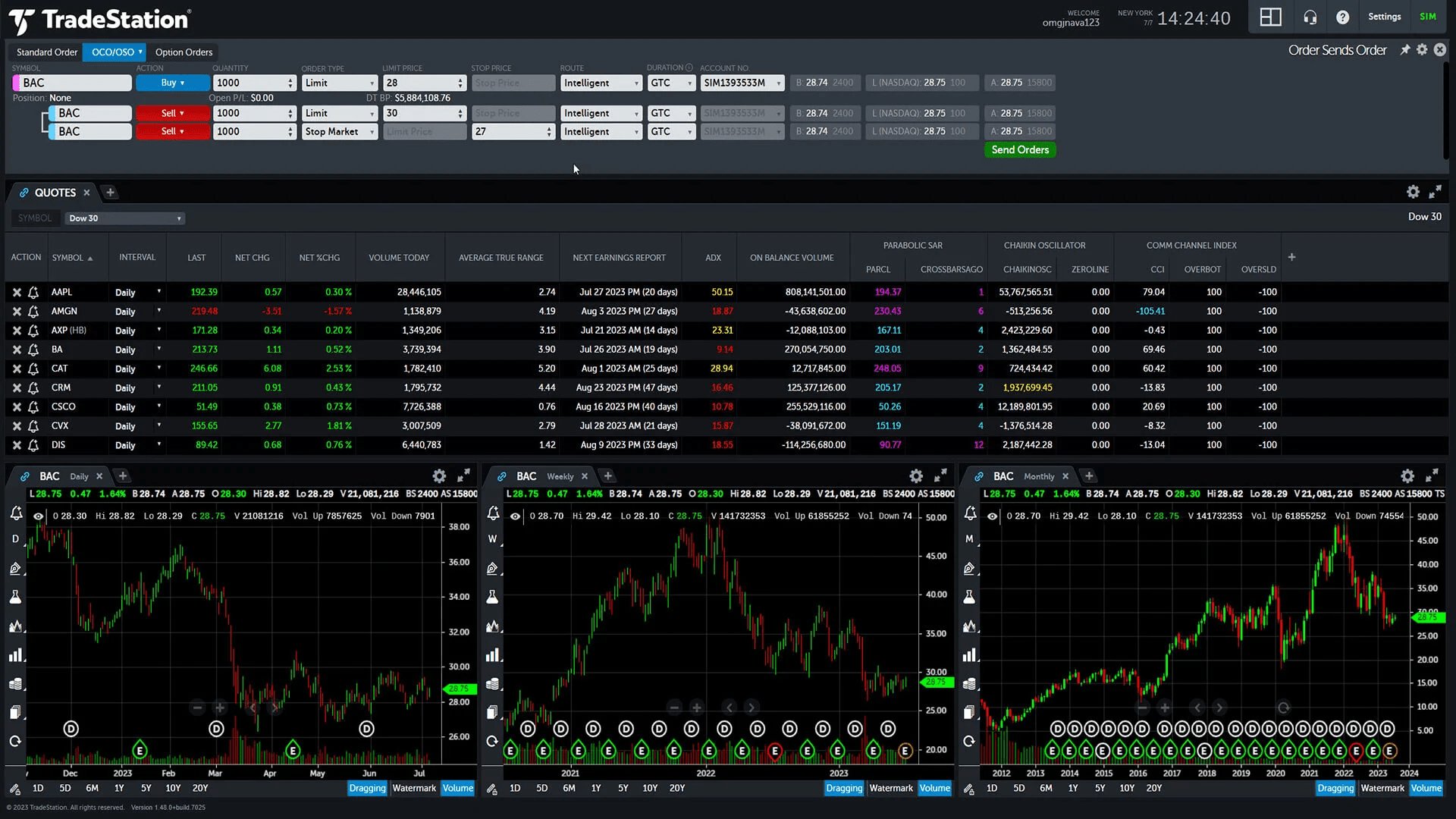

1. TradeStation: Best free algorithmic trading software

TradeStation is a brokerage built for active traders.

You can trade stocks, ETFs, options, futures, and crypto with fast order execution, low fees ($0 per stock trade, $0.60 per options contract), and a complete tech stack that supports full strategy automation.

Plus, programmers can leverage the same technology TradeStation uses in its own applications, which makes for a very native-feeling experience.

Here's everything it offers programmers:

- Comprehensive API access: TradeStation's APIs support real-time data, order execution, and account management across C#, C++, Python, PHP, Ruby, and EasyLanguage.

- EasyLanguage: Its proprietary programming language, EasyLanguage, is designed specifically for traders. It's beginner-friendly (easier than Python), has built-in trading functions and indicators, and is powerful enough for more advanced traders and programmers.

- Strategy building & backtesting: You can build strategies visually or with code, then test and refine them using historical data before deploying them live.

- Paper trading: Simulate real-world conditions without putting capital at risk.

- Advanced market data: Institutional-grade historical and real-time data to feed your backtests and live strategies.

- Cloud & hosting solutions: Run algorithms 24/7 without needing to manage local servers.

- Deep customization: Supports highly customizable trading strategies and the ability to automate almost every aspect of trading operations.

- Educational resources: Webinars, guides, and other learning materials that help make it more approachable.

To unlock free access to TradeStation's API, open an account using the promo code “WAPIAFSG” and fund it with at least $10,000.

The biggest limitation is that you can only apply an algorithm to stocks with open charts. So if you're running multi-ticker scans or strategies across dozens of symbols at once, TradeStation might fall short.

But overall, TradeStation has everything you need to build, test, and execute your own algorithmic trading strategies in both demo and live production environments, making it the best overall platform for algorithmic traders.

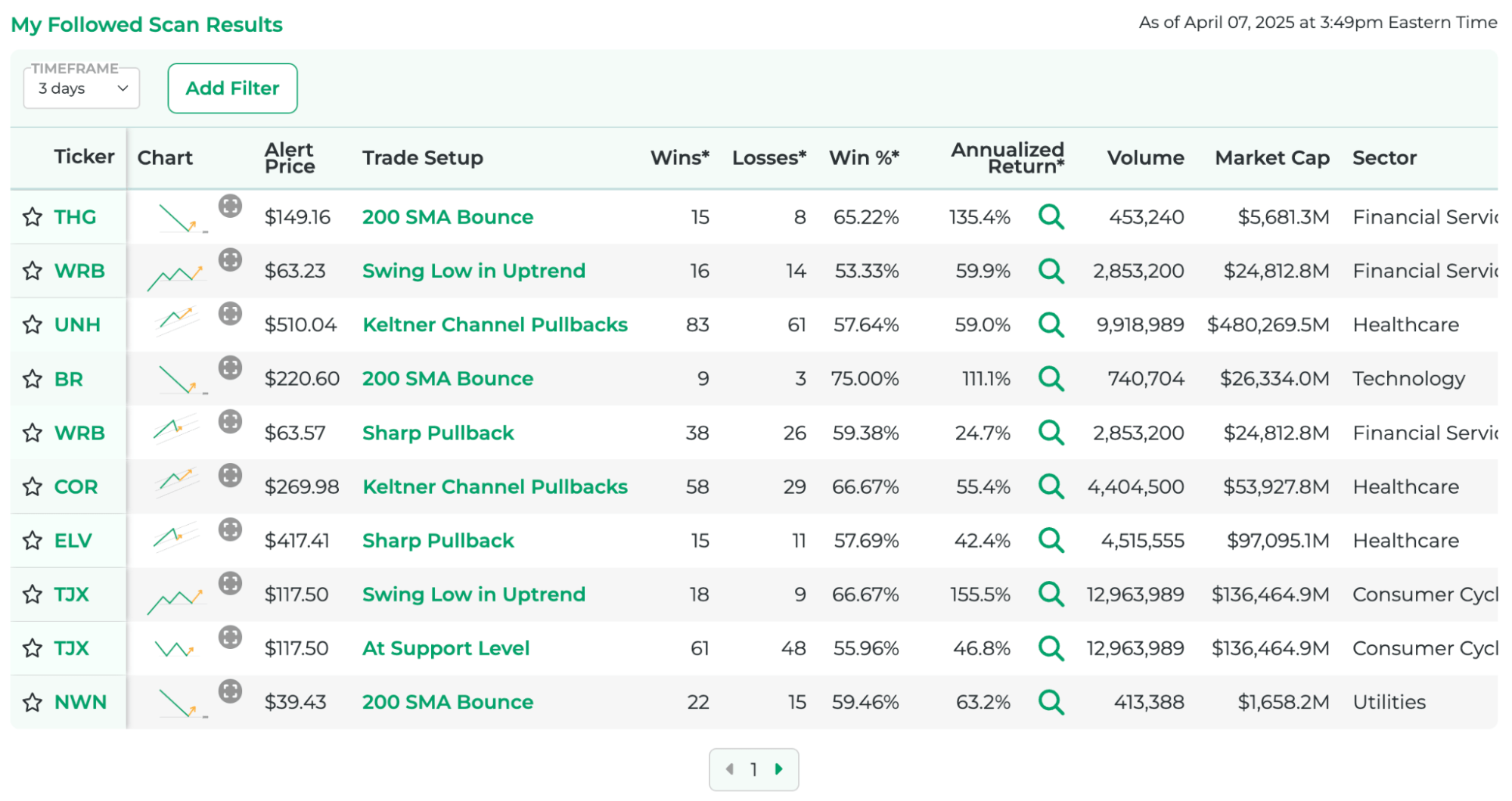

2. Stock Market Guides: Best for non-programmers

If you're not a developer, but still want to benefit from algorithmic trading, Stock Market Guides offers a nice middle ground.

Instead of building your own strategy from scratch, you can plug into a system that's already been extensively tested and optimized.

Their algorithm scans the market in real time, looking for high-probability trade setups based on chart patterns, candlestick formations, and technical indicators.

Thousands of backtests were run to identify which setups have historically performed best.

The algorithm now filters out everything except the highest-performing combinations — like TSLA forming a bull flag, or AAPL bouncing off support with a strong RSI signal.

The result looks like a typical screener, but with all the backtested performance data:

Stock Market Guides divides its service into three types of traders: long-term investors, swing traders, and options traders. The price points for each are:

- Stock Investing: $29/month

- Swing Picks: $49/month

- Options Picks: $69/month

The swing and options services are the most popular in each of the categories, so you'll probably want to choose between one of those depending on which asset you want to trade.

Stock Market Guides gives you access to an algorithmic edge without needing to code anything yourself. It's ideal for active traders who want to enhance their decision-making with real-time, backtested signals.

3. QuantConnect: Best open-source algorithmic trading platform

QuantConnect is a cloud-based, open-source platform designed specifically for algorithmic traders and quants.

It provides a complete set of tools to build strategies, run backtests, and execute trades — via connections to brokerages like TradeStation, Interactive Brokers, TD Ameritrade, Coinbase, and Binance — all from the same platform.

You can access historical and real-time market data across stocks, options, futures, forex, crypto, and more, plus millions of alternative data points (like sentiment, weather, and SEC filings) you can use to develop a unique edge.

LEAN is QuantConnect's backtesting and execution engine. It supports both C# and Python.

The biggest drawback is that while it works well for swing traders, the UI and order system can be a bit awkward for high-frequency or very short trade windows.

If you're planning on executing 15+ trades per day, you may want to opt for a custom framework (see #7).

QuantConnect powers over 440,000 developers who create 2,000+ new algorithms per day and drive more than $1 billion in monthly trading volume — making it one of the most widely used platforms for serious algorithmic traders.

4. Interactive Brokers: Runner-up for best algo brokerage

Interactive Brokers (IBKR) is another trader-focused brokerage that is best known for its low costs and wide range of investable assets across U.S. and international markets.

Tradable securities include 47,000+ stocks, 6,000+ ETFs, 7,000+ options, 13,000+ futures contracts, and 2 million+ bonds. In all, assets span 160 markets in 36 countries.

For programmers, IBKR offers a flexible and well-documented API suite, along with extensive market data and rapid order routing.

Its APIs support both Python and Java, and their Traders' Academy and Quant Blog include tutorials and walkthroughs for building automated systems.

IBKR is a more complex platform than TradeStation. Both its UI and programming environment are better suited for more advanced algorithmic traders.

That said, if your strategy involves global markets or trading multiple assets, Interactive Brokers should be your first choice. It's not the most beginner-friendly, but for advanced users, its breadth of tradable securities is unmatched.

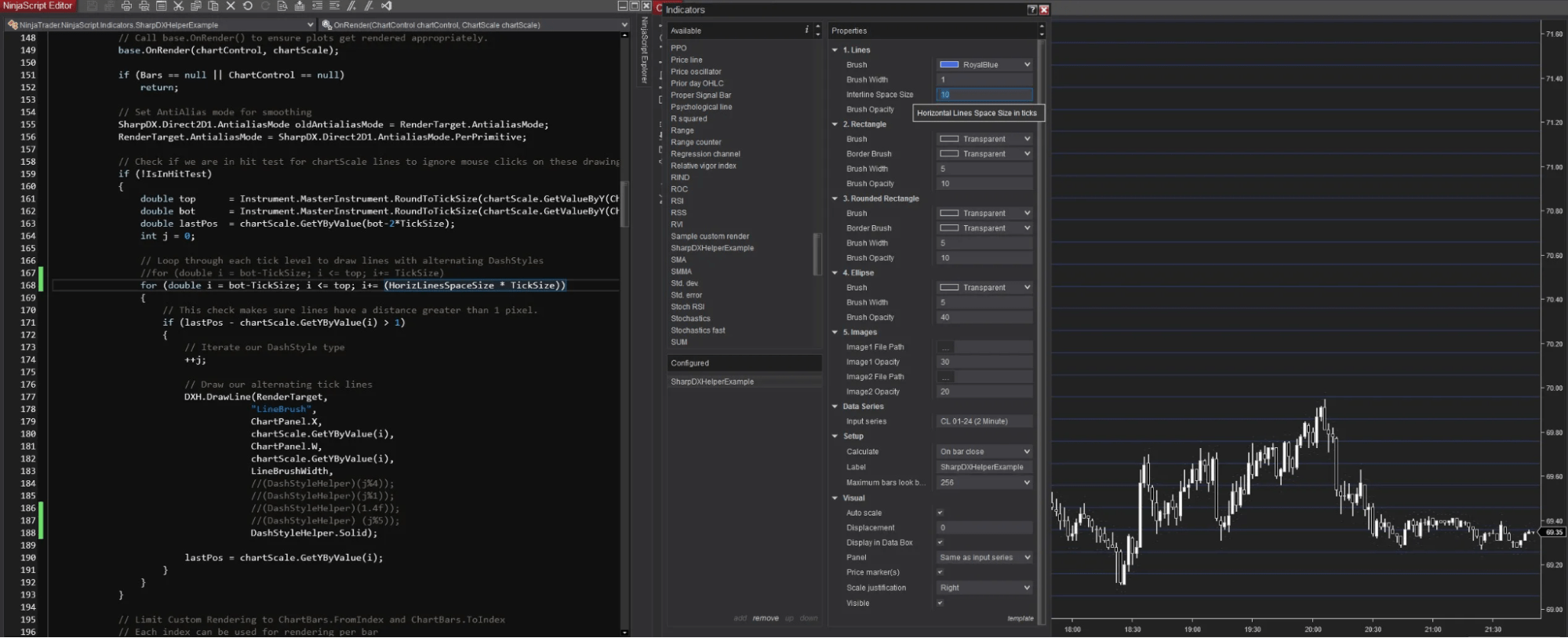

5. NinjaTrader: Best for futures trading

NinjaTrader is a go-to option for futures and forex traders because of its low commissions and charting capabilities.

For programmers, NinjaTrader offers a C#-based trading framework that allows you to build, test, and deploy algo strategies with low-level access to nearly every part of the trading stack, including:

- Account balances and open positions

- Order placement and execution logic

- Real-time and historical market data

- Custom indicators and analytics

- UI elements and controls

Non-programmers can also create their own automated trading strategies using the platform's point-and-click builder, though customization is limited.

Importantly, NinjaTrader also has backtesting tools to test your algorithms against historical price action so you can refine them before live deployment.

Its programming tools aren't nearly as robust as TradeStation's or IBKR's, but NinjaTrader is a solid option for futures-focused traders who are just getting started in algorithmic trading.

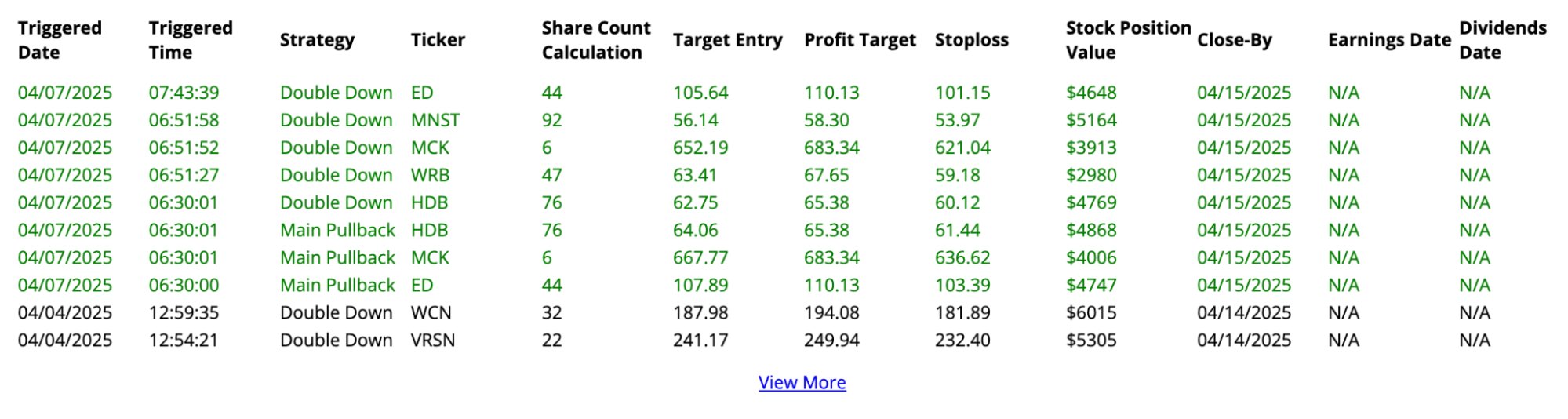

6. Mindful Trader: Best algorithm-based trade alert service

Mindful Trader is a swing trading service (stocks and options) built on algorithmic strategies, designed for traders who want to follow a data-driven approach without building their own models.

The service is run by Eric Ferguson, a Stanford economics graduate who spent four years running hundreds of thousands of backtests to develop his system.

All of his trades are based on strict trading rules. His entries and exits are predetermined, and he does not second-guess a trade when his algorithm sends him an alert.

Each alert is automatically posted to the website and sent out via email, so you get the notification at the same time he does. There are usually 1-3 trade alerts per day.

Mindful Trader is ideal for traders who want to take a rules-based approach without needing to build or manage the backend themselves.

7. Your own infrastructure: Best for full customization and control

Many programmers want complete flexibility in how their algorithms are built, tested, and deployed. For this, nothing beats building your own trading infrastructure.

Most traders who go this route use Python, C++/C#, Java, or Go to build and maintain their stack.

If you want to go this route, you're going to need a combination of tools that allow you to access data, develop strategies, backtest, and execute live orders.

Here are a few popular tools:

| Tool | Purpose | Popular choices |

| Brokerage API | For accessing market data (real-time and historical) and order execution | TradeStation, IBKR, Alpaca, Tradier |

| Backtesting framework | For simulating strategies on historical data | QuantConnect, Backtrader, Zipline |

| Strategy development environment (IDE) | For writing, testing, and optimizing code | Jupyter Notebooks, PyCharm, Visual Studio Code |

You may also add on tools for optimization (Hyperopt, Optuna, Talib), cloud deployment (AWS, Google Cloud, Azure), and monitoring (QuantConnect, Backtrader).

Obviously, setting up your own infrastructure adds quite a bit of complexity. You'll need to manage data access, latency, error handling, slippage, uptime, and potentially even your own cloud infrastructure.

But for serious quants, this level of control is worth it.

What is algorithmic trading?

Algorithmic trading is the use of computers to identify and execute trades based on a predefined set of rules.

These rules can be based on mathematical formulas, chart patterns, technical indicators, price action, volume, other types of market data, or — most commonly — a combination of several working together.

Once the strategy is set, the algorithm can monitor the market and place trades automatically without human oversight.

Algorithmic trading is most often used in day- and swing-trading, but may also be applied to longer-term strategies. It's used in a number of financial markets, including stocks, options, futures, forex, and crypto.

To build and deploy your own algorithmic trading strategies, you'll need:

- Programming skills

- A platform for strategy development

- Backtesting tools to simulate performance

- Access to real-time and historical financial data

- Brokerage integration for live trade execution

How we chose the best algorithmic trading platforms

When evaluating platforms for this list, we took the following into consideration:

- Price: Total cost, value for money, and any hidden fees.

- Functionality: What the software allows you to do, how easy it is to use, how flexible it is, and how much control it gives you.

- Credibility: Quality of information and data, as well as company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up (including free trials) or any discounts.

Final verdict

Whether you value customizability and control or speed and ease of use, there's a platform on this list that can fit your workflow.

For programmers, the fastest and cheapest way to get started is by using an algo-friendly brokerage like TradeStation, Interactive Brokers, or NinjaTrader.

Platforms like QuantConnect — or building out your own custom infrastructure — are popular options for more flexibility.

For non-programmers who want to trade algorithmically, Stock Market Guides and Mindful Trader are your best options. If you want to build your own system, you may also want to try NinjaTrader's point-and-click tool.

Have fun experimenting.