Alpha Picks by Seeking Alpha: Is It Worth It?

Alpha Picks is a momentum-based stock picking service launched by Seeking Alpha in July 2022.

The service uses a systematic, quantitative-based approach to make its recommendations.

Notably, the service's founder and leader, Steven Cress, used to run a quant-focused hedge fund.

The main point of subscribing to any stock recommendation service is to get stock picks that outperform the market. So far, Alpha Picks has done exactly that.

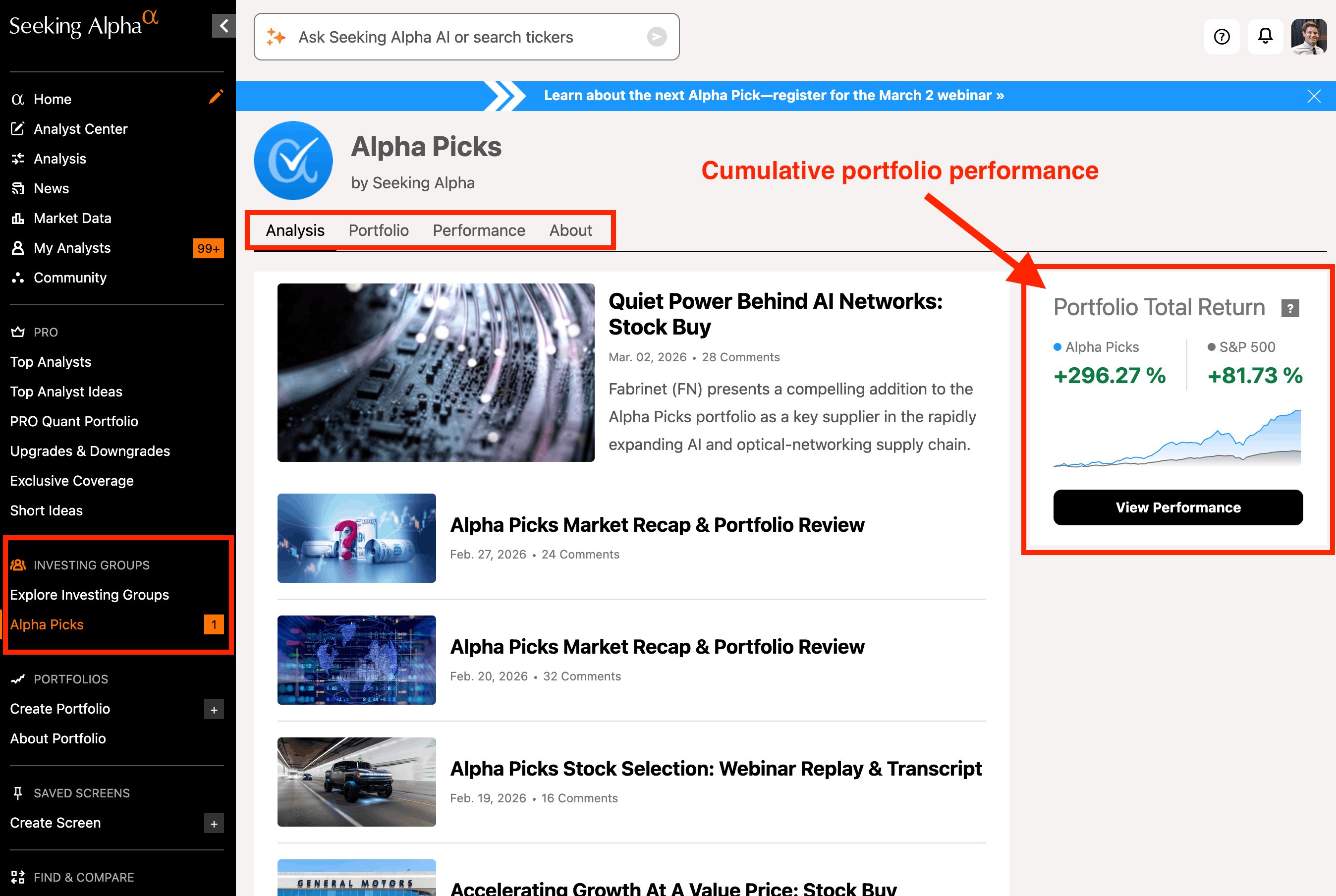

As of March 2026, Alpha Picks has a total cumulative return of +296.27%, outperforming the S&P by over 3.6x (+81.73%) since its launch. More information about this performance — and how it was generated — below.

Despite these impressive results, I don't recommend the service to just anyone. It's expensive, requires a moderately-sized portfolio, and the investing strategy is pretty aggressive.

After being a member of Alpha Picks for more than three years — and tracking every one of its picks — here's everything you need to know about the service before becoming a member.

Alpha Picks review summary

- Overall rating:

- Service type: Stock-picking newsletter

- Best for: Medium- to long-term investors

- Style: Aggressive

- Cost: $499/year (new members can get their first year for $449 through our link)

- Performance*:

- Cumulative: +296.27% vs +81.73% for the S&P (3.6x)

- Average pick: +85.14% vs +22.29% for the S&P (3.8x)

*For the rest of the article, I'm going to use the average performance of its individual stock picks instead of the headline cumulative returns that Alpha touts in its marketing.

The average pick performance better reflects what new members are likely to experience, since past gains from old recommendations can't be replicated by someone joining today.

Alpha Picks is a stock recommendation service driven by a “proprietary, data-driven computer scoring system.” In other words, quantitative analysis.

You can read more about its stock selection process below, but the most important part of any stock picking service is the performance.

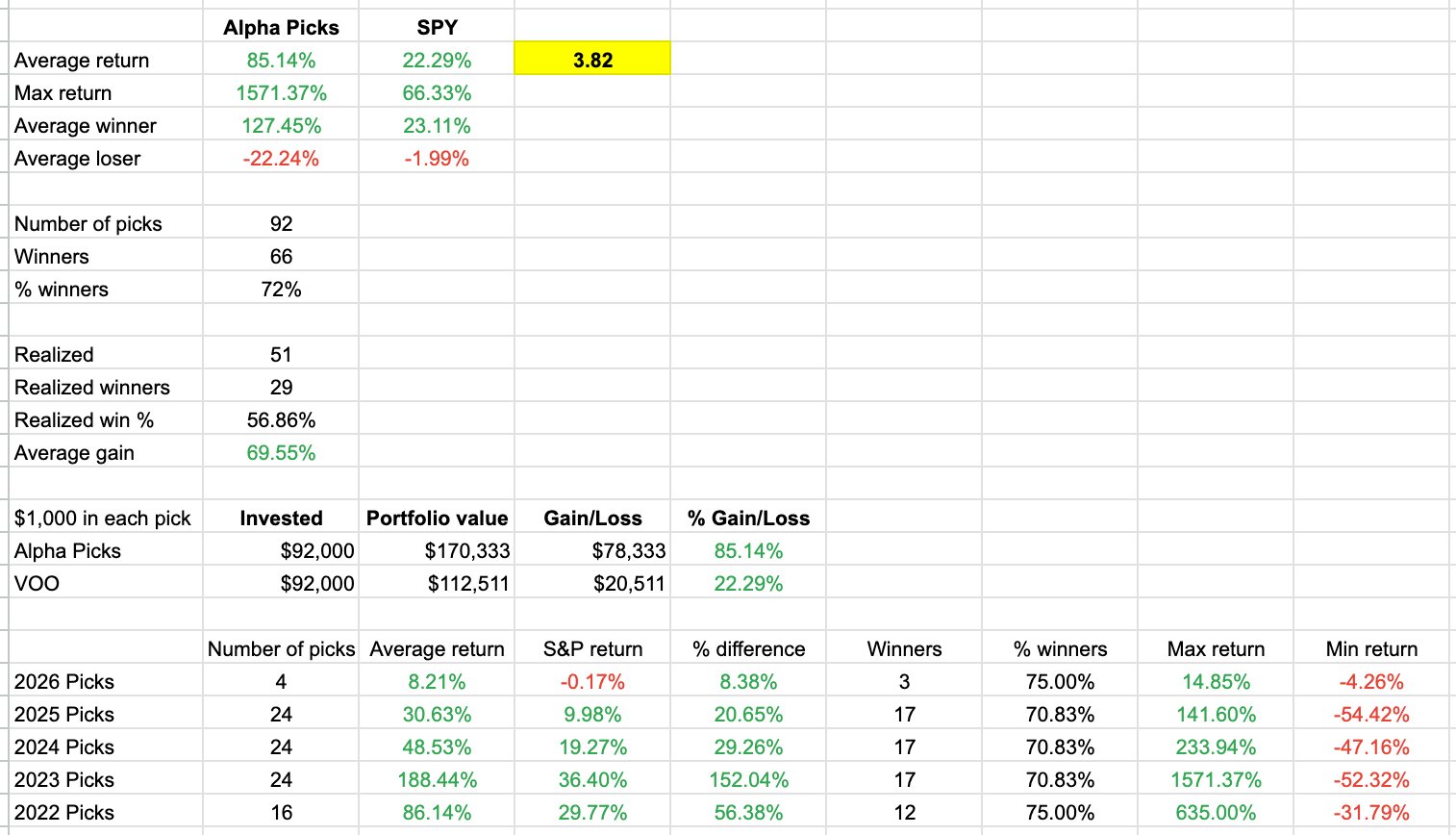

In the 3+ years since its launch, Alpha Picks' stocks have averaged returns 3.8x higher than the S&P 500 (+85.14% vs +22.29%).

These are excellent results, and its performance should be your main consideration when deciding whether or not to subscribe.

However, there are some downsides you should be aware of before subscribing.

Disclaimer: All performance figures listed herein were updated on March 2, 2026. Past performance does not guarantee future results.

What is Alpha Picks?

Seeking Alpha, the company behind Alpha Picks, was founded in 2004 with the goal of providing diverse, high-quality investment research to retail investors.

The core of Seeking Alpha is its crowdsourced content — more than 18,000 contributors produce 7,000+ stock reports and investment ideas per month.

It also provides fundamental data, charts, analyst ratings, and a number of quantitative tools like Factor Grades, Dividend Grades, and its proprietary Quant Ratings (the core of Alpha Picks).

For more information, check out my full Seeking Alpha Review.

Many of its quantitative tools, including the Quant Rating system, were built by Steven Cress. Cress was the founder and CEO of CressCap Investment Research until it was acquired by Seeking Alpha in 2018.

Before that, he had founded the quant hedge fund Cress Capital Management after spending 13 years running a proprietary trading desk at Morgan Stanley.

After the acquisition, Cress joined Seeking Alpha as the VP of Quantitative Strategy. Once there, he had the idea to launch a product for retail investors based on his data-driven approach, experience, and sophisticated algorithms.

And so, Alpha Picks was created.

Key features

- 2x stock picks per month: Get two new “Strong Buy” ideas every month, each chosen through the team's proprietary quantitative ratings and qualitative research. Picks are made on the 1st and 15th (or the closest trading day) each month.

- Accompanying analysis: Each pick comes with a full research report, including the rationale, potential risks, and recent price performance.

- Data-driven strategy: Recommendations are powered by a disciplined, quantitative framework backed by decades of expertise, removing the guesswork and emotion from stock selection.

- Market recaps: Stay current with ongoing email updates and commentary from the research team, giving you context on the broader market and the performance of individual picks.

- Portfolio hub: Access portfolio management tools that track all recommendations, outline reinvestment policies, and help you stay on top of your portfolio without any unnecessary information.

Now the question you should be asking is, How well does it work?

Alpha Picks' performance (as of March 2026)

I've tracked the performance of every stock selected by Alpha Picks since its launch in July 2022.

Its average stock recommendation has returned +85.14% since being added to the portfolio, 3.8x higher than the S&P's average return of +22.29%.

Here's a breakdown of the performance:

- Average return: 3.8x the S&P 500 (+85.14% vs +22.29%)

- Max return: 1,571.37% (APP, selected 11/15/23)

- Percent winners: 72% (66/92)

A few things stand out to me about the results so far.

1. Where the outperformance has come from

Alpha Picks deploys a momentum-based strategy, selecting stocks that have been outperforming their peers with the expectation that the trend will continue.

Momentum strategies don't expect every stock in the portfolio to perform well — they expect some big winners, some average performers, and some duds. But if just a few stocks turn out to be big winners, the whole portfolio outperforms.

This is exactly what I've seen from Alpha Picks so far. Only 72% of its stock picks are profitable right now (vs 97% for the S&P), but a handful of large winners have led to the portfolio outperforming the S&P by a wide margin.

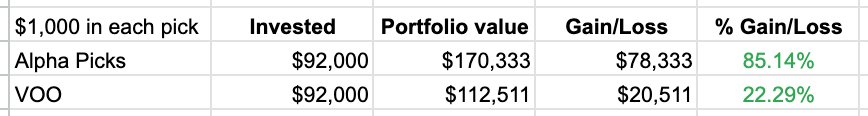

If you had invested $1,000 into each new recommendation and bought $1,000 worth of the S&P at the time of each new pick, here's what your results would look like:

The outperformance is coming from a handful of big winners, including:

- Eighteen of the service's stocks have gained more than 100%

- Nine have gained more than 200%

- Six have gained more than 300%

- Five have gained more than 600%

This — a narrow set of stocks accounting for the bulk of the outperformance — is exactly in line with the objective of the Alpha Picks momentum investing approach.

To see similar results, members are expected to purchase every new recommendation Alpha Picks makes, which requires regular contributions.

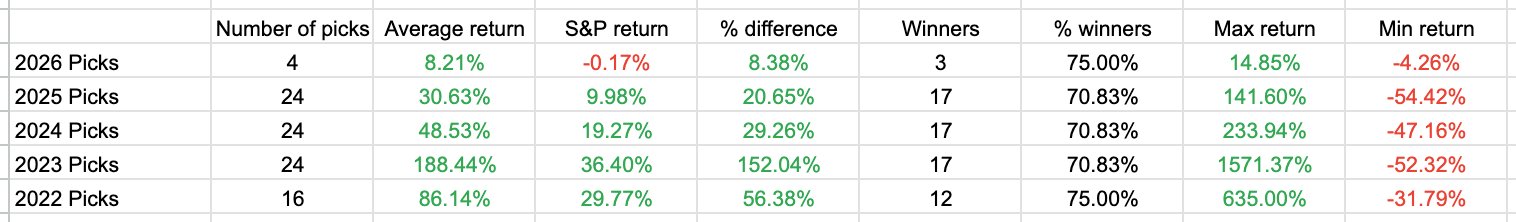

2. 2022 picks vs 2023 picks vs 2024 picks vs 2025 picks vs 2026 picks

Here's a look at how each annual cohort of stocks has performed relative to the S&P 500 since the service's launch in 2022:

These results may indicate, somewhat unsurprisingly, the picks outperform by an increasing margin over longer timeframes.*

*This behavior is consistent with research on momentum stocks, and I've noticed similar results in other stock picking services, like Motley Fool's Stock Advisor.

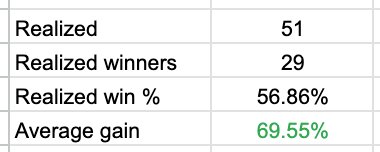

3. Closed positions & average holding period

The Alpha Picks team closed 2 more positions in February, bringing the total to 51 closed positions since the service's launch. Of those 51, 29 have been closed at a profit:

The team closes positions once they've lost their momentum.

There's nothing noteworthy about the win rate or average returns of these closed positions, except that the team has closed 46/68 (68%) of the positions that were purchased more than one year ago.

I had been tracking this because the service initially claimed an expected holding period of two years, yet I noticed many positions being closed well before that. More recently, it updated its guidance to a shorter target of “at least one year,” which better reflects how the portfolio has been managed thus far.

How does Alpha Picks work?

Unlike most of its competitors, Alpha Picks is very transparent about its portfolio process, stock selection criteria, and who makes up its management team.

1. Quantitative analysis

At the heart of Alpha Picks is its quantitative analysis, and the main component of this analysis is Seeking Alpha's Quant Ratings.

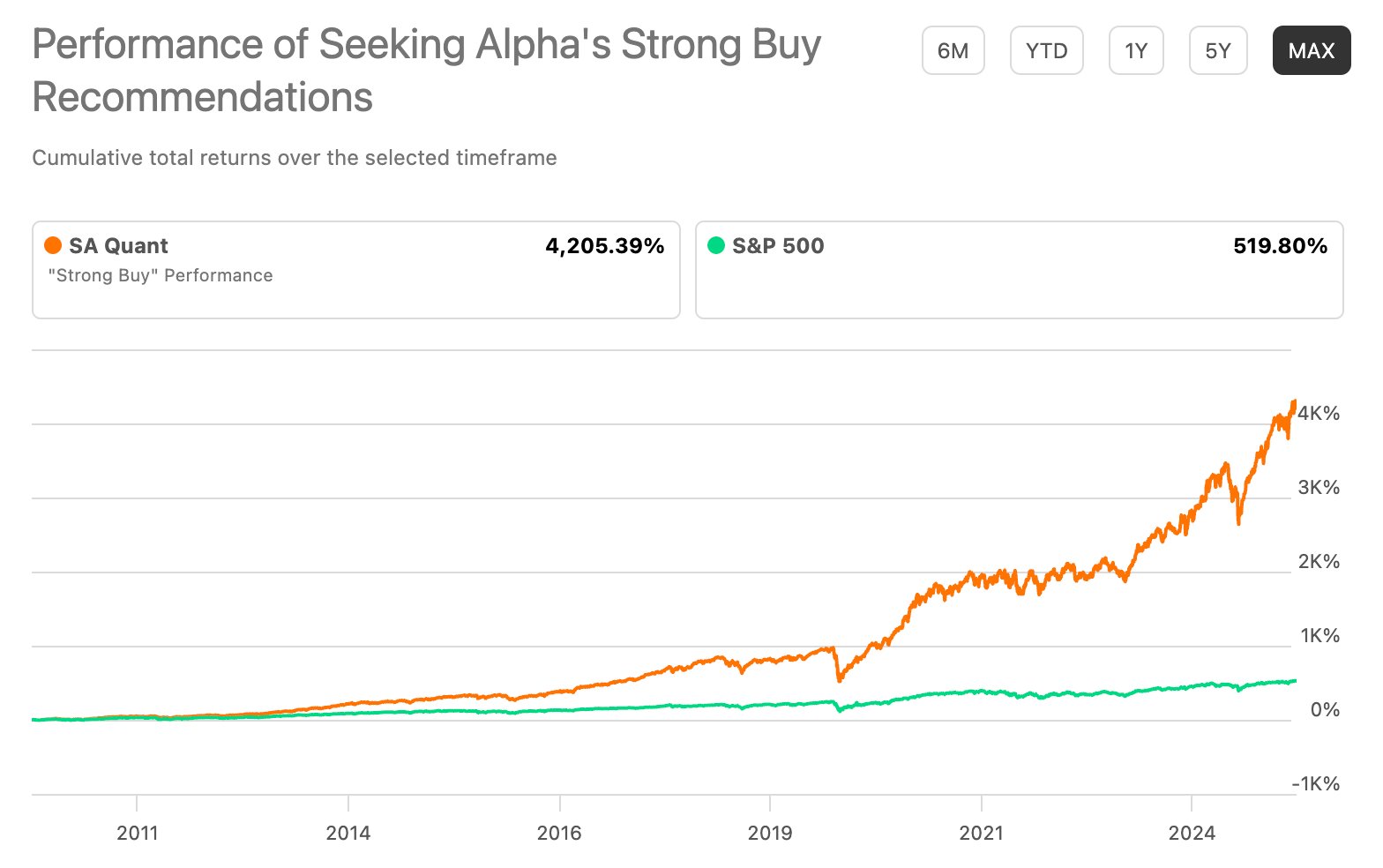

Since 2010, the Quant Ratings model has had an average annualized return of 26%, outperforming the S&P 500 by more than 8x:

The system ranks stocks based on five factors: value, growth, profitability, EPS revisions, and momentum.

As mentioned above, the model was developed by CressCap Investment Research, a quantitative analytics platform, which was acquired by Seeking Alpha in 2018.

As part of the acquisition, Steven Cress, the founder and CEO of CressCap, joined Seeking Alpha as its Head of Quant Strategies. Cress is the leader of Alpha Picks.

Note: Seeking Alpha Premium users can also access Quant Ratings.

2. Investment criteria

Buy criteria

The Alpha Picks team selects two “Strong Buy” rated stocks from the Quant Ratings list each month.

At the time of publication, each pick must meet the following criteria:

- Have a “Strong Buy” quant rating for at least 75 consecutive days

- Be a U.S. common stock (i.e., no ADRs)

- Not be a REIT

- Have a 3-month average market capitalization greater than $500M

- Have a stock price greater than $10

- Have not been recommended in the past year

Sell criteria

Alpha Picks notifies its members when it's time to close or reduce a position in the portfolio.

They sell the entire position if any of the following occur:

- The quant rating falls to “Sell” or “Strong Sell”

- The quant rating falls to “Hold” and remains at “Hold” for 180 consecutive days, as long as the stock is not a “winner” (see below)

- The company is acquired, or it announces a merger of equals

- If a pick's position reaches 15% of the portfolio, it will be reduced to 10% to avoid over-concentration

Letting winners run

The team's research shows that portfolios perform better when letting winners run.

A stock is dubbed a ‘winner' when it doubles from the price at which it was purchased. For ‘winners' whose rating has fallen to ‘Hold' and remains there for 180 consecutive days, only the initial investment is sold.

The team will not sell a position as long as their Quant Ratings model shows it still has momentum, regardless of how much its price has risen (or fallen).

3. Investment team

On top of its algorithm, analytical tools, and proprietary models, the Alpha Picks' investment team always makes the final buy/sell/hold decisions.

In this way, the service describes its investing approach as “quantamental,” combining both quantitative and fundamental analysis.

Alpha Picks is run by a two-person team:

- Steven Cress is the VP of Quantitative Strategy. Steven has over 30 years of experience in equity research and quantitative strategies. Prior to Alpha Picks, he founded Cress Capital Management (a quant-based hedge fund) and CressCap Investment Research (a quantitative investment research platform) after running a quant trading desk at Morgan Stanley for 13 years.

- Joel Hancock is the Senior Director of Product. Prior to joining Seeking Alpha, Joel led product teams at Goldman Sachs, Morgan Stanley, and E*TRADE.

4. Portfolio process

The Alpha Picks team offers three potential strategies its members can deploy:

- Buy at least 5 “Strong Buy” rated Alpha Picks from the existing portfolio.

- Buy the entire portfolio using the allocations in the “Portfolio” tab.

- Use Alpha Picks as an idea-generation tool. Read the analysis of each pick, and choose the stocks that suit your strategy.

Given the distribution of returns in Alpha Picks so far, in my opinion, buying every stock that the service recommends provides the best chance of capturing the few stocks that drive most of the outperformance.

How much does Alpha Picks cost?

Alpha Picks costs $499/year* and includes 24 stock picks each year (two per month), research reports for every new recommendation, weekly portfolio commentary, and regular performance updates.

*Right now, new members can get their first year of Alpha Picks for $449 with our link.

Keep in mind that Seeking Alpha does not currently offer a free trial or a refund policy for Alpha Picks.

That said, I have had good experiences with their customer support in the past — you might be able to talk them into a refund if you have a good reason.

What else is included with Alpha Picks?

After subscribing, you'll be added to the Alpha Picks investing group on the Seeking Alpha website.

The group comes with four tabs:

- Analysis: The Analysis tab (pictured above) shows each of the investment reports and performance summaries in chronological order, as well as the portfolio's total return.

- Portfolio: The Portfolio tab shows the return of each pick, the sectors the stocks are in, their ratings, and the holding percentage.

- Performance: The Performance tab shows the up-to-date total portfolio return and the return data of all the service's picks, which days they were selected, and how they're performing compared to the S&P 500.

- About: The About tab discusses the investing strategy, portfolio process, and strategy characteristics, plus provides some background information on the team.

This hub does a nice job of providing everything you need to know while not overwhelming you with information.

Downsides to Alpha Picks

Alpha Picks has delivered strong results, but there are still some drawbacks to the service that you should be aware of:

- Momentum means volatility: The strategy involves buying stocks that have been performing well, making them susceptible to reversals. There are a number of stocks in the portfolio down more than 30%, and momentum investors should expect some big losers along the way. Furthermore, Alpha Picks has benefitted from a long bull market where momentum strategies tend to work best, and it's unclear how the service will perform if the market shifts.

- High capital requirements: To follow the service properly, you should invest in every pick. With two new picks every month, that's 24 stocks per year. Allocating just $500 per stock still adds up to $12,000 in contributions per year, and you'll likely want to buy more. Larger accounts are better positioned to spread investments across all recommendations.

- High price tag: At $499 per year ($449 for new members), Alpha Picks is more expensive than many alternatives. And since it doesn't offer refunds, you'll want to be sure you're committed before subscribing.

These drawbacks don't negate the service's strong performance, but they do mean it's most appropriate for investors with higher account balances and the willingness to stomach the inherent volatility.

Alpha Picks pro and con summary

| Pros | Cons |

| Outperforming the S&P by 3.8x | Volatility |

| Backtested, proprietary, quant-driven stock-picking model | No free trial |

| 2x new stock picks every month | No refunds |

| An experienced investment team | |

| Simple, beginner-friendly service | |

| Done-for-you investment research | |

| $449 introductory offer |

Alpha Picks vs Motley Fool, and Zacks

Here's how Alpha Picks compares to a few competitors:

| Alpha Picks | Motley Fool Stock Advisor | Zacks Home Run Investor | |

| Service type | Stock picking | Stock picking | Stock picking |

| Investments | Stocks | Stocks | Stocks |

| Investment style | Primarily quantitative | Primarily fundamental | Primarily quantitative |

| Cost | $499/year | $199/year | $59/month |

| Special offer | $449 for new members | $99 for new members | n/a |

| Links | Sign up | Sign up | Sign up |

You can read more about each of these services in my article on the best investing newsletters.

Final verdict

This Alpha Picks review really comes down to a few things:

- The service is outperforming by a factor of 3.8x. Past performance does not guarantee future results, but this is a very strong start for the Alpha Picks team.

- The service is $449 for new members. To make it worth it, you should preferably have a few thousand dollars to invest.

- The service is new. While the results have been great so far, I would like to see a few more years of outperformance, especially in different market conditions, before I can say anything definitive about the investment approach.

While it's still a relatively new service (three years old), Alpha Picks has been doing exactly what it advertises: outperforming the market.

.png)