The 7 Best Stock Picking Services

The stock market is one of the best ways to create wealth.

However, it can also be one of the most effective ways to destroy it.

Choosing the right investments is hard. Plus, it's time-consuming to keep up with the market, read earnings reports, and dig through financial statements.

That's where stock picking services come in. These services have teams of experts who do the research and analysis on your behalf. All that's left for you to do is follow their recommendations.

While all these services promise the same thing — great stock picks with low effort on your part — they're not all created equally. And without having firsthand experience with each of them, it can be difficult to determine which one is right for you.

Fortunately for you, testing financial products and services is kind of my thing.

In my opinion, what makes a stock picking service good is its returns, consistency and reliability, and affordability.

I've tried dozens of these services over the years. Here's my list of the 7 best stock picking services as of 2024.

Summary of the best stock picking services

Here's a quick look at my list:

- Best overall: Motley Fool Stock Advisor

- Best quant-driven service: Alpha Picks

- Best for portfolio management: The Barbell Investor

- Best for a high-caliber team of analysts: Moby

- Best for disruptive technology: Motley Fool Rule Breakers

- Best for long-term swing trades: Ticker Nerd

- Best for medium-term swing trades: Zacks Home Run Investor

Keep reading for detailed breakdowns of each service.

1. Best overall: Motley Fool Stock Advisor

- Our rating:

- Best for: Long-term investors

- Cost: $199/year ($89 for new members through this link)

Ultimately, the best stock picking service is the one that generates the highest returns.

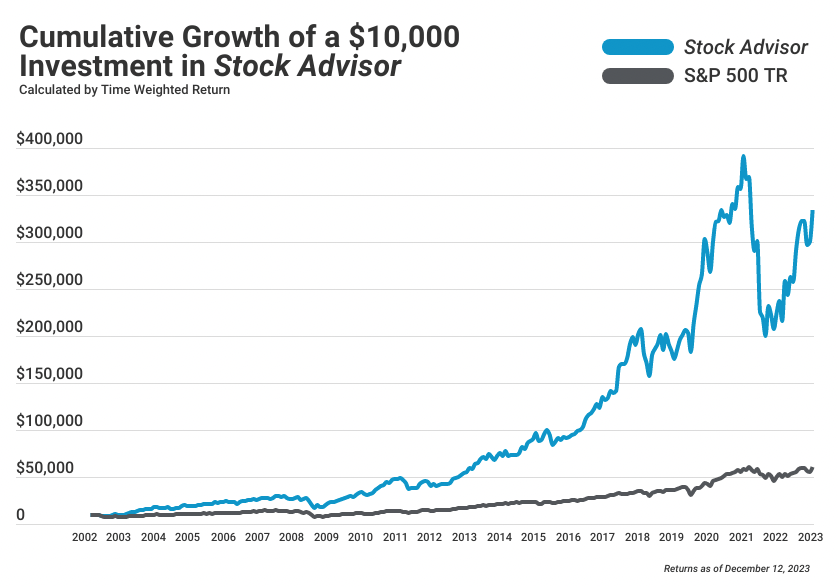

Since its launch in 2002, Stock Advisor has consistently delivered outperforming stock recommendations to its subscribers. Over the last 20+ years, these stock picks have outperformed the S&P 500 by a wide margin according to The Motley Fool site:

While past performance doesn't guarantee future returns, there is no other service that can boast this type of long-term track record.

Brothers Tom and David Gardner launched The Motley Fool with the goal of bringing high-quality investment advice to individual investors. They focus on high-quality, high-growth companies that they plan to hold for 5+ years.

While the results have been outstanding, I do have a complaint about Stock Advisor regarding the amount of risk it suggests you should take. One of the service's primary rules is investing in “25+ companies recommended by The Motley Fool over time.”

I don't believe this is an adequate level of diversification, and think around 50% of your stock portfolio should be in index funds (like VOO, Vanguard's S&P500 ETF).

While this extra diversification may lower your returns if the Motley Fool picks are successful, it is also likely to lower your risk significantly.

What you'll get: The Stock Advisor team sends two new stock picks each month with a detailed analysis of each investment.

Additionally, you'll receive access to the team's “Starter Stocks” and “Best Buys Now” lists, educational resources, community features, and all previous recommendations and performance.

You can get the first year of Stock Advisor for $89 (save $110) with the link below:

2. Best quant-driven service: Alpha Picks

- Our rating:

- Best for: Quantitative-based stock picks

- Cost: $499/year ($449 for new members through this link)

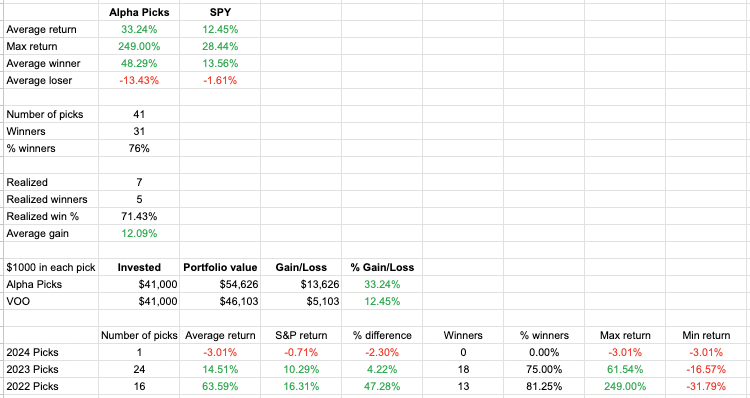

Alpha Picks was launched by Seeking Alpha in July 2022 and is off to an excellent start.

I've been a paying subscriber to Seeking Alpha Premium for the last five years. It's one of my favorite places to find high-quality investment research from a broad range of contributors.

After finding out about Alpha Picks, which aggregates the research on its platform and combines it with its Quantitative Ratings system, I knew I had to sign up.

I've tracked each one of its stock picks for the last 18 months. Here are the results:

As you can see, Alpha Picks' stocks have returned 2.4x the S&P. While the service is still very new, the returns are as good as I could have possibly expected.

For a more detailed breakdown, check out my full Alpha Picks Review.

At the heart of the Alpha Picks service is its quantitative analysis, which is primarily driven by its Quant Ratings model. This model ranks stocks based on five factors: value, growth, profitability, EPS revisions, and momentum.

After filtering stocks through its models, the Alpha Picks' investment team always makes the final buy/sell/hold decisions. The average holding period will likely be 1–2 years.

What you'll get: Alpha Picks will send you two new stock recommendations per month along with an analysis of why each stock is being selected.

You'll also get complete access to every previous recommendation along with an up-to-the-minute display of every stock's performance and that of the entire portfolio.

3. Best for portfolio management: The Barbell Investor

- Our rating:

- Best for: Portfolio and money management

- Cost: $150/year

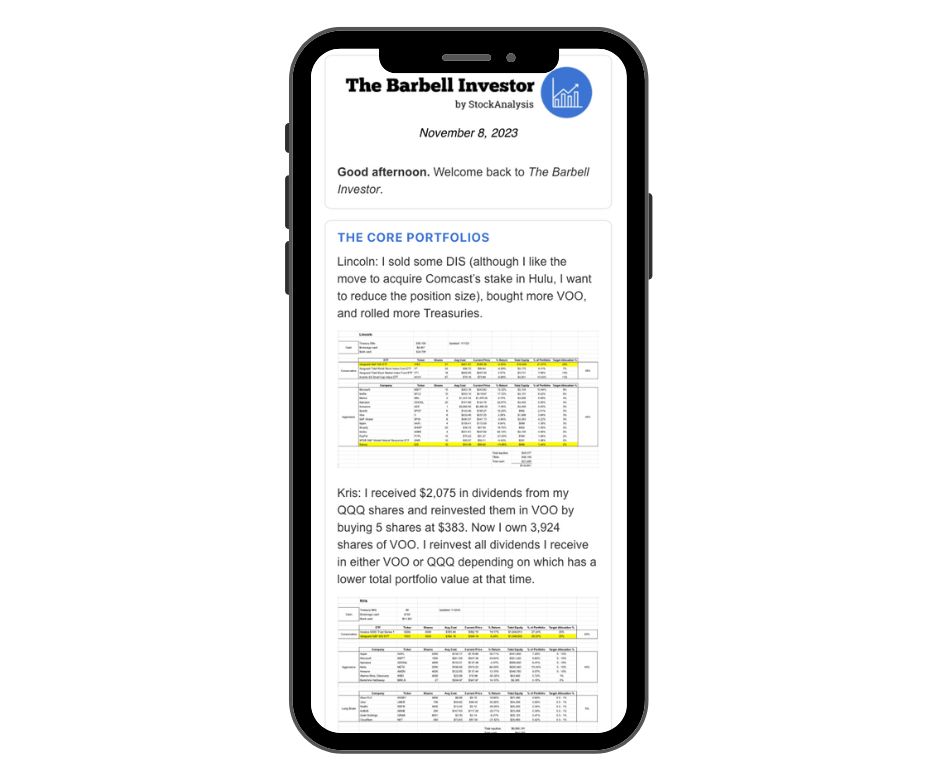

While I'm a fan of the stock picking websites on this list, I have one complaint about the industry in general: nobody shows you what they're doing with their own money.

After reading a detailed report on why I should buy XYZ stock, I'll see this disclosure at the bottom:

“Disclosure: The author has no position in any company mentioned herein.”

In other words, while they're recommending I should buy the stock, they don't have enough confidence in their analysis to invest their own money into it. To me, this is wrong.

So, we did something about it.

We launched The Barbell Investor to show you exactly how we invest and manage our own money.

No “recommendations” or theory. Just real-life applications with our actual money.

While there is a stock-picking component, the focus of the service is on building a portfolio that gives you the best chance of creating long-term wealth.

What you'll get: 2x per month you'll receive an issue that includes any changes to our portfolios, education on a financial topic, market commentary, and a full report on a stock we're considering buying.

4. Best for a high-caliber team of analysts: Moby

- Our rating:

- Best for: Many, medium- to long-term investments

- Cost: $199/year ($99 for new members through this link)

Moby is a mobile-friendly investment research platform for stock and crypto investors.

Unlike the other services on this list (which only provide 2 new stocks per month), Moby makes 3 new recommendations per week.

What sets Moby apart is its team. The team is made up of expert analysts from institutions like Goldman Sachs and Morgan Stanley.

Every piece of content on Moby – all of its investment ideas, daily market updates, market summaries, and research reports – are written by this team.

However, to keep its content jargon-free and easily accessible to everyone, these ex-Wall Street analysts were paired with journalists who can distill complex financial information into actionable insights.

In addition to the fundamental analysis performed by the team, Moby deploys machine learning and quantitative algorithms to find new investment ideas.

What you'll get: You'll receive 3 new stock picks per week. Each new pick comes with a jargon-free report on why it's being recommended. You'll also get access to Moby's Model Portfolios and suite of other features (Political Trades, Stock Screener, online community, and more).

5. Best for disruptive tech: Motley Fool Rule Breakers

- Our rating:

- Best for: Long-term investors who want to invest in disruptive technology

- Cost: $299/year ($99 for new members through our link)

In addition to its flagship newsletter (Stock Advisor), The Motley Fool also launched Rule Breakers back in the early 2000s.

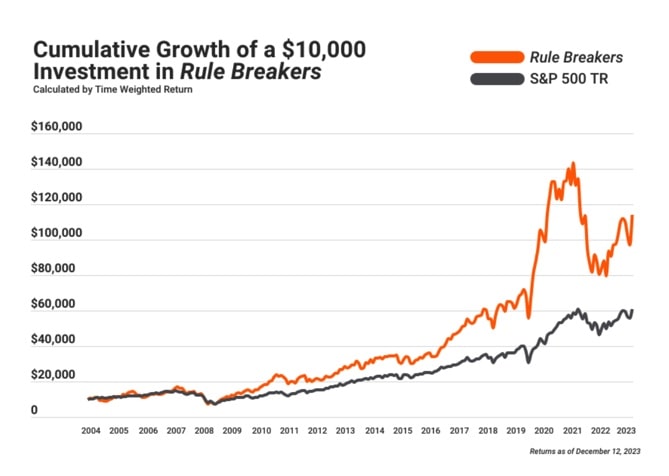

While it doesn't have near the popularity of Stock Advisor, the returns are similarly impressive according to the website:

While the Stock Advisor team can select any stock it deems to be “high-quality,” the Rule Breakers investment strategy focuses exclusively on disruptive technology companies with the potential to reshape entire industries.

Most of these stocks come with very high valuation multiples, making them high-risk, high-reward investments. As such, the Rule Breakers portfolio tends to be more volatile than the Stock Advisor portfolio.

This leads me to my primary complaint about Rule Breakers, which is the same as it was for Stock Advisor: the service suggests a fairly concentrated portfolio of highly volatile stocks.

While this may lead to outperformance, it's also extremely difficult to stomach.

The above chart may look extremely attractive to you, but you would have had to sustain a ~50% drawdown in 2021. For many investors, this size of loss is too painful to keep holding, so they end up selling their stocks at losses.

If you do want to add Rule Breakers disruptive stocks to your portfolio, blending those stocks with an allocation to broad-market index funds may help to reduce the drawdowns and volatility.

What you'll get: The Rule Breakers service is set up the same way as Stock Advisor's — you'll receive two new stock picks per month with analysis, educational resources, community access, and all previous recommendations and performance.

6. Best for long-term swing trades: Ticker Nerd

- Our rating:

- Best for: Long-term “swing” trades

- Cost: $199/year ($99 for new members through this link)

Ticker Nerd is also a relatively new stock picking advisory service. It was launched in February 2021.

The team uses software to filter stocks based on analyst ratings, social media sentiment, and institutional trading data.

After narrowing the list using these filters, they perform fundamental and technical analysis and provide their readers with only their favorite investments.

Ticker Nerd's investment approach combines the fundamental analysis found in Stock Advisor with the quantitative- and momentum-based analysis used in Alpha Picks.

This approach lends itself to a long-term “swing” trading investing style, in which most picks are held between 3–24 months.

Another small difference is that Ticker Nerd produces one report each month with two stock picks, as opposed to most other services on this list which produce two reports with one stock pick per issue.

The website doesn't have much in the form of performance data, however, so you'll have to start the free trial to see the team's recent picks and how they've performed.

What you'll get: You'll receive one report per month with two stock recommendations and accompanying analysis. You'll also get access to Wall Street analyst ratings for every stock covered and a database with all prior picks.

7. Best for medium-term swing trades: Zacks Home Run Investor

- Our rating:

- Best for: Medium-term, quant-based “swing” trades

- Cost: $149/year

Zacks was one of the first companies to popularize quantitative-first investing. While its main site is still focused on providing quantitative research to investors, it launched this done-for-you stock picking service in 2011.

As its name suggests, Zacks Home Run Investor keys in on under-the-radar, small- and mid-cap companies with large growth runways.

The service is led by Brian Bolan, Zacks' “Aggressive Growth Strategist.” Bolan deploys a combination of Zacks strategies (primarily Zacks Rank) and fundamental analysis.

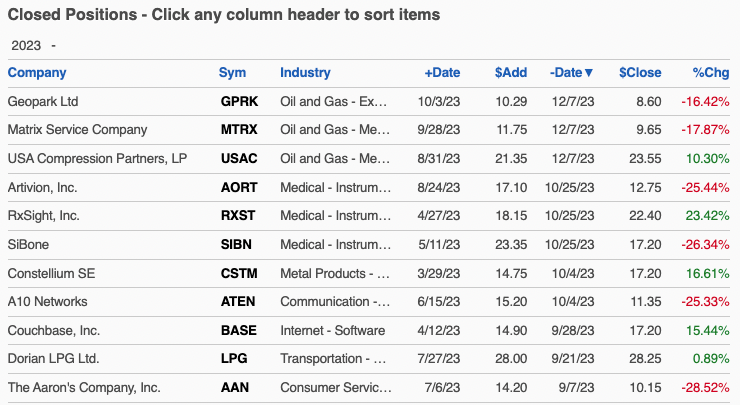

Unlike every other service on this list, Zacks Home Run Investor does not hide the performance of its individual picks behind a paywall.

You can see all of its closed positions on its site:

Zacks Rank is the primary engine that powers all of Zacks' services.

It uses a scoring system to gauge Wall Street analyst EPS revisions, its primary source of data for ranking stocks. The system is based on four factors: agreement, magnitude, upside, and surprise.

After using the quantitative filters at his disposal, it's up to Bolan to determine which stocks are recommended in each issue.

The site claims the average holding period is 1–2 years, but it averages 2–4 trades per month which leads to a much faster portfolio turnover than it advertises. If you opt for this service, expect to be buying and selling stocks multiple times per month.

What you'll get: You'll receive 2+ stock picks per month and reports on why those stocks are being recommended. You'll also get frequent sell alerts due to the service's relatively high portfolio turnover.

Brian Bolan also shares market commentary, which will keep you updated on the latest developments in the markets.

What does a stock picking service do?

Stock picking services provide their members with stock recommendations.

Teams of expert analysts spend hundreds of hours each month scouring the market for the best available investment opportunities. Each service has its own set of criteria for what makes a good investment, but they're all aiming to:

- Provide you with high-quality, highly profitable stock picks

- Require minimal effort by you

Most of these services operate as subscription newsletters. They will send you 1–2 emails per month with 1–2 stock picks and reports each. You'll also get regular portfolio updates, sell alerts, and more on an as-needed basis.

What should you look for when choosing a stock advisor service?

As mentioned in the introduction, there are a handful of factors you should pay special attention to when evaluating these services.

1. Track record and returns

Each service's performance is by far the most important factor to consider when choosing which one to subscribe to. If they don't provide this information or if they have a history of mediocre results, the service probably isn't that good.

If you're wondering who has the best stock picking record, Stock Advisor, Rule Breakers, and Alpha Picks are all performing very well.

That said, keep in mind that just because something has performed well in the past, it does not mean that it is guaranteed to continue to do so in the future.

2. Consistency, reliability, and credibility

One year of outperformance is one thing, but consistently delivering outperformance year after year is what really matters — and is also exceptionally difficult.

The longer a service has been around and the more consistently it has beaten the market, the better.

It's this factor that makes The Motley Fool (both its Stock Advisor and Rule Breakers services) really stand out. Both services have frequently outperformed the market over a span of two decades.

3. Cost and affordability

If you're wondering whether stock picking services are worth it, simply compare the performance of a service to the S&P 500, multiply the outperformance by the amount of money you're investing, and compare that to how much the service costs.

For example, Stock Advisor has nearly 4x'd the returns of the S&P. If the S&P averages 10% per year and Stock Advisor averages 40% per year, you would need to be investing at least $500 to make the $150 annual subscription worth it.

Here's the math:

$500 * 10% = $50

$500 * 40% = $200 - $150 = $50

This is for illustrative purposes only. Past performance does not guarantee future results.

The cheaper the service and the higher the returns it provides, the better.

4. Investing strategy

Finally, you'll want to use a subscription service that aligns with your risk tolerance and financial goals.

If you want to be a buy-and-hold, long-term investor and have very few transactions, Zacks Home Run Investor probably isn't the right service for you. Similarly, if you can't stomach volatility, you should probably pass on Rule Breakers.

While many different investing strategies do work, you want to find one that fits well with your personality and makes it easy for you to manage.

How we chose the best stock picking services

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good the product or service is — i.e., how its returns have been and how long it has been generating those returns.

- Cost: Overall price and value for money.

- Usability: What the interface looks like, whether the emails are easy to read and access, design elements and features, and general accessibility.

- Credibility: Quality of information as well as company and brand reputation.

- Audience: Who the product is for, the uses and applications, whether it actually works, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Stock picking services can help you save time, provide market education, and help you learn how to build your portfolio.

But while earning high returns might be your goal, choosing the wrong service can have the exact opposite effect.

That's why you should choose one that comes highly recommended, aligns with your investing goals, and is produced by a high-quality company.

If you're having a hard time deciding between a few of the services I mentioned above, don't be afraid to sign up for several and compare them side-by-side.

Most of them offer 30-day money-back guarantees, so you can try them for a month before making a decision.

Or, you can be like me and subscribe to several at once.

Personally — and I've crunched the numbers — I see these costs to be one of the highest ROI subscriptions available.

.png)