How Berkshire Hathaway's Class A and Class B Shares Are Different

Berkshire Hathaway is a conglomerate of many different businesses.

It is currently the 8th biggest publicly traded company in the world, with a market cap of $797.5B.

It is operated by the world's most famous investor, Warren Buffett, who also has the majority of his own net worth in Berkshire shares.

Berkshire Hathway has two different types of stock that you can invest in:

The most important difference between Berkshire Hathaway's class A and class B shares is the stock price. As of January 3rd, 2024, the class B shares are trading for $367.44 while the class A shares are trading for $557,075 per share.

However, there are several other important differences between the two types of stock.

Berkshire class A vs class B stock: key differences

Berkshire Hathaway's A and B shares have vastly different stock prices, but they also differ when it comes to voting rights and convertibility. Here are the key differences.

1. The class A stock price is much higher

One class B share (BRK.B) is equivalent to 1/1500 of a class A share (BRK.A). Berkshire's stock price follows this ratio very closely.

Both of the prices move in tandem. They go up and down together, and never deviate much from the 1/1500 ratio.

For example, the class A stock is trading for exactly $557,075 at the time of this writing. If you divide that number by 1500, you get $371.38 — which is incredibly close to the $367.44 that the class B stock is currently trading at.

2. Class A stock has more voting rights

When you buy stock in a company, you are effectively purchasing an ownership stake.

Berkshire Hathaway stock is no different. When you buy both class A and class B shares, then you become a part-owner of the business.

A single class B share represents 1/1500 of the ownership of a class A share. So, if Berkshire ever decides to pay a dividend, then the dividend paid to a class B share will be exactly 1/1500 of a dividend paid for a class B share.

Unfortunately, this does not apply to voting rights. A single class B share has 1/10,000 of the voting rights of a class A share.

So, dollar for dollar, you get 6.66 times as much voting power from the class A shares.

That said, most regular investors will never be able to buy enough shares for their vote to make a difference, at least not in such a large company.

3. Class A shares can be converted into class B, but not the other way around

If you own class A shares, then you can convert them into class B at any time. Each class A share you convert then becomes 1500 class B shares.

However, this only goes in one direction. It is not possible to convert B into A.

The only way to change your holdings from class B to class A would be to sell your B shares and buy the A shares instead.

The two share classes have nearly identical performance

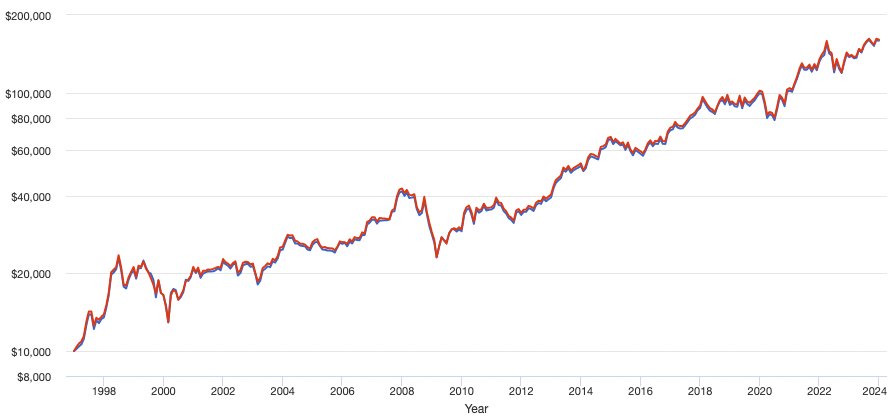

As expected, there is no big difference in performance between the class A and class B shares:

Source: portfoliovisualizer.com

The blue line shows class A (BRK.A), while the red line shows class B (BRK.B).

Actually, BRK.B has performed slightly better since 1997 with a 10.82% compound annual growth rate, compared to 10.79% for BRK.A.

However, there is no reason why this outperformance should continue. It should not make a difference for returns whether you buy class A or class B stock.

Why Berkshire Hathaway split its stock

Warren Buffett resisted the idea of splitting Berkshire Hathaway's stock for a long time.

However, in 1996, Buffett and Berkshire's board of directors decided to introduce the class B shares.

At the time, Berkshire's stock was already trading at more than $30,000 per share. This made it out of reach for many investors.

In addition, some people were planning to start unit trusts and mutual funds that owned class A shares and marketed themselves as Berkshire look-alikes.

Buffett didn't like this, because the funds would be charging management fees and even use misleading marketing practices to entice people to invest in them.

Because of this, class B shares were introduced in 1996, at 1/30th of the price of class A shares.

Then the class B shares were split 1/50 in 2010, at the same time as Berkshire acquired the railroad company Burlington Northern (BNSF).

After the 1/50 split, the class B shares now represented 1/1500 of the A shares.

Although the B shares may undergo another stock split sometime in the future, Warren Buffett has said that the A shares will never split. He believes the high price helps attract investors that are focused on the long term.

Should you buy Berkshire class A or B stock?

Most investors don't have hundreds of thousands of dollars to invest in a single company, so that makes class B shares the only realistic option.

However, if you have hundreds of thousands (or millions) of dollars and want to invest in Berkshire, then there are certain pros and cons for both A and B shares.

To start with, the A shares have more voting rights than the B shares, which matters to some investors.

Nevertheless, the lower price of the B shares provides more flexibility. If you need to trim part of your holdings, then you can sell much smaller amounts at a time if you own B shares.

For example, if you need $10,000 for some unexpected expense, then it may be better to be able to sell a few B shares instead of an entire A share.

In addition, the lower price of the B stock can make it more practical for passing on to heirs or family members without triggering inheritance or gift taxes.

At the end of the day, the main advantage of owning class A shares is increased voting power. But the B shares provide much more flexibility for you to manage your holdings due to the lower share price.

Warren Buffett himself favors the A shares and says that the main reason to buy the B shares is if they are trading at greater than a 1% discount:

“In my opinion, again, when the B is at a discount of more than say, 1%, it offers a better buy than the A. When the two are at parity, however, anyone wishing to buy 1,500 or more B should consider buying A instead.” — Warren Buffett

So, if you multiply the price of B shares by 1,500 and the outcome is 1% less than the actual price of an A share, then that means the B shares are a better buy.

But generally speaking, the A and B shares will perform exactly the same and it really does not matter which one you choose.