The 6 Best Dividend Trackers in 2026

Managing a dividend portfolio can feel like a full-time job.

Between payout schedules, reinvestments, yield changes, special dividends, and tax implications, it's easy for things to slip through the cracks.

That's where a dividend tracker comes in. These tools can organize your holdings, track your income, project future cash flow, and show how your dividend stream is growing over time.

Fortunately (and unfortunately), there's no shortage of options — which is why I wrote this article.

This is our list of the best dividend tracker apps and websites in 2026.

Summary of the best dividend trackers

Note: Most of the pricing listed is for monthly plans, but many of these trackers also offer (discounted) annual pricing.

| Platform | Best for | Cost |

| Snowball Analytics | Best overall | $14.99/month |

| DivTracker | Cross-platform tracking | $6.99/month |

| Dividend Watch | Best for DRIP analytics | $12/month |

| Stock Events | Best mobile app | $49.99/year |

| Sharesight | International investors | $24/month |

| TrackYourDividends | Free dividend tracking | Free (or $9.99/month) |

| Your brokerage | Simple income tracking | Free |

Each of these tools offers some of features for free but paywalls others, so I made a note of what you can get for free and which plan I'd recommend.

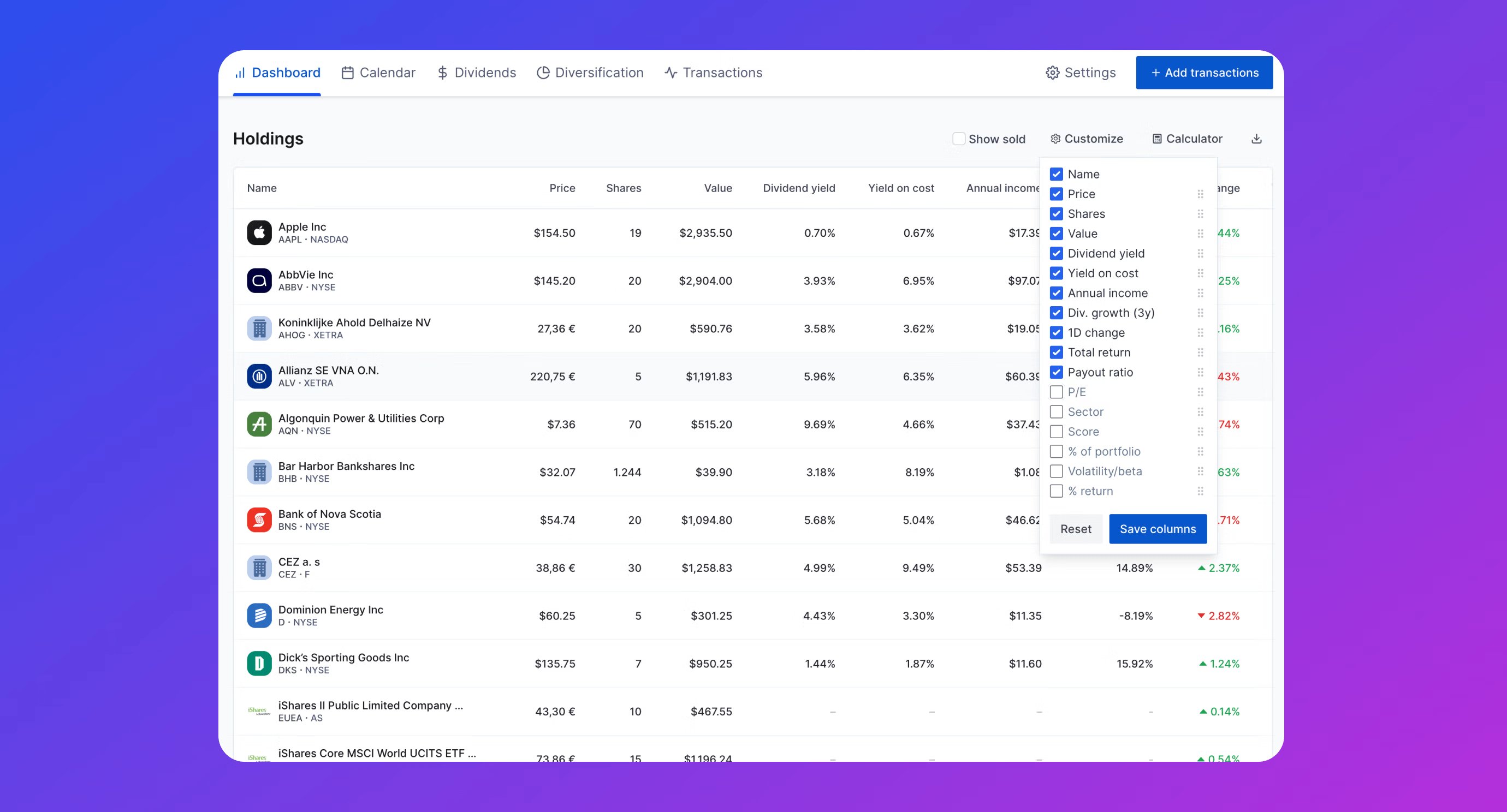

1. Best dividend tracker overall: Snowball Analytics

- Platform(s): Browser, iOS, Android

- Free features: 1 portfolio with up to 10 holdings

- Recommended plan: Investor ($14.99/month, after a 14-day free trial)

Snowball Analytics earns the top spot on this list due to its combination of comprehensive features, ease of use, and well-designed user interface.

After linking your brokerage for automatic syncing, you can track dividend income, see future projections, and assess how your dividend income has grown over time.

Beyond tracking income, users can analyze their portfolios' performance and risk based on data points like country, sector, market capitalization, P/E ratio, dividend yield, and more.

You can also use Snowball's “Dividend Rating” to gauge a company's likelihood of reducing or canceling its dividend based on 13 fundamental parameters (like profitability and outstanding debt).

The worse the grade, the more at risk the dividend is of being cut.

Outside of just dividend tracking, Snowball provides general account features like portfolio metrics and performance to help users understand their risk and what's driving their returns.

There are also tools for analyzing individual companies and their dividend policies.

Snowball Analytics does offer a free plan, but serious investors will want to upgrade to its Investor plan for $14.99/month (or $12.50/month when billed annually).

You can start a 14-day free trial with the button below.

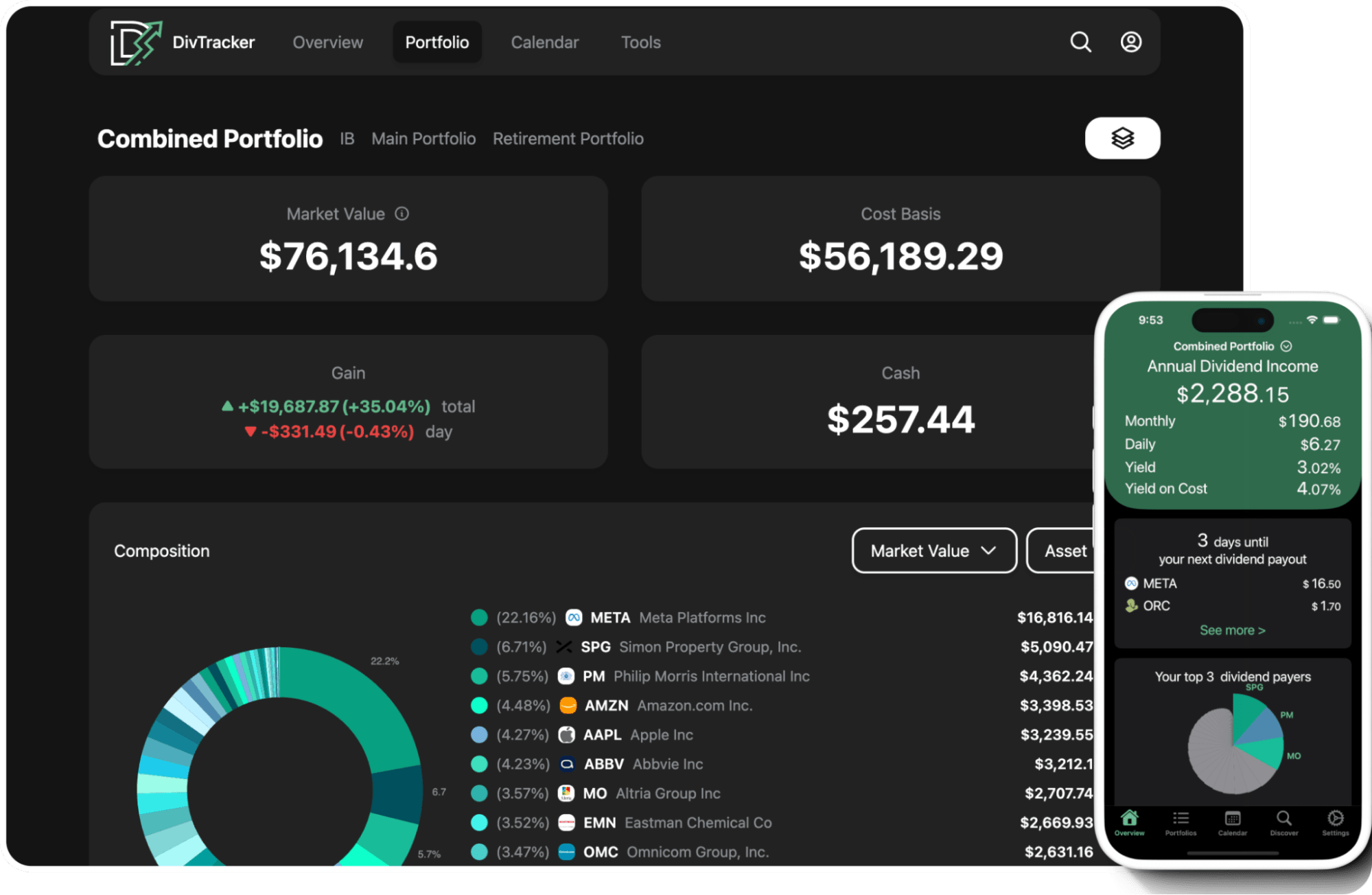

2. Best for tracking across multiple platforms: DivTracker

- Platform(s): Browser, iOS

- Free features: 1 portfolio with up to 5 holdings

- Recommended plan: Ultimate ($6.99/month, after a 3-day free trial)

While Snowball Analytics has a mobile app (iOS and Android), I personally find it overwhelming and a bit hard to use, so I only log in to it from a desktop browser.

DivTracker, on the other hand, has fewer features, which makes for a seamless experience between its website and mobile app (iOS only).

DivTracker shows your portfolio composition, upcoming payouts, annual income projections, and more.

DivTracker shows your portfolio composition, upcoming payouts, annual income projections, and more.

While you could recreate most of these features in a simple spreadsheet, DivTracker's automatic brokerage integration and attractive user interface make the entire process easier and more enjoyable.

DivTracker is a great option for busy investors who want a simple dividend tracker that they can access from their computer or iPhone.

And at just $6.99/month for its Ultimate plan, it's one of the most affordable options you'll find.

3. Best for DRIP analytics: Dividend Watch

- Platform(s): Browser

- Free features: 1 portfolio with up to 10 holdings

- Recommended plan: Pro ($12/month or $99/year, after a 7-day free trial)

Dividend Watch offers a clean, intuitive dividend tracker designed to strike the right balance between simplicity and depth.

Along with standard features like brokerage sync, detailed holdings information, performance information, and diversification data, Dividend Watch also supports DRIP analytics.

Users can enable dividend reinvestment (DRIP) on a per-security basis to see how reinvesting would affect overall performance, yield, yield on cost, and total returns.

Outside of dividend tracking, Dividend Watch also offers financial data on 83,100+ stocks and ETFs, enabling users to do their fundamental research from the same login.

And for tax-conscious investors, you can apply custom tax rates at the portfolio, security, or transaction level, giving you a realistic picture of your actual after-tax income.

Dividend Watch offers a free plan, but it's pretty limited. To get the best sense of whether it's right for you, you can get a 7-day free trial of Pro with the button below.

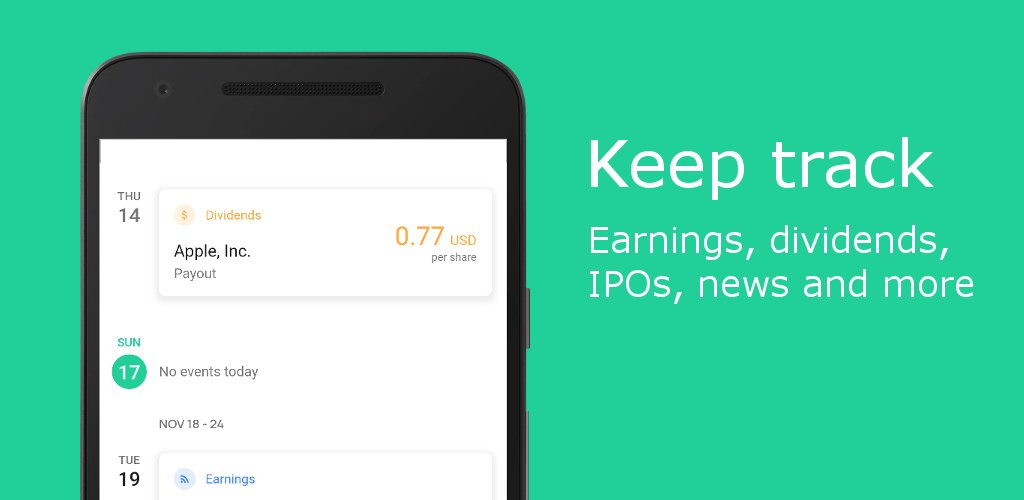

4. Best mobile app dividend tracker: Stock Events

- Platform(s): Browser, iOS, Android

- Free features: 1 portfolio with up to 15 holdings

- Recommended plan: PRO ($49.99/year, start for free)

For a simple dividend tracking app, use Stock Events.

DivTracker's app is iOS only, while Stock Events has an app for both iOS and Android.

If you primarily use only an app, I'd go with Stock Events. If you like to switch back and forth between desktop and mobile (and are an iOS user), then DivTracker is the way to go.

While it primarily serves as a general portfolio tracker, it also has a surprisingly good set of dividend-tracking features.

Its dividend features are primarily focused on the future — upcoming payments and ex-dividend dates, income projections, and forward yield — but it also tracks your dividend income by month and year, and provides basic portfolio analytics.

Outside of dividends, users can track 100,000+ stocks, ETFs, crypto, commodities, and more.

Stock Events also makes it easy to set up alerts and get notified of the latest changes with the companies in your portfolio.

You can use Stock Events for free, but you'll need to upgrade to PRO ($49.99/year) to get the most out of it.

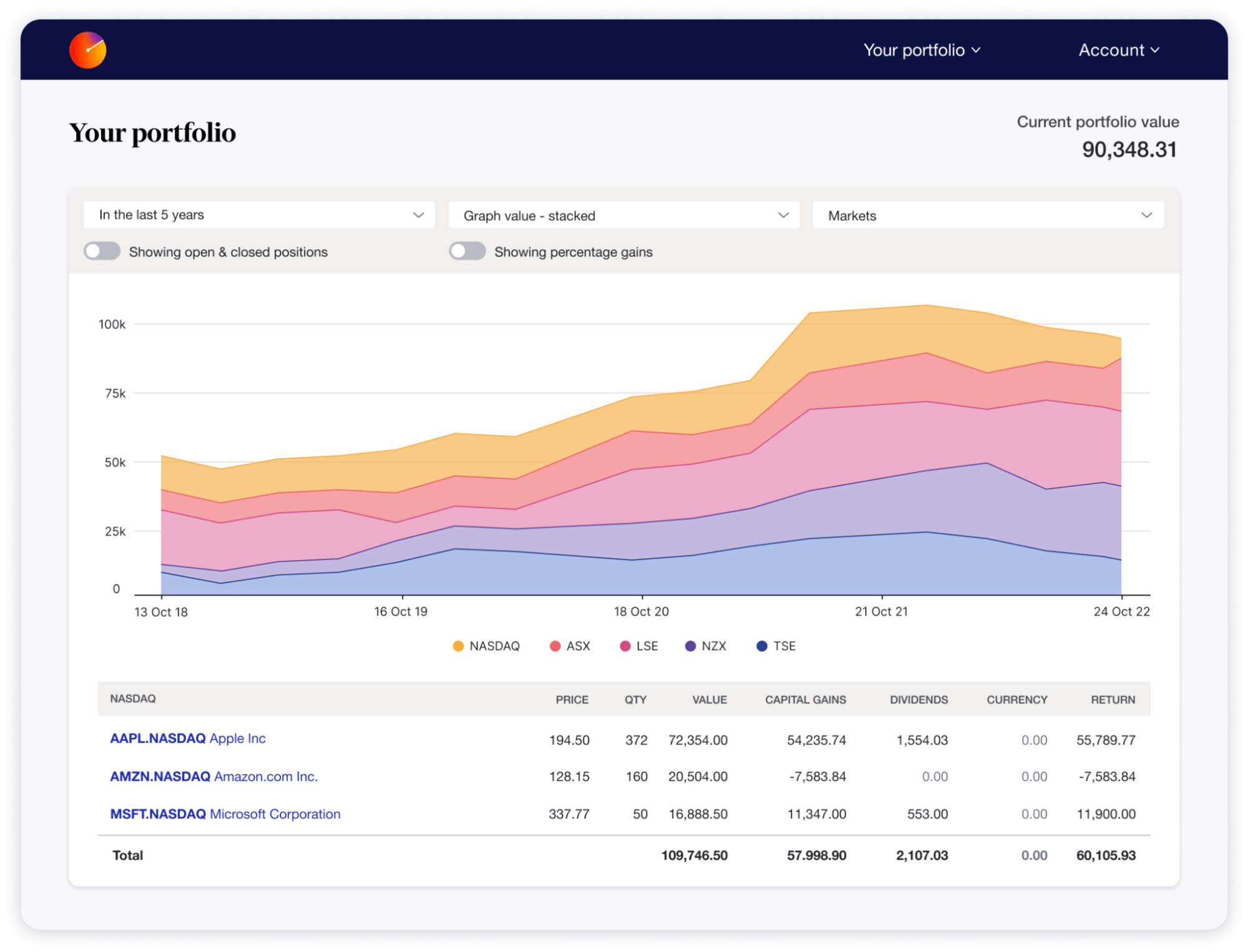

5. Best for international investors: Sharesight

- Platform(s): Browser

- Free features: 1 portfolio with up to 10 holdings

- Recommended plan: Standard ($24/month, start for free)

Sharesight is the best portfolio tracker for international investors with assets in various global markets and currencies.

Not only is its portfolio tracking built to handle this complexity, but its tax reporting features make it easy to comply with your local jurisdiction.

Sharesight also has some solid dividend-tracking features, including historical dividend tracking, income projections, and payment schedules.

Plus, it automatically converts payouts into your home currency, so you never have to manually adjust for exchange rates.

All of this functionality comes at a cost, though. Sharesight isn't the most intuitive platform to use — you should be prepared to invest some time in figuring out how it works.

For this reason, I don't recommend it unless you have a global portfolio. But, for those with a global portfolio, it's worth taking the time to learn how to use it. And it's worth the $24/month.

Sharesight is the best place to track, manage, and file taxes on your multi-national investments.

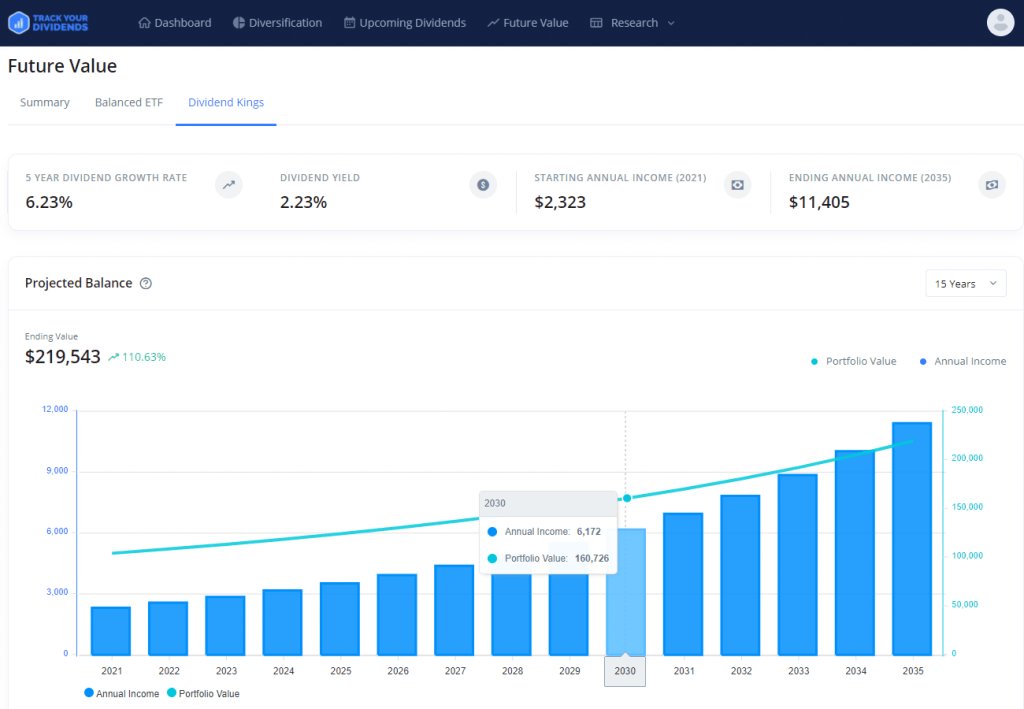

6. Best free dividend tracker: TrackYourDividends

- Platform(s): Browser

- Free features: Unlimited portfolios

- Recommended plan: Free (start here)

TrackYourDividends is the best option for investors looking for a straightforward, no-cost way to track their dividend income and future payouts.

TrackYourDividends was created to help investors grow their dividend income over time.

It does this by tracking current and future dividend payments and by providing tools to help you assess your portfolio's performance, risk, and company fundamentals.

Users can also set up alerts about ex-dividend dates, payment dates, special dividends, and any changes to their companies' dividend policies.

And unlike the other options on this list, TrackYourDividends offers unlimited portfolios — and all its core features — for free.

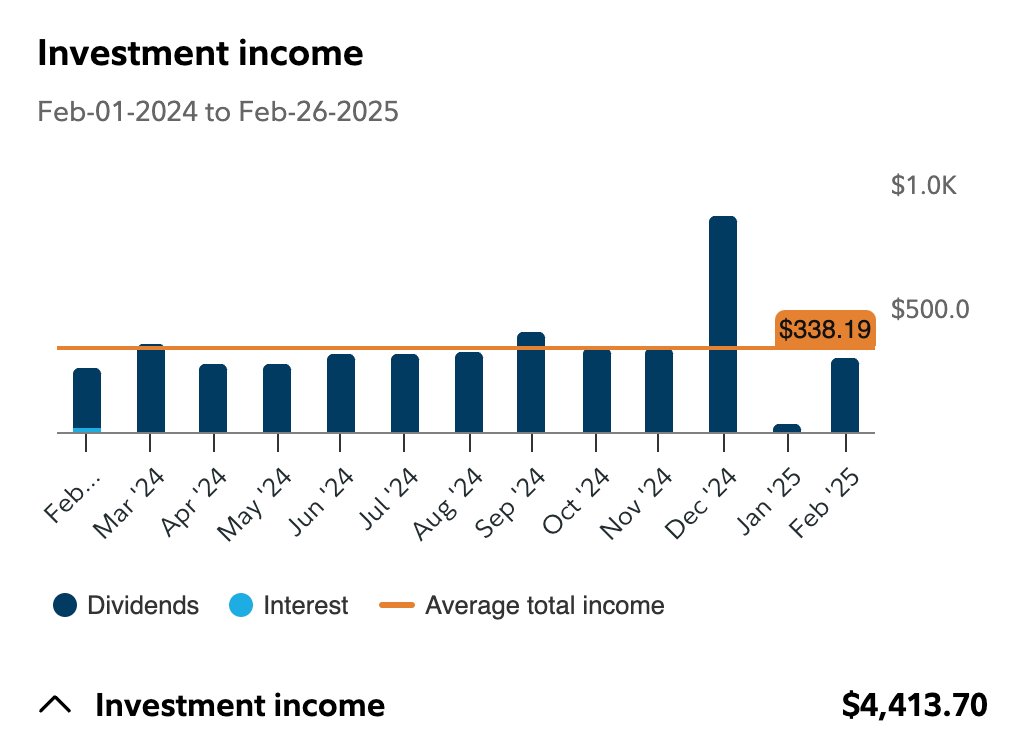

Honorable mention: Your brokerage

- Platform(s): Browser, iOS, Android

- Free features: All

- Recommended plan: None

If you don't need all the fancy analysis and visualization features, you may be able to use your brokerage's native tools.

Most major brokerages (like Fidelity, Charles Schwab, and Vanguard) provide basic income tracking tools that allow you to see your dividend payouts, upcoming distributions, projections, and more.

Source: Fidelity

While these tools were primarily built with retired investors in mind, and are limited in terms of advanced reporting and analytics, they're a great option for dividend investors who don't need any sophisticated features.

Plus, you don't need to open any extra accounts or learn any new software.

If you're looking for a hassle-free way to monitor your dividend income, see what built-in tools your brokerage already offers.

What is a dividend portfolio tracker?

A dividend portfolio tracker is a tool specifically designed for dividend investors who want to monitor, analyze, and grow their dividend portfolios.

Beyond simply recording payouts, dividend trackers offer visualizations of future payments, year-over-year growth, and performance and risk assessments.

They may also highlight important metrics like yield, yield on cost, growth rates, and the sustainability of dividends.

For investors focused on creating a reliable stream of dividend income, these trackers provide an at-a-glance view of how their portfolios are progressing over time.

Portfolio trackers are also useful for notifying investors of upcoming ex-dividend and payout dates and of any changes a holding may have made to its dividend policy.

For serious dividend investors, having all this information in one place means less time spent manually tracking dividends and more time spent making decisions about portfolio growth.

How we chose the best dividend trackers

When evaluating investing products and services, we take the following into consideration:

- Price: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the app and/or site are easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of the tools, as well as the company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up (including free trials) or any discounts.

Final verdict

Snowball Analytics is the most complete dividend portfolio tracker and the best option for most serious dividend investors.

That said, Snowball's mobile app is a bit overwhelming. For mobile-first investors, DivTracker and Stock Events are better options.

For international investors with assets in multiple currencies, and not really anybody else, Sharesight is the best option. Dividend Watch also supports multiple currencies, has a well-designed interface, and a solid set of features.

And, for those who don't want to spend any money on their tracker, we recommend using TrackYourDividends or your existing brokerage's built-in features.